A large part of the unseen world of credit cards is the marriage of payment networks with card issuers to provide specific card features. On each card, some features might be offered by the card network (such as MasterCard/Visa/Diners Club), and others might be provided by the bank (such as Axis Bank/ HDFC Bank/ etc.). For example, while Axis Bank might add the complimentary Meet & Greet services on the Magnus, Diners Club might add the complimentary Golf Access on the Marriott Bonvoy HDFC Bank Diners Club Credit Card. There is a whole chain of how the payments and billing are split up. Or, for a particular card that the bank issues, the network may be willing to take a few bps less of its share to get exclusivity on the issuance of the card.

However, the Indian banking regulator, the RBI, does not like these bilateral arrangements and decided to move the choice regarding payment networks from the bank/issuance partner to the customer.

Effective August 2024, pick your payment network.

Effective August 2024, you should be able to pick the payment network on which you would like the card issued. Per a new RBI directive issued today (March 6, 2024), the central bank has put rules for banks of scale more than a million (10 lakh) credit cards in issuance to offer customers the choice.

The RBI’s new rules state that card issuers must offer eligible customers the option to choose from multiple card networks at the time of issue. This option may be provided for existing cardholders during the next renewal. MasterCard, Visa, American Express, RuPay and Diners Club are the networks for RBI’s new circular.

Also, a specific term excludes American Express India from issuing cards on other networks because it issues cards on a closed-loop system, where it is both the card network and the issuer.

Why this might be of use?

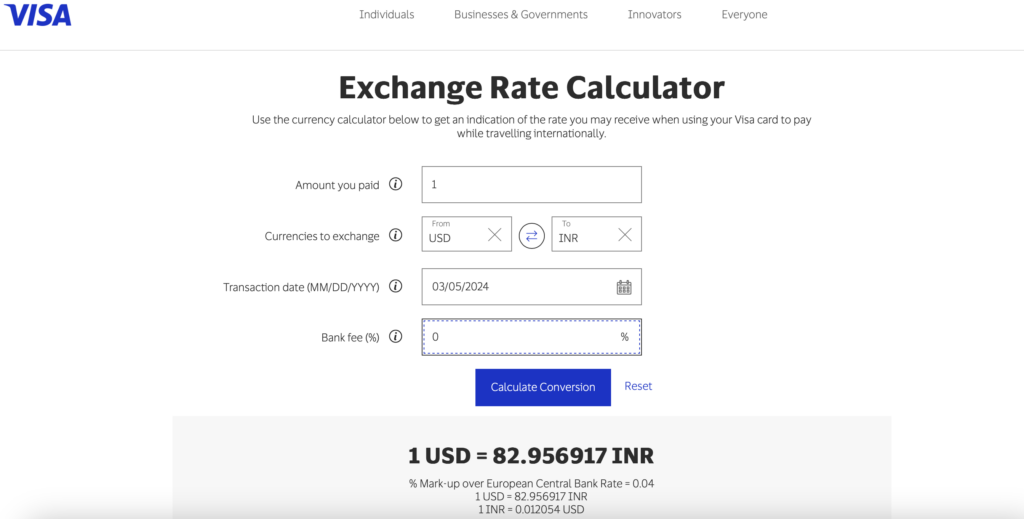

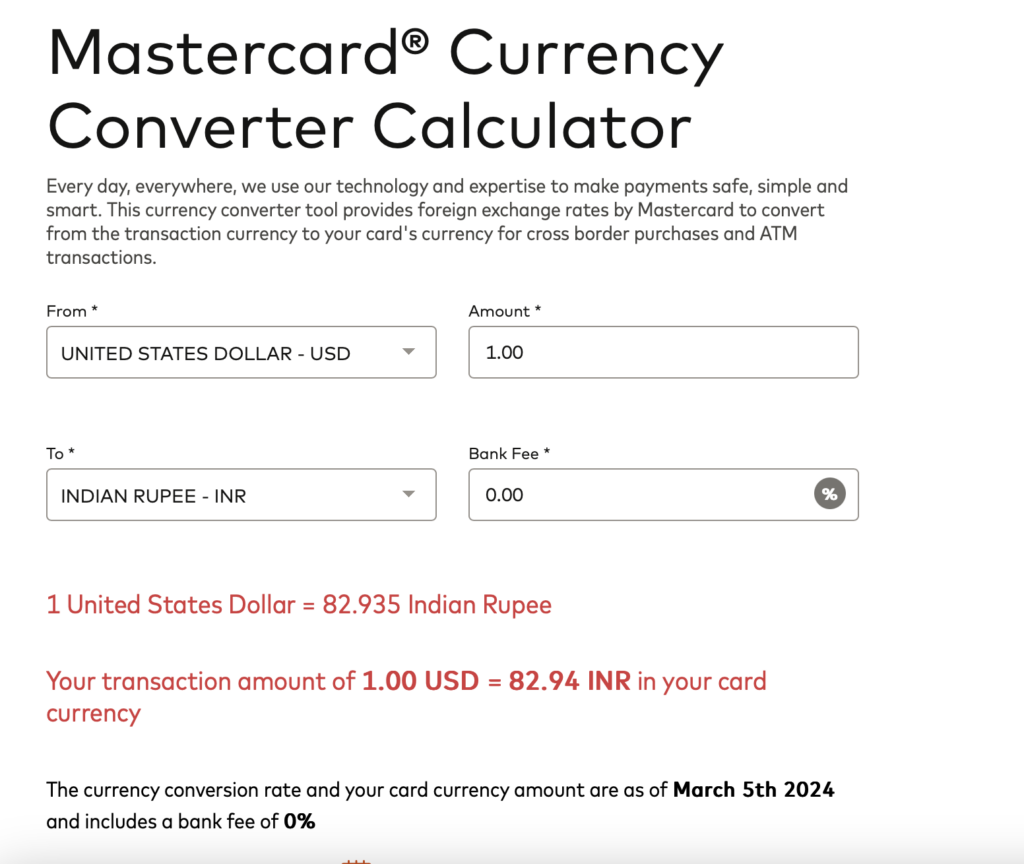

Sometimes, the network-wide perks of a certain network might be better than the other, and hence, you might want to switch to the other network. For instance, MasterCard offers a better forex conversion rate over Visa. Take, for instance, the rates on March 5, 2024, first for Visa and second for MasterCard.

Bottomline

Effective August 2024, the big banks in India will have to offer an option to issue credit cards across various payment networks rather than exclusive arrangements. This move has been notified by the Reserve Bank of India, which is the central banking regulator.

What do you make of the rules of issuance of credit cards being reset by the banking regulator?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Good move