I’ve been planning to start a review of all the travel credit cards in India for a while now, but various things have kept me busy to be able to commit some time to this. But, it is a go now and I hope to update it as frequently as possible. I will start the series with The American Express Gold Charge Card this week. I got this card when the benefits on the Kingfisher First American Express card were modified.

American Express revamped the Gold Charge Card in 2011, and made it one of the most competitive charge card products in the Indian market. Except for people who get their company-sponsored American Express cards way back, people usually did not know of the ‘Charge Card’ concept around India much.

Sign-up bonus: None.

Fee: Free for the first year, INR 4,500 plus taxes on renewal (5,000 MR points bonus on renewal which almost pays for the fee).

Eligibility: A minimum gross annual income of INR 8,00,000.

Features: This is not a travel credit card actually, but a great card for everyone who cares to put their spends on plastic rather than cash and debit cards. No rollovers allowed since you will pay up everything at the end of the month. One of the reasons I love the American Express Gold card is the fantastic level of service you receive as a cardholder. Yes, you are not Platinum, but the service is great and prompt. I’ve had a couple of times when bonuses did not credit to my account in time, and a simple call would help you get your points credited instantaneously.

You got to remember this is a charge card, so no pre-set spending limits. But that does not mean you’re going to go out and buy that six-figure jewellery set on day one and be approved the charge. Your spend and repayment history will gradually dictate how your charges will be approved.

Another particular feature I like a lot is the Online Fraud Protection Guarantee. This being the only charge card I carry around, I use it all the time for online purchases as well. And sometimes, those details can be reaching the wrong hands (unintentionally!). I personally experienced this Fraud Protection Guarantee a few months back.

One fine Sunday evening, I started receiving text messages about various charges on my card from all over Europe and the USA, this while I was watching TV at home in Mumbai. Someone who had the card details was trying to take me for a ride and had used it for travel bookings for more than, err, 1500 $ over 7-8 transactions in Euros and Dollars. I got a call from the Fraud Protection Team (they called, I did not) and I told them I was unsure where these charges were from. Based on my advise they declined 4 high value transactions straight away, and one had gone through for ~USD 600. This one, after a couple of follow-up calls with me, they knocked off (pending investigation) and I got the credit back for the entire amount within 24 hours. 6 weeks later, I received another letter stating that the temporary credit was being reversed and a permanent credit being applied since they found the charge did not originate from me. And yes, they blocked my card on their own initiative after talking to me, and sent me a new one within 48 hours. Now imagine disputing such transactions with other banks in India.

Membership Rewards: The reason I moved away from spending on the Kingfisher Amex was quite simply the fact that Amex/Kingfisher one fine day decided that they wanted all my MR points to be autosweeped into my Kingfisher KingClub account, and I was not happy since this took away the decision-making of when I want to transfer points from my hands to the hands of Amex. (Recently, Amex reversed the decision with Kingfisher in totters!)

That said, Membership Rewards are the single most important reason I like American Express so far. While there is a list of 600 options where you can burn your MR points, the most important ones for me are the options to transfer them to airmiles or hotel points as per my choice. 1.6 MR Rewards earn 1 JP Mile and 1.25 MR Rewards earn a Air India/ Kingfisher mileage point.

Earning Membership Rewards: Earning MR points is a breeze on this card. The card comes inbuilt with a 1000 MR point bonus every month provided you make 4 transactions of INR 250 or more every month on the card. I pay my bills and the 4 transactions are taken care of. That makes 12000 MR points bonuses in a year for tasks you’d anyway do. Plus, there is a 1000 MR bonus if you put in a standing instruction for bill payments, and another 5000 MR bonus on renewing the card.

Apart from that, regular earning means you earn 1 MR point for every INR 50 spent on the card and 1 MR point for every INR 100 spent on fuel and utilities.

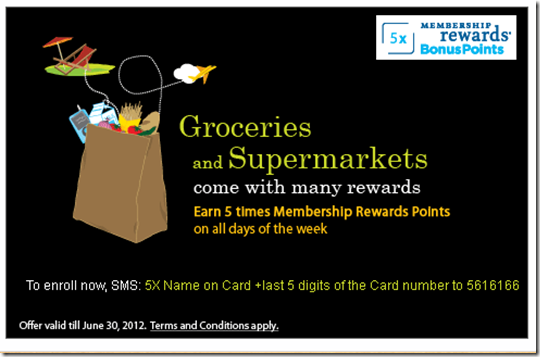

A very promising feature to earn MR points is also the bonuses that are announced at various points of time. For instance, the current bonus being offered is a 5X bonus on grocery stores and supermarket spends which is valid till June 30, 2012. Now, the supermarket next door does not accept an Amex, but some others do (Foodhall, Food Bazaar, Le Marche amongst others). So I don’t go out of my way to stock up every Sunday, but when I am around a big store I sure do use my Amex there.

Burning Membership Rewards: Like I mentioned earlier, there are over 600 MR point redemption options in the Membership Rewards catalogue. For me, the ones that matter the most are the redemption options on airmiles and hotel rewards. I’m upset that Amex decided to impose a INR 250 redemption fee on airmile transfers, which was not a part of the original sign-up documents with Amex.

