The Liberalized Remittance Scheme (LRS) was introduced in India in 2004. The scheme enables Indian residents to remit funds abroad for specific purposes. The system has been one of the essential instruments for promoting international trade and investment and facilitating capital flows into and out of India.

The original limit was USD 25,000 or equivalent. Over time it was hiked as the scheme got popular. In 2015, it was increased to USD 2,50,000 per head. The LRS limit per head is USD 250,000 per financial year (April-March). This limit is even available for minors. If you are a family of 4, you can transfer USD 1 Million outside the country annually.

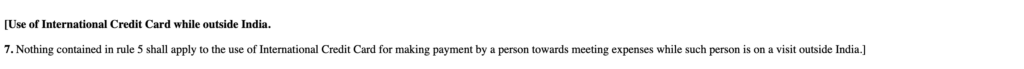

However, the Government of India had kept spending on International Credit Cards out of the domain of the LRS for all these years, as per the FEMA Current Account Rules and the RBI Master Directive.

The Government of India updates FEMA Current Account Rules to bring Credit Card usage under the ambit of LRS.

A minor change made to the LRS rules, notified on May 16, 2023, will change a lot of things that will matter for Credit Card usage outside the country.

With this move, the Government of India has now started to count Credit Card spending on Indian issued Credit Cards outside the country as against the LRS Quota of USD 250,000 per head. While the limit is pretty high for individual usage, take note that if you hit the limit on the top end, you need the permission of the RBI to spend further in currency abroad.

Essentially, this affects everything you may do on a business or a personal spend outside the country. Tickets for Broadway, Hotel Stays, a random coffee paid for on your credit card by the street side, everything will now need to be under the 250,000 limit per financial year. And as per the initial interpretation, if you pick that tab for a bunch of colleagues while travelling abroad, it also goes against your quota of LRS. And if you run a big server capacity using a data centre in the US but use your personal credit card to pay for it, that will also be added to your LRS limit.

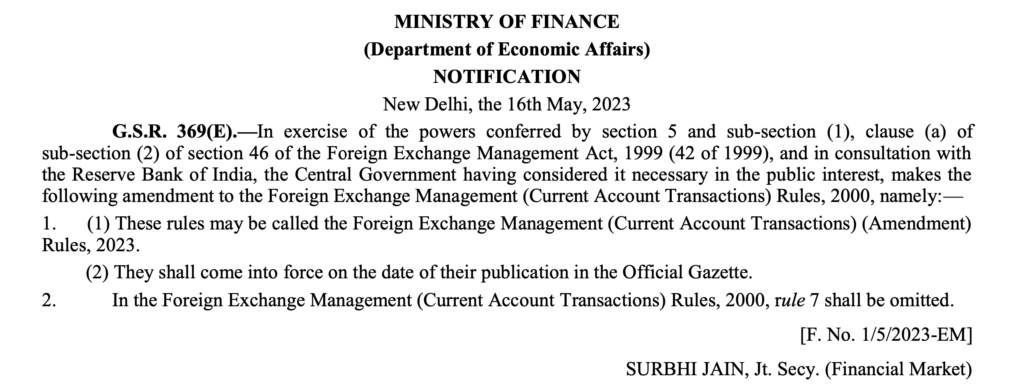

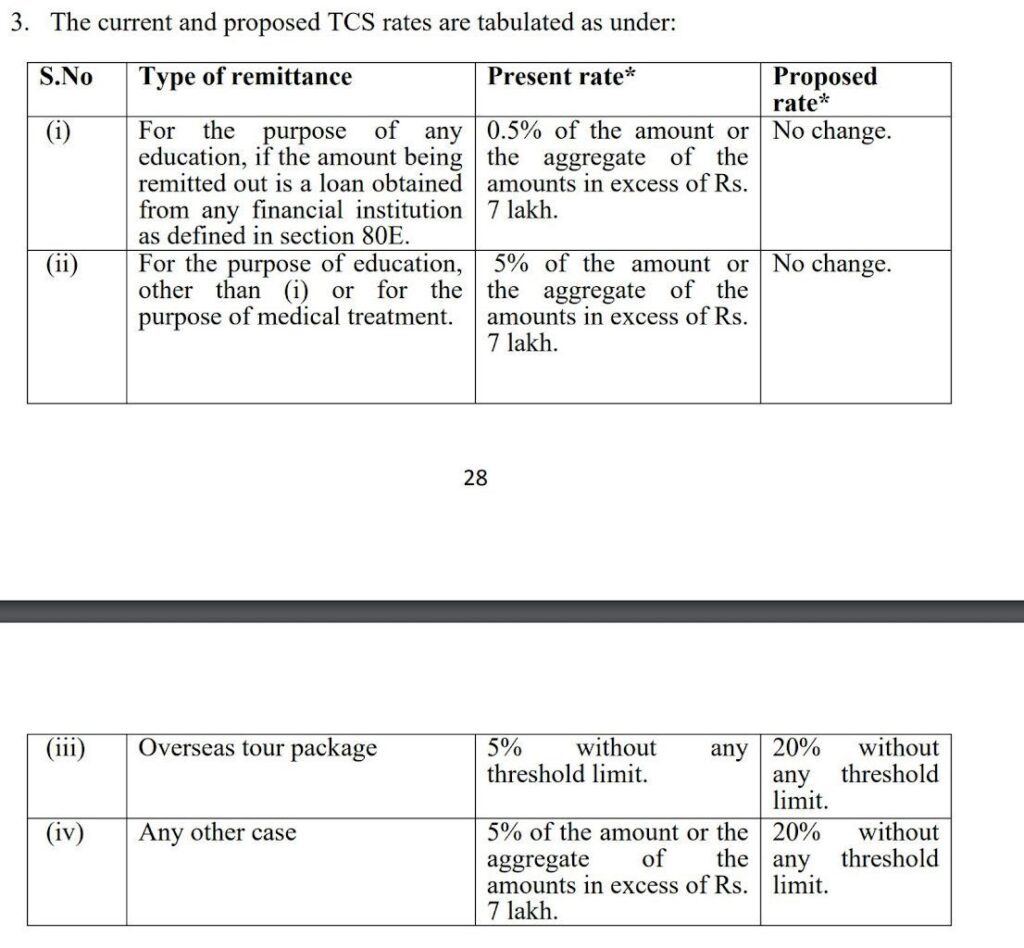

Tax Collection at Source applicable for international transactions, going up to 20% in July 2023

