I’m a firm believer of the fact that miles and points can defray the cost of tralternateavel for most of us, not just to the extent of bringing the cost down but sometimes also travelling in luxury. Premium Cabins, luxury hotels, the whole 9 yards. These could be trips of a lifetime, or these could be just the average long weekend trips, or just a last minute work trip where airfares are high as well. I’d like to repeat here, that travel is not free, regardless of what someone makes you believe, but you don’t have to pay top dollar to get top-dollar experiences, that I can vouch for.

In 2014, when I had to propose to Shipra, we flew on a secret sortie to Paris to make it happen. Tickets were paid for but premium cabin upgrades and peak summer stays were all thanks to miles & points and everything in between. Heck, the hotels even threw in champagne (the real thing, not sparkling wine!) and macaroons sometimes.

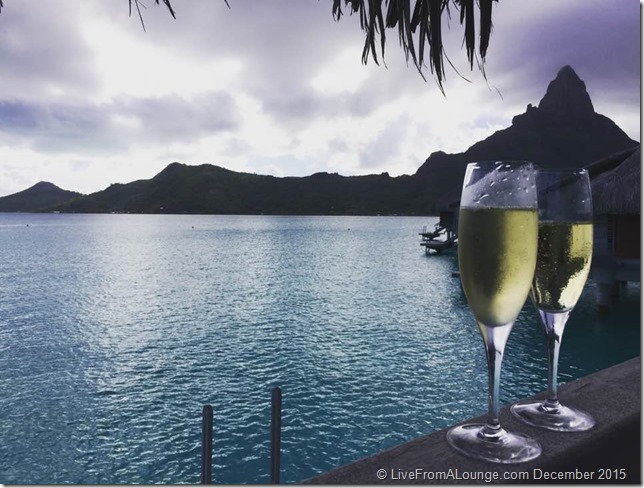

In 2015, when Shipra & I got married, we took a short honeymoon at the 800-1000$ a night Park Hyatt Maldives. We then progressed on to a longish trip covering Bora Bora, Los Angeles, New Years at New York and travelled in the fabled Singapore Suites and Etihad Apartments. That trip would have been worth over INR 50 Lakhs, but for the points!

In 2016, we were able to work out a longish trip to Australia, yet again, travelling in Etihad’s First Apartments and staying at plush luxury hotels such as the Park Hyatt Sydney over New Years, which would usually go for $1000-$1300 a night during the Holiday season. Yet again, a trip of a lifetime and a trip we thoroughly enjoyed. Yes, money was spent, but it was spent on meals and cars, not on stays largely.

People frequently complain that Indian users don’t have the same opportunity as the Americans in earning miles and points. I usually have to remind them that nowhere in the world do people have that opportunity apart from the US of A. Having said that, once the belief in miles & points gets better and people start accumulating more and spending more of these alternative currencies, that should definitely encourage the card issuers to also make stakes higher. It is a good time to be earning miles in India.

Having said that, I wanted to just recap my points & miles haul for 2016, which should amply be able to demonstrate that it is not difficult to be a mileage millionaire in India as well. And you could be earning more than enough miles if you did the right things.

I’d recommend the 2014 and 2015 year analysis as well so that you know my thought process.

Earning Split

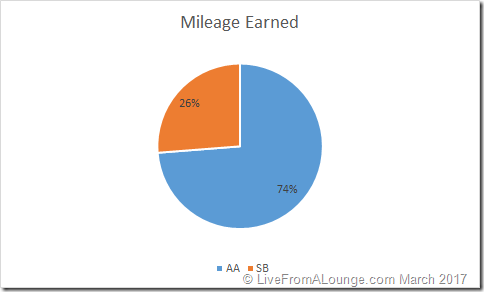

First up, I’ve change things slightly to move to depicting Mileage Earning for both Shipra and myself. Why do that? Because hey, the both of us contribute to our home, and both of us work. And sometimes it works out better to be spending on her cards than my own. Eventually, we are using miles from both of our accounts, so this is how we show it.

