A reader Ajay posted a query on the Reader’s Questions page a few days back about the best credit card to pick to generate miles on travelling. Here is the little ping-pong we’ve had so far:

Hi Aj,

I want to get a new credit card and it looks like the AmEx Gold Charge Card and CitiBank Premier Miles card are the best available options. What would you suggest I get? Here is some information to help you help me make an informed decision!

1. I travel 1-2 times a month domestically and 1-2 times a year internationally.

2. I have FF accounts with SQ, Jet, and Emirates but don’t have a lot of miles on any as I don’t travel exclusively on any one of them.

3. I find it a bit of a hassle to keep an eye on rewards points and would like to ideally be in a program that makes it easy to manage the process while giving good returns. Kotak offers cash back but at a miserable rate (Rs 75/1000 rewards points!!!).I also have a substantial amount of HSBC Premier Rewards points. What would be the most efficient way to use them up before I switch? Should I convert them to a FF program or buy something with them? Thanks for your blog and for being ever willing to help

My monthly spend is between 40-50k so I’d like a card that gives me the best rewards for it. During my research I compared cards by converting the rewards points to rupees. For example, on an average Premier Miles gives value of Rs 1.75 spent on Rs 100 while HSBC Premier gives Rs 1/Rs 100. Don’t know if that’s the best way to go about it though! As for the airline, I mostly fly IndiGo or SpiceJet domestically and Emirates/Jet/SQ internationally based on the fare.

My advice to him was:

@Ajay, if you would like to accumulate miles for your travel which you can use on any airline / hotel for redemption, I would recommend the Citibank PremierMiles card to you. you get 10 miles per 100 Rs. to book tickets directly with the airline. these are transferable 1:1 to 5 international programs and 2 Indian programs. If you would like to accumulate in only 1 program however (9w) then I would recommend the ICICI Bank Jet card to you. If you would like to accumulate on Emirates, there is the Standard Chartered Emirates card as well.

however, I see the most value on the Citibank PM personally, because i gain the flexibility to transfer 1:1 wherever I want amongst their program partners.

American Express Gold Charge Card is a good way to earn lots of MR, which is again usable as a convertible currency with many a programs. I use it at least 4 times a year to earn my 1000 MR, and on all transactions which attract 5x MR.

He wrote back with a new proposition:

Thanks AJ. I called AmEx to get some more information on the Gold Charge Card but they made a convincing case for the Platinum Travel Card. I know that you don’t love the product and gave it a lukewarm review but it looks like a good fit for me. After considering the bonus points, IndiGo + Taj vouchers, extensive partner network and AmEx service it looks rather promising. The fact that the points expire after three years is a downside though. Here’s a small comparison. Would love to get your views.

Annual spend of Rs 5 lac. Rs 50,000 of which on travel.On AmEx Platinum Travel

19,000 points + Bonus of 22,500 points or Rs 20,000 IndiGo vouchers + Rs 10,000 Taj voucher.

Converted to Rupees (bonus points converted to airline miles, further converted to rupees at the rate of 2:1) – Value of Rs 36,000On PremierMiles

23,000 points + 13,000 bonus points.

2 airline tickets.

Converted to Rupees (bonus points converted to airline miles, further converted to rupees at the rate of 2:1) – Value of Rs 24,000

Now, due to a busy few days behind, I could not respond back earlier. But the summary of the situation as I understand is that Ajay wants a best in class credit card which earns miles on his travels, as well as the best value on his accumulated miles.

First, my review of the Platinum Travel Credit Card from American Express is here, where I basically state that the Travel bit is a misnomer on this card since it does not really give special privileges for travel-related spend which other travel cards do, but gives some travel freebies for spending on the card.

Now, let me take the opportunity to compare the 3 options and see what comes out ahead. I have deliberately kept out the co-branded credit cards from the picture since we need a secular credit card which gives the maximum miles for our friend:

|

Total Spend per month |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

Travel Spend per annum |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

Total Spend per annum inclusive of travel spend |

Rs. 600,000 |

Rs. 600,000 |

Rs. 600,000 |

|

Base Miles/Points earned |

15,000 Membership Reward Points |

12,000 Membership Reward Points |

24,000 PremierMiles |

|

Bonus Miles/Points Earned |

15,000 Membership Reward Points (assuming Rs. 150K spent in 5x categories such as groceries, only additional 4 MR shown here) + 17,500 Membership Reward Points (7500 on reaching Rs. 190K spend, 10,000 on reaching Rs. 400K spend) |

25,000 Membership Reward Points (assuming Rs. 150K spent in 5x categories such as groceries and movies, and 1,000 bonus MR per month for using the card 4 times. Only additional MR shown) |

