CRED, the credit card bill payment app launched by Kunal Shah in 2018, has evolved to become a major player in lending. Last night, the company unveiled a range of new products, including co-branded credit cards. Here are the details.

What is “Yosemite”?

“Yosemite” is CRED’s freshly unveiled ecosystem aimed squarely at India’s most affluent consumers. It’s more than just another credit card or investment tool; it seamlessly stitches together finance, lifestyle, and prestige. The style name and events originate from the knack for design that CRED has consistently displayed over the years, presumably inspired by Apple.

The components of the launch included not only the famous credit cards that everyone is talking about, but also many other components.

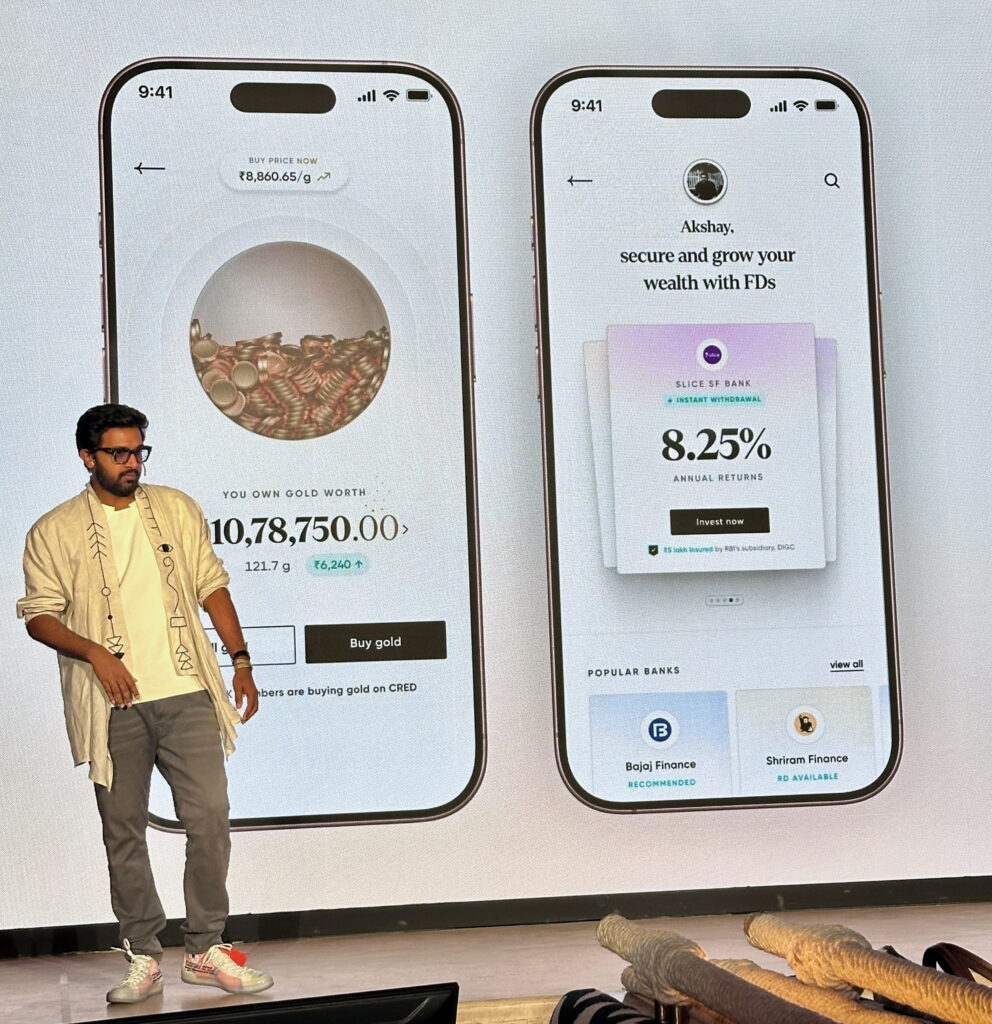

First up, there were upgradedwealth tools under “CRED Money”, which included real-time consolidation/tracking of portfolios, mutual funds, stocks, NPS (National Pension System), and bank accounts.CRED launched CRED Money just earlier this year. Additionally, there are new investment avenues, including FDs (Fixed Deposits) from select banks/NBFCs, with an investment cap per institution. Other options include gold investments (insured 24-carat gold at live rates) with options for liquidity or conversion to jewellery.CRED mentioned that you could have gold coins delivered to your home within 48 hours when you wanted to liquidate. Or, you could walk into Tanishq to get it liquidated for jewellery.

CRED’s new Wealth Monitor Interface (CRED Money)

New Investment Opportunities within CRED Money

CRED’s new Credit Card Launches

Apart from the upgrades to the business, CRED also launched a couple of new Credit Cards, as is well known by now, along with IndusInd Bank, on the RuPay Network.

