Not a lot of credit cards out there give you reward points when you load your PayTM e-wallet. On the other hand, Citibank Credit cards do reward wallet loads. There is a new PayTM Citi credit card offer where you can earn 5X points on PayTM wallet. If you have the right card, the reward rates could be in the same league as what HDFC Bank is offering with their Happy Hours promotion.

Earn 4X bonus Citi points when you load a minimum of INR 5,000 onto your PayTM wallet using the Citibank India App and website. The following Cards are participating:

- Citibank Rewards Card

- Citibank Indian Oil Platinum Credit Card

- Citibank Cashback Card

- Citibank Shoppers Stop Credit Card

- Citibank PremierMiles

- Citi Prestige

- Citi Ultima

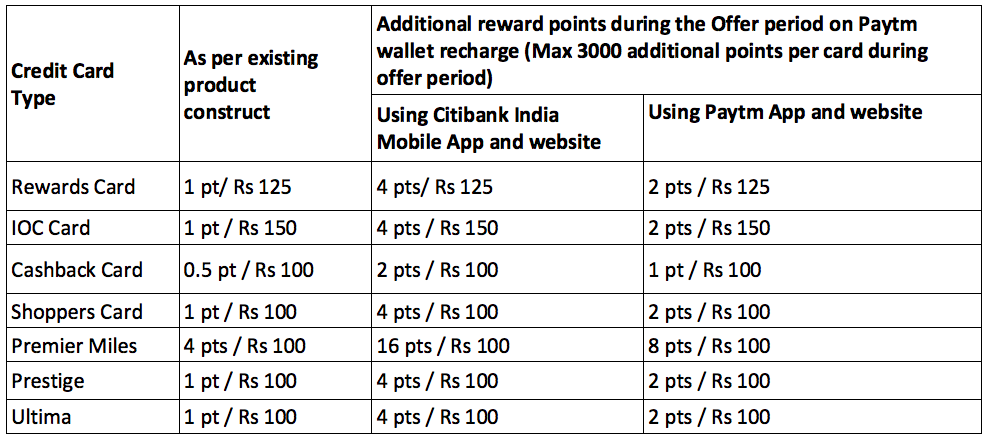

If you load through the PayTM app or website, you get 2X extra points. This promotion is valid through October 31, 2018. The following is the earning rate:

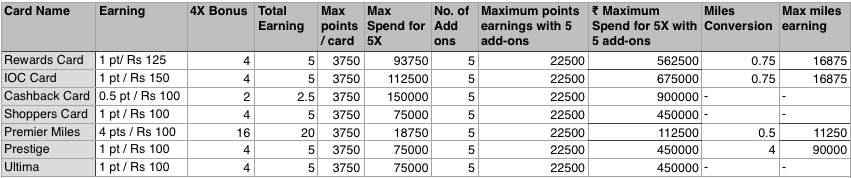

The upper limit on the number of bonus points has been set to 3000 points. Corporate credit cards are not eligible for the bonus. At the same time, if you have add-on cards, each card will be treated as a separate card for this promotion, i.e. you can earn 3,000 bonus point on every card. So, if you’ve maxed out your add-on card limit, you can make 18,000 bonus points. You can read the rest of the terms and conditions here.

Amongst the best card to have during this promotion is the Citi Prestige. You earn 5 Prestige point for every INR 100 which translates into 20 airmiles per INR 100. That gives me a reward rate of about 20%! Maximise the promotion over all your add-on card and earn 90,000 air miles. Do keep in mind Citi points could be transferred to any of the dozen-plus airline transfer partners including Singapore Airline, British Airways, and Jet Airways.

Also, each PayTM account is only limited to have INR 100,000 per month as wallet load limit, so do take that into account as well while making your allocation to PayTM spends.

Bottomline

This new Citibank credit card promotion is an excellent opportunity to mint points. Some incredible value can be derived if you convert Citi points to air miles. And don’t forget, PayTM also offers some nifty cash backs when you shop on PayTM Mall. Hence there is even more value to be unlocked!

What do you think of this Citibank Credit Card offer?

Recap: Citibank Rewards Card, Citibank Indian Oil Platinum Credit Card, Citibank Cashback Card, Citibank Shoppers Stop Credit Card, Citibank PremierMiles, Citi Prestige, Citi Ultima are participating.

Did anyone here receive the bonus points yet? T&C says 60 days on a best effort basis.

Was going to ask this myself. No , neither have I got them. I doubt they’ll credit it EVER.

I am a full KYC Paytm customer. After Rs 10k recharge on first day of offer, I’m now unable to recharge again. I have not reached Rs 1lakh add limit per month and I am attempting recharge after 2 days.

What could be the issue?