3,000 PremierMiles (assuming 6 extra PM for all the travel related spend of Rs. 50K) |

|

Sign-on bonus |

5,000 MR |

0 MR |

10,000 PM |

|

Total Miles/Points earned |

52,500 MR |

27,000 MR |

37,000 PM |

|

Other goodies |

Voucher worth Rs. 10,000 for Taj Hotels stay on spend worth Rs. 400K |

5,000 MR on payment of renewal fee of INR 4,500 + taxes after first year. |

2 PM coupon codes allowing for 1500 Rs. base fare waiver each when booked via PM.Co.in |

|

Redemption Possibilities |

19,000 MR earned on achieving spend limits can be redeemed for Rs. 20,000 worth of Indigo Vouchers. Rest 30,000 Miles can be converted to Air India Miles @ 1.25 MR/Mile = 24,000 AI Miles or Other Participating program miles (9W, BA, IT, etc.) @ 1.6 MR/Mile = 18,750 Miles |

25,000 MR can be redeemed for a stay 2 Nights/3 days at WelcomHeritage hotels or 27,000 MR can be converted to Air India Miles @ 1.25 MR/Mile = 21,600 AI Miles or Other Participating program miles (9W, BA, IT, etc.) @ 1.6 MR/Mile = 16,875 Miles |

37,000 PremierMiles can be transferred into BA, AI, DL, TG, SG, IT, CX on a 1:1 basis = 37,000 Miles or 37,000 PremierMiles can be redeemed for tickets on the PremierMiles website |

|

Expiry |

MR expire in 3 years |

MR never expire |

PM never expire. |

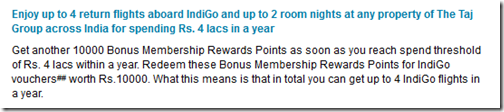

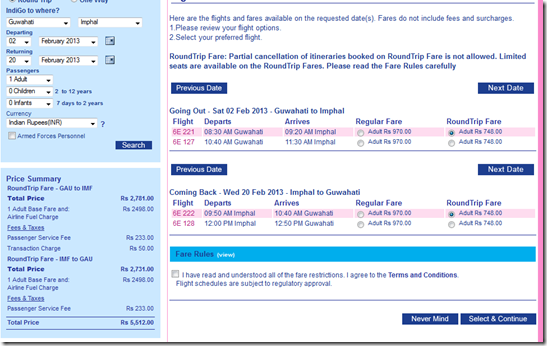

I’d like to take this opportunity to state 2 more things here. Firstly, get upto 4 complimentary roundtrips a year on Indigo with vouchers worth Rs. 20,000 is simply raising hopes.

This assumes a single roundtrip on Indigo airlines should come at Rs. 5,000 per roundtrip. I looked up some of the shortest segments they serve, but I could not find a flight for Rs. 5,000 per roundtrip. Nothing came lesser than Rs. 5,500.

Now, since American Express Cards are only issued in Mumbai, Delhi and Bangalore, you can find short hops at a far date for a little more than the price, yes.

Second, the power of points and miles should not be valued in terms of money. For instance, I try and accumulate all my miles for premium cabin travel which I won’t have been able to pay out of pocket. So, while I am happy to spend 188,000 JP Miles + Rs 25,000 as taxes to do a BOM-JFK-BOM redemption in Jet Airways Premiere Class to New York, I perhaps won’t pay the Rs. 250,000 I would need to pay out of pocket for the same tickets. In this case, the value of 188000 JPMiles was more than 1 Rupee per mile (about 1.2 Rs. per JP Mile, after deducting the Rs. 25,000 paid upfront).

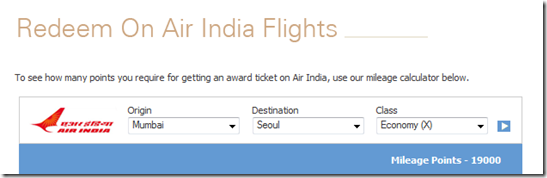

Similarly, 37,000 PremierMiles can get you a good Delhi – Chennai roundtrip in economy, but at the same time, 38,000 PremierMiles can get you a roundtrip to Seoul as well by transferring to Air India Flying Returns (with about 10,000 or so in taxes though, yes!). A ticket that would usually cost you Rs. 50,000 or so otherwise, and hence a value of about 0.95 Rs/Mile. If you spent for some more time, you could as well get London return tickets for about 56K miles + taxes, which would give you a good redemption value as well.

The point I am trying to make is that there is no one fixed value of a mile in terms of hard currency, and trying to get the best redemption value for your points and miles is one part of the fun we have playing this mileage game. In this case, you are advised to accrue the mileage currency which gives you the most amount of bang for your buck by giving you a lot of options and flexibility.

So, while ultimately Ajay is the only one who can decide for himself, I still think that PremierMiles is a good currency to accrue, and you should get the Amex Gold Charge Card free for the first year at least with the potential to earn over 12,000 MR for just using the card 4 times a month. And if you use the Citi PremierMiles more on travel, which your initial interaction indicates, you sure can earn more and get the free tickets faster.

