My go-to credit card these days is the Citibank PremierMiles credit card, and I’ve noticed I must have missed some terms & conditions which now seem changed.

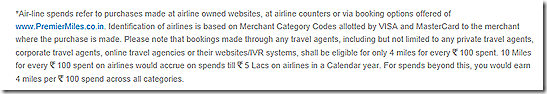

I earlier told you in this post, that the Citibank PremierMiles card only earns 10 Miles per Rs. 100 for the first Rs. 500,000 of airline transactions. Earlier, the Terms & Conditions did not explicitly make the Premiermiles.co.in website spend a part of this limit. However, seems like the T&C were reworded recently, and now, the limit is clubbed within the same limit. Have a look:

So, while I personally don’t like this new update, where I get only Rs. 500K worth of tickets with 10 PM/ Rs. 100, I’m going to live with it for the time being because I don’t think I book more than that amount on my personal card in a year as of now. Most of my domestic reservations happen on this card, and then some international flights too. Some other tickets booked by Corporate for my travel, are clearly not going on personal card.

Promotions

Next up, new promotions. Actually, something I already told you about in an old post but more emphasis. Citibank has a promotional tie-up on Flipkart.com and Infibeam.com.

- Flipkart.com customers are getting 10 PremierMiles per Rs. 100 spent till November 30, 2012 for ordering on their website.

- Infibeam.com customers also get 10 PremierMiles per Rs. 100 spent on specific categories, right through May 31, 2013. You need to select the Citibank Offers page to be able to get the miles though, so take note of that before you buy. The entire list of products [PDF] can be accessed here.

Now, while we are at it, you must tell me how many Premier Miles have you earned so far with this card and where are you planning to go with ‘em? Me, I’ve crossed a 100,000 PM since I got the card last December, and still going strong.

Related Posts:

- Sunday Plastic: The ‘new’ Citibank Premier Miles Credit Card

- Citibank PremierMiles Card: more changes!

- Hang on, do not use your Citi PremierMiles for Jet Airways redemptions

- New partners on the Citibank PremierMiles card and 1 week to convert from Jet Airways CC

- Citibank Premier Miles Card changes and special promo on international spends

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

I have been using it for a little more than a month now…I currently have 13k points…

@AJ I have an existing relationship with Citi and they are processing the application internally. But I am pretty certain if it were a new application, it would get dinged.

@AJ – Try applying for the card online, as soon as you mention your profession as “Self employed”, no matter what income you report, they simply redirect you to a “Thank you page” with following message – “We regret to inform you that we will not be able to process your request as the details provided do not meet our internal criteria. We apologize for the inconvenience this may have caused but would like to thank you for considering Citibank.” If I choose “Salaried” as the profession (rest all details same), the system allows me to proceed further.

@Manish, this is surprising, since I have in the past met a lot of people who are professionals and/or self employed and hold the card. Would you please try calling Citibank or walk into a branch to fill up a form?

Just noticed that the card is now available to Salaried persons only. Self employed and professionals do not come qualify for this card irrespective of your reported monthly/annual income.

@Manish, that is not correct as per information I have. where do you notice this information?

I have about 80k points on this card here in Singapore. Saving them for one those long flights (probably to US), so will keep on saving till I need to use it.