Where did we earn and how?

Essentially, I had to cull through all our travel statements over the past year to be able to tabulate the details. This was important for us to know about where were we earning as well. That takes time and hence we publish the output in March every year rather than before. It turns out, between Shipra and myself, we earned well over 1.25 Million miles and points last year.

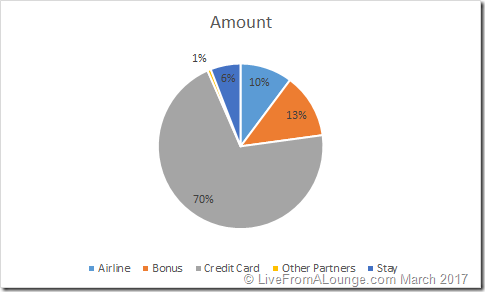

These include miles & points in Airline programs, from our travel (stays), from credit card based spending and other miscellaneous stuff such as shopping, service recovery credits and so on. Like you’d see, we have a strong preference for spending on Credit Cards. Could work for everyone now that Cashless is king!

After all, I may not be on a flight everyday or in a hotel every day, but I’m definitely spending money on my credit cards most days, right? The logical question to ask is how did we earn them as well?

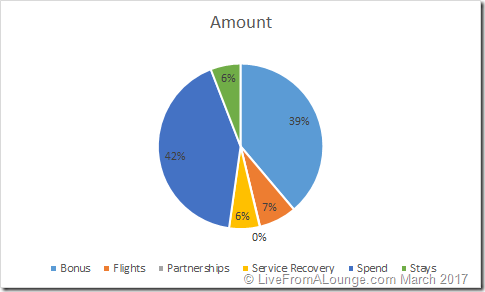

This is how they were earned. You’d see, only about 7% from real flying. 42% from Spending, and another 39% from bonuses (included from credit card bonuses, promotional bonuses such as Hyatt 5K and so on). Things do go wrong when you spend time on the road, so 6% from service recovery when airlines or hotels want to pacify you, such as in this case. The best way to read these numbers is not to try and compare them with the chart above.

But which programs do we like?

Miles and points is a passion where you need to diversify and concentrate at the same time. Diversify because you should not have all your eggs in the same basket (it won’t serve your purpose all the time, and if a devaluation hits, you’re fully doomed!). Concentrate because your points are going to be good for nothing if the points value is too small. For instance, if you earned 250 JPMiles, 500 Hilton Honors and 350 Etihad miles on a trip, they won’t be good for much. But if you put all of those in your JPMiles account, we are talking maybe a 1000 JPMiles and that is 1/5th of the way for a free flight between Mumbai and Goa.

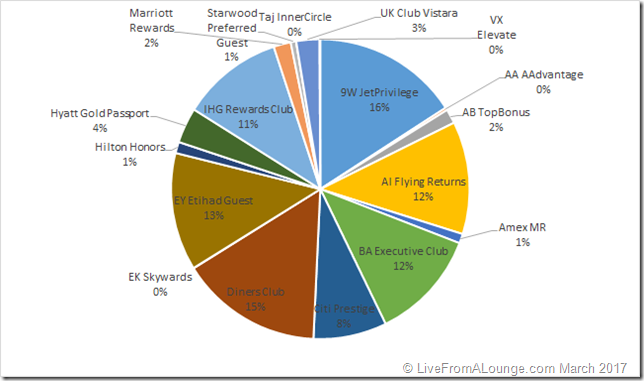

Since this is the split of all the miles we’ve earned in 2016, you’d not get a full picture of our miles and points stack. Having said that, we continue to lean towards earning JPMiles for our spends, apart from Diners Club and Citi Prestige points as well. Air India was 12% of last year’s earning stash but now that I’ve cancelled my AI SBI Card, maybe it collapses next year. IHG, Etihad, BA are all other favourite programs as well. You don’t see much earnings on Hyatt last year for us, because we focused a lot on redemption spends rather than earnings! What to do, you earn, and then you burn at some point of time as well!