Here is how Amex fares for airline redemptions:

- 1.6 MR points = 1 JP Mile(9W) / 1 Avios(BA/IB) / 1 Asia Mile (CX)/ 1 Finnair Plus point/ 1 Royal Orchid Mile(TG)/1 KrisFlyer Mile (SQ)/ 1 Flying Club miles (VA)/ 1 Etihad Guest point (EY)

- 1.25 MR points = 1 Kingfisher / 1 Air India mile

Amex MR points are also transferable to Hilton HHonors and SPG.

A customized offer on this card (something I will not take), is the ability to encash 25000 MR points for 1 out of 6 Gold Rewards. These include iPods, travel packages at WelcomGroup, Tissot watches, CK gift vouchers or gaming consoles from Sony.

Overall Assessment:

For those of you who want to quickly build up a stash of MR points and use it on your travel exploits later, you could and should use this card. And with the first year free, you could always try it out and cancel if it does not work to your satisfaction. This is one of my personal favourites.

LinkedIn promotion: Like I mentioned in this post, Amex and LinkedIn are running a special promotion whereby you can refer yourself and your known ones for an Amex Gold Card (free of cost!) and the referrer gets an award of 10,000 MR points on your application being successful. If you’d want a reference, drop me a line at aj@livefromalounge.com and I will be happy to send you a link.

Related Posts:

- Why my American Express Gold Card is fast gaining walletshare!?

- Amex bites the bullet on the Kingfisher Amex Credit Card

- Now, get an American Express Card at a discount via LinkedIn referrals

- And now its American Express India’s turn to downgrade Membership Rewards

Disclosure: This post is not at the initiative of Amex or their associates and I am not earning any fees to write this piece. It is purely my own opinion about the card and its utility.

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

Hi AJ,

First of all thanks for your awesome articles. Its a pleasure to read them.

Lately, I have been interested in the Amex platform of cards esp. the Gold Charge Card and their Platinum Travel one. I have a question, when you say in the above review regarding Gold Charge card’s fee – ” 5,000 MR points bonus on renewal which almost pays for the fee.” – How are you seeing this, given that Amex values their MR points for approx Rs. 0.25/MR for regular redemption.

Thanks

AC

@AC, I look at them in terms of what those 5000 MR can buy. I must admit since I wrote this, the value of redemptions was changed and lowered. I’d recommend one to go for the Citibank PremierMiles now. You can find the review on the site as well.

Just for your info.. As I was told… Amex has started sourcing cards in Hyderabad now.. which was not the case earlier.

Hi AJ,

Sent you an email for reference. Another question, will standing instruction for 4 utility bill payments would count for RM1000 monthly ?

regards,

Gaurav

Hi AJ,

Amex called today with their Gold Card. The Rep. will be coming tomorrow to collect documents. Few calrifications :

1) I was told that 4 transactions (for 1000MR p.m.) should be 4 card swips and not online transactions ?

2) 4 transactions should be in the calendar month and not billing cycle ?

3) Will it be benefitial if I go via Linkedin offer?

4) Bill Payment standing Instruction is as in Credit Card bill payment or Utility Bill Payments ?

Regards,

@Gaurav,

Four transactions .. So swipes or online is fine. MR are accounted monthly so Txns in a calender month yes! LinkedIn helps me increase clout with them to get more info out, so appreciate if you use it if you please, standing instructions on utilities payment with them.

Hope this helps

Hi AJ,

Does this card gives complementary acess to lounges? Thanks in advance.

@AJ, no access to lounges on this one

Hi AJ, thanks for a great review but I also agree that Citibank Premier Miles card is definitely one of the best in terms of mileage earning. I was using JET platinum card from Citibank which was also pretty good but Premier Miles is step ahead surely.

And @Gaurav, I suggest you try CITI Premier Miles once and you will be happy surely.

hey AJ,

It does sound like a waste, which is unfortunate as a higher end product is sorely lacking.

I thought the 50,000 was a one time fee and annual fee was 10,000?

Look forward to reading your review on this.

Amex customer service is definitely better than any other i have experienced, just wish they had more acceptance.

Citibank and i don’t get along, they tried to rip me off years ago and I ended the relationship with them.

do you think its worth getting an upgrade to a Plat Charge card from Amex?

@Gaurav, while I will review the Plat charge card separately, I feel the benefits are minimal as compared to the US Plat product and the fee double. Figure this, they give you a Plat Charge card for 450$ there with 200$ statement credit per calender year (400$ in all if u used 2 years over), free global entry application, purchase protection, a priority pass select which allows you unlimited access to the 650 lounges ($399) and a marvelous sign up bonus on top of it.

India: no sign up bonus, 50K INR fee (USD 1000), and only priority pass select out of the above benefits. do you think its worth?

I too got the gold charge card once my KF Platinum became a fancy coaster thanks to the implosion of KF.

I like my gold card, the service from them is indeed prompt and fairly helpful.

I dont know how this is the only card you carry around though because i have been to two restaurants recently that refused to accept (Cafe Zoe, Under the Banyan Tree) which is why i have a backup Visa from the state bank of india.

id like to move to the Platinum Charge card but 40k fee is hard to justify.

@Gaurav, this ain’t my only card, but this is one of my preferred cards. I have 4 others I keep and 1 other I use all the time Citi Premier Miles, which is introduced here: http://livefromalounge.boardingarea.com/2011/12/06/finally-a-credit-card-which-earns-me-lots-of-miles-in-india/