How I love my American Express plastic is something I have talked about in the past. I’ve been using them only for a year and a half now almost, but along with my Citibank Premier Miles Credit Card, the American Express Gold Charge Card is my go-to card. I’ve written about my views on the American Express Gold Charge Card customer service and will do a full review on this card in my upcoming series on Travel Credit Cards for India.

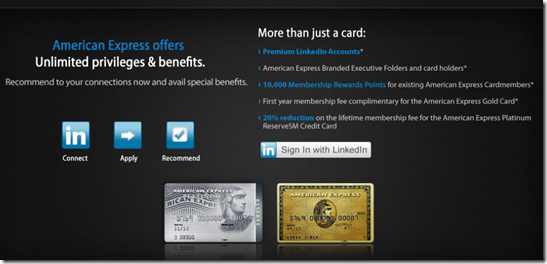

LinkedIn and American Express India had tied up in September 2011 to source referrals for new American Express Kingfisher First Credit Cards and Platinum Reserve Credit Cards via existing LinkedIn members. Now, they are back.

Under the new promotion from American Express launched on 16th April and valid till 30th July 2012, for every application which has been been recommended by an existing card holder, the new card holder gets a discounted fee on the Platinum Reserve card, and the Gold Charge Card for free for the first year (which is their regular offer in the first place!)

The details of the offer are as follows:

- The applicant of the card gets the American Express Gold Charge Cardfor free for the first year. This is a lovely entry level American Express product, which allows you to earn 1,000 bonus MR points per month by just making a minimum of 4 INR 250 (USD 5) transactions in a month. In total, you have an opportunity to earn about 25K bonus Membership Reward points in a year which are over and above what you get for your spend (INR 50 earns you 1 Membership Reward point). The entry requirements are very low, so if you earn more than INR 8,00,000 per annum, you can apply for this card.

- The applicant for the Amex Platinum Reserve CC gets a 20% off on the Lifetime foundation fee of INR 50,000 (USD 950), so comes to INR 40,000 (USD 770). On approval of the application you get 65,000 Membership Reward points, which in my opinion, more than make up for the value of the Rs. 40,000 spent on the credit card fees (for a lifetime!). Apart from other privileges, you get access to the American Express Lounge at Mumbai and Delhi Airports (10 vouchers).

- In case the applicant wants to go with Amex Platinum Reserve CCwith an annual fee option, it is priced at INR 10,000 (~USD 190). Again, you get 22,000 Membership Reward points for approval which are almost double the cost of the card fees for the first year. You also get 2 lounge access vouchers to access the American Express Lounge at Mumbai and Delhi Airports.

- The holder of the existing American Express card gets 10,000 Membership Reward Points for the reference (on approval). Upto 15 references can be made per annum. Alongside, various freebies are on offer such as travel vouchers, premium LinkedIn accounts, business card holders etc.

Overall, a win-win proposition for the applicant and the referrer. The applicant gets an Amex at a discount, and the referrer gets 10K Amex MR Points in India. Overall, 150K MR Points can be made with this offer.

For the benefit of my readers, I will be writing detailed reviews of various Travel Credit Cards in India very soon, and I will start with these ones. So watch out for that section.

If you’d like to help me travel a bit more, you sure can use my reference via LinkedIn and I’d appreciate your support. Drop me a mail on aj@livefromalounge.com with your key details (name, email address, city and which card you’d like to sign up for) and I’ll add you on LinkedIn and send you the card reference. Only Indian residents (including expats) can apply!

I would also invite readers, if they want to get a reference for themselves, to send me an email as well. Don’t put it in the comments since you’re inviting invasion of privacy, but I will try and put out a system to help you with some references as well.

Enjoy the benefits.

Related Posts:

- Why my American Express Gold Card is fast gaining walletshare!?

- 10,000 MR points/King Miles for referring Amex applications in India

- And now its American Express India’s turn to downgrade Membership Rewards

- Finally, a credit card which earns me lots of miles in India!

Disclosure: Take note that no commissions accrue to me when you sign-up for any credit cards around here or any other cards that I would write about in the future.

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

Lifetime option looks good…Do you know if such an option exists for Indians in US?