That is about how Shipra and I minted over 1.25 million miles last year. I’m sure we passed on some opportunities and we made good with some others. This is a brief insight, but I’m happy to answer questions on specifics in the comments section as well.

I’m keen to also hear your experiences about your mileage earning endeavors in 2016. You could share those with us here, or email me at ajay at livefromalounge dot com as well!

Sorry to say though all your posts have good pictures and click bait title you still never try to explain the cards used and strategy to redeem those miles for stay and travel. which most travel hackers do without holding things back onto themselves . Your following would glow rapidly if you could put some details like creditmantri guy does. I never see a single post that clearly explains your redeeming strategy.

@Zimmer, if you have a pointed question, just ask. I don’t see myself as a travel hacker, but a miles and points specialist. They are two different things. And Credit Mantri is a financial website, we are not. So, find the difference?

Nothing more than a clickbait…. If you’re trying to be the Indian pointsguy, at least detail out the cards you use and what are the benefits of these cards. Don’t break down how much you spend and where.

No offence to you, but just an honest input!

@Mahesh thank you for your feedback about clickbait and honestly putting out my years of effort trying to put it in the Indian mindset that miles and points are not just for the American folk but we can have it too. I am not trying to be the Indian PointsGuy, and as much of a respect I have for what he has made out of his web property, I don’t think us or our agenda’s compare. I understand it is a thankless job writing a blog trying to get people to win over their mindset that points are worthless, but I do invite you to do the same for 6 years along with a full time job and a family and multiple commitments and then we can talk about if it is clickbait or not.

Legit points. I moved to US 4 years ago and Pointsguy did paint a picture on what one can do with travel and I earn about 600k miles/points every year with spend and travel. Thanks to Amex Plat, Citi Prestige and Chase Sapphire Reserve.. however Its possible that I might be moving back for a number of reasons and I would want to continue to play the points and miles game.. I used to own Citi PM card but I cancelled it when they devalued from 1-1 transfers to 2-1.. now I’m looking for information on different travel cards in India and I cant seem to find it.. I know it will help many others but I do thank you for what you do..

Good Lord!

It will take me a decade.

Regards

Can you list me all the credit cards which u used in accumulating 1.25 million miles?

1.25 Mil is impressive with you being based out of India. Nice article but i actually cant figure out how you earned so much. I can understand that you cant divulge your actual CC spends but can you share how much you flew in revenue tickets and what miles you earned there. same for paid hotel stays and points earned and where you transferred them. Similarly which CCs earned you the most and how you allocated the points. More than strategy it will help us figure out where we stand with respect to you. No point me getting all dreamy eyed about millions of miles when the truth is that my potential is just 25% of yours.

@Saikat, I don’t think that information is required. I’m not trying to set a benchmark here for you guys to follow. I’m just trying to say that by doing everything with miles in mind, you get a good byproduct per annum apart from your regular spends. For instance, I know someone who buys their cars on credit cards, good enough for a lot of miles. I don’t even have a car. Then some people would be spending lesser than me. So, the point is not to benchmark yourself to me, but to do everything you do to get as many points as possible for you to get. it could be 25% of me, or 185% of me and that should not matter to anyone.

thanks Ajay. Appreciate that you actually take out time to respond to individual points. Guess will wait for your credit card strategy.

They are not “alternate” currencies!! That means switch back and forth!

Try ALTERNATIVE

Could you clarify if you got miles on multiple airline/hotel programs for the same credit card transaction? I am curious on how you got miles on “related” programs (e.g. Etihad, JP; or AA and BA).

@Subhash, AA by shopping transactions, BA through CC transfers.

I have Diners Black & ICICI Jet Sapphiro cards. I have been feeling that it is better to accumulate points rather than JP Miles. The value of 20,000 points on Diners Black is far more than the same JP Miles. I now book my domestic tickets on Goibibo even while travelling Jet since I think it gives me a better value (+ usage of gocash and other stuff).

What do you think?

