Ever since American Express announced a promotion for 50% more Marriott points, I have been flooded with questions about the American Express Platinum Charge Card for a couple of days now, more specifically, is this the right time?

Let me first quickly walk you through the American Express Platinum Charge Card in India. The offering is pretty simple and pretty good, so to say:

- You get 100,000 Membership Rewards on sign-up directly via the American Express website (or INR 40,000 worth of vouchers). However, when you sign up via our link, you get 110,000 Membership Rewards points (You need to spend INR 25,000 in the first 60 days to get the 100,000 points. Also, on spending INR 10,000 you get the 10,000 bonus).

- You get elite memberships to all of the following hotel chains:

- Marriott Hotels (Gold) [Room upgrades, points bonuses, late checkout]

- Hilton Hotels (Gold) [Lounge Access, 5th night free on redemptions, upgrades, complimentary breakfast]

- Radisson Hotels (Gold)

- Shangri-La (Jade) [Helps you get Star Alliance Gold in 3 flights with Singapore Airlines, apart from matching with Taj Gold]

- Priority Pass Membership for two for unlimited Lounge Access

- Access to American Express Centurion Lounges across the globe, including in Delhi & Mumbai

- Access to Golf Courses

- Special deals on tickets. For instance, right now you can get an upgrade to Etihad First Class if you book Etihad Business Class to Europe/USA with American Express Platinum Travel Desk.

- Every INR 40 spent gets you one Membership Rewards point, and on overseas spend you get three times the points.

- The card comes to you in a metallic form factor now, and American Express is the only card issuer in India to go this way for now.

