[Changes to the card are coming on April 20, 2024]

I signed up for and got approved for the Axis Bank Atlas Credit Card in February 2023. Since then, I’ve used the card for all sorts of expenses, including travel, and the card is now one of my daily driver credit cards. Here is my review of the Axis Bank Atlas Credit Card.

The Axis Bank Atlas Credit Card is not very old, launched in February 2022, as people started to travel again. It is also not the first travel-focussed credit card in the Axis Bank portfolio, with the bank having co-brands with Miles & More and Club Vistara. By acquiring Citi’s Retail Assets, they already have Citi PremierMiles. But Atlas is an attractive airline-agnostic credit card from the portfolio of Axis Bank, regardless.

Axis Bank Atlas Credit Card Overview

Axis Bank’s Atlas Credit Card targets those who travel a lot or want to accumulate travel currencies. The card does not come with lifestyle benefits but rather laser-focused on travel perks. Atlas is also Axis Bank’s first gamified credit card, where the bank went away from its usual benefits package to enhance it for those who do a lot of business with the Bank via this card. The card enhances its benefits on clearing certain spending milestones every membership year, apart from granting bonus points. This allows the card to become just a generic travel credit card for some, while it becomes a super-premium card for those who spend a lot on it.

Axis Bank Atlas Credit Card Eligibility and Application

The Axis Bank Atlas Credit Card can be applied online/offline. Eligibility for the card is at an annual income level of INR 9 Lakh for salaried and INR 12 Lakh for self-employed folks. You can also apply for it on a card-to-card basis. The card is available to customers already holding a Banking Relationship with Axis Bank and those new to the Bank. To get started on your application, Apply Here.

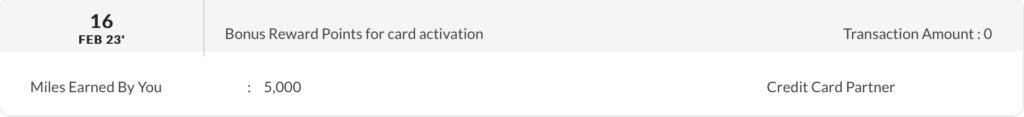

Axis Bank Atlas Joining Benefits

Atlas has a modest joining fee of INR 5,000 + GST (net INR 5,900). In exchange, the Bank provides 5,000 EDGE Miles into your Rewards Account when you make one transaction within 30 days of card setup. These Miles will be credited to your account within seven days from the transaction’s date.

Atlas has a different reward currency than the other Axis Bank offerings, EDGE Miles. Each EDGE Mile has an INR 1 value (unlike the INR 0.2 value of the EDGE Rewards), and it can also be transferred to all the airline and hotel transfer partners of the EDGE Rewards programme.

Atlas Credit Card Points Earning

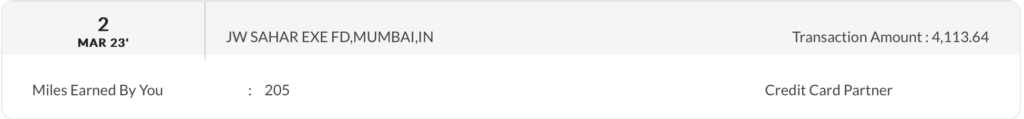

Atlas provides 2 EDGE Miles/INR 100 spent on the card for all online/offline transactions. For instance, if you spend INR 1330 at an eatery, you should expect to earn 26 EDGE Miles in your account. Points are usually credited weekly, but the T&C states they can take up to 12 days. You can check the points earned using your customer ID with the bank here. Compared to other Axis Bank credit cards, the points you earn are in multiples of INR 100, so you don’t lose points, for instance, on INR 300 or INR 100 and so on.

However, being a travel credit card, Atlas rewards more points when you spend at Airlines and Hotels. If you spend directly with an airline or at a hotel, you get 5 EDGE Miles/INR 100 spent. Direct airline spending refers to purchases made on the airline’s websites, counters, and helplines. Direct hotel spending relates to purchases made at hotel websites and counters (for instance, at check-out or the restaurant). You also get 5 EDGE Miles/INR 100 spent when booking hotels and air tickets via TravelEDGE, Axis Bank’s travel bookings portal.

Bookings made through any travel agents, including but not limited to any private travel agents, corporate travel agents, online travel agencies or their websites/IVR systems, are eligible for only 2 EDGE Miles for every INR 100 spent.

Remember, Axis Atlas does not grant EDGE Miles for transactions over INR 5,000, which means the maximum points you earn for insurance are 100 per transaction. However, insurance transactions will count towards the milestone on Atlas.