Earned ~200,000 points last year. Combination of HDFC Regalia and AMEX platinum travel. This year, shifting from a “points” based strategy to a miles based strategy. Equipping myself with Regalia + Jet Privilege Diners+ Amex. Maybe some debit cards which are co-branded.

Debating whether to switch spends from regalia to Citi Prestige/ Yes Bank First Exclusive..

Interesting that Bonus miles ~= Spends. Your money is working far harder than ours!

@AA or any one with diners black – I have diners black & have been using it extensively with the partners for 10x rewards. While I didnt keep a tab on points accumulated, a recent back of envelope calculation makes me wonder if I m getting all the points I should. I m guesstimating ~8% less points awarded on last 3 months sample. Any such experiences?

I have the diners rewardz. I tallied the numbers and they generally don’t give you the total value, usually shortchanging by about 5 percent. They “bank” on the fact that most people don’t notice.

I am a newbie in Miles manufacturing in India. Can you help me where and how to start

I’m also started ~1 Year back.

1.If you have any credit card, convert into co brand cards (Google “jet airways co brand cards”), apply new if you don’t and It is also possible in HDFC debit card.

2. Convert your current CC points to Air miles.

3. Always use co brand cards.

Now I have ICICI Visa, Indusind amex and HDFC debit MC with 22K JP miles. I hope this helps

Dude, what was your credit card spend in 2016; since without that it is hard to form a baseline of what someone can earn in miles per year. Either I’m reading your charts wrong or I didn’t understand the article, but if you made 42% of the 1.25 million miles from credit card purchases; even at an average rate of 10 miles per 100 rupees, that would amount to ~ 50+ lacks. Is this figure even remotely accurate?

@Dave, the spend I did not collate and honestly, that is information I won’t share here. From Credit Cards, you would have to also account for all the signup and annual bonuses as well, not just spend done by swiping the card. Tack on to that there are cards which give you 33 miles per 100 INR spend, so your averages are not correct there!

Makes sense I guess. Could you point me to some cards which give the high mileage rate. That would be helpful. Thanks for the information.

@Dave will be writing up my Credit Card spend strategy in a few days. check that out. but to help your curiosity, look at the HDFC Bank Diners Club

Hey Ajay

Still waiting for your Credit Card strategy for the year! Any idea when you would be able to share it?

Even me too surprised a lot after looking at the 1.25M figure, I am very sure that you must have spent 20-25L to earn these miles.May be earning these many miles is a dream come true for middle income group whose income would be aroung 10L-20L yearly.

@Sravan, maybe you could start with earning 30-40-100K and then reach the million miles goal over a period of time?

Yeah, but still earning 1M Miles is a big thing and that too it will have expiry which forces us to use withing certain time period.

May be your next article will help me to achieve some extra miles in my kitty. 🙂

If possible can you kindly include some techniques which can extend the miles expiry in your next article.

Thanks Ajay for this. I have recently picked up this hobby and your blog is an excellent reference document.

1. The Diners club rewards that you are mentioning – is this from the HDFC Diners Club Black or we can directly earn Diners Club Rewardz points in India?

2. Would love to know what was the approx. spend that you actually did on the credit cards to earn 70% of 1.25m miles? Reason I am asking is that generally on average I have seen that I usually don’t get more than 3-4% rewards on my spends on cc. For earning this much, I will have to spend about 22-23 L on my CC every year.

@Sanket these Diners points are earned on the Diners Black. As for the second question, I don’t track my spends really. I just focus on what is the optimum card for which transaction. I’m not spending money to earn miles, but earning miles as a by product of my spending. So, no targets there really!

April is coming soon so whats the credit card strategy for 2017, since without credit card theres very less of earning right!!

@Maulik, good things take time. if you’ve noticed the credit card strategy has never gone up before late march or early april 😉

Haha. Even I checked the publication date of the previous years’ credit card strategy posts, yesterday, to get an idea about when will the latest one be published. Eagerly waiting for it.

Thanks for all the informative posts, Ajay!