Ever since we’ve published the Reader Success Story of Lov earlier this week, where he headed to the USD 2000 a night St. Regis Vomulli in the Maldives on points, I’ve been inundated with questions about how can other people find their way to this beautiful resort as well? The common theme, of course, has been that they don’t travel much so they don’t collect as many points as they’d like to.

The response I’ve given to a lot of these questions have been the same, get a credit card which gets you the points. In India, there is only one card issuer which partners with Marriott Bonvoy, and there are some great opportunities going on at the moment to convert your Membership Rewards points to Marriott Bonvoy points and use them.

The Marriott American Express Membership Rewards connection

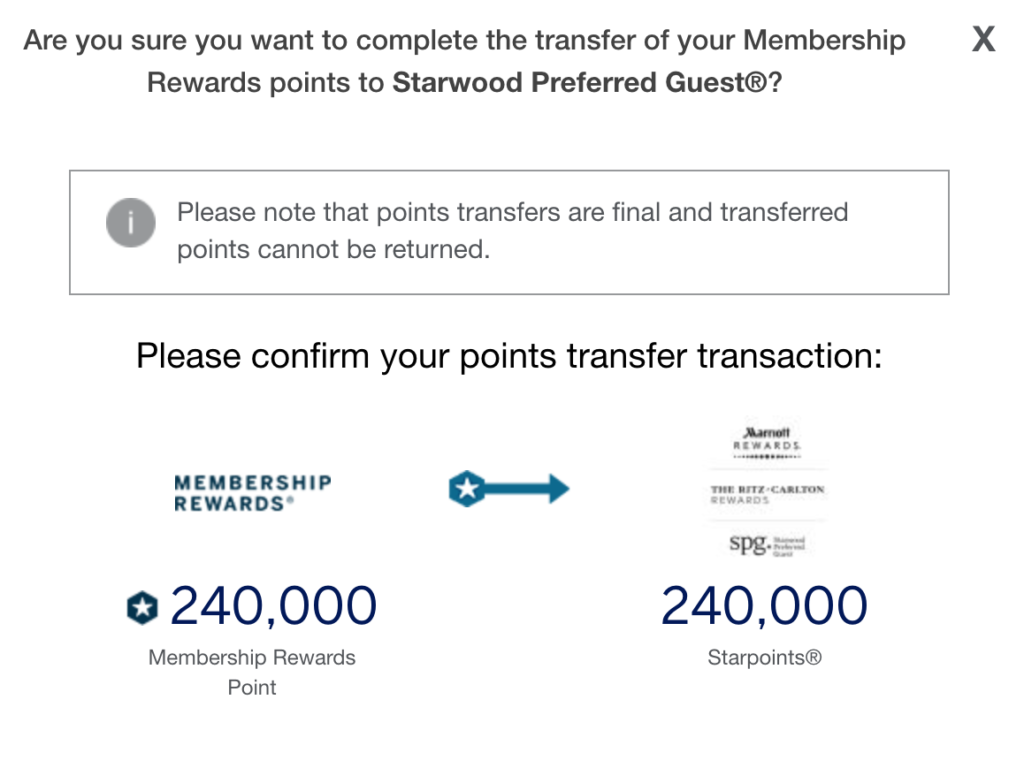

Membership Rewards, which are the loyalty currency of American Express, can be converted 1:1 into Marriott Bonvoy Points.

Marriott Bonvoy points, the currency of the Marriott Bonvoy programme, can be used at over 6000 hotels around the globe, including some great ones in India itself. Further, Marriott Bonvoy has a great feature, whereby if you are booking four nights as a reward, you get the fifth night for free.

Which means if you were to book the St. Regis Maldives for four nights on points, you would not just be able to get the four nights free, but also a fifth night as well, because Marriott Bonvoy gives one night free for every four nights you redeem (only continuous nights count), which means you effectively will get the St. Regis Maldives for 48,000 Membership Rewards per night.