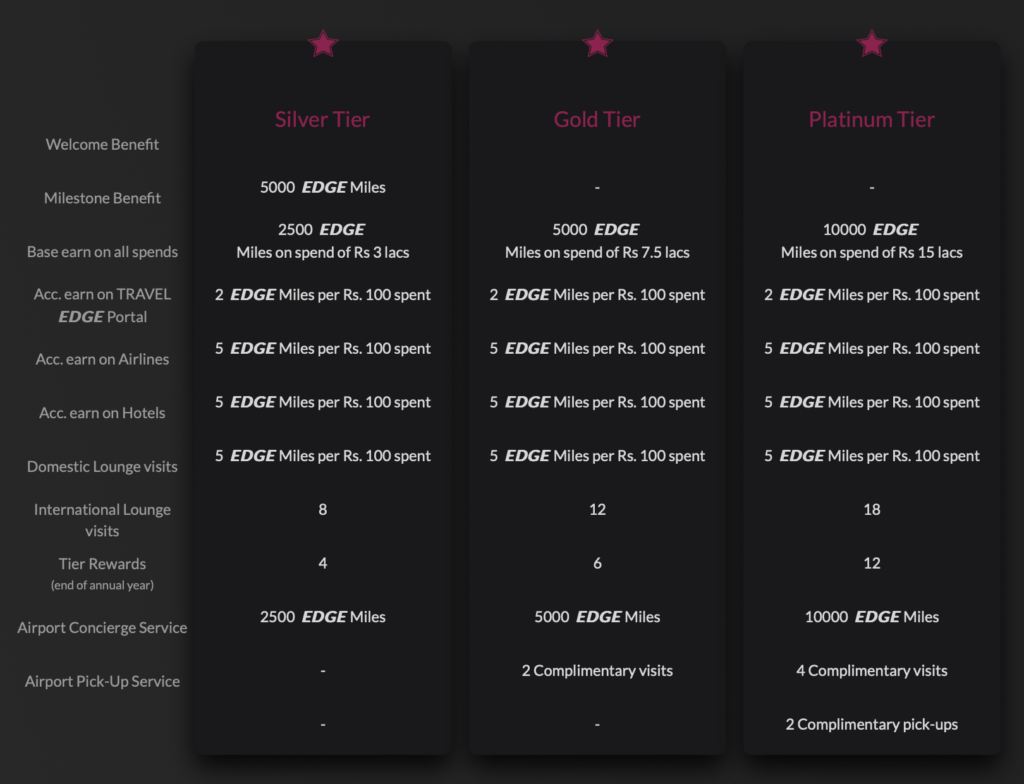

Axis Bank Atlas Credit Card Tiers

Axis Bank provides three “milestones” to achieve every year on the Atlas Credit Card, which changes the rewards paradigm for you, depending on how much money you spend within a calendar year on the card. These milestones also determine the perks you earn on the card, and once you qualify for a tier, you hold it during the following membership year (unless you get further upgraded)

- Silver: This is the first tier on the Axis Bank ATLAS journey, and everyone, once enrolled for the card, starts at the Base and achieves Silver by spending INR 3,00,000 within the membership year. You are credited 2,500 bonus EDGE Miles within 60 days when you enter the Silver Tier.

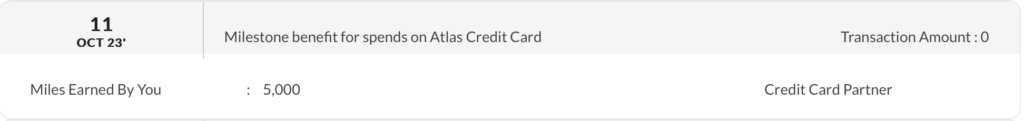

- Gold: This is the middle tier on the Axis Bank ATLAS journey, and you achieve the Gold Tier by spending INR 7,50,000 within the membership year. You are credited 5,000 bonus EDGE Miles within 60 days when you enter the Gold Tier.

- Platinum: This is the highest tier on the Axis Bank ATLAS journey, and you achieve the Platinum Tier by spending INR 15,00,000 within the membership year. When you enter the Platinum Tier, you are credited 10,000 bonus EDGE Miles within 60 days.

So, if you just spent on your daily spending every year and surpassed the INR 15 Lakh annual milestone, you would get 30,000 EDGE Miles, plus a 17,500 EDGE Miles bonus (2,500 + 5,000 + 10,000 for clearing the three tiers). That makes it 47,500 EDGE Miles or 95,000 airmiles/hotel points within 12 months. However, you have to know that the bonus points for each tier take up to 60 days to turn up, so while it can be frustrating, and you can drop emails to Axis Bank, the EDGE Miles will turn up when they have to.

