I recently went back to adding credit cards to my wallet after a long hiatus. I’ve had most of the top-of-line lifestyle and travel cards for years. However, Axis Bank recently (re) entered the market with renewed vigour, so it was time to add more cards. In September 2022, I added the Axis Magnus to my wallet. You can read my full review of the Magnus. However, I added another card from Axis Bank’s Credit Card stable to my wallet recently, the Atlas Credit Card.

The Axis Bank Atlas Credit Card

While travel was returning to normalcy in early 2022, Axis Bank launched the Atlas Credit Card. The card was the second airline-agnostic travel credit card in India, with Citibank PremierMiles being the first, launched in 2012. Whether the fact that Axis was duplicating the Citi CC portfolio, not confident of winning the bid to acquire their assets or Axis was betting on a significant resurgence of travel, we will never know. But it was on my watchlist for a while.

Here are some unique features of the Atlas Credit Card which drew me to it:

- Atlas does not reward you EDGE points, but rather EDGE Miles. While each EDGE Reward point can be used for an INR 0.2 redemption, an EDGE Mile can be utilised for INR 1 redemption.

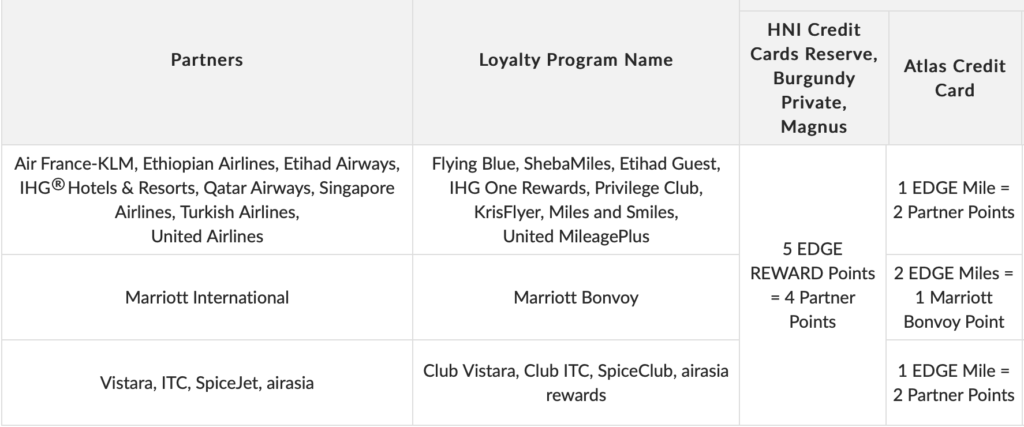

- Atlas EDGE Reward points can be transferred at a 5:4 ratio (those from Magnus). EDGE Miles can, however, be transferred at a 1:2 ratio (except for Marriott, which is inflated)

- I earn 5 EDGE Miles on Hotel and Airline spending (directly at the hotel/airline/via Travel EDGE) and 2 EDGE Miles for all other spends. That means, on an ongoing basis, I earn ten airmiles/INR 100 spent at a hotel or airline, compared to 4.8 airmiles/INR 100 paid via Magnus. For instance, here are the points I earned on a ticket worth INR 15000 I booked on IndiGo last week.

- Even on everyday spending, I earn four airmiles/INR 100 spent on Atlas, which is marginally lower than the Magnus.

- Atlas grants you miles in multiples of INR 100, compared to other cards in the Axis Bank ecosystem, which use INR 200 as the usual multiple, so fewer miles are lost in the process.

- For the fee I paid (INR 5000+18% GST), I already received 5,000 Atlas Miles (10,000 Airmiles, or 20,000 if I look at this Turkish transfer promotion)

- There is a gamified angle to this card as well, where I unlock the following extra miles along the way:

- 2,500 Bonus Atlas Miles on spending INR 300K on this card within a membership year

- 5,000 Bonus Atlas Miles on spending INR 750K on this card within a membership year

- 10,000 Bonus Atlas Miles on spending INR 1500K on this card within a membership year

- Not just that, in year two of the card, the renewal benefit also comes across as follows

- 2,500 Renewal Atlas Miles on spending INR 300K on this card within the first membership year

- 5,000 Renewal Atlas Miles on spending INR 750K on this card within the first membership year

- 10,000 Renewal Atlas Miles on spending INR 1500K on this card within the first membership year

- Finally, once you hit INR 15 Lakhs in spend on this card, you start getting 2X on Forex spending for a year after.

When I noticed that I was clocking far more spending on Magnus than was needed to clock the INR 100K spent per month, I also wanted another card. And that is where the Atlas fit in.

Comparison with HDFC Bank’s transfer programmes

After my application, HDFC Bank added transfer partners to Infinia and Diners Club Black. HDFC Bank gets up to 7,500 bonus points monthly when I book tickets via Smartbuy on the DCB and 15,000 bonus points monthly on Infinia. While the 16.67% points are great, they eventually transfer into 8.3 Miles/INR 100 spent on many transfer partners I like. And on Atlas, spending on air tickets (and hotels directly booked with Marriott/Hyatt/any other brand) and postpaid gets you 10% airmiles/INR 100 spent.