American Express Lounge Mumbai Terminal 2 Entrance

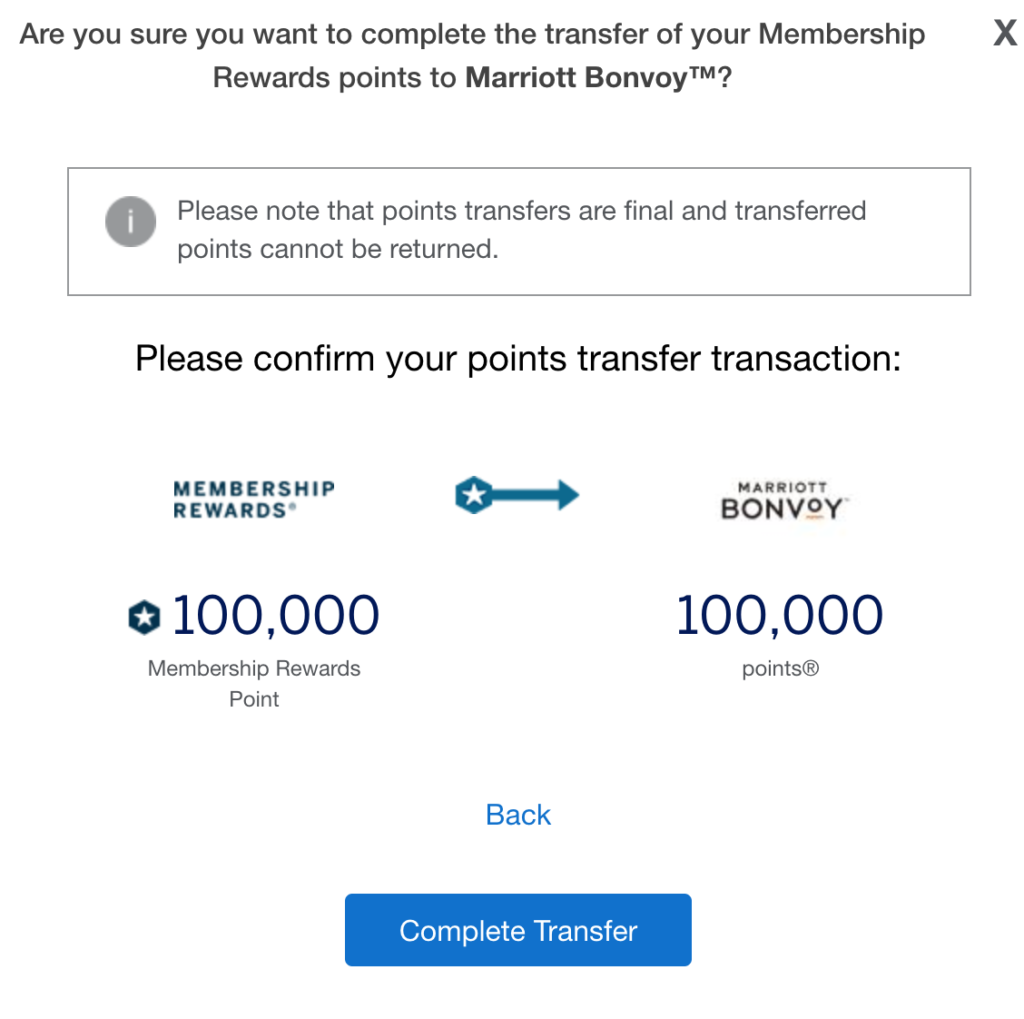

The apparent draw for American Express Platinum Charge Card are the rewards that you get for signing up. Like I mentioned ahead, Amex is offering 110,000 Membership Rewards points on signing up for the card and making a small minimum spend on it. Each Membership Rewards point transfers 1:1 to Marriott Bonvoy on an average day.

But for the next forty days or so, any transfer gets you 1.5 Marriott Bonvoy points for one Membership Rewards point transferred. Which means, even when you take the 110,000 points welcome points, you get 1,65,000 Marriott Bonvoy points. Earlier, I’d said that the Platinum Card is akin to buying Marriott points at INR 0.56. Now, this means, you are buying Marriott points for INR 0.37 now.

I’ve written extensively about how Membership Rewards can be used as Marriott points. When used right, you can get at least the value of the fees back, but with this bonus, you can smash it out of the park.

For instance, if you just wanted to use it for business travel across India and are okay with the entry-level Marriott Hotels, you can get 22 nights at category One Marriott Hotels, which would usually go for INR 4500 to INR 5,000 a night ex-taxes. These would be the Fairfield, Four Points, Aloft kind of hotels, and you stand to make about INR 123,200 on the value of these points on your business stays.

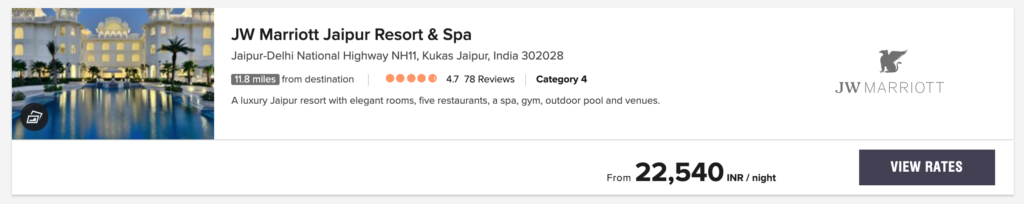

Or let’s say you want to go for a luxury trip with your family in one of the luxurious Marriott hotels in India. Let’s say the JW Marriott Jaipur Resort & Spa, which usually retails at INR 15,000 plus taxes per night. You stand to get six room nights there (make two trips or get the kids another room!) and you are getting at least INR 106,000 value out of these points, and will still have some left for another trip.

There are many other permutations and combinations as well, but the point is, with 165,000 Marriott Rewards points, you can make quite some holidays or work trips with more to save. And as you add supplementary cardmembers, you will get about another 20,000 points for adding these cardmembers.

And let’s not forget, Marriott Bonvoy offers the ability to transfer points to 40 different airlines at 3 Marriott Bonvoy Points to 1 Airline Mile. Every 60,000 Bonvoy points you convert into 20,000 Miles, you get 5,000 bonus miles as well.

- AEGEAN Miles+Bonus

- Aeroflot Bonus

- Aeromexico ClubPremier

- Air Canada Aeroplan

- Air China PhoenixMiles

- Air France-KLM Flying Blue

- Air New Zealand Airpoints

- Alaska Airlines Mileage Plan

- Alitalia MilleMiglia

- American Airlines AAdvantage

- ANA Mileage Club

- Asiana Airlines Asiana Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- China Eastern Airlines Eastern Miles

- China Southern Airlines Sky Pearl Club

- Copa Airlines ConnectMiles

- Delta SkyMiles

- Emirates Skywards

- Etihad Guest

- FRONTIER Miles

- Hainan Airlines Fortune Wings Club

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- Japan Airlines JAL Mileage Bank

- JetPrivilege

- JetBlue TrueBlue

- Korean Air SKYPASS

- LATAM Airlines LATAM Pass

- Multiplus Fidelidade

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- SAA Voyager

- Saudia Alfursan

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- TAP Air Portugal Miles&Go

- Thai Airways Royal Orchid Plus

- Turkish Airlines Miles&Smiles

- United MileagePlus

- Virgin Atlantic Flying Club

- Virgin Australia Velocity Frequent Flyer

So, if you are getting 165,000 Marriott Bonvoy points, you are getting 50,000 airmiles (transfer 120,000 Marriott points to get 40,000 points with 2x 5,000 bonuses) and will have 45,000 Bonvoy points left for another day.

