This is one of the many articles we are writing to help our readers during the times of Corona, and also on the use of credit cards in general. If you have been supported by LiveFromALounge.com over the past 9 years of our writing in any way, we request you to help us right back, with a small amount or large of your choosing towards our efforts. pay rent with credit card India

We are not putting our articles behind any paywall to make sure the most number of people can benefit from these.

With the CoronaVirus situation having affected the liquidity of many people around, I finally decided to write about how to pay your rent on your credit cards. I am aware that a lot of people may be at a stretch at the moment with their finances, but in no way am I advising anyone to roll over credit, but I am definitely offering a way out that has existed for a long period of time to pay rent, which I would assume is a significant portion of monthly expenses, with your Credit Cards.

There are many reasons to look at paying rent/lease/howsoever else it is referred to in your contracts to use a residence or an office space with your credit cards:

- Big spends, so get you closer to your milestone spend quicker

- In the case of many credit cards, and depending on the payment processor you use, you get reward points as well

- You get to stretch your liquidity for about another 30-45 days

- As long as you are paying it back in good time, your credit reports get impacted positively.

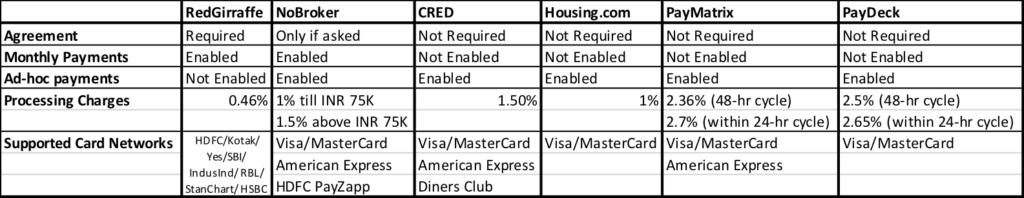

There are many companies that offer the ability to pay rent and other expenses with your cards. Here are some of the ones I know about, along with their pros and cons, as well as their transaction fees.

Table of Contents

RedGirraffe RentPay

RedGirraffe has been one of the oldest service providers offering the ability to pay rent on your credit card in India, and they call their Rent Payment product RentPay. With RentPay, you can pay your home or office rent on a monthly basis with your credit card. The charges applicable for paying with RentPay are minimal, just 0.39% + GST of the amount payable on a monthly basis. The minimum fees are INR 39 per transaction.

For activating RentPay, you need to submit the details of your landlord and their bank account number as well. Not just that, you will need to submit a PDF copy of your active lease and fill up a short form as well. I have been using their services for the past three years or so, and every month, they work like clockwork, debiting the amount from my credit card and doing a wire transfer to my landlord within 2-3 days of debiting the amount. For the landlord, the money comes in as an NEFT transfer, so they don’t have any bother about any deductions to their amount, and for me, I just have to pay 0.39% more for the ability to get reward points for my payments.

However, RedGirraffe works only with select card issuers, which include HDFC Bank Credit Cards, IndusInd Bank Credit Cards, ICICI Bank Credit Cards, Kotak Mahindra Bank Credit Cards, YES Bank Credit Cards, PayZapp, RBL Bank Credit Cards, Standard Chartered Bank Cards and HSBC Bank Cards. Post-registration, verification by RedGirraffe usually takes around a week. Depending on the bank you register with, service activation might take anywhere between 10 working days to a month.

At least to my knowledge, however, RedGirraffe RentPay is not available for Adhoc transactions, and hence you need to do the paperwork to ensure a long-term standing instruction to use RentPay. RedGirraffe states there is an InstaPay service available for ad-hoc payments but I just can’t seem to find it active on their website.

[PS: Mind the spelling, it’s RedGirraffe with a double R and a double F]

Current Promotions with RedGirraffe:

- Pay via HDFC PayZapp using promo code BILLPAY and get 5% in your PayZapp wallet 60 days after up to INR 200. Valid till October 31, 2020.

- Pay with Citibank Personal Credit Cards and get a cashback up to INR 3,000 on rent payments above INR 20,000. Valid for registrations till December 11, 2020. Month 1: INR 750 Cashback, Month 2: INR 1,000 cashback, Month 3: INR 1,250 cashback.

