Once upon a time, HDFC Bank Diners Club had a lot of transfer partners. This included the likes of Marriott Rewards, Hyatt and American Airlines. One fine day in 2016 all these partners went away. Then, HDFC Bank Diners Club had knocked off Air India as a transfer partner in August 2017 without notice. I am hoping that partnership will come back soon, and I have good reasons to believe that.

However, I’ve been sort of tired bringing you bad news about your Diners Club credit cards over a period of time, so I thought I’d give you what could be hopefully good news this week. Diners Club/HDFC Bank have added more transfer partners over the past few days, which is good news in my book!

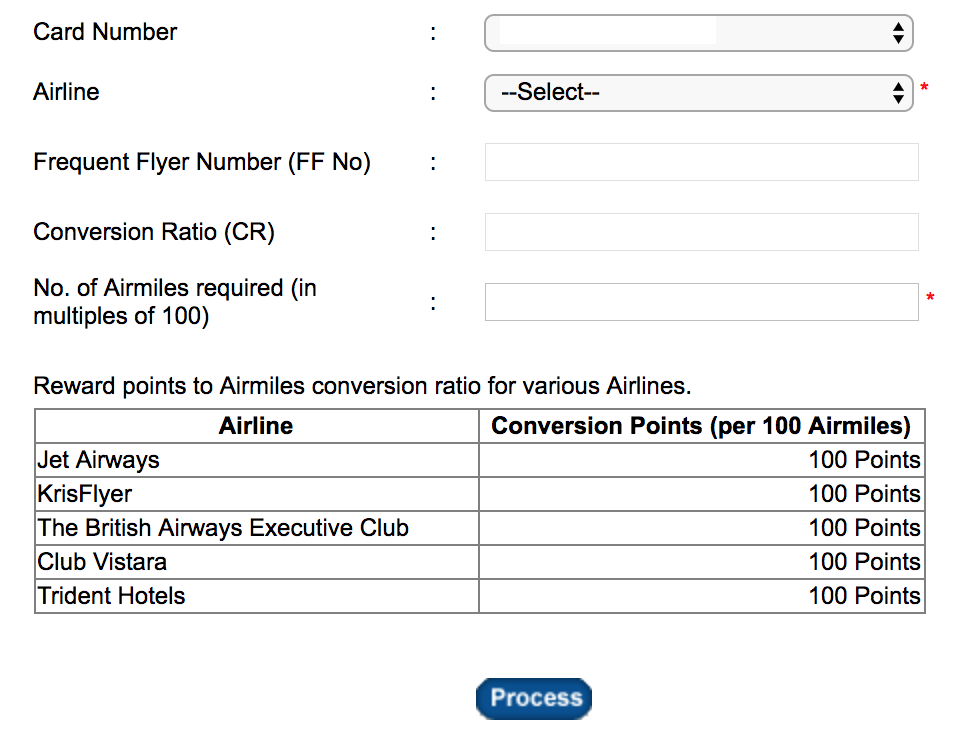

I happened to check into the airmile redemption portal for HDFC Bank Diners Black today. One can access it by going to the Cards section on the HDFC Bank NetBanking portal. This leads you to a separate website. And I noticed that 3 new partners were added to the list:

- British Airways Executive Club

- Club Vistara

- Trident Privilege

All the partners have a 1:1 conversion ratio with HDFC Bank Diners Black. [Update: Only valid for Diners Black] Which means for Premium holders, it would be at 1:0.5 conversion ratio and for Rewardz it would be at 1:0.3. I’d, of course, need confirmation from some of you on those ratios since I don’t have the Rewardz or Premium cards and so someone with the card can confirm in the comments section.

What is interesting, also, is that the partnership is only for Diners Club cards at the moment. For instance, I checked with a Regalia card, and that card only has Jet Airways and SQ as a transfer partner.

British Airways First Class Boeing 787-9

This is indeed great news. As of now, British Airways could be good value for redemptions. Heck, I just used 100K points per head in July to fly back from London in First Class with Shipra.

What do you make about the new transfer partners of HDFC Bank Diners Club credit cards? I think it is a sign of things to come!

Just checked with my Diners Premium card and only 9W & SQ are showing up as transfer partners.

Maybe the additional partners are for Diners Black only?

It is very good news.Really exited about Vistara

Thanks Ajay for the heads up. Good to see new partners. I am already a Vistara Gold and have a Vistara points earning credit card. So this addition is a welcome change.

Thanks for the reply Majumdar!

So as someone who predominantly flies economy, looks like it makes sense to not transfer RPs to a FFP

Ashok,

Typically air miles value at around 30-40 paise if redeemed for economy class tickets. Around 70p to INR 1 if redeemed for business class, but can be valued for more than INR 2 if redeemed for first class. So essentially air miles are VFM only for biz class and first class tickets. This apart, very often airlines give premium on redemption for instance Jet frequently gives 20-50% extra miles upon redemption.

But availability of such tickets is often an issue and that needs to be factored in. Plus, tickets purchased outright as bank RP redemption qualifies as paid flight and you get air miles which is not the case for miles redemption.

Regards

Seasons Greetings Ajay!

I’ve not had much experience with Frequent Flyer programs other than redeeming Air India points from the SBI Air India card for flights (i’ve never even tried upgrades!)

So transferring Diners points to an FFP program hasn’t ever sense to me. I’m on Diners black and a each point is worth a 1 Rupee. So if i were to get onto to hdfcdinersclub.in and book the ticket i want, i’m pretty much getting full value for my points at 1 Rupee per Point.

On the other hand if i compare with my Air India points redemption i’m typically redeeming a Blr-Del sector for 13500 miles with the ticket price hovering around 6-7k for short notice bookings. I’m clearly getting very poor value for my points right, so why would i transfer points to the Air India FFP.

It is my understanding that most other FFP programs will similarly provide less than optimum value to points so why would anyone on Diner’s black want to transfer? Do some Airline/Hotel programs offer better value or is it some concern that HDFC may devalue these points – what am i missing?

Thanks.

@Ashok, your strategy works best when one needs an Economy Ticket. Let’s say from Mumbai – Goa. INR 3500 v/s 5000 JPMiles+money. When you want to travel business class however, tickets are INR 18000 upwards, while mileage tickets are 10000 JPMiles + tax and surcharges. First Class, even better. So, redeem for economy tickets but Business/First, you come out ahead with miles.

Thanks!

Hello. I’m interested in this card. Can US consumer apply for one?

Thanks

Nope.