In April 2021, Citibank announced that it would be exiting the retail businesses, including credit cards, retail banking, consumer loans and many other such lines of business in 15 geographies in Asia and Europe, including India. Their rationale was that the business did not gain scale in these geographies, so they wanted to refrain from committing more resources to these markets. In March 2022, they announced that the Indian retail business would be carved out and sold to Axis Bank for USD 1.6 Billion. The date was said to be set as the first half of 2023.

Citibank is close to delivering the goods to Axis Bank.

For most of the second half of 2022, Citibank inundated me, and perhaps most of their customers, to get them to consent to transfer their relationships to Axis Bank. They spammed me day in and day out for me to say YES. Not a good impression to show that they were desperate.

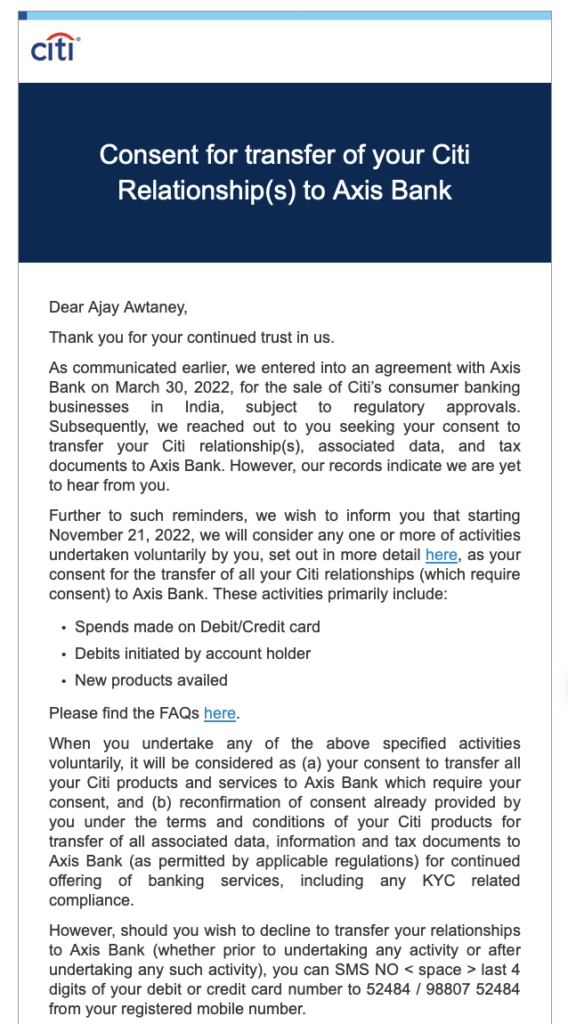

When they could not convince customers to say YES to moving their relationships, Citi changed tactics and wrested a YES out of them. They said that if you use your card, it’s consent. If you redeem your rewards, it’s consent. And so on.

And this worked, given me and a lot of other folks got these messages over the past few weeks, despite not having expressly clicked a link to say Yes.

To keep the band of customers together, Citi has also hiked marketing spending and discounts over the past few months, as everyone would have noticed. They’ve even been paying influencers to get the message out about their discounts.

After all, the eventual deal size of what Axis Bank pays Citi for would depend on the number of accounts delivered on the closing date. So, the overbearing enthusiasm from their end now. I wish this enthusiasm existed over the years, and they did not have a small book to show for their years in India in the first place.

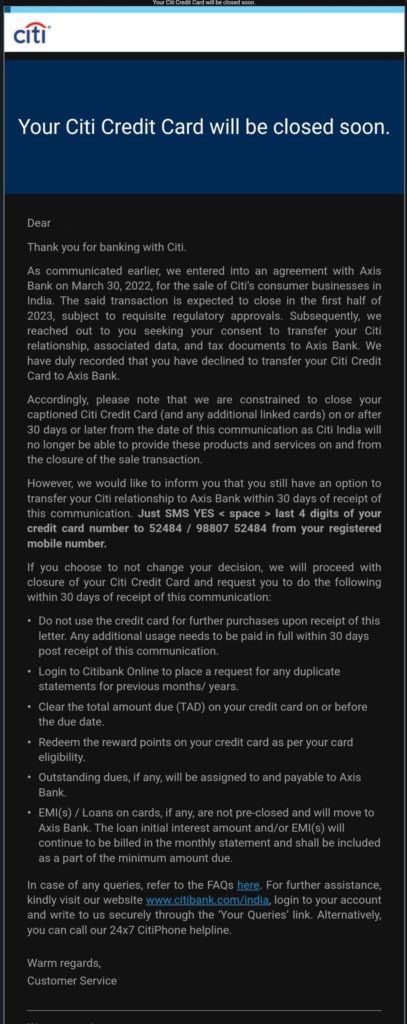

Citi has started closing accounts in preparation for a move to Axis Bank.

