Call it the Axis Bank effect, or it was in the works for a long time before (It is the latter!). At least the thought was, and perhaps the implementation got fast-tracked with Axis Bank beating them to the finish line. Back in the day, HDFC Bank’s Diners Club Black product used to have an excellent list of partners, which went away overnight. HDFC Bank has added many new transfer partners to their premium credit cards, HDFC Bank Infinia and HDFC Bank Diners Club Black.

HDFC Bank adds 14 new transfer partners

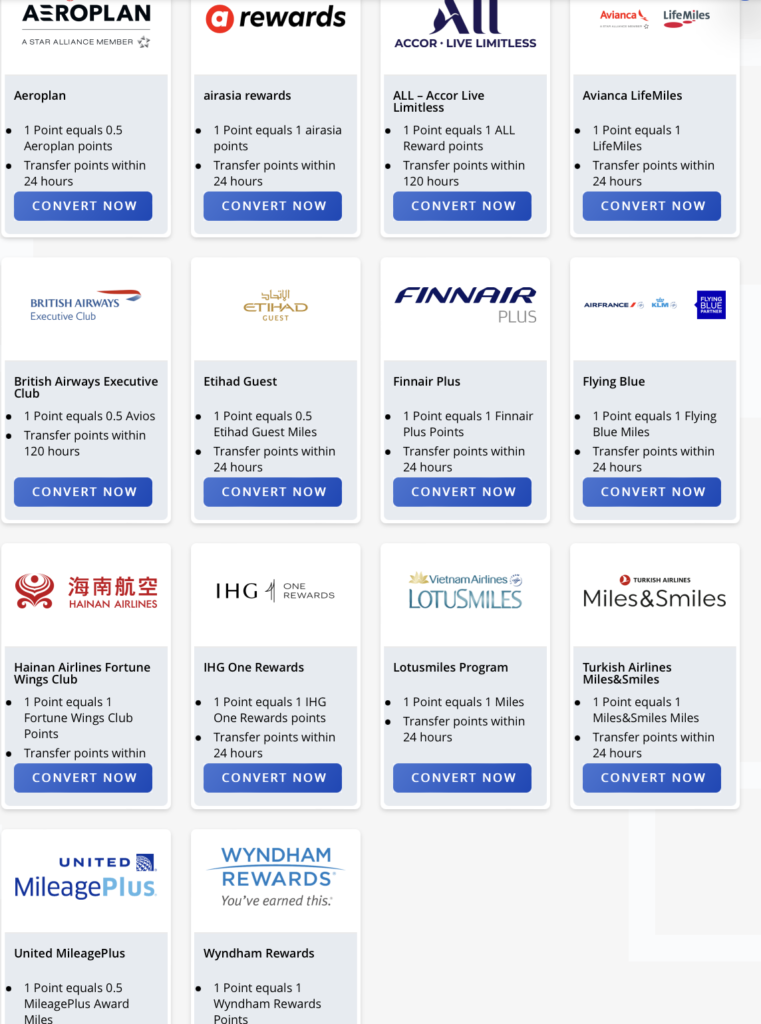

Here is a screen grab new transfer page that has been activated by HDFC Bank (although it is via their third-party partner Rewards360, so it works on an external site).

Here are the new partners and the transfer ratios:

Airlines

- Star Alliance

- Air Canada Aeroplan: 1 HDFC Bank Reward Point = 0.5 Aeroplan Miles

- Avianca LifeMiles: 1 HDFC Bank Reward Point = 1 LifeMile

- Turkish Airlines Miles&Smiles: 1 HDFC Bank Reward Point = 1 Turkish Airlines Miles & Smiles

- United MileagePlus Miles:1 HDFC Bank Reward Point = 0.5 MileagePlus Mile

- oneworld Alliance

- British Airways Avios: 1 HDFC Bank Reward Point = 0.5 Avios

- Finnair Plus: 1 HDFC Bank Reward Point = 1 Finnair Plus Point

- SkyTeam Alliance

- KLM/Air France Flying Blue: 1 HDFC Bank Reward Point = 1 Flying Blue Mile

- Vietnam Airlines LotusMiles: 1 HDFC Bank Reward Point = 1 LotusMiles

- Others

- AirAsia Rewards: 1 HDFC Bank Reward Point = 1 AirAsia Point

- Etihad Guest: 1 HDFC Bank Reward Point = 0.5 Etihad Guest Points

- Hainan Airlines Fortune Wings Club: 1 HDFC Bank Reward Point = 1 Fortune Wings Club Point

Hotels

- Accor ALL: 1 HDFC Bank Reward Point = 1 ALL Point

- IHG One: 1 HDFC Bank Reward Point = 1 IHG One Point

- Wyndham Rewards: 1 HDFC Bank Reward Point = 1 Wyndham Rewards Point

And suppose you are interested in Vistara, Singapore Airlines and InterMiles transfers. In that case, those are still available through the older route of logging into Net Banking and initiating a transfer.

You would note that most transfers will be completed with a turnaround time of 24 hours, although they might just be instant (I will try them out and report back when I can). Some have a transfer timeline of 120 hours (5 days), which might indicate that they need to process the miles manually.

With this move, HDFC Bank has put its feet in all three alliances and brought on board some great partners in Turkish, United, Avianca and Etihad Guest.

