Lufthansa has been offering their Miles & More co-branded credit cards in India for a long time, initially with Deutsche Bank. When DB sold their India retail business to IndusInd Bank, LH transferred their co-branded relationship to Axis Bank in 2013. As the Miles and More Frequent Flyer Programme celebrates 30 years, the programme is offering a special offer to their Indian members for new signups.

Get up to 45,000 Miles and More Miles by signing up for the Miles & More Axis Bank Co-brand credit card.

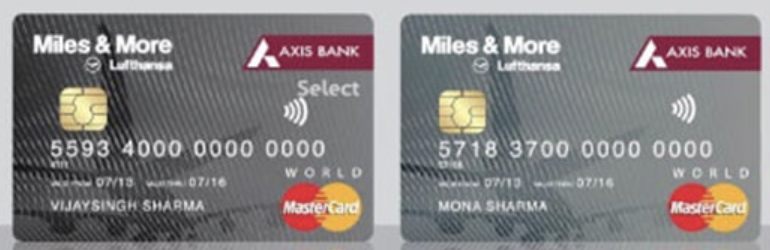

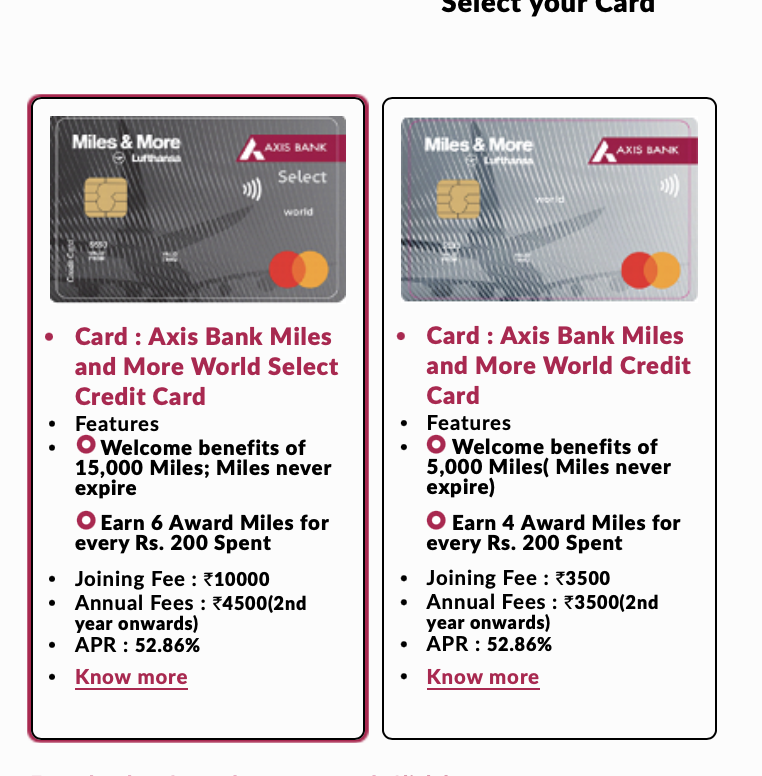

Lufthansa offers two variants of their co-branded credit card in India with Axis Bank.

Those are:

- Axis Bank Miles and More World Credit Card: This is the lower-end version of the Axis Bank co-branded card offerings and offers a 5,000 M&M Miles bonus on sign-up. The card costs INR 3,500 + GST in terms of fees every year. Additionally, you earn 4 Miles per INR 200 spent, and on payment of renewal fees, you get 3,000 miles.

- Axis Bank Miles and More World Select Credit Card: This is the higher-end version of the Axis Bank co-branded card offerings and offers a 15,000 M&M Miles bonus on sign-up. The card costs INR 10,000 + GST in terms of fees for the first year (sign-up) and INR 4,500 + GST on renewal. Additionally, you earn 6 Miles per INR 200 spent, and on payment of renewal fees, you get 4,000 miles.

