Over the months, we’ve been asked a lot of questions about how to select an airmiles card for spends. While I’ve been using credit cards since 2001, and as a result, I’ve got a different profile with the banks, some of you are all starting out now. For the benefit of those readers, Shipra shared the best cards to start earning JPMiles.

We keep cards from across the JPMiles co-branded platform to ensure that we get the maximum benefits from each bank. For instance, there are 4 free tickets on Jet Airways for the take, just in case, you’d like to fly your s.o. for a surprise vacation.

If you don’t know where to start, JetPrivilege launched a Credit Card portal a while ago which helps you compare the features of all the personal credit cards that Jet Airways and JetPrivilege are co-branding with. Let’s take this website for a spin to see how we can pick our almost perfect credit card to earn JPMiles.

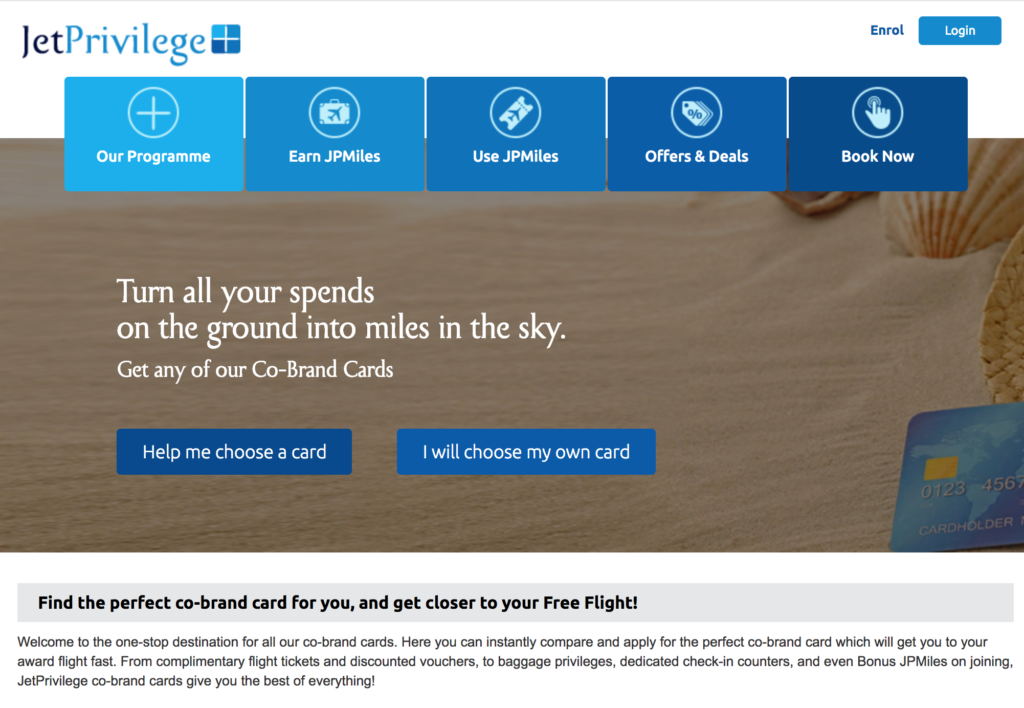

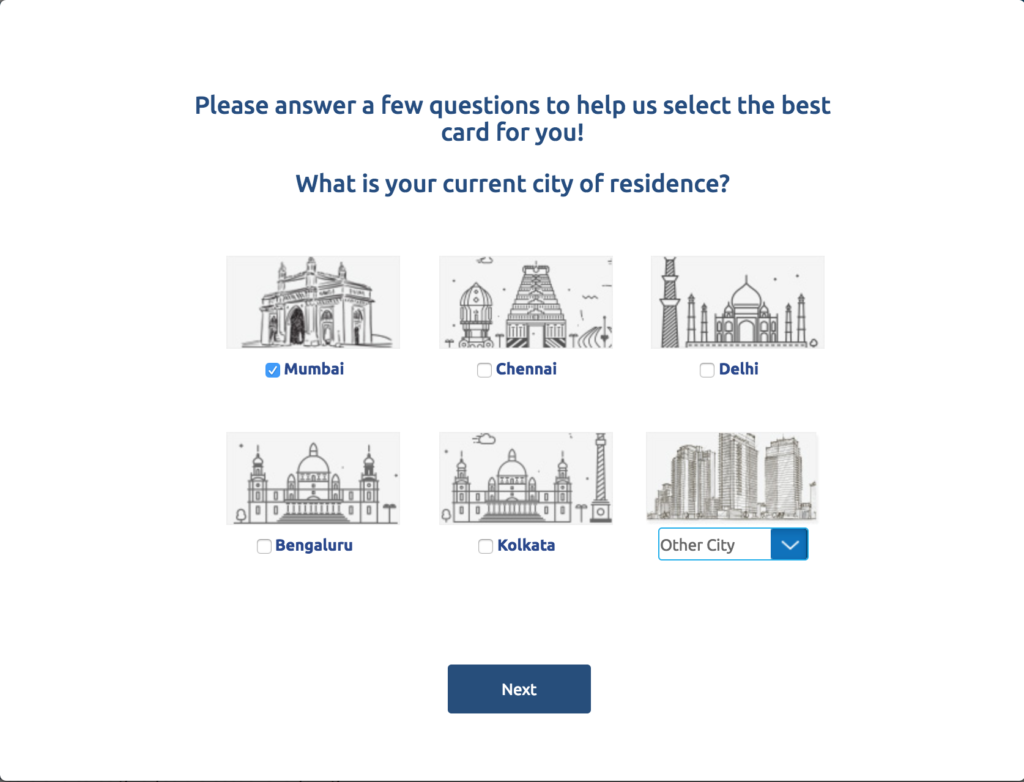

When you head to Help me choose a card, it gives you a host of options to help you select cards by just answering a few questions. Let’s have a look. Step 1: You tell them your city of residence.

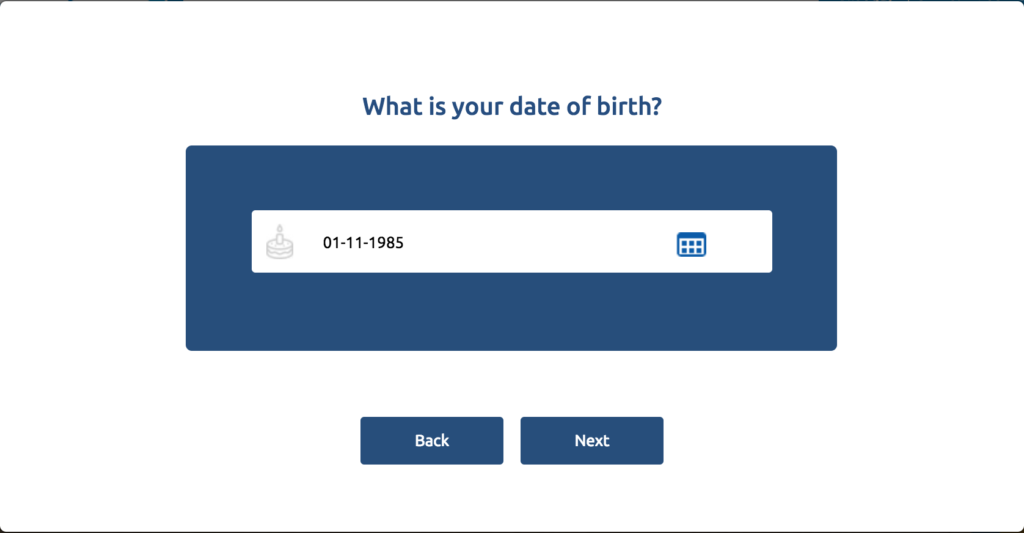

Step 2, your Date of birth, to determine which cards will you be eligible for. In this case, I’m going to be 5 years younger!

