The Indian Central Bank, the Reserve Bank of India, which is the overall regulator of all sorts of banking products in India, including Credit Card products, has late last night notified a new set of orders which would affect the operations of two different card network platforms in India: Diners Club and American Express.

A new order to this effect was issued late in the evening on April 23, 2021.

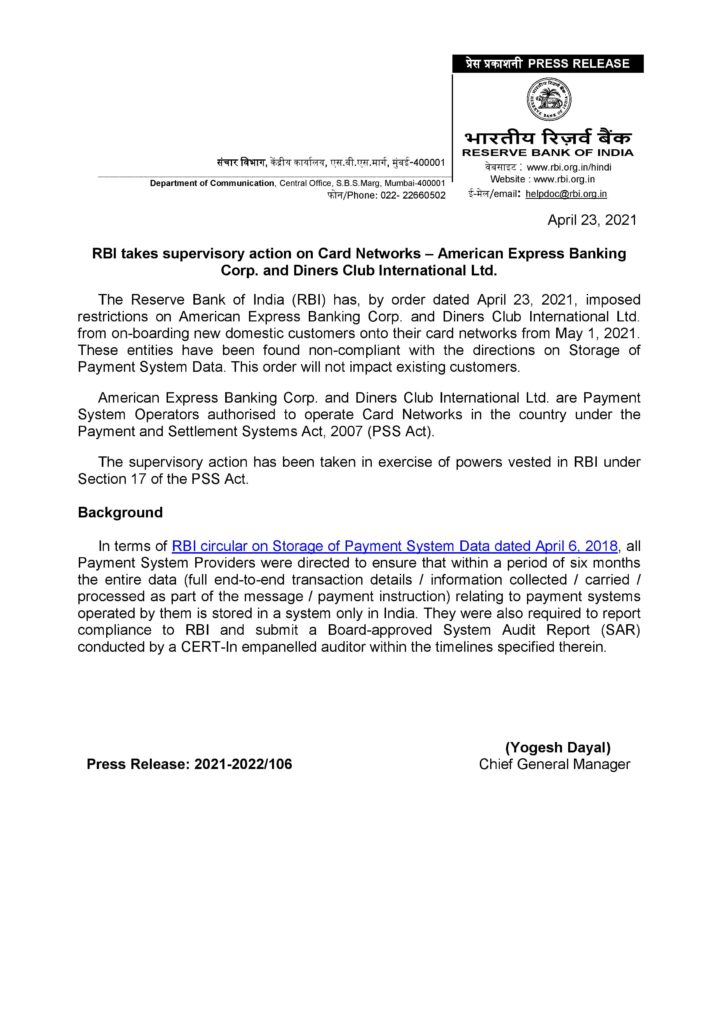

As you can read in the order, all Payment System Providers were notified to localise all their data in India. Now, American Express Banking Corporation, which is the Indian operating entity of American Express and Diners Club International Limited, an entity of Discover, which owns the payment network of Diners Club, has been barred from issuing new cards in India from May 1, 2021, onwards.

Reacting to this move, American Express issued a statement that said,

We have been in regular dialogue with the Reserve Bank of India about data localization requirements and have demonstrated our progress towards complying with the regulation. While we’re disappointed that the RBI has taken this course of action, we are working with them to resolve their concerns as quickly as possible. This does not impact the services that we offer to our existing customers in India, and our customers can continue to use and accept our cards as normal.

This is a surprise move, and on the back of HDFC Bank being barred from issuing cards to new customers, it is a double whammy for them since HDFC Bank was the sole issuer of Diners Club cards in India. Same for American Express, which won’t be able to issue new cards till further notice from May 1, 2021. And to think all of this was happening in the same timeframe when Citi decided to move out of India as well.

What do you think of RBI’s new move to disallow Diners Club and American Express from issuing new cards in India?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hi Ajay and other readers any idea about platinum retention offer this year ? If RBI is not permitting new customer enrollement then retention of existing customer is a big task especially in this covid scenario. I like to know if any retention offers have given to any of the readers …

Amex and diners both deserve this or for that matter anyone else who didn’t meet localisation rules. Ideally even a fine from RBI.

It is a great and well deserved move by RBI. They had over 2 years to implement this but their management’s arrogant thinking that they are over RBI, they did not do anything.

When it was time for GDPR compliance, they did it asap and published articles fawning over the law. This was precisely because they knew that EU will fine them 20 million Euro or 4% of annual revenue (whichever is greater).

By not paying heed to Indian Regulatory Bank as if it it was beneath them, they shot themselves in the foot. They could have easily achieved compliance within 6 months but it was their decision to not to go through with that. As the saying goes, “As you sow, so shall you reap”. I hope this puts a real sting in their Indian revenue and they’d think twice about neglecting RBI next time.

Aptly summed up

Decision came at a wrong time for Amex and Diners As rightly expressed every one must comply to the respective countries directives. Company must sack the head of the Dept

Hey Ajay, a long time reader here with some feedback. Somehow I knew when news about Amex was posted that your article would be up in a day. But, I also had figured that no article would be up after Citibank’s departure news.

Your channel still remains a good source for understanding and learning about air miles and credit card points earning, but I have seen since couple years that you don’t post about Citibank cards as much as you do about Amex and HDFC anymore. Considering prestige still remains an excellent points earner with highest mile conversion, I find that surprising.

With Citibank’s impending departure or sale, your analysis would really help people with premiermiles and prestige, at least while they are still active in India.

Hope to see you return to a more balanced coverage. This is my constructive feedback as a regular reader and not any attempt to start online spat. Hopefully you will take in right spirit.

@Mihir, the skip on Citi was not intentional. If you’d notice I was gone for a couple of weeks. Now back, and trying to put everything together, one piece at a time. You’ll see something soon.

Hope all well at your end my friend.

If HDFC bank buys citi then i would close my account.

Incredibly disappointing news. They should have given more time to the companies to execute the orders or some other compromises.

India is unpredictable when it comes to government interference in businesses. It’s not a desirable ecosystem for corporations to function.

End result is that global corporations will want to stay away and everyone loses.

2 years was enough time for them to localise their data….they need to start respecting Indian regulations as much as those in the western world…..they can’t afford to ignore India and even if they do we have our home grown private sector banks to fill in the gap….so chill and be proud of our regulator

What a generalization “India is unpredictable when it comes to government interference in businesses. It’s not a desirable ecosystem for corporations to function. End result is that global corporations will want to stay away and everyone loses.” AmEx didn’t do what regulator asked all financial institutions to do. It wanted to stand out, and it did.

Looks like an attempt to push RuPay cards

i think after giving 2 years to comply this move seams to be correct one…everyone has to follow the rules.