RuPay, the homegrown alternative to MasterCard and Visa in India, is on a tear offering promotions that encourage the use of their network over the product options from the bigger, global networks. Here is a good one, in case you’d like to use it.

RuPay offers up to INR 750 cashback on spending via UPI.

As you know, you can link up your UPI handle with your RuPay Credit Cards to enable you to scan and spend rather than carry your cards in person all the time. The network has rolled out a new promotion to promote using the RuPay Credit Cards on UPI, offering up to INR 750 cashback on spending via UPI.

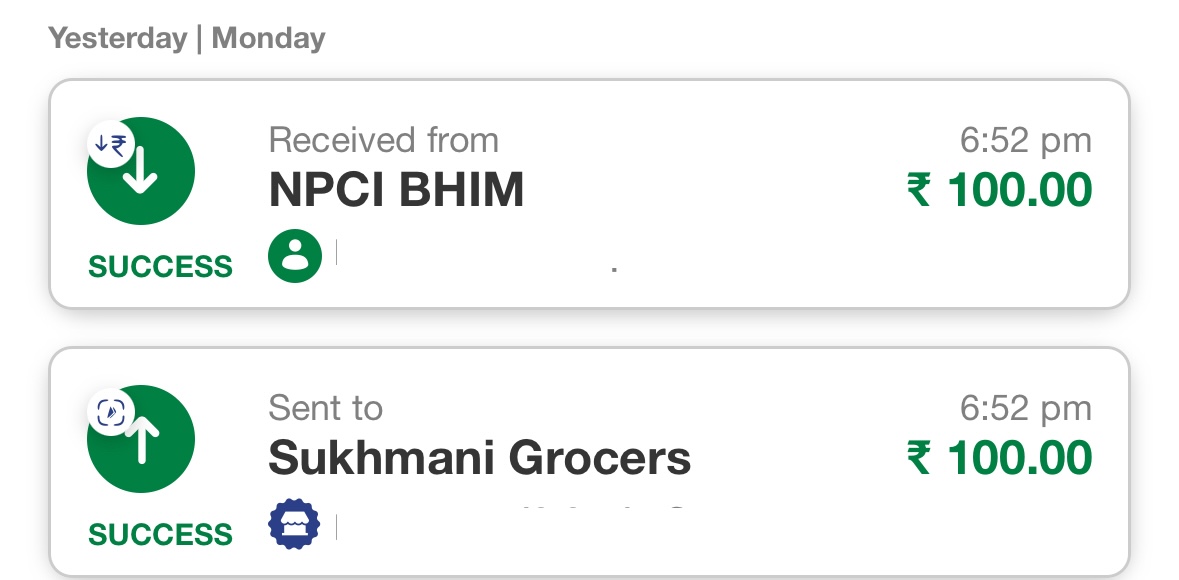

For the first three transactions made with a UPI-enabled RuPay Credit Card (using UPI), the network will send you INR 100 back into your linked bank account. The minimum transaction has to be INR 100 to receive the cashback, though. And you have to make the payment via the BHIM UPI app.

The INR 100 comes back into your account immediately, as you can see in this screenshot from a transaction I made yesterday.

After you’ve completed the three transactions, you get INR 30 cashback on a minimum transaction size of INR 200 for up to five transactions. Similarly, you can repeat this in March 2024 (the INR 150 cashback, not the INR 300 cashback mentioned above). The promotion went live in January 2024, so the first bout of INR 150 was already gone. The promotion is valid through March 31, 2024.

Here are some RuPay Credit Cards you can still apply for if you haven’t added one to your card collection yet.

- Axis Bank Indian Oil Rupay Credit Card

- HDFC Bank Shoppers Stop Rupay Credit Card (Lifetime Free)

- HDFC Bank IRCTC Rupay Credit Card (Welcome Voucher worth INR 500)

- ICICI Bank HPCL Super Saver RuPay Credit Card

- IDFC First Power Plus RuPay Select Credit Card

- Tata Neu Infinity HDFC Bank Credit Card

- Tata Neu Plus HDFC Bank Credit Card

Bottomline

There is a new promotion from BHIM to use their app to pay with your Rupay credit cards and earn 100% cashback up to INR 300, and then an INR 150 cashback on five transactions per month (INR 30 each). For normal transactions on a day-to-day basis, I’d say this is a pretty sweet, nifty offer, and one should use it up on their Rupay CC via UPI purchases soon (you have to remember to use the BHIM app, though).

Have you used the current BHIM promotion to use your CC on UPI?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

The biggest challenge with Rupay that is emerging is that a lot of merchants simply decline this mode of payment through UPI. Eventually the distortion in MDR between direct bank transfer vs through card has to dramatically come down.