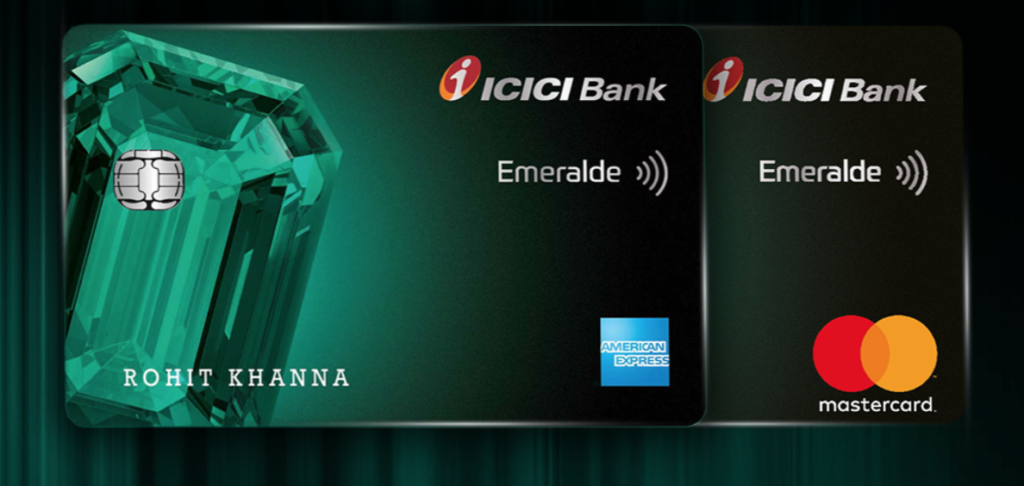

Last month, I wrote about the ICICI Bank Emeralde Credit Card, which is the newest addition to the ICICI Bank Gemstone Collection. This credit card is supposed to be a super premium lifestyle credit card, which would be priced at INR 12,000, and promises benefits worth INR 300,000 in return.

The card comes as an American Express + MasterCard Elite Credit Card, and it comes together in one fee paid per annum worth INR 12,000, or INR 1,000 per month. As I wrote then, the card focusses on benefits in three categories, Travel, Lifestyle and Wellness. Wellness is not a category that any credit product in India has been concentrating on so far. So that is a welcome addition.

- Travel:

- There will be unlimited international lounge access offered on this card at 450 lounges outside India, and unlimited domestic airport spa access (via DragonPass).

- Unlimited domestic lounge access with Amex and MasterCard (Chennai, Kolkata, Mumbai, Ahmedabad, Pune, Goa, Delhi, Hyderabad, Bangalore, Cochin, Jaipur)

- You get complimentary wi-fi at airports and in-flight with Boingo using the Amex version.

- Free cancellations on travel and hotel bookings up to INR 12,000 per annum, twice a year. This is similar to the free cancellation offers from HDFC Bank Credit Cards.

- The card drops the lowest markup fee on international transactions from an Indian card at the moment, taking it to 1.5%.

- Lifestyle:

- In line with ICICI Bank’s long-standing tie-up with BookMyShow, ICICI is offering ₹750 discount on buying two tickets for movies and events, up to four times every month. In reality, this means eight tickets every month, since you get two cards (Amex and MasterCard).

- 4 Complimentary rounds of golf every month in India and around the world, with a complimentary round/lesson of golf on every ₹50,000 or more spent on the card in the previous calendar month, up to a maximum of 4 rounds/ lessons of golf every month.

- Wellness:

- You get up to 50% off on Gym memberships at Golds Gym company owned gyms in Mumbai and Pune and a free dietician consultation.

- 30% off on fees at Talwalkar Health Club Facilities across India on the annual package (valid through March 2019).

- INR 1000 off on Kaya Skin Clinics

- Complimentary Hair and Scalp Check at Richfeel.

- Buy 1 Get 1 free at VLCC Beauty Services and free weight loss consultation

- Discounts at Truefitt & Hill

- Rewards:

- The spanner in the wings is that the card offers you Payback points towards rewards.

- Four PAYBACK points on every Rs.100 spent on all retail transactions except fuel

- One PAYBACK point on every Rs.100 spent on utilities and insurance categories

- Payback points convert to INR 0.25 in cash, or 5 Payback points to 1 JPMile, and no other conversion partner.

- The spanner in the wings is that the card offers you Payback points towards rewards.

- Apart from that, as a milestone benefit, you get a complimentary gift voucher worth INR 5,000 from Da Milano on spending INR 2,00,000 in two months of joining. You also get an INR 7,500 voucher from Trident Hotels on your birthday.

Bottomline

In the super-premium market, there is a lot of headlining that happens, and clearly, ICICI Bank constructed this card with that in mind. There are a lot of benefits, but no real rewards at play. Clearly, ICICI Bank added up the value of all the benefits to come to the INR 3,00,000 value for the benefits they offer on this card. Perhaps their thought process is that no one needs to think of rewards when they can get the benefits. They haven’t met our readers who want the benefits and rewards.

Given their entry criteria is even more strict (INR 30 Lakh) than, let’s say, American Express for the Platinum Charge Card, which comes at INR 15 Lakh for Self Employed and INR 25 Lakh for salaried, and with much better benefits and partners, I am not sure how many applicants are they targetting with this card.

What are your thoughts on the ICICI Bank Emeralde Credit Card?