As a part of their 30th anniversary, Lufthansa is offering a special promotion, where they are tripling the miles on offer for both the card variants, as long as you apply by November 30, 2023. So, for the Axis Bank Miles and More World Credit Card, you get 15,000 Miles on signup, and for the World Select Credit Card variant, you get 45,000 Miles on sign up.

This seems to be a promotion offered only by Lufthansa, so Axis Bank does not have any details on it. Even when going through the application flow, there is no mention of the special offer. It would help to keep a screenshot of the promotion just in case you need to have a back and forth with Miles and More.

One of the unique features of this card is, that M&M Miles never expire, as long as you make at least one transaction on the card account every month. Miles and More evergreens miles on the loyalty account as long as they see sign of at least one miles credit every month from the credit card. When you cancel the card, the clock starts ticking and 36 months from then, the miles expire, unless they have been already used.

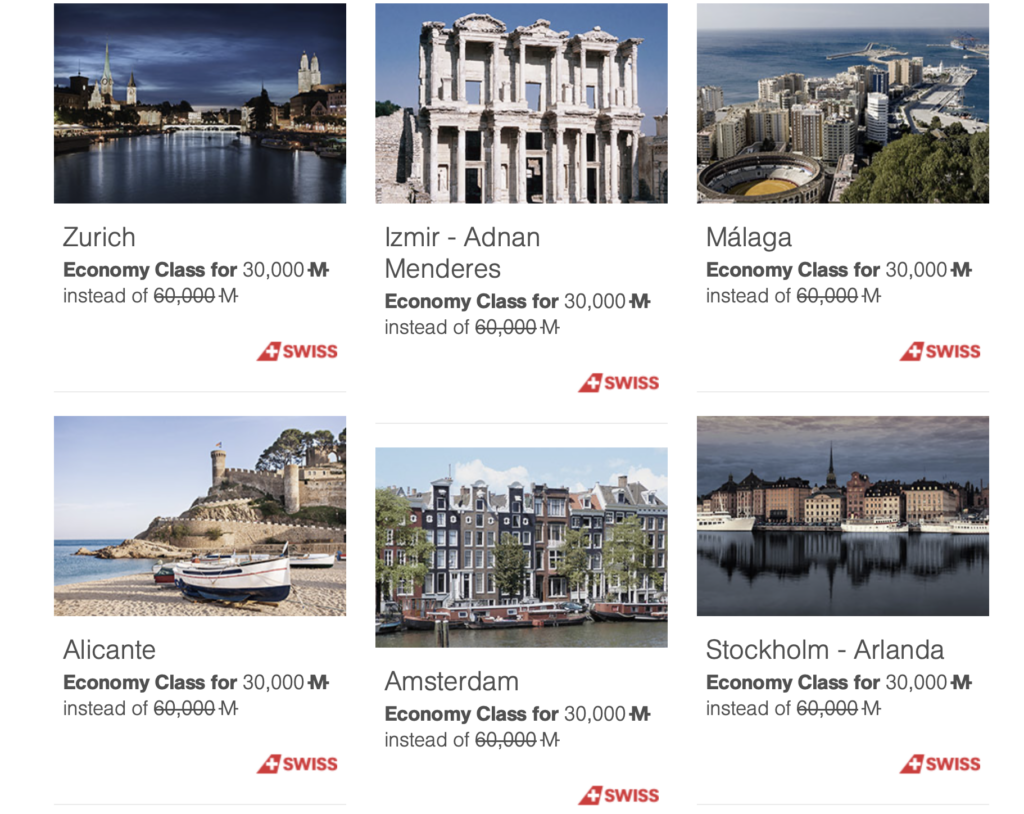

The bonus miles on the higher end card variant, World Select, are good enough to get 75% of the way for a round trip ticket from India to Europe (in Economy) or a round trip ticket to Japan with miles to spare. Or, if you have the Mileage Bargains available, for instance these ones, you can get a round trip for 30,000 to Europe as well (on Swiss).