Bottomline

Atlas is an airline-agnostic travel credit card, which offers 10 miles/INR 100 spent at Hotels and Airlines, and 4 Miles/INR 100 spent at other places, apart from bonuses at INR 3 Lakh, 7.5 Lakh, and 15 Lakh spends. Once you’ve clocked INR 15 Lakhs, you also get a 1X bonus on Forex spends, apart from 6 Airport Concierge Services and 2 Airport pickup services.

What do you make of the Axis Bank Atlas Credit Card and my approach towards spending on travel? Am I missing something? Do share in the comments.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Axis atlas if one attains platinum status are they benefits like airport pick up as per calendar year or card anniversary year

I just noticed that the ‘other spends’ category has been devalued, it appears. Instead of the earlier rate of 2 Edge miles per Rs 100 spent, now the website says only one edge mile will be awarded per Rs 100 spent. Silent devaluation?

Hi, great review as usual. Have been evaluating the ATLAS as a replacement for my existing premiermiles card. Would you have any insight into when these EDGE miles expire. Didn’t see anything regarding this called out anywhere. Thanks

Hi Ajay Ji,

I need one clarification if i spent 1lac any direct airlines portal i will get 5000 edge miles .This edge miles if i redeem in axis edge portal will i get 5000 rs worth flight ticket ?

@Rajesh, yes.

so there is no traveledge through Atlas ?

and by booking directly , it means that we can’t use the services of OTA like MMT,balmer lawrei etc ?

@aka there is no travel edge through atlas. on booking on airline/hotel website you get 5X EDGE Miles and otherwise you get 2X

Hi Ajay , good decision, but my question is Why didn’t you go with AXIS RESERVE card? Is it better than Axis Atlas for spends after 1 lakh spend on Magnus?

@Siddharth, one costs 5K and one costs 50K. Simple.

great thing.. My bookings are cancelled last moment , hence i end up booking corporate all the time and do not book it direct.

Will ask my Bank though if they can give the Atlas as a corporate card. Thanks @Ajay.

Hi Ajay

I enquired about the Atlas card but there is one thing which is confusing. As per Axis bank rep., Axis gives 1 Edge mile per 100 rupees whereas as per your article they give 2 edge miles per 100.

@Rajesh, it is 2. Unfortunately, Axis Bank is continuously evolving its product and its sales team is not the best people to know everything, since they don’t update internal trainings as quickly.

I am also thinking of shifting my spends after crossing threshold on Magnus. But wouldn’t Amex be a better card ?

Amex platinum travel. ? Or do you think atlas is best.

I also want to diversify.

So axis magnus/ DCB and Amex.

What do you think ?

@RJ, yes, Axis/DCB/Amex will help you diversify. I use all those, and also Atlas.

I heard and read that Axis allows 3 Normal Variant credit cards and, 1 premium credit card only, how you managed to get 2 premium cards?

Are these the only two cards you hold from Axis?

@Ankur, don’t think this is a premium credit card, else won’t have been priced at INR 5K and issued on Signature variant.

Ajay you have mentioned that

I earn 5 EDGE Miles on Hotel and Airline spending (directly at the hotel/airline/via Travel EDGE) and 2 EDGE Miles for all other spends. That means, on an ongoing basis, I earn ten airmiles/INR 100 spent at a hotel or airline, compared to 4.8 airmiles/INR 100 paid via Magnus.

——————————

However, for Magnus spends via travel EDGE earn you 5x points that is 30 points per 100 or 24 airmiles.

@CardHero, Forgot to mention, as much as I like the 5X, I do have a strong preference for booking direct where possible, purely because it allows me more visibility on the change and cancellation fee. so, I’d say where travel is not fully firmed up, which is 50% of the cases, I’d still be booking direct. But in the other half, yes, Travel Edge helps.

Wouldn’t the number of Airmiles be 24 in case of Magnus for bookings on traveledge. You have mentioned 4.8 in the article. For direct booking it would make sense but for bookings on traveledge I think it would be 30 points or 24 Airmiles post 5:4 conversion

@Jaydeep Mehta, Forgot to mention, as much as I like the 5X, I do have a strong preference for booking direct where possible, purely because it allows me more visibility on the change and cancellation fee. so, I’d say where travel is not fully firmed up, which is 50% of the cases, I’d still be booking direct. But in the other half, yes, Travel Edge helps.

Ajay,

Are you certain about the 2X spends on Forex spends after you reach the Platinum tier. I noted this was mentioned when I applied (October 2022), however there is no reference to the same on Axis website, after they rolled out the 5 points per INR 100 for hotels.

@Mika, you might be right actually. The pamphlet from the airport said so, but there is no reference in the welcome kit. Will call/email and check.

**2X Miles and not spends**

I shouldn’t type without enough caffeine.

But yeah, you got the message 🙂

Ajay, how many cards are you allowed to hold on Axis?

@Swastik, 3

Is it possible for NRI to get these credit cards?

@Ajay I have the same question and have been getting different answers from bank reps. I have an NRE/NRO account, will I be able to open a credit card?

Hi ajay,

Would atlas mikes be awarded on insurance spends?

Great 🙂

Thank You 🙂 Good Insight

Look like i should close DBC

Last time they approved Infinia but in covid i didnt opt now they are approved.