Amongst the pandemic and the moratorium Banks had to offer to their customers, Risk management departments were on high alert as well to protect the interests of the banks. After all, Credit Cards are unsecured loans, and there is nothing stopping people from using more credit during a time when earnings might have dried up.

I’ve heard a few discussions between banks and their customers over the months, and some banks routinely call customers when they flag high-value transactions which might not be of personal nature but incurred on a personal credit card. However, nothing to worry on most counts.

However, recently, there were some actions from HDFC Bank Credit Cards, which might have bothered many users, so I thought it would be deserving of a post of its own. I took some time to dig into this and get some data points. The Bank has always had the same systems and approach. However, they seem to have lowered their tolerance to spend levels as a result of which more people are facing these situations at the moment.

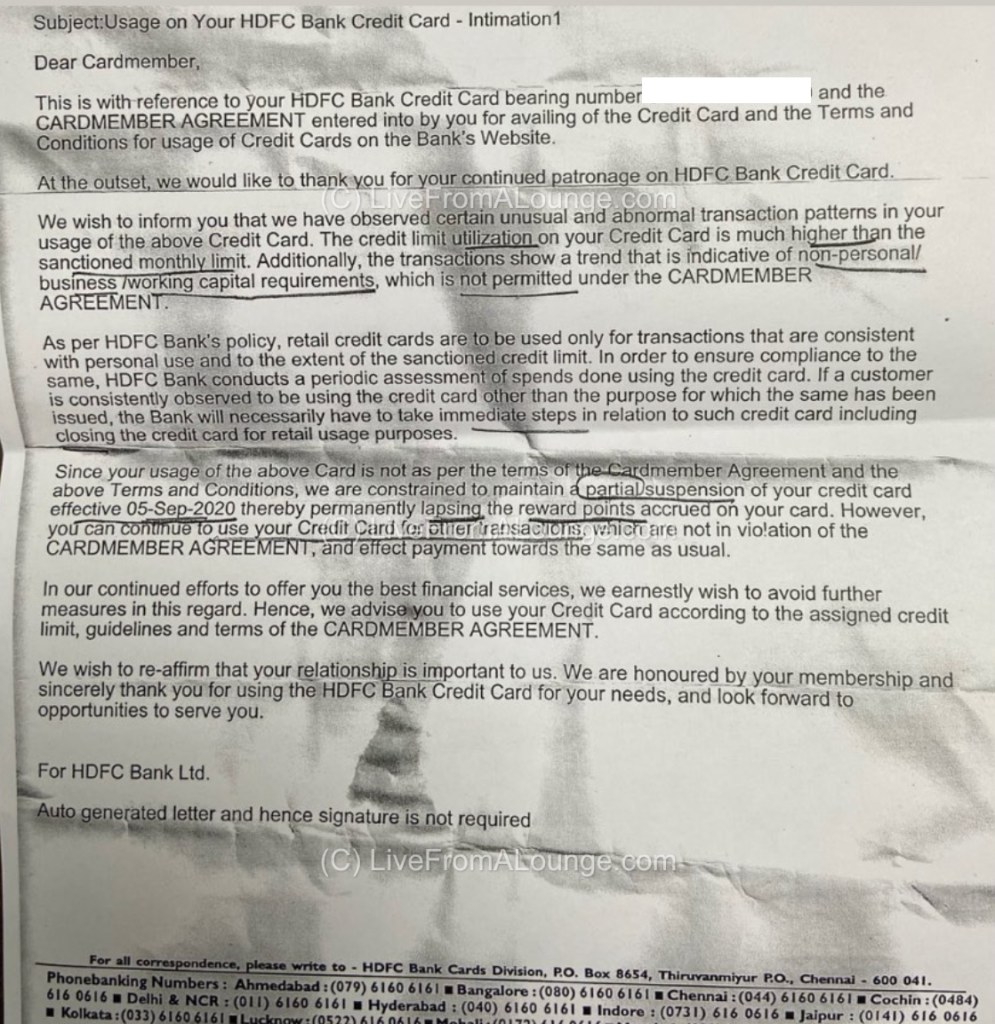

In September 2020, HDFC Bank has sent out automated letters to some customers, flagging them for business spends on personal credit cards, and debit all their reward points. The bank claims that these cardmembers were using more credit than was originally sanctioned to them (by making payments and rereleasing the limit) and also these transactions were being flagged off as of a non-personal nature. Here is a copy of the communication received by one of our regular readers.

I’ve heard from readers about points anywhere between 100K – 300K being debited from their accounts on the back of these transactions. The Bank has not debited points against certain transactions, but all the remaining points in the customer’s accounts at the moment.

But there is not all bad news. HDFC Bank is open to listening to reason and is also restoring points. For instance, in the case of this letter, the reader held an HDFC Bank Diners Club Black Credit Card and was penalised for making payments for his immediate family members using his credit card, which I believe fully comes under the purview of retail. I am not disclosing the exact nature of the spend so that the privacy of the member is protected. He wrote an email to the bank at the credit card customer care address, in this case to customerservices.cards@hdfcbank.com, explained the situation, and the bank has returned his points.

There is no one to say when this situation could impact anyone or any transactions on your spends could be flagged. Banks usually vet transactions which may be flagged, and if in your case you get into such a situation, you should reach out to the bank and raise a formal complaint to return your points to you. Not just that, please feel free to explain to them your situation and spends.

Have you been in this situation recently? Do share your experiences with us.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

This really sounds crazy. Especially when they can void all the points accumulated. Best I guess is to move them as quickly as possible to other buckets !

Faced a similar problem with Ci ti on high value usage since March 2020.

Use other card instead nowdays.

I have had a similar experience last year. I regularly travel abroad and my hotel bills would run into lakhs and so would my premium flight tickets especially when purchased for my family. I had also made good use of 10x and other rewward programmes and had accumulated over 6 lakh points. They voided all points in July 2019 saying my expenses were not retail. I provided them with all proof that they were retail in nature but unfortunately they never got back despite a few reminders and I lost 6 lakh points.

Did you try all levels of escalation? till nodal officer?

There are 4 levels where you can give a complaint.

HDFC is the most used credit card by Indians and also the worst when it comes to credit card rewards programme. I had been a HDFC card holder previously Infact my first cc was from HDFC, I always had issues with bonus rewards special mention 10x programme which was run back then. I have Switched to citi and Amex about 2 years ago and I never faced issues with rewards points with citi and Amex. Even my colleague who had a HDFC diners cc have been facing similar issues.

Same here, even escalated to nodal officer. Nothing except false commitments of calling back which never happens.