For instance, there is a bunch of hotels which are going at 60,000 Marriott Bonvoy points per night right now, but will go up to 85,000 points in 3 weeks. If you are already an American Express card holder, you should totally try and scoop one of these properties for one of your upcoming vacations. Maybe it is time for this…

There is a whole bunch of exquisite Marriott properties in India as well which are great redemptions. One of my favourite ones, for instance, is the JW Marriott at Mussoorie, which only requires 35,000 points per night. It has been one of my favourite Marriott hotels in India so far.

There are of course many others as well.

How to get started on earning Membership Rewards?

It’s simple. Get yourself an American Express Card which earns you Membership Rewards. That means, not a co-branded card but one of American Express proprietary card. You can hold one charge card, one co-branded credit card and one proprietary credit card from American Express in one go. If you don’t already have one of these Membership Rewards earning cards, you can get one quickly:

- American Express Membership Rewards Credit Card (Free) : With this link, Amex is offering the card free, plus 4,000 MR points subject to minimum spends within the first 90 days. Every month, you can use the card just four times in a month for INR 1000, and get another 1000 MR bonus every month. That makes a total of 16,000 Membership Rewards points in the first year, which is two nights at a Category 1 hotel straight away (Think Mahabalipuram, Amritsar, Ahmedabad and others…)

- American Express Platinum Reserve Credit Card (INR 5,000): With this link, Amex is offering the card for a discounted fee of INR 5,000 , plus 15,000 MR points subject to minimum spends within the first 90 days. That is two nights at a Category 1 hotel straight away for INR 5,000 (Think Mahabalipuram, Amritsar, Ahmedabad and others…)

- American Express Platinum Charge Card (INR 60,000): The American Express Platinum Charge Card offers 100,000 Membership Rewards points for signup. On using this link, you get an additional 10,000 Membership Rewards points, making it 110,000 Membership Rewards points, hence the cost of each Bonvoy point, goes down to INR 0.55, which is so much cheaper than the INR 0.9 at which they usually go.

Those are some of the ways you get to earn and use Membership Rewards points for big ticket holidays in the coming year.

Have you used the Membership Rewards to Marriott Bonvoy transfer capability? What do you think of it?

Even wonderful is that you can transfer from Marriott Bonvoy to 60 different airlines in 1:1 ratio with a bonus of 5000 miles for every 60000 points transfer.

When you transfer directly from Amex to an airline, the transfer ratio is 2:1.

So best is to transfer Amex–>Marriott Bonvoy–>Airline

Ok… That’s some Kickass work around..

I mean I would love to get a hotel redemption but at the end of the day, not sure if have patience to save it for that big night in supreme luxury hotel.

So transferring to Bonvoy to Airlines can actually make it great value.

Any idea about airline partners ?

Emirates/Etihad/jet?

@Priyansh, over 40 programmes. There is a lot of reading for you to catch up on!

it is 3:1 -> 60000 transfers to 20000 miles with 5000 Bonus miles.

Man…I love to use the 1:1 ratio

It’s 3:1, which airline has 1:1. ?

Manu I’m afraid you’re mistaken.

https://www.marriott.com/loyalty/redeem/travel/points-to-miles.mi

All listed airlines in marriott page are at 3:1, and not 1:1. Do enlighten us if you see any 1:1 and back it up with any sources.

if we hold multiple cards, do the points from all of them go into a single Membership rewards account?

@Saikat, yes.

Not if u hold Platinum Travel Card and any other Proprietory cards. The Membership reward points earned with Platinum Travel Card cannot be clubbed with any other card.

@Vinod yes, the Plat Travel Card is a separate basket altogether.

This is eerie coincidence, I booked St. Regis Vomulli stay through Points before your first article. And now comes a follow-up article from your end. Thanks for the additional info tips.

Superbly written. nice to know about the bonvoy tie-up.

I have the Amex rewards card. hopefully in a couple of years will transfer it to bonvoy for a cat 5 hotel.

is it possible to hold both the plat reserve and the rewards card at the same time.

It is possible. Sometimes Amex gives a free Membership Rewards card as a companion card to go with Plat Reserve.

From Amex, at a time you can hold a Corp card+Charge Card+Credit card+Jet card