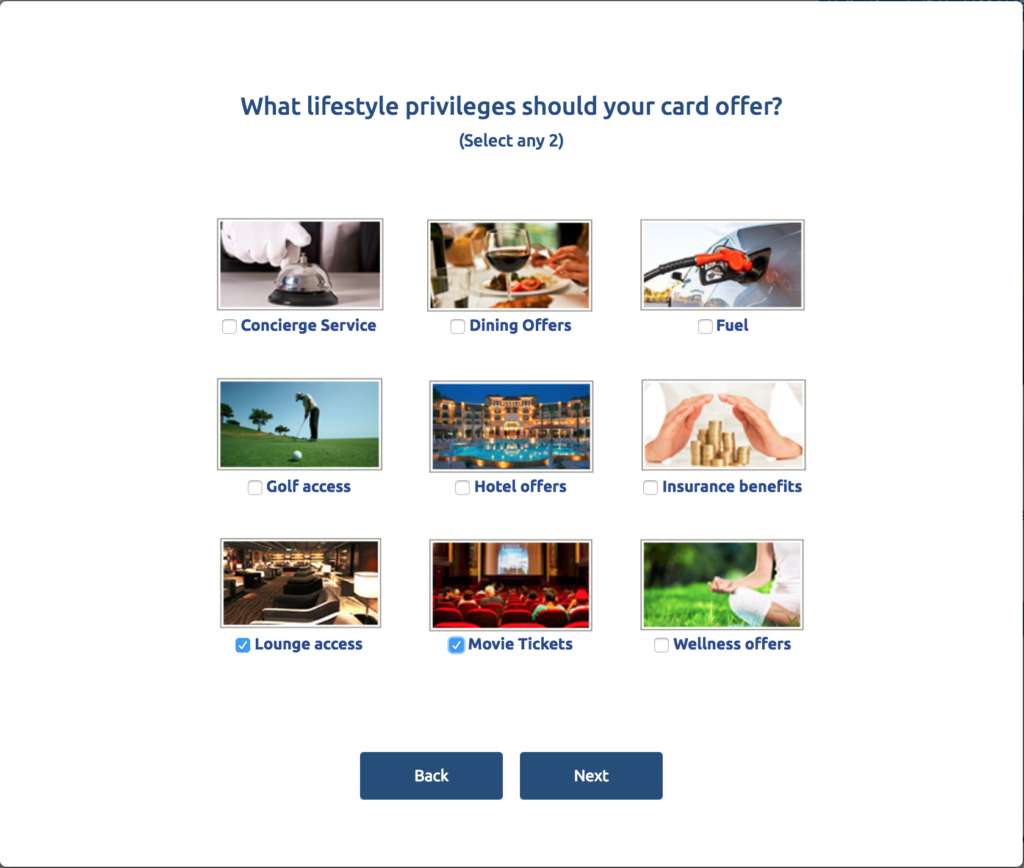

The engine also wants to know what extra you’re looking for in the cards, so that you get the perks of the card as per what you want. In my case, I’d like some movies extras and lounge access for sure. So, that makes the list interesting.

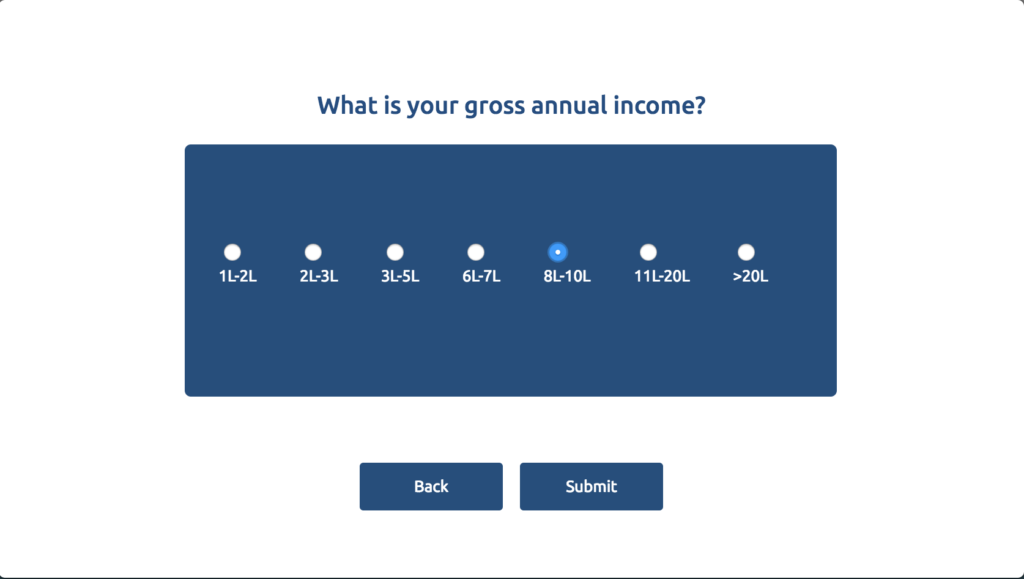

The next part is really easy. It is about your income and flying patterns. Our fictional friend flies 10 times a year. I do that over a long weekend sometimes.