Plus, if you sign up now, your card should be with you in the next 10-15 days, in good time for the Diwali offers which Amex almost always announces. And American Express is making a lot of offers for promoting categories as well, such as education, insurance and so on. As for the points, they come in very quickly after you complete the minimum spends.

What are your thoughts about signing up for the American Express Platinum Card if you have been on the fence so far?

Support LiveFromALounge in making more quality content for you.

How would you rank Amex plat vs Citi Prestige? Currently hold a prestige and am thinking of applying for the Amex plat.

In my experience, Citi Prestige has much better customer care and much better concierge service.

The rest of the benefits are available on the website.

What about purely from a point earning perspective as an every day card? Prestige was useful in making Insurance payments for point earning but with that withdrawn the value for me is much less.

@Ajay I’m hoping to pull the trigger in hopes that I can move points over to Marriott during this bonus period.

Question – would it matter if Marriott account is registered in the states? (I recently moved back to India)

Hi Ajay, I have joined Amex Platinum couple of months using your link and found it very good for my travel.

I work as a Consultant in Big 4 where international travel is part and parcel of my job description. I was wondering how does Charge card billing happen? If I charge the corporate travel to the Plat card, i can easily justify the membership fee for the benefits I will receive. The main concern is the payment processing time for my firm on expense submission. I believe Charge card payments have to be settled each month but would like to know how exactly it happens?

Does a bill get generated and we settle immediately or we track the expenses charged on the card and settle it immediately within the month?

@Alex J. You spend -> Monthly statement of Charge Card gets generated -> You get about 15/20 days to pay. You can’t carry forward the expenses like in a Credit Card. The Due Date is the last date to settle in full. Makes sense?

Thanks Ajay.

@ Ameya, The CC policy is very flexible. We can use personal cards for hotels and ground transport but airlines – it is the corp amex only.

Hey Alex J,

I too was in a Consulting role in a Big 4 and we were given Amex Corporate cards by the employer. All our bookings/payments went thru only that and we couldn’t earn the points.

Hope you check the policy.

With the way they are signing up folks for the plat charge I sincerely hope that the concierge and service improves. It is no better than the prestige helpline at a much higher premium. Also the benefit to fee ratio is far better internationally (like in the US) so I always wonder what’s stopping them from sweetening the deal here. The FHR is definitely a big plus on the card.

Ccgeek, interesting observations. On the contrary I have observed citi prestige concierge to respond much faster and do much better work compared to the Amex platinum. I’ve had to wait for days and even a week for amex to even respond to my concierge emails.

Ajay,

is there an expiry date for redeeming the Marriott Bonvoy Points?

I guess including the still high GST rate on 60k annual fee makes the cost INR 0.41 per Marriott point.

@Kumar, yes. But even then it is a steal.

I got it for 40k “Under offer” and then also got the Reserve but with a crazy limit of 2.5Lac.

That’s right >50 ITR and 790+ Cibil gets you 2.5Lac in AMEX world.

Hi Ajay,

I believe this is applicable only for the first year. If I find it difficult to justify the annual fee for the next year onwards and end up discontinuing the card next year, do you know if I can get it again in a later year, say a couple of years later?

What are the renewal benefits?

@Toshi yes you can.

Ajay,

What is the usual timeline on upgrade request -> card -> points in account?

Want to make sure there’s enough time to get stuff in place

My Amex rep said the card upgrade would be processed in 24-48h and the bonus points will hit my account within 48 hours of spending INR 25k on the card.

@Anish you are all set for Centurion. Plat is just the stepping stone 😀

Hahaha don’t think I can ever justify the 2L fee 🙂

Hi Ajay,

Is it possible for you to have an article of the centurion in India? I have seen quite a few from the US. Personally it’s I am quite young to have either but I believe it will be an exciting read.

Just pulled the trigger, I received a targeted offer for 125k MR points which should convert to 187.5k Marriott points.

I have a targeted offer on my plat travel. Only thing that is keeping me back is, currently I am approx 1l short of travel card milestone benefits of approx 20k.

Unsure about what to do

Same here. I was on the fence even with the targeted 125k MR points offer. But the 50% bonus made the decision a no brainer, even with the tight timeline.

Great

Is that only for targetted customers ?

From which card upgrade ?

Thanks

How do you get a targeted offer?

can you check on their website for one?

Upgrade from Jet Amex

Did you get all 125k MR? I got 1 Lakh and saying bonus of 25K will arrive after 90 days after the offer end date of 30th September. Said the same for 20,000 bonus offer for add on cards. So that means I can transfer only 1 Lak to Marriott with 50% offer, can’t do for the 45000 points.