HDFC Bank had launched the ClubMiles HDFC Credit Card in 2017, to make a product between the Premium Card and the Diners Club Black Credit Card. The unique feature of this card is that it is focussed on points transfer rather than cash redemptions for rewards.

So, when you transfer points from this card to the transfer partners, viz British Airways, JetPrivilege, KrisFlyer and Club Vistara, you could get 1:1 transfer ratios, a la Diners Club Black. But when you would use the points to redeem tickets via Smartbuy for cash, the value would be 0.50 paise, a la HDFC Regalia or HDFC Premium Diners Club.

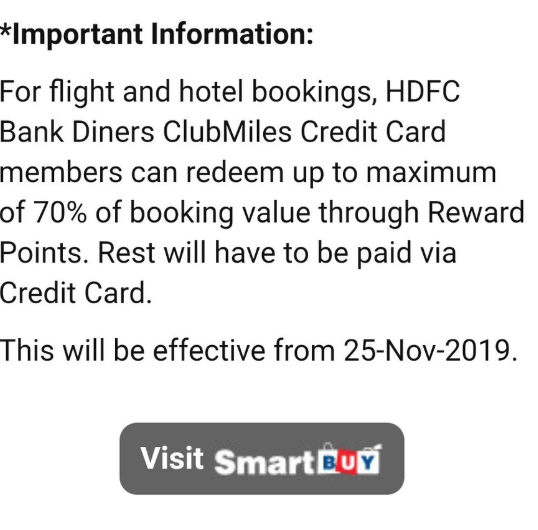

However, a new rule is coming in effect on November 25, 2019, which will be changing this equation further in favour of using these miles for transfers and not for tickets. HDFC Bank has notified a change, that says that from here on, only 70% of the value of a ticket would be redeemable on points and that at least 30% of the value of the ticket would have to be paid for using the ClubMiles Credit Card itself. The new rule comes into effect on November 25, 2019. This information has also been sent out to members today. Update: Regalia will also be subject to this change.

For example, if you wanted to book a ticket for INR 5,000, as of now, you can redeem 10,000 points from your ClubMiles account and get the ticket issued. Come November 25, 2019, you would be only able to use 7000 Reward Points out of your ClubMiles card account (equivalent for INR 3,500), and the rest would have to be paid using the card.

I am not sure what is the motivation behind this move. Also, I’ve not heard of this change on any other card so far, so I would like to believe this is limited to the ClubMiles Card.

If you are a ClubMiles HDFC Card or Regalia customer, how does this affect your usage strategy?

H/T: @Chirupolo, Vaisakhan S

Hi, was browsing HDFC’s Credit Cards catalog to find out that they are not accepting new applications for DC Club Miles and Regalia First right now. Any idea as to why? I hold Club Miles as it allows me to transfer points to Club Vistara at a 1:1 ratio. Don’t want to “Upgrade” to Privilege and lose that benefit.

@Ambareesh, new applications may not be accepted but old card members will still get the same privileges as earlier. So you don’t need to worry.

@Ambareesh, new applications may not be accepted but old cardmembers will still get the same privileges as earlier. So you don’t need to worry.

Smartbuy 10x rewards for Diners Black are not updated for November! Any insight? Only partner brand info stayed same.

It’s better to move to other cards like sbi prime etc

This is a deal breaker. Unless you are going on multiple trips you will forcefully have to transfer the remaining 30% points on redeem them for .20 paisa for every 1 point. Since they expire in 2 years.

Dear Ajay,

I am confused to use this card now. They dont post 9X points some time. We need to keep follow them. 5K point cap and now 70% cap. Better to close this card for now. So I am planning to close and maintain amex Platinum travel card. From past four years am getting same benefits from amex. But HDFC is arrogant and not customer friendly so planning to close. Thanks

This is applicable for Regalia as well. I have received email today.