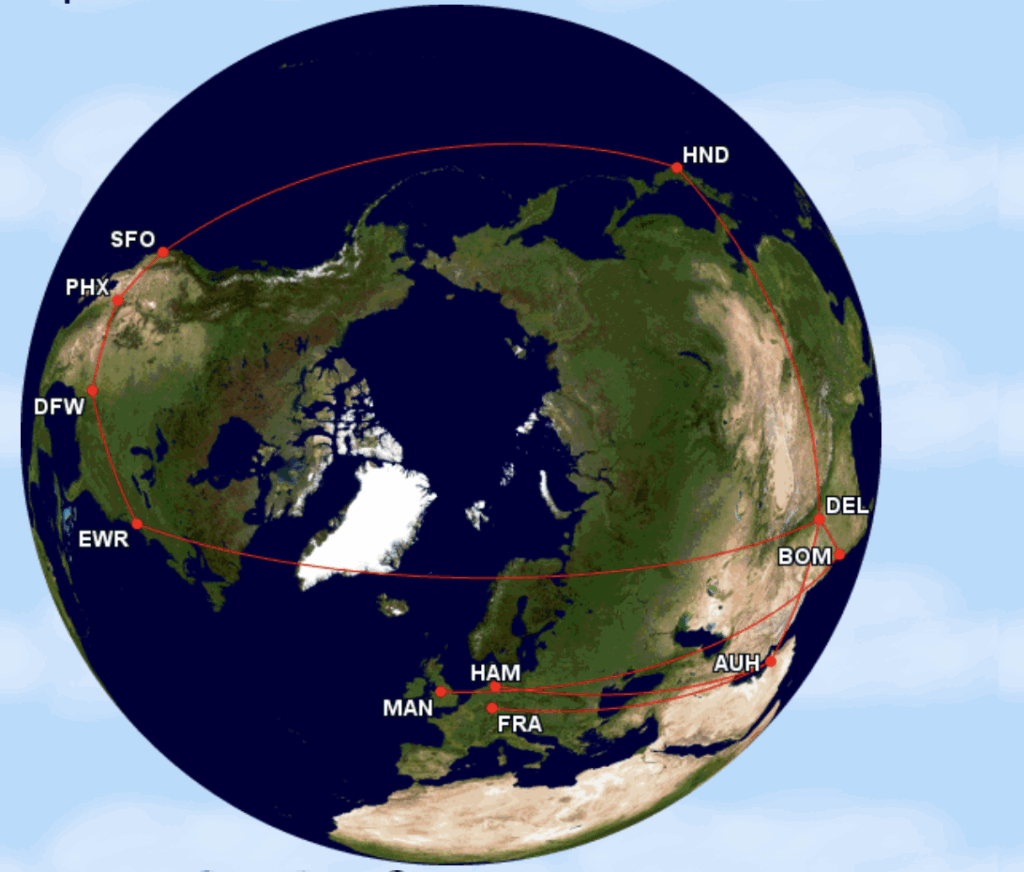

I’ve been on the road a lot lately, having done about 40,000 miles in July itself due to various work commitments. Now, I have a ton of credit cards in my wallet (you can read the July update here), but I wanted to share what has been my optimal card stash, which I’ve been using recently on the road.

As you know, I always carry three cards in the back of my phone (no Apple Pay in India, so far). On international trips, some of that changes. Here are the three cards I’ve been using frequently during my recent international trips.

