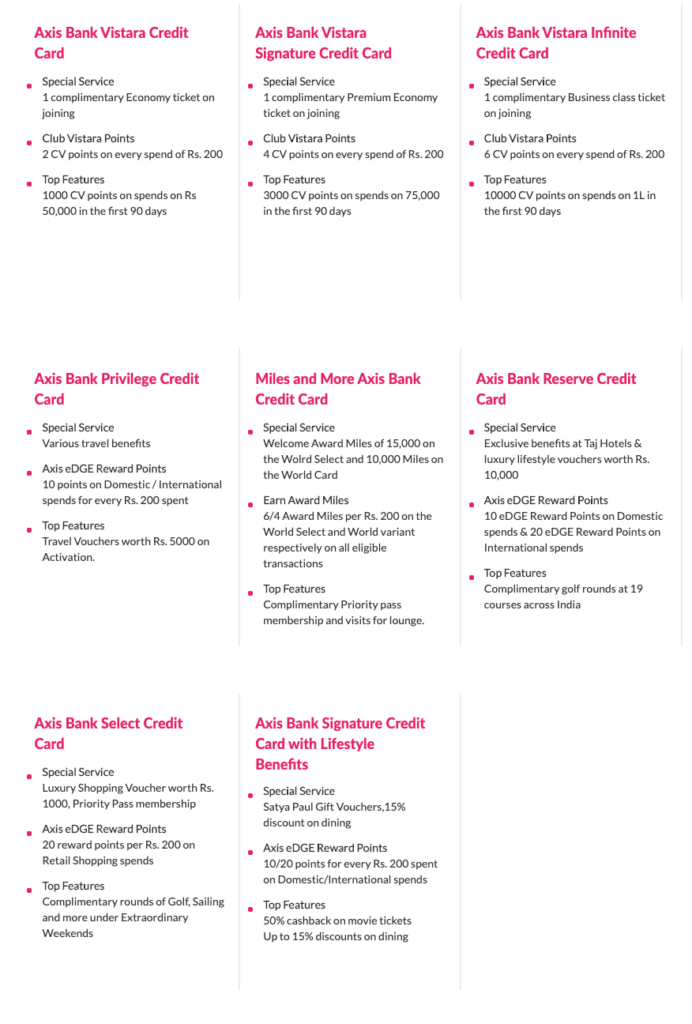

Axis Bank is almost all set to launch a new credit card focussing on the premium end of the market within the week, to be called Axis Bank Magnus. Axis Bank already has a tonne of Premium Credit Cards, so first let’s list them out for you:

- Axis Bank Vistara Infinite Credit Card

- Axis Bank Privilege Credit Card

- Axis Bank Reserve Credit Card

- Axis Bank Select Credit Card

- Axis Bank Signature Credit Card

All of these above listed cards already provide a mix and match of the various benefits that most credit card companies offer these days. Apart from that, Axis Bank also has its own rewards programme called Axis Bank eDGE Rewards, where you can redeem points earned via various Axis Bank Credit Cards for INR 0.20 per point for all sorts of things such as clothing and transport vouchers.

Now, Axis Bank is all set to launch the Axis Bank Magnus Credit Card, which will be issued on the MasterCard platform. The credit card focusses on the upmarket affluent, and here are some of the features they will offer:

- 12 EDGE Reward Points on every 200 INR spent

- 2X EDGE Reward points on OTAs such as MakeMyTrip, Yatra and Goibibo

- One Complimentary Domestic Flight Ticket

- Airport Concierge Service

- Priority Pass with 8 + 4 Lounge Access

- 15% across Oberoi Hotels

- Complimentary Dineout Plus Membership

- Buy-one-get-one free on Movies/Events via BookMyShow

- Markup fee of 2% on international transactions

- Interest rate of 2.5%

- Annual Fee Waiver on spending INR 15 Lakhs in the preceding year.

For the offering this card is making, it seems like it will be priced at INR 5-10K per annum, mostly at INR 10,000 per annum plus GST. The bank dropped the website after accidentally putting it up and then pulled it down so we don’t know everything yet. There is also a video.

Unfortunately, there seems to be no single USP of this card, which may want me to consider it in the first place. Most of these features are already there in some of the other cards.

- One Complimentary Domestic Flight Ticket (Offered by PremierMiles of the past & all the co-brand cards!)

- Airport Concierge Service (Meet & Assist, already on the City Prestige)

- Priority Pass with 8 + 4 Lounge Access (For a lifestyle card, many offer unlimited lounge access)

- 15% across Oberoi Hotels (very American Express’que)

- Complimentary Dineout Plus Membership (Every lifestyle card out there is offering some or the other dining programme membership)

- Buy-one-get-one free on Movies/Events via BookMyShow (ICICI Gem Range has had it for years)

- Markup fee of 2% on international transactions (HDFC Bank Credit Cards have had it, amongst others)

I will write more about this when the card goes live, but for now it appears a me too attempt in the crowded world of premium credit cards, where Axis Bank is unable to offer something different. Oh, and also, the very popular Golf benefits are not mentioned, so perhaps not there.

What do you make of the new Axis Bank Magnus Credit Card?

(HT: Jaydeep Mehta)

Ajay- would love to see an update post on Magnus seeing how axis has upped their game on this card. Is this a better option than infinia now?

The background music is awesome.. else more or less familiar services..

Can you tell me about the music piece.

Agree with Ajay on the post. Its a ‘me too’ attempt by Axis.

What is the eligibility criteria ?

18lakh of ITR

10k +GST joining fee

Can you please comment on Airport Concierge Service.

I had a chance to visit the Mastercard link below.

But, which services are complimentary?

https://mastercardconcierge.globalairportconcierge.com/index.php/en/concierge

@ajay, could you do a piece on how to avail the golf benefits available on numerous cards?

Hey !

Usually, the golf benefits are from Visa/Mastercard/Diners/Amex. You may call your concierge toll free directly to avail the same. Its pretty simple.

For Axis bank you can check on http://extraordinaryweekends.com/

By Signing up.

PS: You need to book at least 4 days in advance.

If you have a Citi Prestige, Diners Black and Amex Plat in your wallet then you dont need this card. In fact you would get less value for money.

The reward rate seems to low for such a card. We all have the above features in 1 or the other card.