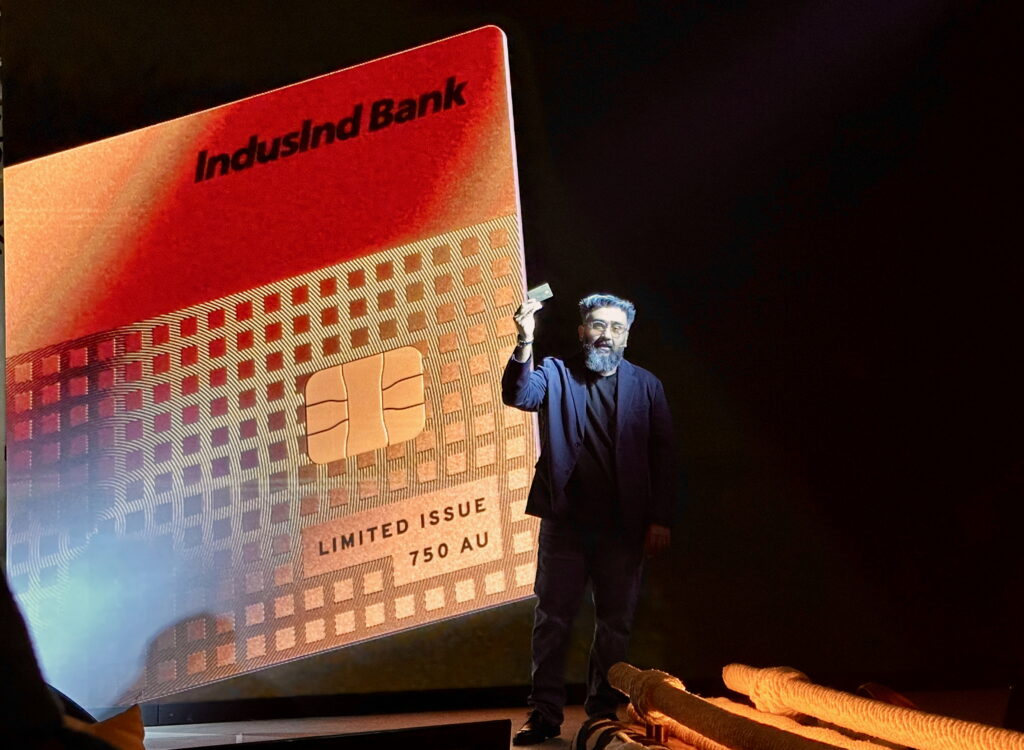

The first card to emerge from CRED’s stable was Sovereign, an invite-only society. Think high-end privileges — “art & collectables, cultural privileges, white-glove travel, even civilian spaceflight.” The card issued under Sovereign is custom-made with 18-karat gold. CRED did not discuss the card extensively because it was intended for the rarest of the rare. The card will also become the first one that will launch on the RuPay Ekaa network (intended to compare with Visa Infinite and MasterCard World Elite).

Kunal Shah holds up Sovereign at the Launch Event

Second, and the more prominent release was an open for all credit card (in collaboration with IndusInd Bank, RuPay) designed as a “lifestyle accessory” with rewards, redemption across e-commerce + offline + travel + hotels.

Kunal Shah and IndusInd Bank / RuPay executives hold up the card at the Launch Event.

The card is a good looker, and it involves a design philosophy, which I will discuss in a separate post. The key features include 5% value (up to 5,000 CRED points, not equivalent to 5,000 CRED Coins) on online spending, 1% on Offline spending and UPI spending. These are redeemable across 500+ CRED Pay merchants, 2,000+ products on the CRED Store, as well as flights & hotels. The key gain here is in comparison to other such products; CRED is trying to break away from the mould of high cashbacks only on specific merchants. For instance, ICICI Bank Amazon only offers 5% on Amazon Spends as a Prime Member.

You can use points across e-commerce, hotels & flights (Ixigo, Expedia, etc.), CRED’s own store, and CRED Pay merchants. An INR 1 Value when you use it for travel, and a 0.5 INR Value in case you choose to turn it into Cash.

What’s new vs what CRED had before?

What Yosemite marks is a shift:

- From broad premium services toward the ultra-premium / luxury segment. Not just “good rewards”; rewards, prestige, and curated experiences.

- Deeper wealth/investment features (not just paying bills or spending money, but growing, preserving, converting — gold, FD, etc.).

- Invitation/exclusivity baked in (“Sovereign” society) rather than being opt-in for everyone.

Why this matters (and for whom)

From a strategic/business lens, Yosemite does several things:

- Tiering/segmentation: CRED splits out its consumer base, aiming to monetise top-tier users much more aggressively (luxury pays). The more affluent consumer tends to have a higher lifetime value, is less price-sensitive, but has a greater entitlement to service.

- Stickiness: If you track all your wealth tools + lifestyle benefits in one place, plus you want the “Sovereign” status, you’re less likely to switch. It’s not just a card; it’s an identity/club.

- Brand elevation: “We don’t just help you manage credit; we are the gateway to exclusive culture, experiences, influence.” That places them to compete not only in fintech but also in lifestyle.

- Revenue diversification: Revenue not just from interest or fees, but from premium membership, partnerships (art, travel, etc.), more interchange/rake-ons from luxury spend, maybe even venture / early-stage investment deals.

For users with high spend and a taste for luxury, Yosemite could deliver real value. For users who are moderate spenders, many benefits may feel out of reach or under-utilised.

Bottomline

“Yosemite” is an impressive move. If CRED executes well, this could set a new standard for fintech luxury in India. It feels like more than just a punch-up; it’s an attempt to redefine fintech’s role in high society: not just spending, saving, and investing, but also belonging, experiences, and identity. But the real test will be in execution. For people who can use most benefits (frequent travellers, big spenders, art & culture aficionados), this might be worth it. For many others, this’ll be aspirational — cool card, probably under-used perks. Additionally, I hope they steer clear of the manufactured spenders.

What do you make of CRED’s new Credit Cards and everything else?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Same for the new in-between behind the article scroll to view the content ad unit.

Call me pessimistic, but it looks like shiny packaging on…nothing.

It’s a spray and pray, more for investor optics than actual users. A large hammer looking for a nail.

P.S. This floating fixed banner to other LFAL posts hinders navigation and usability. Maybe ditch if not generating enough value?