If you’ve been following me on Instagram (@shipraatalounge), you would have seen glimpses of my summer travel in the British capital. I just got back from a week-long business trip to London. Over the weekend, I had some free time and thought it would be a good idea to add up all the miles I earned on this trip. The final numbers pleasantly surprised me. Therefore, I thought I’d share my thoughts on how we could all earn airmiles fast, without breaking the bank!

Flying = 14,200 miles

I flew Jet Airways, Mumbai-London-Mumbai and while the number of base miles I earned on this sector was only 7820, as a JetPrivilege Platinum member, I also got 75% bonus JPMiles. To top off, I got another 500 bonus JPMiles for booking direct (250 JPMiles per sector). Flying Jet Airways made sense due to two reasons. First, tier points to help me retain Platinum status for another year; second, I was able to use upgrade vouchers on the outbound sector and travel Premiere. It makes a lot of difference on a 9-hour long-haul flight when one could fly the better cabin. Of course, I got to use the lounge in Mumbai as well as in London, even when flying economy from London.

Booking my air ticket = 10,500 miles

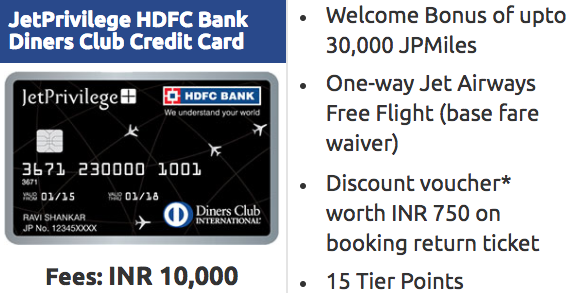

JetPrivilege HDFC Bank Diners Club Credit Card

The thing I like about the JetPrivilege HDFC Bank Diners Club credit card is that it offers one of the best JPMiles earning. The card earns me 24 JPMiles for every INR 150 I spent on booking JetAirways tickets. Therefore, all the Jet Airways tickets booked on Jet Airways website are booked on this card. Booking this trip alone got me 10,500 JPMiles.

Airbnb stay = 3,380 miles

What happens when there is a last minute trip, and hotel prices in Central London are skyrocketing? On this trip, Airbnb came to my rescue. I stayed in a beautiful Airbnb by the Thames and my hosts’ pet dog Lily was a great stress buster after work. For the stay, which I paid on my credit card, I added another 3,380 miles in the kitty.

Commute in London = 1,422 miles

In the entire last minute trip planning scenario, I forgot to carry any Pound Sterling for small expenses. That’s when my credit cards came in handy. Where I would have perhaps paid cash to buy an Oyster card and top it up, this time it was all digital transactions. For the Uber rides to and from the airport and topping up the card for the underground in London, I got myself another 1422 miles.

Eating out in London = 750 Miles

All my eating out, including business lunches, morning coffee and gorging on the weekends at the local farmers’ markets were paid on my credit card, and all the guilty pleasures I indulged in got me another 750 miles.

Shopping in London = 440 Miles

While I didn’t buy too much on this trip, however, I still managed to earn 440 airmiles from all the cocoa butter, avocados and all the fancy organic stuff I got back from London. Small number but I suppose some miles on my spending is better than no return.

UK Visa = 1,100 Miles

While I love visiting London, the most irritating thing about going to London is the obnoxious visa fee we Indians have to pay. I had to apply for last-minute express visa service and paid INR 29000 for a 6-months visa. The visa fee earned me 1100 miles since I used a credit card.

Total Miles Earned = 32,000 Miles

Adding it all up I earned about 32,000 miles on this trip alone. But the more interesting learning was that I earned more airmiles from spending money than flying. To be honest, some of that spending happened because I had no choice but to use my cards.

I learnt that I would have easily forgone a few thousand miles if I had remembered to carry local currency. When I look back at my spending, I haven’t spent extravagantly anywhere, and the small earnings added up to thousands. It made me think about Ajay’s recent column on CNBCTV18.com about ‘Why you should be obsessed about collecting air miles’

Most of my spends will get reimbursed, and without going out of pocket, I have managed to earn myself enough miles for an international ticket to Hong Kong or fly to Goa every quarter.

I’d love to hear how diligently do you spend on your cards to earn airmiles when you travel?

I have over 3 lakh miles with Jet Airways. With them in financial doldrums these days, I’m worried if I’m sitting on a pile of worthless junk?

Hi Shipra,

Both of you provide some excellent trip reports. I never thought that people in India were serious about collecting frequent flyer miles. I have picked this up in the last one year, and feel addicted to it. Though I stay in Australia, I came up by chance with this blog. Looking forward to more from both of you.

Airbnb stay = 3,380 miles, Commute in London = 1,422 miles, etc.

Were all these JP Miles or any other ones? Could you please specify which miles at each point?

Hi Deo, JPMiles for flying and booking the ticket on the JP co-branded card. Everything else on Citi Prestige. Hope this clarifies.

Hi Shipra,

Amateur tip: If you buy forex from Thomas Cook India website, you can pay using your credit card, hence more miles. Agreed the rates are higher than doorstepforex.com, but doesn’t matter if you can charge it to your clients (corporate travel) 😛

Cheers,

Thanks Sagar. That’s a good tip to keep in mind.

Hi Shipra,

How many upgrade vouchers were required for premeier one way ?

Hi Puneet, 3 vouchers to upgrade BOM-LHR.