In December 2020, HDFC Bank was barred by the Reserve Bank of India from issuing new credit cards and launching any new digital products till the bank was not going to be able to solve technology issues the bank faced from time to time which saw various outages on its Internet Banking again and again. And then, there was radio silence from both sides for about nine months. In the meantime, RBI barred American Express from issuing new cards, and MasterCard and Diners Club were also banned, however, on a different requirement, about data not being stored in India. Now, we finally have some good HDFC Bank Credit Card News.

Reserve Bank of India allows HDFC Bank to issue new credit cards.

The Reserve Bank of India has sent out a partial retraction of the ban on the Bank on August 17, 2021. The RBI has given HDFC Bank the go-ahead to start issuing new credit cards again. This does not mean that the Bank is ready and has started to issue credit cards from August 18 onwards. But the HDFC Bank should start issuing cards anytime soon now, and they have promised a return “with a Bang”. The bang was already visible earlier in the year when scores of customers received free LTF Card upgrades, and there is no reason to doubt the aggressiveness HDFC Bank will display once it gets back in the market.

HDFC Bank has confirmed the lifting of the ban with a media statement issued today.

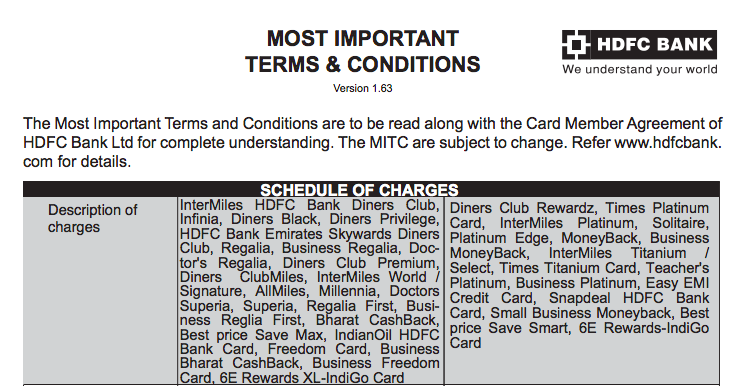

Anyhow, even when the Bank comes back into its issuance mode, it will find some of its partners gone for the time being. Diners Club cards have been barred for now, so one of their wildly successful cards, the Diners Club Black, would be unavailable currently for issuance. This would also impact the Emirates co-brand card, which was put up on their Most Important Terms and Conditions but has been removed again.

And on top of that, with the MasterCard ban, HDFC Bank will find one of its other exclusive products, the IndiGo co-brand cards, not being issued much unless the Bank switches it over to the Visa network. Remember, card products are often co-constructed with the networks, and the 6E product looked like one such product, given MasterCard’s logo was all over on the launch as well.

This is a good thing for HDFC Bank, and I’d expect a more aggressive push into the market in the coming times from their end. There is also that Marriott co-brand card that we still don’t know much about, by the way.

Bottomline

Expect to hear more from HDFC Bank in the coming days as the Bank starts to issue credit cards again. They are cleared to issue credit cards by the RBI after a lengthy ban and an unprecedented one.

What do you make of the HDFC Bank credit card news and what do you expect from the HDFC Bank in the coming days?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Hello All,

My RM called to inform an offer to convert DCB LTF to Infinia FYF. Is it worth going for?

Hi Ajay,

Is there any chance that after launch of the new cards, Infinia/DCB gets devalued? We’ve already seen some sort of devaluation (rather restrictions) last year when points redemption was 70% of the booking value, 10X reduced to 5X/3X for Amazon,IRCTC/Flipkart, maximum bonus smartbuy points to 15K/7.5K from 25K/15K.

Hi Ajay,

Which credit card is complimentary for HDFC preferred account customers? I already have Infinia (before upgradation to Preferred). Which card my mother & wife can get? None of them have any credit card (except add-on). HDFC netbanking showing only the basic cards eligibility for them (Intermiles/IOCL/Millenia/Moneyback). But as per the benefits mentioned for Preferred customers, they are eligible for Premium credit cards (Infinia?).

@Pranab, I’d imagine they should be able to get regalia LTF. But talk to your RM, he/she is the best person to facilitate this.

Thanks. I had a word with her and she asked me to wait for few days to go the offer LIVE.

Was trying to get the diners club black and looks like I have to wait longer. The 10x reward benefits for Swiggy and likes makes it more useful for my spending pattern.

Would you suggest I go for Infinia in the interim or continue using Regalia / Intermiles.

Hi Ajay, have been trying to upgrade to infinia from my diners club card for quite sometime but not happening. Is there any way of doing it other than waiting for an invite?

Hi Ajay is it sensible to get a citi prestige card now, since Travel is restricted at the moment. so not much utilisation of miles / priority pass. Considering the high fees attached? I have just been offered to upgrade from Premiermiles to prestige. Little confused. Pls suggest. Thanks

@Raghinder, the card still pays for itself. 10K miles + 10K vouchers + unlimited Priority Pass. Also, your PremierMiles grow 1.8x times when you upgrade (1.8 times the miles basically). so it makes sense to upgrade.

Any updates on any new super rewarding/ ultra premium card by hdfc to be launched ??

@saheb, first let them wake up from their slumber, it is not like an action plan is ready.

Wish and Hope they took all this time to refresh their existing card design and some features and Hopefully some exciting Hotel Co Branded Cards.

ICICI Offerings have been lackluster even when they had chances to capture the market.

Unless ICICI ditches Payback for premium cards, they aren’t going anywhere. Payback is not the platform for a premium card segment customers.

Agreed. Payback is so lousy. I would like to believe that Amazon card would have given them a lot of customers