One of the biggest players in Indian Credit Cards and one of the most favourite ones seem to be in a rush to get back to pole position after they have the RBI Embargo on the issuance of new credit cards lifted from them.

In an interaction, aptly titled, How are we playing our cards, HDFC Bank’s Country Head for the Payments Business, Consumer Finance, Digital Banking & Marketing, talked to us about how the bank was progressing well with its goal of getting back to the top of the issuer charts. For HDFC Bank, the key goalpost right now is to achieve an issuance run rate of 5 lakh cards per month,

In the interaction, HDFC Bank announced that they had already issued 4 lakh credit cards since the embargo was lifted and till September 21, 2021 (a shade over a month). In an earlier interaction, they had indicated that there are over 20 partnerships coming up, and they have only released details of one of them. So, more to come over the months ahead. Additionally, the bank is working on a strategy where they will reinvent existing products as well, apart from creating new ones, and that existing card members will also benefit from the new updates to the products.

To emphasise on this strategy, Mr Parag Rao, commented, that,

As a leader in the cards space, we promised, we’d be back with a bang. We are now pushing the pedal not only to acquire new customers, but also to enhance offerings of our existing cards.

Our strategy to re-invent, create and co-create has been crafted based on the analysis of customers’ buying behaviour, the categories they spend on and the spend patterns. The months that we have spent readying and sharpening our strategy are now bearing fruit. We are ready to unveil best in class offerings and experience to our customers, just in time for festive season.

The Bank has revamped three credit cards from their portfolio and taken up three credit cards for an initial revamp. These include the Millennia, Freedom and Moneyback+ Cards. The new card variants wll be available to customers in October 2021. For the existing Freedom and Millennia credit card holders, they will also be moved to the new product structure.

- Freedom Credit Card: The Freedom card is targeted majorly towards those who are starting their career. It will also cater to segment that has a greater need for credit allowing them to utilise credit for their large spends in a very affordable yet highly rewarding manner. One gets 5X Cashpoints on EMI spends at merchant locations.

- MoneyBack+ Credit Card: The MoneyBack+ credit card is targeted towards those who are seek value on their everyday spends. You get 10X Cashpoints on 5 key merchants : Amazon, BigBasket, Flipkart, Reliance Smart Superstore & Swiggy, and 5X Cashpoints on EMI spends at merchant locations.

- Millennia: The new avatar of the card will cover all the areas millennials are likely to spend in, such as shopping, dining, entertainment & travel. You get 5% cashback on 10 merchants – Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber & Zomato, and 1% Cashback on other spends including EMI spends & Wallet Loads (except Fuel). The Maximum cap per cycle of cashback is INR 1,000. For older customers, the validity of cashpoints has been increased to two years from the earlier one year. Also, the minimum points required to redeem is reduced to 500 instead of 2000.

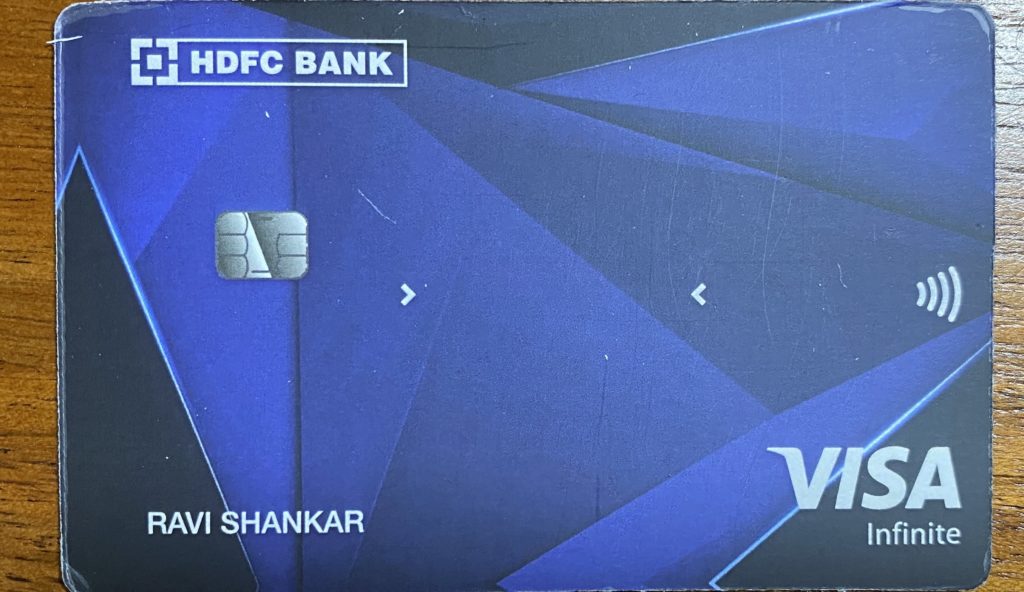

There is at least one credit card, however that HDFC Bank left out of the announcement today. And when I tried to enquire about when will HDFC Bank reveal details of the moves they are making in the premium/super-premium segment, they said to wait as they got us more information. This could be a step up to the HDFC Bank Infinite credit card, but looks very similar to the Chase Sapphire Preferred issued in the USA, which is a metal card, and perhaps was the first metal card out there. The only thing to know right now, is that it will be on the Visa Infinite platform.

Bottomline

HDFC Bank is going to be aggressive in the coming months on the launch and relaunch of credit cards, and will also be rolling out significant new promotions under the Festive Treats banner as they get set to capture marketshare. The fact that they are openly talking about it, itself indicates that they will be aggressive because marketshare is usually not such openly discussed. They have already relaunched three cards, and promised a lot more in the coming days.

What do you make of the HDFC Bank Credit Cards strategy going forward?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Are they going to find another new 4 lakh customers for their 20 partnerships, as the current ones will have to forego their existing card for a new one, that too by sending forms to Chennai, or cancel and re-apply!! That’s their digital banking in this age..The bank with the worst stone-age processes!

Hdfc should focus on improving offerings for existing cardholders than just adding new card holders. The best redemption option was to use your points to book flights on the smartbuy platform. Earlier you could use 100% points (one point = 1 rupee) to book flights which they have now restricted to just 70% and balance 30% still needs be paid by card. Not sure when did they change this as didn’t book tickets last year.

@Prashant, it has been there since July 2020. https://livefromalounge.com/hdfc-infinia-restructure-redemption-july-2020/

Have been receiving a call everyday from call centers trying to sign me up for an hdfc credit card. I already hold a card. Wish Mr. Rao is reading this and understands how this practice dilutes the hdfc bank brand.

Hi Aj,

Any update on the hotel cobranded card?

Thanks

@Ankit, their lips are sealed