Thank you for bringing this up. I am facing the same issue since yesterday. Shown a list of reasons why the transaction might have been denied ( 10k limit / day , 1L limit / month , etc. ) , NONE of which apply in my case. I guess Citibank has had enough of this & are repenting their offer now.

I even called up Citi customer care. According to them, all is fine at their end. They have taken my complaint but i don’t think anything will be done.

I know few other people facing same issue.

Looks like a deliberate attempt to prevent users avail this offer.

Yup facing the same issue since two days

Definitely deliberate. Makes no sense at all.

Even Paytm is acting quite strange , citing weird ‘technical’ glitches for some high amount payments , that I had initially planned. I guess they too want your money to pile up and be used at their “mall”.

I noticed that max I can load per card is Rs 10k. Tried another card and it worked but only allowed max Rs 10k per card.

Seems they are not allowing load beyond Rs 10k per card across offer period.

Yes , but that’s the daily limit via Citi app or website. I was able to load 10k everyday till Saturday. But not even a penny after that.

Looks like Citi has heard us rant, they have fixed this now. I’ve recharged 10k (2 transactions of 5k each) using my prestige this morning. My last recharge was on Saturday and I was facing the same issue reported in this thread the whole of Sunday and yesterday.

Thanks for informing

IOC Points are worth 1 rupee a piece if you redeem for fuel. That’s more valuable in my opinion.

Not comparing with prestige card.

The Citi APP (Mobile or Web) only allows 5000 Rupees maximum as recharge. Is this by design or since I have set PayTM up today in my Citi Mobile App.

Regards

My account is permitting me to transfer Rs.10,000 per day (two transactions of Rs5000 each).

The wallet recharge limit is 10K per month if you have ekyc enabled for paytm.

It is 10k per day (at 5k limit per transaction) and 1L per month if you have enabled full kyc.

Was informed by a paytm ‘chosen’ store agent today that full KYC is allowed from Nov 15. It was on hold for the past many months apparently.

S&S

how does one add funds to paytm wallet (via citibank for the max bonus) from a citi prestige addon card?

The addon cards don’t show up on the primary card holder account and cannot add them either.

Any one have any luck?

ah nevermind, i created a separate account for the addon card holder

@bluecrabs yes that is the only way to do it

I’am still trying to figure this out

1. I’am the primary card holder of CIti Prestige

2. My wife has an addon Prestige card

3. My wife has her OWN citibank savings account

4. When I try to link the addon card – it says it cant. Has anyone else been able to figure this out ?

create a new citibank online profile just for the addon card

https://www.citibank.co.in/ssjsps/firsttimeuser.jsp

Is this a targeted promotion? cant find a link on citi india website

Can I make a ULIP payment via my Paytm account?

How can I use add-on card for recharge using Citi website/app? It will only show the primary cards there to use.

Unable to use the Citibank website / app option to recharge my wallet ( for 5X points ) , and repeatedly being shown an error of ‘Transaction Declined , Contact Citibank’ . Anyone else facing the same issue ??

I successfully recharged today through Citi website. Could be some temporary issue.

Yes , just spoke to Citibank a few minutes back. There was some technical glitch ( with my account ) which they corrected.

But are i going to spend Rs4.5L. Be realistic……

Actually depends on person. I am not saying everyone can spend 4.5 lacs but you can buy anything from flights to phones and electronics. And you can use that Paytm money anytime. So huge flexibility.

Plus you also get to use Paytm coupons and discounts, so not like you are facing any issue there.

Infact, considering the 3% fees on transfer to banks, it just makes sense to use the card if your reward rates are better than that. (9% for premieremiles, 20% for Prestige)

Could you explain the last portion once again please ?

Infact, considering the 3% fees on transfer to banks, it just makes sense to use the card if your reward rates are better than that. (9% for premieremiles, 20% for Prestige)

I have a prestige card and have got the max permitted supplementary cards of 5. Am curious.

You load the money into PayTM wallet using your prestige card and transfer the wallet money back to your bank account with the 3% fee. As long the the benefit outweigh the 3% fee you should try it out.

As mentioned, Paytm transfer from wallet to bank is at 3%.

(Free for merchants).

you get 3750 prestige miles on 75000 Rs per card.

Considering same value as 1 re/jet mile (and other miles), and transfer ratio of 1:4, that’s 15000 Rs. For every 75000 Rs. Spent

Against it, the transfer to bank charges will only be 2250 Rs. So still worth it.

I personally value Jet miles (have less involvement with other miles at 50 paise), so value of your cashback is 10% as per me, but even then it’s a good offer considering 7500 Rs worth miles against 2250 Rs charges.

Not a bad deal if you have some big insurance payments to make