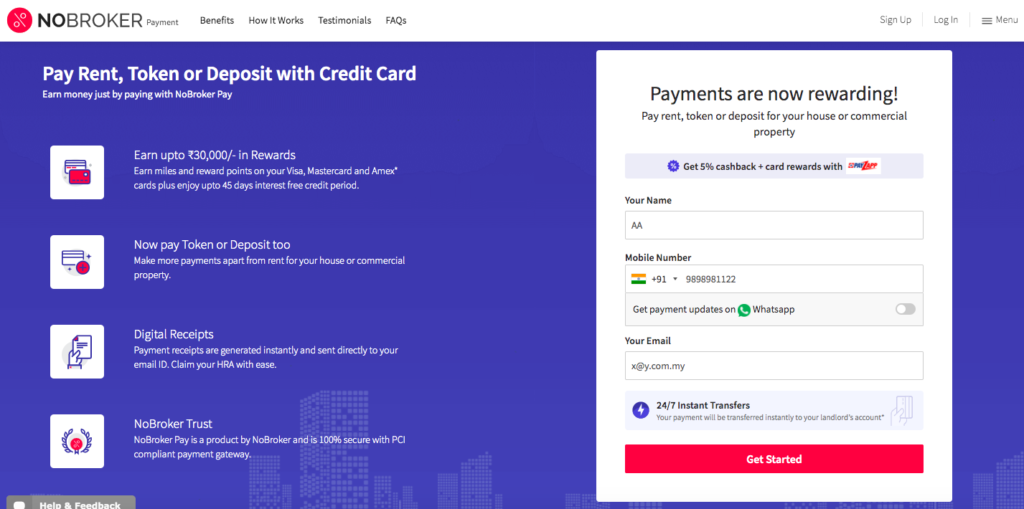

NoBroker

NoBroker Pay, as NoBroker calls its rent payment product, has been the second mover in the rent payment market and been around since January 2019. NoBroker works on a fixed fee model, which continues to increase it seems over a period of time.

For activating NoBroker RentPay, you need to submit the details of your landlord, their bank account number and PAN Number as well. Rent transfers are on their way pretty quickly (within 2 working days). NoBroker needs your landlord’s PAN number if you are making a payment above INR 50,000 as monthly rent. No rent agreements are required unless specifically asked for by NoBroker.

You can make an ad-hoc rent payment or you can set a monthly auto-payment. The benefits of using NoBroker are that you will be able to use all sorts of credit cards from any bank. Visa and MasterCard cards are accepted. The charges are 2% of rent paid, but for the moment these have been reduced to 1% for payments under INR 75,000 and 1.5% for payments above INR 75,000.

Current Promotions with NoBroker:

- Pay via HDFC PayZapp and get 5% cashback in your PayZapp wallet 60 days after up to INR 500. Valid till October 31, 2020.

- Pay via HDFC Millenia Cards using PayZapp and get an additional 5% cashback in your Millenia Card as Cashpoints up to INR 750 for a minimum rent payment of INR 2,000. Valid till October 31, 2020.

- Pay with Amazon Pay ICICI Credit Cards and get a 5% cashback up to INR 350 on rent payments plus 1% AmazonPay. Valid for payments made till December 31, 2020.

CRED RentPay

In April 2020, CRED has also rolled out a Credit Card based payment platform for the payment of rent called CRED RentPay. CRED’s product does not need any paperwork and is easy to set up to make the payments. You can set up your rent payment to be paid via a credit card or via UPI. In case you choose to pay via your Credit Card, which includes Diners Club, Amex and MasterCard/Visa, you will be paying 1.5% over and above the amount for CRED’s commission and processing fee of the rent. You can pay an amount of up to INR 2,00,000 with CRED’s rent product at the moment. Again, for rent payments over INR 50,000, you will need to provide a PAN card number as well.

CRED does not offer a monthly rent auto-payment option at the moment, and also their fee looks high in comparison to the other more established options in the market such as RedGirraffe.

Current Promotions with CRED:

- Pay via Axis Bank Credit Cards and get a flat INR 500 cashback by paying rent using CRED on a minimum transaction of INR 10,000 till October 24, 2020.