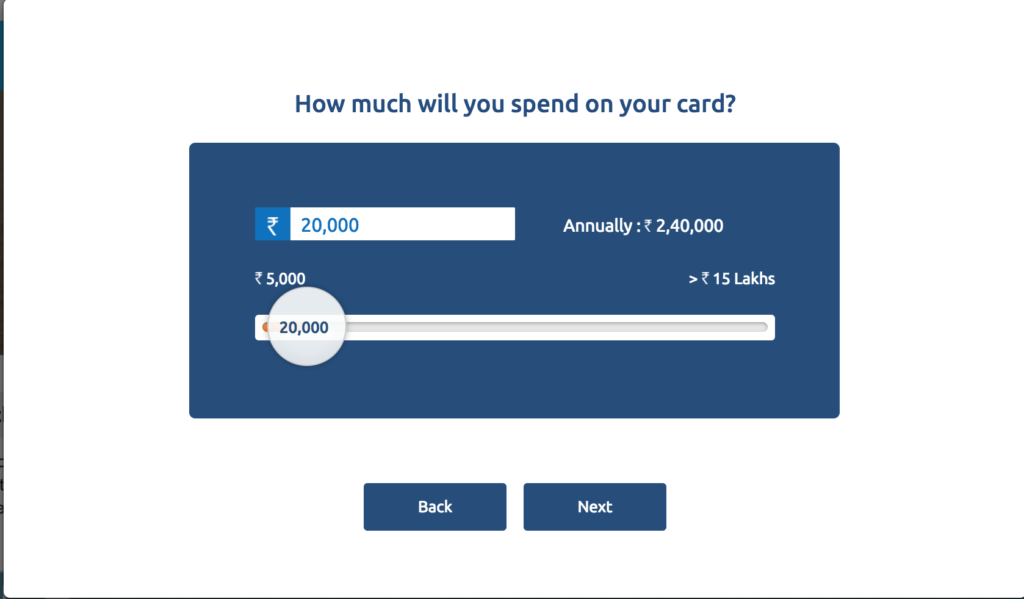

One last question is about the approximate spend on your card per month. We went with 20,000 INR, which is a modest number and very achievable.

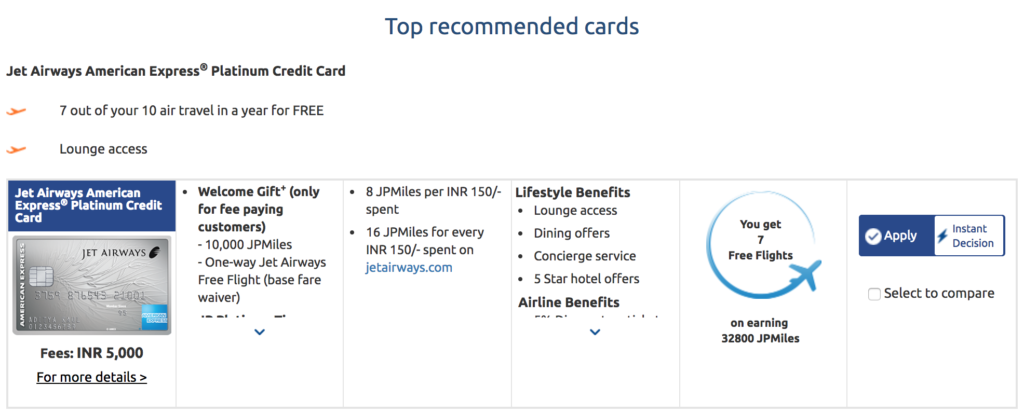

And after those simple questions, the engine recommends cards that it deems fit for your wallet. Like in this case, the Jet Airways American Express Platinum Credit Card, which fits the lounge access but not the movie criteria. Best part, you get to know about your approval instantaneously.

Also, the engine tells me to go for the Jet Airways IndusInd Bank Odyssey Amex Credit Card

That is the easy wizard mode of the website. But for instance, if you wanted to get under the hood and tweak everything to your own requirements, you could do that too. Let’s say you want a card when you’re based in Amritsar and want to pay no more than INR 5000 as fees. But you also want to be playing Golf, so you set up the page.

And out comes the result. You should be getting the Jet Airways ICICI Bank Sapphiro Visa Credit Card or the Jet Airways ICICI Bank Sapphiro Amex Credit Card.

There is, of course, a lot to choose from. With 15 co-branded credit cards in the market, JetPrivilege is clearly out there trying to make sure you get the right card to fit your needs.

Have you tried out the JetPrivilege Credit Card portal? What do you think about it?

I dont know how it calculates the free flights mentioned in the website

If yearly spend on Amex card is 240000 (20000/Month) you would only get 12800 JP miles which entitles you to get just 2 tickets

Plus you would get a JP disount code + 10000 JP Miles ( 2 tickets)

so in total you get only 5 tickets instead of 7 which is shown

@Sravan: 12,800 JPMiles if we calculate 8 JPMiles per INR 150/- spends, 10,000 JPMiles as a welcome gift, 2,500 JPMiles for applying via the portal. makes it a total of 25,300 JPMiles (5 free flights). Add the base fare code and it makes it 6. I think in this screenshot, JetPrivilege used to offer an additional 10000 JPMiles for signing up via the portal and hence it would make for 7 free tickets and some change.