There are credit cards, and then there are credit cards. Over the past seven years, I’ve seen almost all of them and used all the good ones to earn miles and more miles. I thought over the Diwali vacations; I’d pen down my thoughts about some of the best airline credit cards India has in 2018.

There are only three domestic airlines in India, so naturally, the ambit of this discussion goes about all the three of these. Of these, Vistara has a co-branded credit card tie-up with Axis Bank, Jet Airways’ JetPrivilege has a co-branded credit card tie-up with HDFC Bank, ICICI Bank, IndusInd Bank and American Express. Air India has a co-branded credit card tie-up with SBI Card.

Keeping this context, let us look at the best airline co-branded credit cards in India. You will notice they are all the premium card variants.

1. Axis Vistara Infinite Credit Card

Axis Bank launched the Axis Bank Vistara co-branded credit cards in 2016. I got mine as quickly as I could. The cards come in 3 variants, and I got the top-end one. The Axis Vistara Infinite Credit Card gets you up to 4 Business Class tickets for spending INR 7.5 Lakhs in a year, the first one coming in for sign-up or renewal of the card every year. You also get Gold Status on Vistara for as long as you hold the card. The card costs INR 10,000 + GST per annum.

You get 6 CV points for every INR 200 spent, however, no points multiplier for booking Vistara tickets on this card at the moment. Also, I do find customer care to be a bit iffy, which should not be the case for a card of this stature. Overall, from a rewards maximisation perspective, however, this is a great card.

Here is a complete review. Apply Now.

2. HDFC Diners Jet Privilege Credit Card

HDFC Bank & JetPrivilege have been working together for a long time, and their last co-branded product launched is indeed their most rewarding. The HDFC Diners JetPrivilege credit card gets you 15 tier points for sign up, 5 tier points every year for renewal. Also, you get one tier point for every INR 1.5 lakh spends. Not just that, you get 24 JPMiles/INR 150 spend on Jet Airways website or app.

The card costs INR 10,000 plus GST for the first year (INR 5,000 plus GST after) and you get 15,000 JPMiles for signup + 15,000 JPMiles on milestone spends. Also, unlimited lounge access on the Diners Club network of over 800 lounges. In the country, with the vast HDFC Bank and Rupay terminals network, it is very well accepted not. The downside, being a Diners Club product, it is not as well recognized outside the country.

Here is a complete review. Apply Now.

3. ICICI Jet Airways Sapphiro Credit Card

The Jet Airways ICICI Bank Sapphiro Credit Card is one of my favourite cards for various reasons. Firstly, this card is available as an Amex & Visa combination. So you can use the Visa card where the Amex variant does not come through for you. Secondly, the card comes with a free ticket on Jet Airways. The USP of this card is also the Dragon Pass that gets you Airport Spa access and the Free movie tickets on BookMyShow.

Jet Airways ICICI Bank Sapphiro Credit Card

The Jet Airways ICICI Bank Sapphiro Credit Card comes in for INR 5,000 + GST, and free for JP Platinum customers. It gets you 5 – 7 JPMiles/INR 100 for everyday spend. The card has undergone many changes over the years, but it is still a solid mid-end proposition.Read a full review here. Apply Here.

4. Amex Jet Airways Platinum Credit Card

The American Express Jet Airways Platinum Credit Card gets you 8 JPMiles/INR 150 spend on normal charges and double on spends on Jet Airways website. You also get complimentary access to twelve lounges, a signup bonus of 10,000 JPMiles and one Jet Airways ticket. But the best part of this card is access to the American Express Lounge in Delhi, and hopefully, also the soon to open American Express Lounge in Mumbai Airport.

The card costs INR 5,000 for the first year and INR 10,000 after the first year. As a JP Platinum, you’ll also get it free. Apply here to get bonus JPMiles on your application.

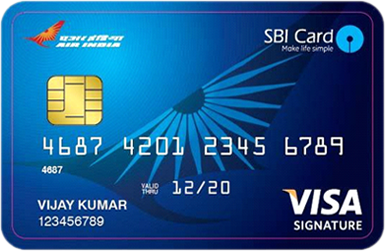

5. SBI Air India Signature Card

This was the most generous card in the market when it came out, but then it fell from its glory and down and now isn’t as high anymore. But this is the best you can get for being a supporter of Air India, and if you use the card for yourself, you would still have a great earning with this card.

Air India gets you 30 miles/INR 100 for spending on Air India tickets for your travel, and 10 miles/INR 100 for everyone else’ tickets. They give you 20,000 Air India miles for sign up and another 100K miles towards milestone bonuses as you go along to spending INR 10 Lakhs on this card. The card costs INR 4,999 + GST per annum.

You can use your Air India miles towards Air India flights as well as Star Alliance redemptions now that the redemptions are online. Here is a review of what we made out of my Air India miles on Air India Business Class to London. Apply Now.

These are my top 5 airline co-branded credit card picks. Between Shipra and myself, we hold all these cards except one which I held for the longest time, so these are not just hear-say reviews.

I’m curious to hear what are your best picks for airline co-brand credit cards? Which ones of these are on your wishlist?

Can i use vistara miles to book award ticket on singapore airlines? Or vistara miles currently is only valid for vistara flight bookings?

@Ravish you can use vistara miles to book award tickets on SQ. But the award chart is not fantastic.

Good review. I have tried almost all the cards including both variants of Indusind jet that is Visa and Amex.

As there is no renewal benefit in Air India SBI, I have not renewed it. Their service is also horrible no statements et cetera and poor customer care.

Ajay, what about Axis Bank with Miles and more. I guess it’s the only card which gives lounge access out of India. Benefits wise it’s same as Vistara infinite except no Gold status on Lufthansa.

Ajay, are you sure that Vistara gold status will continue as long as we hold this infinite card? means gold status also will also get renewed along with the renewal of the card?

I’m curious about this as well? Since my card just got renewed but the Gold status didn’t and I’m down to Silver.

Yes

Mine got downgraded to Silver as well. Then I contacted the customer care at Axis and it was restored.

ok. I’ve contacted Vistara through and they informed me that Gold status will get automatically continued.

When I contacted the customer care to clarify this, I was told that it would be downgraded unless I accumulate required miles and flights to maintkna the gold status.

ohh… so some confusion is there. Ajay will be in a good position to clarify this.

I have the HDFC diners black and have had a lot of issues with acceptance in India as well as outside. Just recently I couldn’t use it on the emirates website to book tickets and had to book the same on makemytrip. The hotel in Dubai didn’t accept it either and only one store in the mall out 3 I tried it in accepted it.

Diners are catching up fast on their network acceptance..I am bit surprised why did not you try booking through SmartBuy HDFC and rather opted for MMT. Black card could have earned you 10X reward points on the emirates ticket, and it’s most unique and awesome reward programme where 1 Reward point = Rs 1 could have earned you Rs 25,000 worth of reward points from a single transaction.

I have been using Diners Black from past few years and enjoying it a lot…no comparison with any of the listed cards in the article.