Feel free to poke holes in my assessment and I will try to clarify!

Related Posts:

- Sunday Plastic: American Express Platinum Travel Card

- Sunday Plastic: The American Express Gold Charge Card

- Sunday Plastic: The ‘new’ Citibank Premier Miles Credit Card

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

I own Citi PM card and i pretty much use it for all my expenses and mostly one round trip to US every year. So far i’m loving the card very much. Kudos on detailed analysis above! Also not to mention, PM uses Visa Signature which has its own benefits. Free movies/ Complementary Lounge access in Bangalore/Chennai/Delhi/HK/Singapore etc..more details can be found on Visa Signature site..

Not sure whether AMEX platinum travel card provides similar Indigo coupons and Taj coupons in the second year and henceforth

my card is up for renewal. they do offer this in the 2nd yr too. waiting to see what else they plan to offer.

Just to simplify, I am taking out initial benefits & promotional rewards and calculating on-going rewards only – Every year, If you use American Express card for Rs. 4,00,000, you will get 16k Indigo, 10k Taj and approximately 5k indigo vouchers from accumulated reward points. The total cash equivalent is 31k (7.75% of total spent). Same amount spent on Citibank card will give 16k miles. Can it be worth more than Rs. 31,000? Simply, no!

Agree with Shan. In addition to this, it comes with 4k Indigo voucher as welcome gift, making the total value more rewarding in the first year. I got this card and will use it for first 4,00,000 in a year and then use PremierMiles card.

So I just got the amex platinum travel card, and here was my calculation:

Spend 4L per year.

Get 6k + 10k = 16k indigo vouchers.

Get 10k Taj vouchers.

Total 26k.

Even if you pay 5k as membership fees, you’re still getting goodies worth 21k on a spend of 4L (400k), i.e. about 5.25% worth of money spend. In addition to this, amex points are worth about 0.8% of the amount spend.

In addition, there are numerous 5x and 10x points offers, most notably from makemytrip which is 10x.

Also, you can fuel up at HP petrol pumps with no surcharge.

So you’ll at least get 6% worth of your spend and probably more.

That’s a pretty fantastic deal imho and I personally didn’t find any other card coming close to this.

For now, I’m putting all my charges on this card. We’ll see how it pans out eventually.

Any other cards that come close?

@Shan @Aush, while you can get 26K value out of this card as per your own analysis, if you spend this money on a real mileage earning credit card, you would get miles, which are worth lot more. For instance, on Jet/ICICI amex, you could earn 28K miles, good for one-way to Europe on Jet Airways flights.

I think i agree with both Shan & AJ. Some people may found more value in domestic short trips, with a luxury stay, while others would be more satisfied with one way international tickets or upgrades.

Although we had this discussion few days back, i just went through this post in detail now.

Commendable analysis which is easy to understand, Thank you for being patient with the noobs 😉

@AJ, Thank you very much for answering my question in such detail. Now that the AmEx Platinum Travel Card has become cheaper I am planning on getting that in addition to the Premier Miles card for those times when AmEx is not accepted and for travel spends.

@AJ , I feel Amex Platinum Travel card is a bad product. more importantly it is at variance with Amex’s premium positioning..a tie up with low cost airlines Indigo.plus it is not even value for money..as you pointed out.It is just a ‘ me too’ product in the market.

Excellent analysis AJ. At the end of the day it all boils down to how you use your miles. I am still new to this game but learning pretty quickly. I have both the Citi PM and Amex Gold charge card. I also took the HDFC Jet card since it came for free with 10000 JP Miles.

You need to necessarily keep the redemption options in mind when comparing any mileage/loyalty program. I’d recommend doing an apples to apples comparison. Pick your most preferred sector where you would consider redeeming your own miles, domestic or international, and then see which program turns out more beneficial. PM has this whole 3hrs before your flight redemption option but those tend to take up more miles. So, when trying to compare, pick a travel date about a month away and then see which one requires less miles. I have seen PM miles requirement fluctuate and that makes it difficult to know what it would cost in terms of miles.

Then there is the bit about card acceptance. In india, Amex is accepted in 2 out of 3 card accepting establishments, online and offline. Visa/mc are accepted everywhere a card is accepted. Overseas, this isn’t as much an issue.

In the event that u have to pay a fee for using a card, merchants tend to charge 3 to 4% for Amex and 1 to 2 % for visa/mc. This impacts your ability to earn.

Then there is the issue around chargebacks and fraudulent transactions. Amex first reverses the charge and then investigates thereby putting the burden on the merchant, which isn’t the case with visa/mc. This is also a reason that Amex charges are higher for a merchant and a customer at times.