HDFC Bank and Jet Privilege extended their 2012 relationship of issuing co-branded credit cards in 2015, with the launch of a co-branded Diners Black credit card. I stayed off this card for about a year, given that I already have the other Black card. However, I did manage to get Shipra to sign up for this card last year, and we received the card in August 2016.

With Diners, Jet Privilege only issues the Black variant. With the spread of HDFC Bank terminals, and some other banks also starting to accept Diners Club on their terminals, acceptance of the Diners Black is pretty good at the moment.

Jet Privilege Benefits

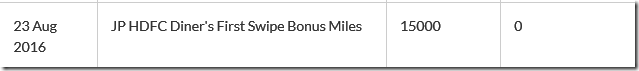

The credit card comes with a great proposition to start you off. In the first year, you get 15,000 JP Miles and a Jet Airways Economy Class domestic ticket code to get your relationship on this card started, on first swipe of the card. You get 15 Tier Points in your JetPrivilege account towards your qualification criterion in the first year. These 15 tier points were all that we needed to have Shipra get to Platinum last year. Not bad if we could get it done sitting at home, right? There is also an INR 750 discount voucher for making a round trip booking on Jet Airways.

On renewal, you get 5 Tier Points as well as 10,000 JPMiles per renewal cycle on realization of fees. Every year you also get a free base fare ticket code, which if used right, can recoup the cost of the membership fees. With holding the card, you also get to keep your JP Miles from expiring for 5 years instead of 3 years.

On the airline, one gets a 5% discount every time a ticket is booked directly with the airline on jetairways.com. Also, you can use the Business Class check-in counters for domestic flights of Jet Airways. One gets 10 kg excess baggage in Business Class and 5 KG in Economy Class, except for domestic Deal fares.

Spend Benefits

The HDFC Bank Diners Club co-branded card is the most lucrative card if you are a Jet Airways customer. Period. On regular spends, you get 8 JPMiles/INR 150 spent, but on spending on Jet Airways’ website, you get 24 JPMiles/INR 150 spend. Our family books all our personal Jet Airways travel on this card now.

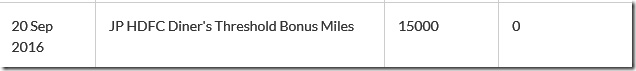

If you spend INR 1,50,000 within the first 90 days of card issuance, you can look forward to another 15,000 JPMiles being credited to your account. Additionally, for every INR 1,50,000 spent on the card, one tier-point is added to your JetPrivilege account.

Additionally, if you spend at the partners which participate in the Extra JPMiles program, you could get other bonus JPMiles on your spend as well. The only spend category which does not earn any points on this card is Fuel, given there is a Fuel Surcharge Waiver in place.

Lounge Access

Unlimited Lounge Access is available at 600+ Lounges across the world, including 30+ Lounges across India. Domestic Lounges are at Delhi, Hyderabad, Bangalore, Mumbai, Chennai, Kolkata, Ahmedabad, Vadodara, Pune, Goa, Cochin amongst other centres. The full list is available on airportlounges.in.

Golf Benefits

HDFC Bank offers unlimited Golf Games at 20 Golf Courses in India and over 40 Golf Courses worldwide. Additionally, there are complimentary Golf Lessons also available at select driving ranges across India.

Eligibility

There is no criteria mentioned on the website, but if this works the same way as it works for Diners Black regular, then you need to be earning at least INR 15 Lakhs to be able to make a case with them.

Annual Fees

The Fees for the first year is INR 10,000 plus applicable taxes, and going forward you get INR 5,000 per annum plus taxes as fees on renewal. Unlike other JetPrivilege co-branded cards, you cannot have this one for free even if you are already a JP Platinum.

Foreign Exchange Markup

2% plus applicable taxes

Value Assessment

As one of India’s biggest airline, Jet Airways’ ticket can be used very well if planned the right way. In various instances I’ve used the ticket for a value of up to INR 5,000 as well. This recoups the value of the card fees for me. Additionally, the bonus miles depend on your spend. We are Jet Airways’ frequent flyers and we put all our Jet purchases on this card these days. The tier points come handy to Shipra to plan for her requalification as well, as her travel schedule is erratic.

Overall Assessment

I’d think if you are Jet Airways’ regular, this card is a must have in your pocket to maximise your spends with the airline. The benefits on offer justify the price point. However, this card does not participate in the HDFC Bank Diners Club 10x spend program, which does not allow me to get 10x on my spends with those vendors.

Bottomline

The use case of this card is pointed towards those who want to deepen a relationship with Jet Airways/ Jet Privilege and are willing to put money on the table in this regard. I may love the airline or hate them sometimes, but for me, they are the best full-service option out of Mumbai right now.

Have you taken on the JetPrivilege HDFC Bank co-branded Black Diners Club card? What has been your experience with the card?

Hi Ajay hope you are doing good, can you please tell me how long does it take for the bonus tier miles and tier points to get credited to your JP account.

Hi Ajay,

I have recently taken this card. I have one query related with Threshold bonus miles.

I understand that transactions like money load in wallet and petrol are excluded from JP miles earning. But will these transactions related with money load in paytm or fuel will be considered for threshold?

For e.g. if I spend Rs 150 000 out of which 25000 are in Paytm wallet load and 25000 are in fuel, will I be eligible for threshold bonus miles?

Hi Ajay,

Do you or do you know of any one who hold both Dinners black and Jet Diners. I have been told you can’t hold both.

@puneet venkata yes, you can’t hold both

Have this card over an year now and all the mentioned benefits you mentioned is useful. My gripe is with the customer service with no dedicated line for a premium card like this. Also Hdfc staff is also not aware of the benefits and it becomes a challenge to explain. I prefer the services of Citi prestige better

Hi ajay,

Wanted to clarify why you feel ‘this is the most lucrative card’ for a jet airways customer. The card gives 24 jp miles for every inr 150 spent. The diners black via 10x promotion on goibibo or makemytrip would give 50 points on inr 150 spent which you can convert to 35 jp miles (1 point = 0.7 miles). Curious to know if i am missing something.

Regards,

Jai

@Jai, your maths is correct. However, I’ve leaned towards direct booking here because of reasons I will explain in a future post. If you prefer to book via a TA such as Goibibo, yes, your version is correct

Diners Black converts at 1:1 to JP miles – the website has a typo.

Signed up and received the card in October last year and since then have gone from gold to platinum and lapped up close to 1,50,000 JP Miles including 15,000 miles twice within first 90 days. Being a frequent domestic traveller, this is the best card, period.

I have one query related with Threshold bonus miles.

I understand that transactions like money load in wallet and petrol are excluded from JP miles earning. But will these transactions related with money load in paytm or fuel will be considered for threshold?

For e.g. if I spend Rs 150 000 out of which 25000 are in Paytm wallet load and 25000 are in fuel, will I be eligible for threshold bonus miles?

Ajay, Look forward to your annual write-up on Credit Cards to keep / junk. Thanks.

Actual effective FCY cost to the cardholder on a premium HDFC Card like this one would be ~2.30% {since along with 2% FCY, HDFC would add Service Tax (0.28%), Krishi Kalyan Cess (0.01%) and Cess Tax (0.01%)}

Although, this is still lower than non-HDFC Cards which charge 3.5% FCY, effectively coming to 4.02%.