Now here is the double whammy. Since so far, Credit Cards have been kept out of the ambit of the LRS; there has been no taxation on the use of credit cards abroad. However, since Credit Cards are now brought under the purview of the LRS, effective immediately, they are also subject to Tax Collection at Source.

The government of India rules currently authorise a Tax Collection at Source of 5% of the amount used under LRS for any purpose when this goes beyond INR 7 Lakhs in a financial year. For educational purposes, the amount is 0.5% and for foreign package tours, it is a flat 5%. So let us say you use INR 2,00,000 for a trip to Singapore under a package tour. You would pay INR 2,40,000 to the person who sold you the tour, with INR 40,000 being sent to the Government of India under your PAN. You can later ask for a refund of this amount if your total income tax liability is lesser than the tax already deducted.

However, effective July 1, 2023, you must pay a 20% Tax Collected at Source without any minimum limits on which the TCS starts. This means every time you pay USD 4 for a coffee in New York, you are also depositing USD 0.8 towards your taxes in India, which will either be adjusted against your income tax or will have to be refunded to you after you file your returns.

Here is the relevant excerpt from the tax proposals for this year (which is now law).

In this case, the knockout punch is that Credit Card issuers in India still need the systems or processes to make this work for now. The banks may have other departments that have this facility activated (Foreign exchange sales, Forex Cards and so on). So, if the banks wanted to charge the 5% TCS on Credit Card purchases outside India effective immediately because you paid a big bill at the Louis Vuitton flagship store in Paris, they need to learn how to deal with it, at least now.

Bottomline

Credit Card spending outside India became a lot more hassle-some. The Credit Card spending abroad will now be included in your Liberal Remittance Scheme quota of USD 250,000 per head, and there is no way to track how much you used up (apart from collecting all the bills at your end). So, if you wanted to use a big one-shot payment to go wire abroad for that house in Portugal you have been wondering about for your retirement, best of luck because how will you spend abroad then? And now that Credit Card spending is covered under LRS, effective July 1, 2023, it will all be subject to a 20% Tax Collection at Source, which can be adjusted against your tax liability.

What do you think of all the changes to your international credit card spending?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Isn’t this going against digital India? And would also lead to people taking the maximum allowed (I believe $10k) when travelling overseas.

This reminds me of the time angel tax was introduced in the budget. We all know what happened to the government of the day in the next election. However the provisions were never rolled back even when a new dispensation was in power.

What is the objective behind this notification? If it is to track foreign currency usage through credit card?, If so, it already gets reported in AIS, probably a bifurcation could be added between domestic and international spends. If the idea is to boost tax collection, then how much could this net in post refund? 2000-3000 cr? is that really significant basis the cost it imposes on individuals, companies, banks etc.

What happens if someone is a victim of credit card fraud while travelling internationally? Is it flat 20% TCS on CC spends or will the merchant code determine the TCS %. What happens to addon cards? What happens when you spend money on behalf of family or friends or a corporate expense charged on the personal card which later gets reimbursed?

Many a times I book International flights for my friends & family for discount on different cards. Will that to be also subject to TCS?

And what happen when a foreign transaction is refunded, say after a month for cancelled hotel. What happen to that TCS?

How foreign currency markup will work?

Such a positive move by the Government to encourage generation and spend of illegal (black) money. I’m glad the government is taking these steps to make the lives of people who use official channels more cumbersome.

#sarcasm

Is it applicable to Govt promoted rupay international credit cards? Also i think along with currency markup fees they will charge tax at source so it would be ~22% additional fees for each international transactions.

@Subham, it affects all credit cards issued in India, for payments not made in INR.

@Ajay Hi, any thoughts on if NRI credit cards (credit cards issued by Indian banks to NRIs holding a NRE/NRO account at said banks) would be outside the purview of this rule since remittances from non-resident Indians were outside the purview of the LRS scheme earlier also?

Thanks

@Ganesh, there really is no clarity right now on so much. While there are pseudo-experts doing spaces on the back of one piece of paper, in reality, even banks are clutching at straws for the moment. Give it a few days for more clarity to emerge.

Does this affect debit cards also?

@Max, this was always going to go live for Debit Cards on July 1, 2023 anyways. Credit Cards were out of the ambit, and no longer the case.

Hi Ajay,

TCS Rate for debit card is 5% right?

@ Arjun 5% now, 20% in 6 weeks.

will this be application to a American Express charge card as will since technically is not a credit card.

Btw, Mr. Ajay, I am a huge fan of your articles and learn a lot from them.

Thank you

This is a push of the RBI for the past few years to make it extremely difficult to use credit cards. It seems someone in RBI does not like credit cards personally and is pushing their agenda forward. My international subscriptions became impossible to use, now all use is difficult.

I think maybe someone can guide how can we as Indians get hold of an american credit card.