Bottomline

HDFC Bank has brought up a list of 14 new transfer partners, including partners across all major airline alliances and three hotel chains in their mix. The list includes some first-to-Indian card issuers transfer partners, including Avianca LifeMiles, one of my favourite international programmes, and AeroPlan. Existing partnerships with Singapore Airlines, Vistara and InterMiles continue as well (although they are direct partnerships, and these are via their partner Rewards360). The transfers are now live for Infinia and Diners Club Black.

What do you make of this new list of partners added to HDFC Bank’s Infinia and Diners Club Black Credit Cards? Which one is your favourite addition?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi @Ajay,

HDFC bank has launched a metal version of Diners Black card and removed the daily smartbuy rewards capping. Does it make sense to upgrade from plastic to metal? Fee remains the same.

@Manish, if you don’t have any sort of free version of the card, then yes, it makes sense to upgrade from PVC to Metal.

Hi Ajay

Thanks for the reply. I don’t have free version of this card. Have an Infinia LTF. Upgrading to Metal ups the spend threshold from 5 lacs to 8 lacs for a fee waiver without much added benefits. I prefer to put most of smartbuy purchases on Infinia anyway. Not sure if upgrade is worth it except for a metal card in the wallet.

Hi Ajay, Thanks for your articles and great contribution to the travel community, always. Just a suggestion – I don’t see any detailed review of accor program (earning and redemption) in the whole of Google. A request if you can add an article on the same. I was never a fan of accor but recently hearing the program is of great vale even vs marriott or itc.

@R, guides take time, but I’ll add it to the list of things to do and try and get it out soon. As for Accor’s simple take here is 2000 points = 40 Euro. So, it is a revenue-based programme that is redeemed in blocks of 2000 points from your account. So if you like cheap to mid-end hotels, you should find great value in redeeming points there. You can redeem at the time of booking, or at the time of check out both.

That’s a super fast and great summary. Thanks, very useful. Can I redeem on walk-in F&B expenses.

Ajay – Accor (ALL points) have a 1:1 transfer ration. When paying at accor properties (as per their website) using ALL pints, 2000 points = $40 = ~3200 INR, which is a very good deal.

Is it so straight forward or am I missing some fineprint/ catch here? I’ve got a Diner’s black fyi….

(I’ve recently purchase Accor plus membership based on your article last week and will be staying in Novotel BKK in a few weeks and for me using points is probably making perfect sense). Thanks in advance for your reply.

@Sandeep, no catch. That is exactly how you describe it.

hi Ajay,

I can see that the Accor ALL transfer ratio has been downgraded to 1 Diners Black Reward Point = 0.5 ALL Rewards Point. That makes it much less attractive now.

Thanks,

Manish

@Manish, covered by us about a month ago, here. https://livefromalounge.com/hdfc-bank-transfer-partners-devaluation/

Hey Ajay,

Can you tell us why you rate Lifemiles so high? Is Award seat redemption option available ex.India?

I transferred to Turkish Airline just now. It was immediate.

Axis has beaten HDFC outright in the cards game.Wether the move is permanent or temporary is what time will tell.

@Vardhan, I disagree. Axis is the challenger brand with a mandate to upset the apple cart. It has started flexing muscle by going for the Citi acquisition and recent moves such as the Magnus ones, but is it there yet? I don’t think so. And if you think three months on the blogosphere and Twitter buzz means everyone moved from their regalia or Infinia to Magnus, then yes, some folks did. But as the largest in the market, HDFC reacted quickly and pulled up their socks to offer a redemption choice just a few months after Axis. Makes sense?

(PS, the Magnus 25K is a genius stroke, but I’m sure they are eating costs on that, and that means it won’t last forever or will change in some form, eventually!)

Hi Ajay,

As the Infinia points expire in three years’ time, can I transfer them to their partners and enjoy extended validity of my points in the new avatar? If yes, what the the best options available as of now? Thanks

@Swamy, yes. Best available options depend on where you want to travel.

The transfer rations vs axis still is not favourable – especially when you consider the higher reward ratio of axis – especially for UA and EY.

Although I must admit – Lifemiles is an amazing addition.

I just wish somebody adds Hyatt!

@Aayush, as I responded to someone else in the comments, the Axis approach is aggressive because you need to eat costs if you want to jump up on the lists and gain market share. HDFC does not feel the need to gain market share. With this, they are adding more ammunition to stay competitive, yes, but if people don’t like the product, they don’t have to transfer.

Welcome move.

I would have loved to see ITC, Marriott and TIC on this list.

@R, for that, you have Axis Bank Credit Cards!

Agree Ajay; I sense HDFC infinia is no longer king of CC in India…its taken over by Magnus.

Thanks again for the great article, as always.

@R, Magnus is still the challenger. Infinia would have a far broader base, I believe of users who have not even heard of Axis Magnus. Remember, credit card optimisation is an echo chamber in India, not a national sport as it is in the USA.

Great move .. but transfer ratio of 1:0.5 in most cases is disappointing. Even Citi Prestige offers 1:1 for BA, Etihad and others.

So it’s actually a partial devaluation.

@Krishnakumar, Prestige offers 1:4 for BA, and Etihad, i.e., one on Citi = 4 on BA/Etihad/others… their scale is different and is globally negotiated. In the case of HDFC Bank, just a start right now, and they have passed on the cost in the form of redemption rates to customers. So, no devaluation here, at all. If one does not like it, one does not have to use it. Simple.