Jet Airways announced three weeks back that they were going to partner with 3 banks to launch co-branded credit cards and HDFC Bank will be the first off the mark there. Last evening, the product details of the HDFC Bank – Jet Airways credit card were put out on the HDFC Bank website.

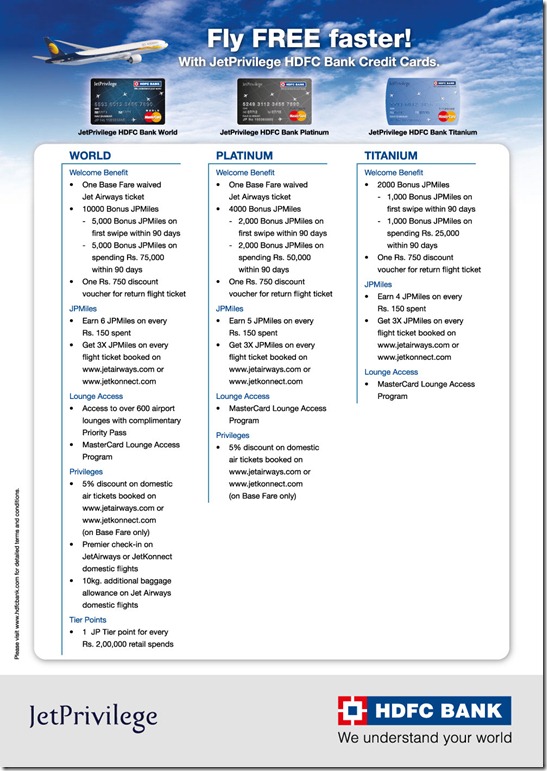

In summary, the Jet Privilege HDFC Bank credit cards will be offered in 3 variants (all MasterCards) : World, Platinum and Titanium. Have a look below at the comparison sheet of the three versions (click on the image to zoom in).

I will review all the products in detail in my review series of credit cards for mileage in the coming days, but here are some first impressions:

- The card variants are priced similarly to the earlier Citibank co-branded credit cards with the World card at Rs. 2,499 per annum, the Platinum at Rs. 1,499 per annum and the Titanium version at Rs. 599 per annum. Unlike the earlier Citibank proposition, this card does not come free for Platinum members. [Update: Platinum members get it free now]

- The new credit cards offer 6 JP Miles/5 JP Miles/4 JP Miles per Rs. 150 spend, which is in line with the earlier Citibank co-branded card which offered 4 JPMiles per Rs. 100 spent on the highest variant (JACC Platinum). However, small tickets less than Rs. 150 will not accrue any JP Miles altogether (not even prorated).

- The card offers 3x JP Miles on buying tickets on Jet Airways websites, which is a better proposition than the earlier 2x JP Miles using the Jet Airways Citibank Credit Cards.

- The welcome gift of 10,000 JP Miles on the World Card (5,000 on first transaction and 5,000 JP Miles on spending Rs. 75,000 on the card within 90 days) is a solid deal at this price point. Even if you chose to do only one transaction, you will be recovering your fees on the card. Even with the Platinum version, the points are good value 2,000 JP Miles for Rs. 1700 (fee+taxes). The renewal fee benefits are gone unlike the Jet Airways Citibank Credit Card offer earlier. [Update: renewal benefits are back: read here.]

- Like I predicted on FlyerTalk earlier, there is no mention of upgrade vouchers in this card proposition. The earlier Citibank card offered an upgrade instrument for every Rs. 2,00,000 spent on the card (later devalued to Rs. 3,50,000).

- However, on the highest end card, every 2,00,000 spent on the card will earn you 1 tier point towards your status on JetPrivilege. This is something out of whack, because you can earn a tier point by only spending Rs. 2,500 to buy a cheap one way ticket to anywhere on the airline and lacks the punch of the upgrade instrument offer earlier.

- The MasterCard Lounge access program is offered by multiple banks so nothing that adds to the edge of this product.

- Only the highest end variant gets some privileges such as excess baggage allowance, but that too only on domestic flights. So, this is a downgrade for those who had the existing now discontinued Jet Airways Credit Card.

Clearly, this Jet Privilege HDFC Bank is one of those cards you should take for the sign-up bonuses, because I won’t bother spending Rs. 2,00,000 to be earning one tier point. The Priority Pass offered is the lowest variant, and it seems to me that it is the ‘in thing’ to offer this with a new card product these days. However, each use of this Priority Pass costs $27, and I have not met someone so far in the last 5 years who accesses a lounge after paying $27 on this card. The ones I get every year also stay in my wallet and get trashed at the end for so many years because it is useless to have this version of the Priority Pass.

I am waiting to hear what will be offered to those who predicted correctly in the Wheel of Fortune contest. Initially they offered a 1 year free card.

Related Posts:

- Jet Airways’s announces new credit card partnerships with 3 banks

- Burn Notice: Citibank and Jet Airways – friends turning foes!

- Jet Airways Citibank Credit Cards devalue upgrade benefits with effect from September 2011

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

What is the minimum income for being eligible for the JetPrivilege HDFC Bank World CC?

I fully agree. the upgrade vouchers were the only thing of value on the prevous cards. even this has now been devalued. Also IMHO all the frequent flyer programmes of all airlines are not worth it. I have lacs of miles in my jetprivilege account but I have never even only been able to get a fee ticket. whenever you want to travel the free seats will never be available particulary if you want to travel business class.

Agree – looks like a non starter. The Rs. 2L incentive looks to be meaningless.

I had been looking forward to a solid offering as a comeback by Jet. What has come out looks to be much poorer offering. Not worth shifting from the card offered by citi as an alternative.

Also when compared to the offerings at various times by other airlines – a much lesser benefit is seen.

AJ

Checked my JP account today. I got 1000 bonus JP Miles (credited on 8th Aug) for the Wheel-of-fortune event. But as I don’t hold JP Platinum tier status, I am more interested in the 1 year fee-waiver! I hope the 1000 JP Miles were in addition to the 1 year fee waiver. [Greedy Me :D]

AJ,

I had participated in wheel-of-fortune and correctly predicted HDFC Bank. Now I am waiting for Jet-HDFC to fulfill the 1 year fee waiver promise. Logically, Jet should tell HDFC to contact people who were successful in the wheel-of-fortune contest. Otherwise how will the process work?

Btw: I am surprised by the fact that Jet didn’t send any email (to the former Citi-JACC customers) on launch of this card. Did you get any email in the past 2-3 days this regard?

@YKS, like you know its all messed up. I hope they sort out things as they go along…. No emails yet, but then there are complaints of late of far too many emails. I think the intention is to have a quiet launch and then go all out later once they have a marketing plan in place

Agreed, you could just buy your own airport lounge access for less as well. Now the companies that sell lounge access to the credit card companies are selling direct to consumers there are much better deals for regular and even occassional travellers.

Not even worth applying for – who needs Jet miles now anyway? Upgrade vouchers were the only reason to use the Citibank card…