Qatar Airways has announced a new conversion bonus, which could be profitable if you look at flying Qatar Airways or engaging with the Avios currency via the sister programme British Airways Executive Club. The airline is offering a 30% conversion bonus for many banks across the globe.

Qatar Airways 30% More Transfer Bonus

Between May 1 and 31, 2024, Qatar Airways is offering a straight 30% Bonus when you convert your credit card reward points from various banking partners into Qatar Airways Avios.

The banks that are eligible for the Avios conversion offer include:

- Ahli Bank (Qatar)

- Ahli United Bank (Bahrain, Kuwait)

- Bank of Maldives (Maldives)

- Bank of New Zealand (New Zealand)

- Banque Saudi Fransi (Saudi Arabia)

- Chinabank (Philippines)

- CIMB (Malaysia)

- Citibank (Australia, Hong Kong, India, Philippines, Poland, Singapore, South Korea, UAE, USA)

- Commercial Bank (Qatar)

- CTBC Bank (Taiwan)

- Doha Bank (Qatar)

- Dukhan Bank (Qatar)

- Emirates Islamic (UAE)

- HSBC (Hong Kong, Sri Lanka, Singapore)

- Hyundai Card AMEX (South Korea)

- Kasikorn Bank (Thailand)

- Kuwait Finance House (Kuwait)

- Mashreq (UAE)

- Ping An E-wallet (China)

- QIIB (Qatar)

- QNB (Qatar)

From an Indian perspective, then, if you were an existing Citi customer holding the PremierMiles or Prestige card, or some of the other Citi cards, you would be able to convert your reward points to Avios in your Qatar Airways Privilege Club account and get a 30% Bonus. The conversion is at the following ratio:

- Citi Premiermiles: 2 PremierMiles: 1.3 Avios (instead of usual 1 Avios)

- Citi Rewards: 1 Point: 0.975 Avios (instead of the usual 0.75 Avios)

- IndianOil Citi Card: 1 Point: 0.975 Avios (instead of the usual 0.75 Avios)

- Citi Prestige: 1 Point: 5.2 Avios (instead of the usual 4 Avios)

- Citi Corporate Card: 2 Points: 1.72 Avios (instead of the usual 1.32 Avios)

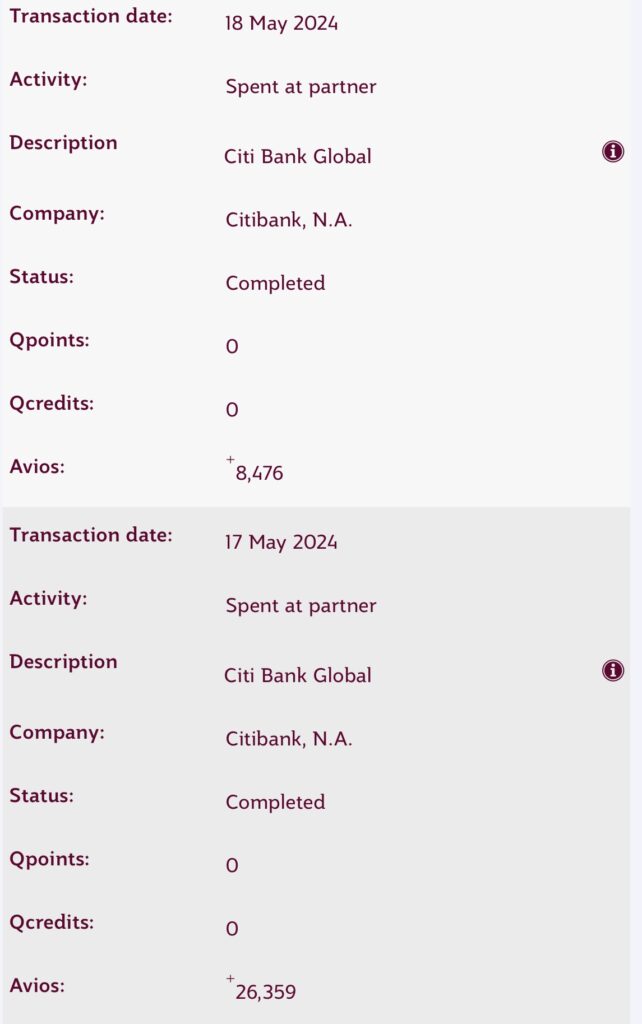

Since this is a bonus being offered by Qatar Airways Privilege Club, the airline will credit the bonus miles, and they will do so by June 15, 2024 (15 days after the campaign end date). The bonus Avios will be calculated per transaction and not on the cumulative sum of base Avios converted from Rewards Points during the Campaign Period.

Qatar Airways Q Suite

In reality, though, Qatar Airways is crediting the 30% bonus points right away (combined with the conversion). Points transfer into Qatar Airways within a day (including the bonus).

Convert Qatar Airways Avios to British Airways Avios

In 2022, Qatar Airways Privilege Club moved to Avios as its rewards currency. It offers a 1:1 conversion and free mobility between Avios in your Executive Club and Privilege Club accounts (apart from your FinnAir, Iberia Plus and Air Lingus AerClub). This means you can earn a 30% bonus on conversion for use in the BA Executive Club later.

However, before you rush to transfer and empty your balances to Avios, remember that Qatar Airways Privilege Club charges a carrier-imposed booking fee on award redemptions, over and above the taxes and fees. For Economy, this charge is USD 35 per sector, and for Business and First Class, this charge is USD 70.

Bottomline

Qatar Airways Privilege Club is offering a 30% bonus on converting select bank points to Avios in its programme. This is a great opportunity to receive an upside on the conversion you might have made, with the further ability to transfer these to the BA Executive Club. Also, this is a great opportunity to move some of your Citi points out if you are fidgety about the future of these on the Axis Bank platform.

What do you think of this 30% Privilege Club transfer bonus? Will you participate?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Perfect timing! With Citi’s move to Axis, I expect customer service and product offering to decline substantially. It’s really sad because a 15 year relationship is going to end, but I have zero confidence in Axis