Apply here for the Lufthansa Miles and More Axis Bank Credit Card

Bottomline

Overall, this is a great promotional offer from Lufthansa and it makes a lot of sense to sign up for the Axis Bank Miles and More Credit Card during the offer period, as long as you have some interest in Lufthansa miles or Star Alliance miles. You get 45,000 LH Miles for the higher-end card variant, and 15,000 LH Miles for the lower card variant as long as you apply by November 30, 2023 and make one qualifying purchase on approval.

What do you make of the Axis Bank Miles and More Credit Cards 3X Signup Miles offer?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Ajay,

I’ve got the card, activated it and made first transaction. Now I wait for miles to be credited? Or any linkage of Axis to Miles and More account to be done? I gave my M&M number during card application. But you know Axis – can’t count on them to automatically take care of this.

Any thoughts?

— Rishi

@Rishi, linkage or not, I cannot confirm. When I applied on their digital application form in the branch, I made it a point to enter and verify my M&M number as well. I guess, when the fee is paid and the first transaction is done, you will see the points in the account. It will show up on the statement as well, before it is sent to the account.

What if we apply before 30 november but approval comes after 30 november . Will I be still eligible for the offer ?

@Nitish, if you apply now, usually it takes six days for the approval to come through. That was my experience. The offer T&C says ”

Apply for your Miles & More Axis Bank Credit Card by 30.11.2023, and make at least one qualifying purchase.” Which should mean you need to make a purchase worth INR 200 or more when the card arrives. Trust this helps.

Sir basically it means i just have to apply it before 30th and make the transaction whenever the card arrives . Right ?

@Nitish, that is my interpretation.

i received the card today. So if I transact any amount today or in coming days, will i get the bonus points. ? I applied the card on 25th november .

@Nitish, the T&C stated to apply by November 30 and then make a purchase to activate the card. By that logic, you should do fine. However, T&C were sparse. I’ve activated mine though, and hope to see the results of it later this month.

Actually i confused whetger we had to make a transaction before 30 november or not ?

Are you expecting the reward points bonus at the end of this month ?

Do we have to give our service card number during card applying like vistara CV ID ?

And how much amount transaction we have to do ?

Hello SIR.

I have a problem. Please guide me.

I applied for the card on 26th november. And got my card on 6 December.

Still I have not received the points. My 2nd statement has been generated.

I contacted the customer care. They said that it was that the card should have been approved before 30 November. But it was no where written on the site.

Even if we consider this argument, then why they gave the 30 November as last date.

If a person applies on 30 November, who gets approved the card on the same day ?

Please guide me.

@Nitish, 30K points were from the side of Miles & More, and if your 15K bonus was credited within two cycles after the issuance date that was committed by the bank, they were automatically added to your account. Also, points are generally credited 28 of the month.

Ihave emailed to the airlines also, thry said we are not responsible. Talk to your bank.

Please tell me if this offer is valid while applying online or offline through the branch?

@nitish, no differentiation made in the “sparse” T&C published on Miles and More website, ultimately, they will be funding the 30K excess miles. I don’t think it makes a difference.

Have you got the bonus points sir ? And in how much time it took to credit ?

@Nitish, yes. They came after the second statement. my first statement was generated the second day after the card got delivered, so the transactions were not recorded yet.

No response from axis bank yet. Not sure whom to follow up with. Any guidance Ajay?

@Arjun, go to branch and get earlier application cancelled and new one approved

How will it be helpful for roundtrip to Japan from India. How many miles are needed for the same (&taxes).

@Jap, 40k needed

I signed up for it. But got an email/sms. Saying will let you know if it’s approved. But no response. Already have a hdfc infinia and vistara infinite and a great cibil score. Any idea how to follow up for status of the application.

Applied for two cards .. one for me and one for my wife. i saw that a trip to europe is 60000 miles. and this gives 45000. what would the cost of an approximately 45k trip cost in miles..

Thanks to Ajay i also got the vistara infinite card.

Great offer, unfortunately I already hold reserve, Magnus and vistara infinite already and acis doesn’t offer 4th card.

I hold 4 axis cards. I just got the atlas as my 4th one. I think 4 is the limit for axis now.

Good need if this is true.