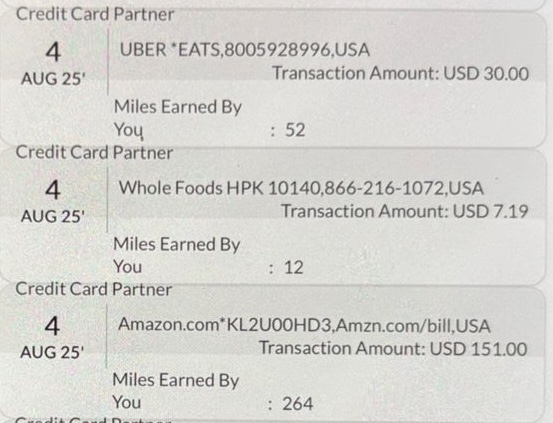

- Axis Olympus: Old is gold, they say. This card has remained largely untouched for over a decade, and I hope it stays under the radar in the years to come. It has been transitioned to the Axis Bank stable, and I finally started using the Axis Olympus Branded Metal Cards. There are no category bonuses, no Gyftr tie-ups, and no kickers. Just a good old 1 Point (4 airmiles)/INR 100 spent domestically and 2 Points (8 airmiles)/INR 100 internationally. And not just that, with 8 Airmiles for a 1.8% foreign exchange markup (2.12% net, including GST), it is a no-brainer to use this card when travelling abroad to earn 8 Airmiles per INR 100 spent.

- Scapia Credit Card: There is a particular reason I added Scapia to my portfolio: they offer a feature called Airport Privileges, which allows you to pick up a gift or make a purchase for yourself at the airport (or dine without needing to enter a lounge). You can also access an airport lounge. You need to scan your boarding pass for any of these. Suppose you visit a shop at the airport and make a purchase, or dine at an airport outlet listed on Scapia (after activating your privilege). In that case, you receive Scapia’s money up to INR 1,000, not as a refund, but added to your Scapia Coins Account. You can use the coins to purchase tickets, hotels, and other items. Internationally, this card is for all the pocket change expenses where I don’t care so much about the points, but to keep it away from my high-value spend card, the Olympus—a soda here, a small snack there. The card offers Zero Forex Markup, and the amount adds up to my INR 10,000 monthly spend to keep the Airport Privileges alive. It is a lifetime free card. Apply here to receive the card and INR 200 worth of coins on approval.