THERE ARE LOT OF PROBLEMS ASSOCIATED WITH THIS CARD e.g. NO ONE EVEN THE BANK EMPLOYEES KNOW THE BENEFITS LIKE THE MOVIE TICKETS BOOKING, HOW TO LINK IT TO THE MAIN ACCOUNT AND HOW TO GENERATE PIN WHICH MAY TAKE COUPLE OF DAYS WITHOUT ANY FRUITFUL RESULTS

Kaya skin clinics do not offer any discounts on this card, one can check on kaya customer care before taking this card based on icici claim that there is feature of this on card.

I have applied for this card today and was told that we would be getting either Amex or Mastercard and not both like in other ICICI cards.

Two companies I wont deal with on my death bed – one of ICICI and the other of Reliance ! Whit all that they have put together and dumped points on Payback !!

Given that I already have Boingo, and the fact that they have almost no free massage partners on arrivals, a hard pass for me. I’d have taken this card for free arrival showers/massage alone.

For someone who doesn’t have Boingo, it is a great time saver — in India it works with every Docomo hotspot, that includes Starbucks and almost all Airports. No OTP or anything, one click and your Mac is onto Docomo’s premium plan. And here’s the thing — once you get it, you can’t really lose it. Apparently Amex has no way to communicate card cancellation with Boingo, and I see no option to cancel or change the plan on my account. As soon as you enrol, your account enters a weird lifetime free access mode, and it never really goes away. And enrolment happens based on BIN numbers, so I doubt Boingo communicates with Amex on specific cards that enrol.

Is there a limit to the number of devices you can connect to Boingo through the same account?

Four.

I tried finding BIN for Corporate Platinum online. Not successful

@Prashant, you naughty boy!

Not impressed with this card at all. Does not come close to Amex Plat Charge or even Plat Travel. Also one has to consider Amex’s transfer partners, Amex offers, and their legendary customer care and concierge service. The fees may be lower, but Amex also gives ample ways to recoup the fees.

@SH exactly my point as well. The only competition for Amex is Citi. And they are both global banks. Everyone else can’t come close to stitching up similar partnerships.

I have to see. Very very impressed with amex customer care. I think it is miles above citi. Specially the fraud protection part.

One feature of the emeralde card i like is the wifi offer

I’d say Citi’s customer service is pretty much on same level of Amex if not better, at least for Prestige. Amex Plat doesn’t even have a dedicated line in India for Plat like they do in US, but Prestige has a separate Prestige line.

I’ve had no issues with chargebacks with Citi, even for stuff where the reason was service not provided as promised, they were very quick to issue credit.

That said, Prestige concierge now seriously lags behind Amex. But it wasn’t always this way.

I think this is based on each individual’s experience.

Quick question – does BOINGO come with amex plat charged?

Nope. In India, only on Corp Plat and Corp Gold.

I’ve had terrible experiences with Amex plat charge concierge. It is a total sham. Citi prestige at the price point does what is expected. Amex has a bunch of postmen manning their platinum lines who read from a document without thinking of understanding stuff. They goof up on even basic restaurant reservations. Very miffed. Just waiting for the year to get over.

I’m so amazed that people are having bad experiences with concierge. They always seem ultra savvy to me. I mean, a lot of times I can Google a lot of stuff I throw at them, but they haven’t done a worse job than what I have done so I have slowly started to trust what I’m being sent.

Also, Plat’s travel line is extremely powerful. I mean, they have booked me hotels when I’m in the middle of nowhere which were not on their system, because I wanted something super cheap to crash. They had to call and book. They didn’t get a cut, they just did that because I had almost dead phone battery. At 2 AM. I’m a fan.

Question — Do you use Plat as your everyday card?

I have no idea why the is so much inconsistent in their service. I have even compiled a list of goof ups and have sent them. To quote a few : requested a table at an ITC restaurant ( amex CV partner in the dining program) couldn’t get one. Booked one through easy diner and got it. Next asked them for a tour ticket was told it was full… That too after a week. Booked the same ticket through an aggregator soon after. So now yeah pretty fundental level misses. I don’t use the card as my everyday card. The DCB is the one for me

Because of its higher earning rate. Curious: why do you ask

Amex service varies depending on your usage of the card, in general — although not sure for concierge. They even have a tag for it internally to cue in if you’re a high spender, or a person they know will use Amex for their first swipe.

For example, I’ve never gotten lower rep than a senior travel counsellor from them, but I have friend’s who have Plat who never get a higher ranked rep and have bad experiences.

For Amex, in general, color of the card doesn’t matter as much as loyalty. They want merchants to know they will lose valuable customers if they don’t process Amex. They repay that loyalty back very well.

Just this week, I got a next-to-sea table at a fully booked Greek restaurant in Goa, by calling Amex standing outside the restaurant. I’m not sure why basic reservations are failing for you. I use Amex for everything. Plat sees hundreds of transactions a month. Like — everything.

Hmm… While I agree with the general logic of having senior consultants for frequent Sievers/ loyal customers, I am not sure if the system does that when you call the Platinum line. Besides for a card that comes with a 70k annual fee there certainly needs to be a minimum service threshold. Anyone I could teach out to? Have referred earlier to the head cc but they continue to disappoint. Of course there are a few sporadic instances where the concierge was brilliant..but those are an exception while fallures are a Norm

Just had a decent experience with Citi customer care for Prestige. My Taj gift card loaded with Rs 10k had expired almost 6 months back. Tried getting in touch with Taj Inner Circle with no help. Citibank ensured the card is revalidated. Though it took a few days, but they got it done. Also for Amex they are happy to extend the Taj vouchers issued on Amex Travel Card for say 3-6 months.

Does not impress me much.