For those who chose not to be heading to Axis Bank, Citi has now started closing their bank accounts. For instance, Social Media is currently full of complaints from customers whose accounts with Citi have vanished overnight.

Just came back from citi bank MG road , bangalore office. you ppl have closed close to 5k account without any notification. it is really shameless behav from a prestigious bank.

— Amaresh Dhal (@tweet_amaresh) February 9, 2023

Thanks @NewsMinuteNow for listening me. @Citi and @AxisBank for listening how bank accounts are close on the fly yesterday as per citi staff on citi phone, account was supposed to be closed on 15 Feb or 15 March 2023

— Srinivasan G/சீனு (@gsvasan) February 9, 2023

In fairness, Citi had sent out emails to customers about a pending closure of their accounts in the past month or so.

Citi has stopped renewing the insurance for Prestige Customers.

This one gave me chuckles. Citi did not renew its group travel insurance, which is a part of the benefit from Citi for all Prestige Customers for their international travel, and blamed it on administrative challenges. I don’t think, though, in my small number of years running M&A in financial services and banking, did I ever refer to the sale of assets as “administrative challenges.”

When asked if they are rebating the fee for withdrawing a key product feature or replacing it with something else of an equivalent nature, Citi said no and no.

Bottomline

Citibank is nearing the finish line in terms of putting a bow on its assets in India and handing them over to Axis Bank. In exchange, they will be paid over a billion dollars. However, I don’t like how they’ve gone about the whole exercise, which largely reeks of desperation from Citi’s end to get this done with and tarnish the reputation they built in India over the years (only talking credit cards here, not banking!). And hence, I already moved my spending from Citi to Axis Bank in anticipation.

It will likely be a few more days before we get a morning email saying we are customers of Axis Bank, so why not already start benefiting their P & L. I anticipate the deal to be closed before the end of this financial year (March 31, 2023).

What are your thoughts on Citi’s handling of their retail banking business sale to Axis Bank?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Citi may decide to conduct its business as they like. When you signed up for your account you were clearly given to understand that terms of service may change. We perhaps relied too much on Citi and for that reason their withdrawal hurts. If your dissatisfaction continues, you have option to pull out from their services elsewhere in the world. I am also an existing customer of Citi both in India and USA. What has been hurting the most , and creating dissatisfaction, is their smooth process of transferring funds between the account in both the countries. Let us share base pain points and alternate ways to achieve the same outcome at same or lesser cost. I would not fret over Citi services in India, competitor will always be available.

I just dont understand why you people are so negative about city bank. As a Citibank nri customer I have a great experience and got best customer service. They approached us since six months when they signed deal with Axis bank. THEY CLEARLY TOLD US POLITELY, THAT IF WE DONT GIVE CONSENT OUR ACCOUNTS WILL BE CLOSED BY THE CUT OFF DATE. If you give consent your banking will be as usual with Axis bank. So what is the issue?

Harshad Patel

USA

@Harshad Patel WHY DO YOU HAVE TO TYPE IN ALL CAPS ON MY SITE?

What happens to the group insurance taken from Citibank? Mine is up for renewal end Feb. No one replies to emails sent to Citibank

So, what did you do with your Citi prestige miles ? Used ? Or is there a transfer mechanism announced, to Axis ?

@Manish, still there. Why would I transfer them to some programme and start the clock on having them expire?

My application to a separate axis card got rejected because of their internal reasons. i am intrigued to know what will happen when axis gets hold of my credit card account from citi. They will pay citi for it and then close my account perhaps. i hope they pay a heavy price for it. i have no interest in keeping a relationship with axis, said yes only so i could use my citi card for as long as possible. They gave me my first credit card 15 years ago, and citi is like my 1st love.