I have been a oneworld loyalist for the past five-six years, ever since I first started to use American Airlines to fly to the Americas. Since then, I used to maintain Emerald status on oneworld with two airlines, American Airlines as well as British Airways.

My American Airlines status is going to drop in a week’s time, because I haven’t sent much business their way in the past year, partly due to me being in India most of the time last year. At the same time, I had earned two years of BA Gold status a couple of years ago, and this expired as well on December 31, 2015. British Airways does not do a hard drop to base tier, but a soft drop to the next tier, and in this case, I was downgraded to Silver (oneworld Sapphire) for a couple of years as well.

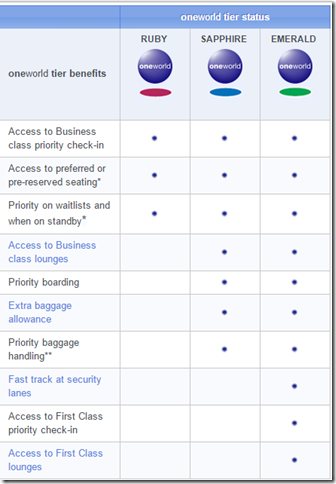

oneworld Tier benefits

Here are the benefits of oneworld Emerald and Sapphire, via the oneworld website:

Like you would notice, BA Gold/oneworld Emerald entitles me and one travelling companion for access to the First Class lounges of oneworld airlines across the world, amongst other benefits. Sapphire would have been good too, since it would have provided access to the Business Class lounges, but why go there if I have access to the best lounges they have.

Citi Prestige offering upto BA Executive Club Gold

One of the offering of the Indian version of the Citi Prestige credit card is

British Airways Executive Club upgrade and 5000 bonus miles on the completion of your first British Airways flight with your Citi Prestige Credit card.

This offer is only valid for the first year, and you need to have an active BA Executive Club account, which has already been utilized to take at least one flight on British Airways, which is paid for with the Citi Prestige Credit Card.

The above offer means:

- BAEC Base tier members get upgraded to BAEC Bronze

- BAEC Bronze tier members get upgraded to BAEC Silver

- BAEC Silver tier members get upgraded to BAEC Gold

- BAEC Gold members, well, are only going to get their 5000 bonus Avios.

Last year, when I received my second Citi Prestige Credit Card, I fully foresaw a situation where I may not be able to generate the 1500 tier points for retaining the BA Gold tier, given many a things were hanging in the air and I was not expecting to travel to Europe as often last year as I usually would. Hence, I did not apply my BA upgrade at that time, because I was only going to get 5,000 Avios but no status upgrade then. For reasons unknown to me, BA does limit these upgrades to Gold tier, since Gold Guest is an unpublished tier. I continued to travel on British Airways and book tickets with my Citi Prestige Credit Card.

Getting the tier upgrade

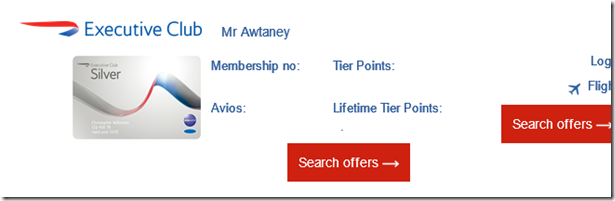

After the tier drop was confirmed, I received an email from British Airways welcoming me to the Silver tier in the beginning of January 2016.

A couple of days later, I sent in my request with all the required details to the concierge desk of Citi Prestige, which included my BAEC number, the PNR and travel details of the trip I had paid with the Citi Prestige Credit Card, for getting the upgrade.

According to the T&C, the request was supposed to be actioned within 15 working days, i.e., a month after making the request, but it did not happen on time. However, some more follow up, the upgrade was confirmed, and I was back to being BA Gold.

Bottomline

In my view, this is one of the single most important benefit for international travellers that the Citi Prestige card can offer. While I am aware that most of the target group for the card would perhaps have some status with at least another airline, this gives them an opportunity to be treated better across the board on all the member airlines of the oneworld alliance.

Have you utilised your BA Tier upgrade benefit yet?

Join over 5000 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Do you know if authorized users are able to get their status upgraded, as well as the card’s primary holder?

@Vikas only the primary user

what a useless article. how many or your readers will have the Indian version of the card. maybe, oh i don’t know, put that very limiting fact in the title or first line of your article?? classic click-bait which is why your blog sucks

@josh last I checked 50% plus of my readers would be from India so it works for them. And as for who sucks I’ll let my readers be the judge of that, you don’t need to show up here anymore 😉

If you were an independent blog, then you would be justified in your attitude. However, you are part of a blog network that is predominantly American. Your posts appear on that site & via RSS feeds. So yeah, I don’t think it’s too much to ask for that a major limitation be listed in the title, or at least near the top, so readers don’t have to make it two-thirds of the way through a lost before finding out this doesn’t apply to them.

For the record, mate, the reason I am on BA is because BA wants to diversify its audience from just being an American blog network. YMMV.

For the record I do have the Indian version of this card.

Hi Ajay,

Do you know if US citizens with a PAN card would be eligible to apply for this card? I could also provide an Indian address if required.

Thanks!

@Raj I don’t know how the paperwork would go but as long as you can show Indian Tax Returns, Indian address and Indian pan card, they’ll process it for you.

NRI’s get a credit card in india only on keeping a fixed deposit against the card. Thats how it is in HDFC, cannot confirm about Citibank.

@Agarwal: How did you suddenly jump to Gold – was that because of the tier points, or do they also publish a JP Gold benefit?

But no way to get this with the US version right?

@Chris, I think you’ll need to check with the american bloggers for that.

I also jumped suddenly from blue plus to gold in jet airlines by diners jet card

Citi prestige is a interesting card it pampers you a lot , like two free limousine, meet and greet etc, priority pass etc, which otherwise one do not generally venture by paying.