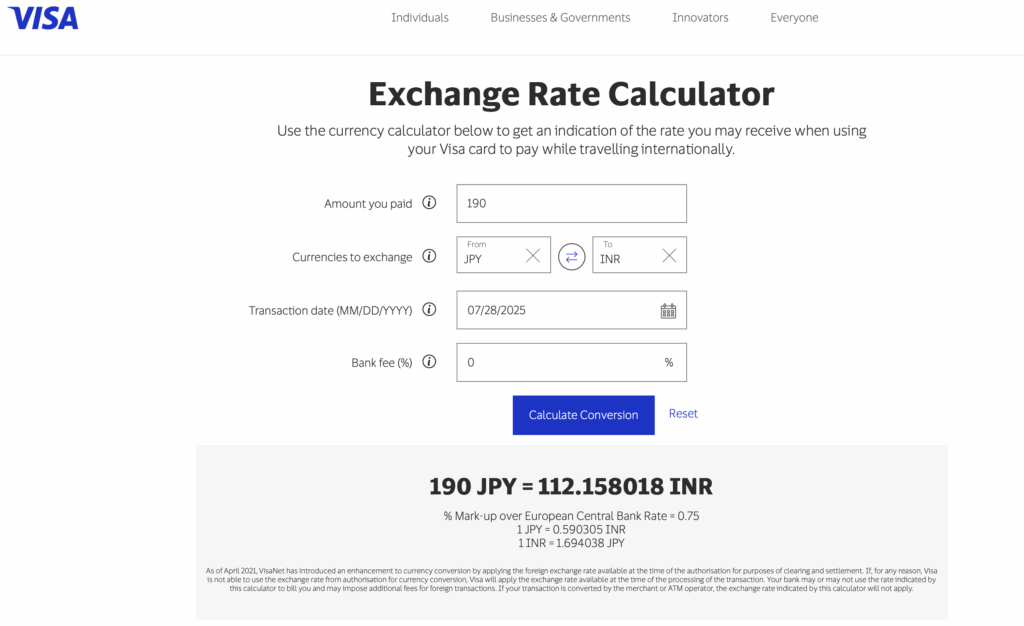

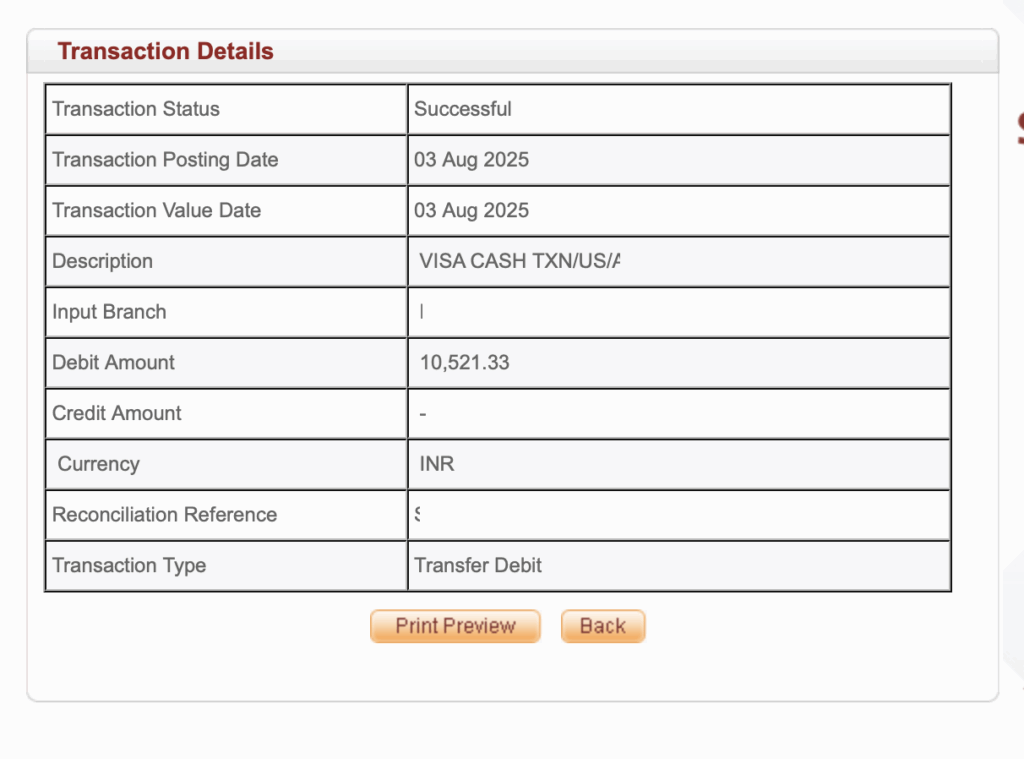

My card wallet also includes a debit card when I travel internationally. Although I rarely need to use it. As I’d detailed earlier, in March 2025, I finally opened a savings bank account (Exclusive) with IndusInd Bank, which came with a zero monthly balance, thanks to the fact that I hold an IndusInd Bank Credit Card (the Pioneer). I prefer to travel with minimal or no cash on my person, and this card came in handy last week when I had to withdraw USD 120 for spending at a grocery store ATM. The unique feature of Exclusive account Debit Cards is that there is no markup on withdrawals from foreign ATMs.

