Today, January 27, 2022, is when the transaction between the Government of India and the Tata conglomerate, the original owner of Air India, before its nationalisation is completed. The Tata Group had won the bid towards the airline’s privatisation in October 2021 and signed a share purchase agreement the same month.

Air India Takeover by Tata Group complete

This afternoon, the procedureal formalities to complete the take over of Air India by the Tata Group were completed. This morning, a board meeting was held at Air India Limited, and at the Tata Sons end as well. Subsequently, the consideration payable to the Government of India, INR 2,700 Crores was transferred to the Government accounts. There was a meeting held between the Prime Minister of India, Mr. Narendra Modi and the Tata Group Chairman, Mr. N Chandrasekaran before the transaction was closed out.

Shri N Chandrasekaran, the Chairman of Tata Sons called on PM @narendramodi. @TataCompanies pic.twitter.com/7yP8is5ehw

— PMO India (@PMOIndia) January 27, 2022

Subsequently, at a joint meeting held at the Airlines House in Delhi, which is the Air India headquarters, the Tata Group was handed over control of the airline. Here are some pictures from the boardroom.

Here is a happy family image of the two sides.

In a statement issued by the Tata Group, they said,

The Tata Group today announced the completion of the transaction for purchase of Air India from the Government of India. The Tata Group takes over management and control of the airline, starting today.

The transaction covers three entities – Air India, Air India Express and AI SATS. Air India is India’s flag carrier and premier full service airline. Air India Express is a low-cost carrier. AI SATS provides a comprehensive suite of ground handling and cargo handling services.

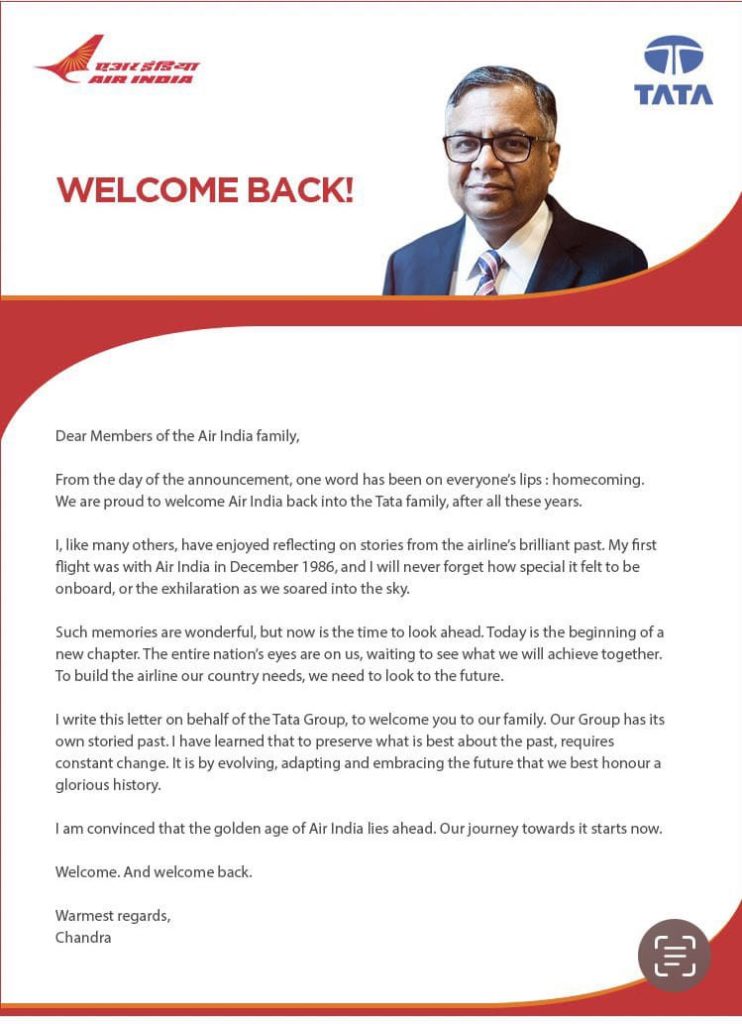

Chairman N Chandrasekaran said,

We are excited to have Air India back in the Tata group, and are committed to making this a world-class airline. I warmly welcome all the employees of Air India, Air India Express and AI SATS to our Group, and look forward to working together.

The Government of India also confirmed that the airline is no longer under their control.

The strategic disinvestment transaction of Air India successfully concluded today with transfer of 100% shares of Air India to M/s Talace Pvt Ltd along with management control. A new Board, led by the Strategic Partner, takes charge of Air India. pic.twitter.com/wd5ZcUFomI

— Secretary, DIPAM (@SecyDIPAM) January 27, 2022

From tomorrow onwards, new soft touches are expected to be rolled out on flights and Air India will be recognised as a Tata company. An email was sent out to all Air India employees by the Group Chairman as well.

Bottomline

Two years after starting the process for the third time, the Government of India has managed to sell Air India, to founders at the Tata Group on January 27, 2022. From today, Tata Group is the owner of the airline.

We wish them best of luck in turning around the airline to its original stature!

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Ajay, any thoughts on applying for the SBI-AI co-branded card? Or should we hold out for a bit on any new cards that may be in the pipeline and changes that might come up within Flying Returns?

@Ajay. Thanks. Any word from Singapore Airlines?

I have high hopes given the combined potential of Air India’ routes, Vistara’s soft/hard products and the market share of the two along with Air Asia. If the Tatas play their cards well, this could be a great success. They surely face many challenges. I wish them the best. India deserves to have a good flag carrier.

@Rishabh, hold up. the only combination on the cards right now is AIX/I5.

For sure I don’t expect any M&A activity between AI/IX/UK/I5 immediately. Primarily because UK and I5 are JVs. But I can’t imagine all 4 being run independently too long. It would be very interesting to see how SQ and Air Asia respond to this in the long term. They obviously have had plenty of time to ponder over it as the AI deal must have been years in the making.

i5 is almost a fully owned Tata Group entity now. AirAsia BHD is exiting the JV.

https://www.business-standard.com/article/companies/tata-sons-to-buy-residual-stake-in-airasia-india-for-19-million-121111800797_1.html#:~:text=Tata%20Sons%20is%20all%20set,stake%2C%20said%20a%20banking%20source.

In terms of any amalgamations, I foresee i5 and IX merging first – given the increasing competition in the space and the relative similarities between the two airlines.

A UK-AI merger will likely be tricky given that the Air India brand name needs to be retained for a few years, if I recollect correctly, and also because UK continues to be a JV. We may however end up seeing some interesting code-share arrangements coming up very soon, with the intent to harmonize and optimize networks of both carriers. I also wouldn’t be too surprised to see soft products migrating to largely similar products on both carriers to optimize costs.

I’m sure @Ajay would agree, Vistara’s soft product has taken a serious beating over the last few years. It’s nowhere close to what it once was and what was promised. I wish Air India charts it’s own path under the Tatas rather than follow Vistaras.