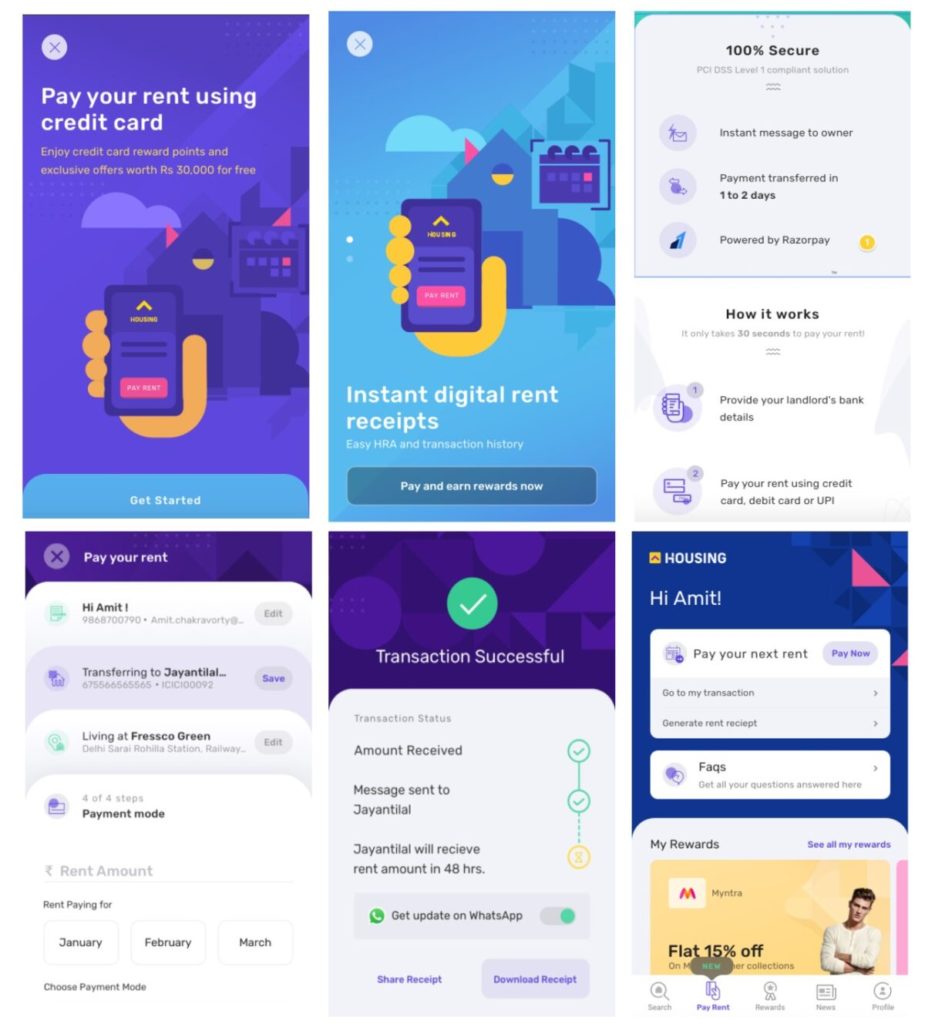

Housing.com Pay Rent

Joining the rush of new entrants who want to use rent payments to bring customers to their products is Housing.com, the online property search portal. They recently launched a product for Rent payment as well. Housing.com’s rent payment product only works with Visa and MasterCard products for now.

Housing.com launched with a 0% promotional offer, however, they are now charging 1% fees towards rent payment. The rent payment tends to get settled pretty quick, usually the same day.

There are other payment processors in the market as well which can help you with Rent payments, however, these are usually very high, so we won’t go into much detail about them.

- PayMatrix.in: Accepts all sorts of cards including American Express, however, be ready to pay 2.36% on top of the amount you need to pay when using Credit Cards to pay. PayMatrix does not accept Diners Club Credit Cards at the moment. Rent payments are transferred within T+2 working days. In case you want the payment to reach the other party within 24 hours, it would be another 0.3% for the perk (2.7% total).

- PayDeck: Accepts MasterCard/Visa cards. Be ready to pay 2.5% on top of the amount you need to pay when using Credit Cards to pay. PayDeck payments are transferred within T+1 working days. In case you want the payment to reach the other party within 24 hours, it would be another 0.15% for the perk (a total of 2.65%).

Comparison

Overall, here are the six major options you have towards Payment processing in India for your rent, and in some cases, other products too.