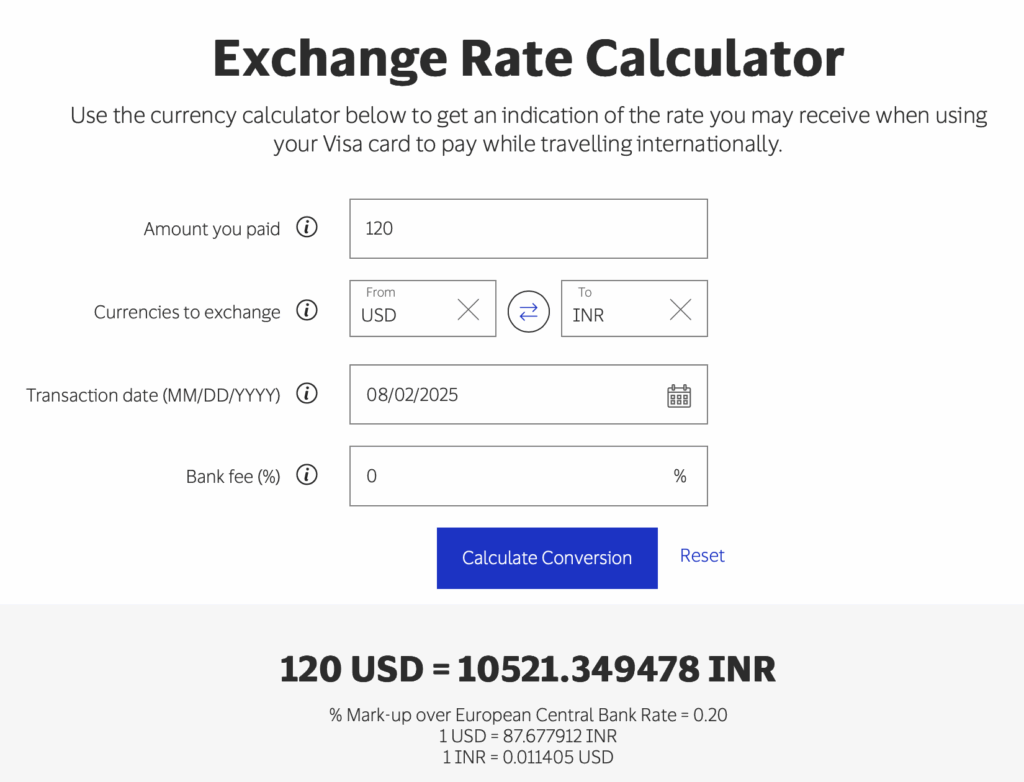

Here is what the entry in the Bank statement posted.

And this is precisely the amount that VisaNet shows that should have been debited from my account.

There are a couple of other cards that serve as backups, but they are not always available. One of them is the HSBC Premier Card, which charges a 0.99% foreign exchange markup plus GST. And with the current Forex Cashback promotion, the amount is reduced to half. And then there is the ever-popular HDFC Bank Infinia, with the Global Value Programme, which reduces the markup to 1%+GST as well. And then there is the IDFC First Bank Mayura, which also offers a 0% Markup on foreign exchange spends.

Overall, I find that for international spending, my stack is optimised to earn a good number of points, while not worrying about points on smaller spends (I don’t care about 1 point on a USD spent, right?)

Bottomline

Over the past few weeks, I’ve been on the road a lot, and I’ve been using a mix of Axis Olympus, Scapia, and the IndusInd Bank Signature Debit Card that was issued with my IndusInd Bank Exclusive Savings Account. As second fiddle, the HSBC Premier, the HDFC Bank Infinia and the IDFC First Mayura.

What do you think I can add or remove from this stack to make international spending even more optimal?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi Ajay can you advice or point me to the right resource to get the IndusInd Exclusive debit card against Pioneer. Spoke to a Bank RM who wants to sell me Pioneer with no commitment or guidance for Zero MAB Exclusive Account.

@Ashish, open the Exclusive account (2 L ac opening cheque) and link it to the same customer ID as your Pioneer Card. Then, withdraw your money if you like. It will be a zero balance ac now.

Hi Ajay. Looking at the miles you received for spends on Olympus – it’s 2%. How are you calculating 8%?

@NDA, each EDGE Mile earned on the Olympus converts to 4 miles, so 8 miles /INR 100 on international spend, and 4 per INR 100 on domestic spends.

How would you place the HSBC premier against the Axis Olympus, especially with their zero foreplay markup offer currently ongoing?

@Bigspender, the zero forex comes in after 10L spend, so Olympus, with their 2% markup and 8 miles/INR 100 works out better over 3% from HSBC Premier.