Bottomline

I’ve been doing my rent payments with my credit card for a very long time, and I think it is one of the most convenient ways of making sure your rent gets over to your landlord in time, and also that you end up getting points for the effort. Why leave any points on the table?

As for a landlord’s perspective, I’ve heard from many people they’d like to discuss this with their landlord but there is nothing to discuss here. As long as they get their rent payment in full, they are happy. How it reflects on the bank statements should not be a worry at all.

Have you been using your credit cards to pay rent? Let us know about your experience.

ProTip: Now that PayZapp is on the RedGirraffe platform, you can use RedGirraffe to pay with any credit card and not just those partnered by the company.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. Even though the amount you enter has to be in INR, you may use an international card to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

pay rent with credit card India

pay rent with credit card India

pay rent with credit card India

Hi Ajay, I recently received a mail from HDFC Credit card saying a maximum of 1,000/ 2,000 RPs will be earned for rents paid via credit card..Can you please let me know if this affects rents paid via RedGirraffe…

Thanks

Tarang

Cred does not support Amex payments !

I was able to pay only in first month of this feature launch and Amex payments have been disabled since.

Hi Ajay,

Great article but you missed a vey important part of reward points. Do we get on which card or mode. Can you add to this article.

Thanks

Does Citibank allow for points/miles to be accumulated from using one of these services?

I’ve been a loyal RedGirraffe customer since the last 3 years. It’s been an absolutely smooth and pleasant experience for me. The only thing I wished that it had for support for Amex cards.

They’ve also started a service for paying children school fees now within their platform. Currently exploring that and trying to set that up also.

In this note, assuming I have a monthly payout of 75k via this service, which of my cards should I credit all this amount to? (Considering that Amex is not valid)

HDFC Regalia, Diners Club Miles, ICICI Sapphiro Intermiles (Visa + Amex) are the ones in my kitty.

Also, on an ending note, I hope they start accepting Security Deposit + Maintenance charges also. Is there any such service currently?

Hi Anuj,

I pay my society service charges and security deposit via Redgirraffe

How were you able to do that? Showed it as rent? Did they ask for agreement

They allow you to pay maintenance charges if you show them the proof. It goes under the flagship category RentPay. Hope it helps. Regards, Patrick

When we use Payzapp with Redgirraffe, any idea what merchant code is used for rent payment? Want to use Citi Prestige to pay, but wary of what it means for points. With diners, it works pretty well and there’s no issue with points…

I called Citi to confirm this once. The rep said this transaction came under Insurance for some reason. I think he was untrained. I didn’t call back to check.

Again, this is for paying with Citi Prestige through PayZapp. I switched over the Diners Black because of the lack of surety. Would like to go back to Citi Prestige due to better transfer partners and higher earning potential

I gave in and tried with Payzapp/Prestige this month. Came in statement as “Instapay non BBPSPAYNOWIN”. No points so far. Looks like it indeed comes under one of the many categories they now ignore for points…Back to Diners then…

My query is how do they identify it is a rent payment?

What if I just pay amount to my wife saying as rent, say 30k per month using Amex Plat Travel Card. Now according to CRED i need not do any registration and PAN number is not required for below 50k threshold.

Assuming i do this for 7 months , total charges INR 3150 ( 450 per month) to cred i reach my 4 lac milestone very easily. So with 10k bonus points, 10K Taj Voucher and double dip with 2.1 lac cred coins. this seems a good deal.

Is there anything I need to reconsider? What are your views on this hack?

If I am not wrong, 50k is Yearly limit, not monthly.

this is very much possible . I did this with two amex platinum travel cards for the last two years. earlier membership reward points were also added. but now it only counts towards the 4 lac mile stone.

Did you use Cred to do rent payments using AMEX? I find that Amex cards are not supported for rent payments in CRED. So I was using paymatrix to do rent payments using AMEX but convenience charges are 3% which is a bit high comparatively. Please suggest the best platform for payment of rent using Amex.

Realized too late NoBroker transactions dont fetch points on Amex. Was hoping to take advantage of the 2x promo on the Plat charge.

Thanks Ajay for this write-up

Ajay, rentgiraffe payments can be made adhoc via the payzapp mobile app billpay section. That’s what I use, no auto deduction.

When using Redgirraffe, for amounts less than usual rent, you can update them via email or WhatsApp beforehand and they’ll usually update the amount for a month accordingly.

I have done this few times without much hassle.