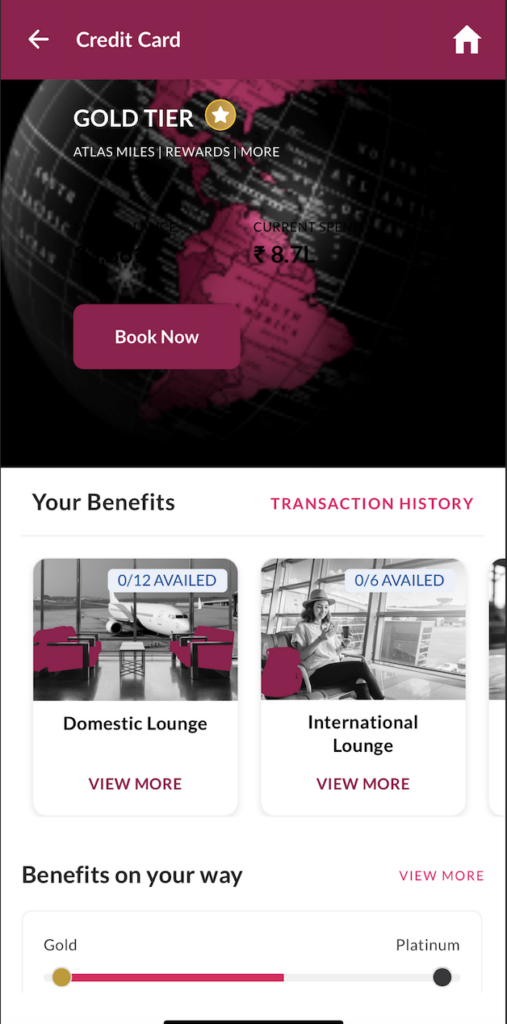

You can see your Milestones in the Axis Bank App by entering the Atlas Credit Card journey. The spending needed towards the next milestone is also shown there. The spending threshold for Milestone benefits excludes rent and wallet transactions.

The tiers determine how many EDGE Miles you would get on renewing your Atlas Card. Depending on your membership tier, the following EDGE Miles will be credited to your account after the realisation of your fee:

- Silver: 2,500 EDGE Miles

- Gold: 5,000 EDGE Miles

- Platinum: 10,000 EDGE Miles

If the cardholder doesn’t achieve the tier threshold in the next anniversary year, the existing tier gets downgraded at the end of the following year. So, you get to keep your status for at least a year.

Axis Bank Atlas Credit Card points burning.

You can use your Axis Bank Atlas Credit Card EDGE Miles for many use cases. The most basic one, offered for a long time, was to use them at a value of INR 1 per EDGE Mile for redemptions on air tickets.

But Axis Bank has added 20 transfer partners over the past year or so, and here is a list of the transfer partners along with the transfer ratios:

- Independent

- AirAsia Rewards: 1 EDGE Mile transfer to 2 AirAsia Rewards

- Club Vistara: 1 EDGE Mile transfer to 2 Club Vistara Points

- Etihad Guest: 1 EDGE Mile transfer to 2 Etihad Guest Miles

- SpiceClub: 1 EDGE Mile transfer to 2 SpiceClub Points

- Star Alliance

- Ethiopian Airlines ShebaMiles: 1 EDGE Mile transfer to 2 ShebaMiles

- Singapore Airlines KrisFlyer: 1 EDGE Mile transfer to 2 KrisFlyer Miles

- United Mileage Plus: 1 EDGE Mile transfer to 2 MileagePlus Miles

- Turkish Airlines Miles & Smiles: 1 EDGE Mile transfer to 2 Miles & Smiles Miles

- Air Canada’s Aeroplan: 1 EDGE Mile transfer to 2 Miles

- Thai Airways Royal Orchid Plus: 1 EDGE Mile transfer to 2 Miles

- Air India Flying Returns: 1 EDGE Mile transfer to 2 Flying Returns Points

- oneworld Alliance

- Qatar Airways: 1 EDGE Mile transfer to 2 Avios

- Japan Airlines JAL Mileage Bank: 1 EDGE Mile transfer to 2 Miles

- Qantas Frequent Flyer: 1 EDGE Mile transfer to 2 Miles

- SkyTeam Alliance

- AirFrance KLM Flying Blue: 1 EDGE Mile transfer to 2 FlyingBlue Miles

- Hotel Networks

- IHG One Rewards: 1 EDGE Mile transfer to 2 IHG One Rewards

- Club ITC: 1 EDGE Mile transfer to 2 ClubITC points

- Marriott Bonvoy: 2 EDGE Miles transfer to 1 Marriott Bonvoy Point

- Accor ALL: 1 EDGE Mile transfer to 2 ALL Points

- Wyndham Rewards: 1 EDGE Mile transfer to 2 Wyndham Rewards Points

As you can see, Axis Bank has covered all alliances, domestic carriers and international hotel chains with a pretty lucrative transfer ratio, which makes it possible for Atlas to keep happy those who like to use miles and points to make their life comfortable as well. Some of these programmes have an instant transfer. At the same time, the rest could take up to 10 working days for transfer.

While most transfers happen at a 1:2 ratio, the Marriott Bonvoy conversion at 2:1 beats me, but I’m sure there is some pricing logic as to how they price the points they buy from Marriott behind it.

Axis Bank Atlas Credit Card Lounge Access Benefits

While the Axis Bank Atlas Credit Card intends to have you spend across the board, the niche it specialises in is Travel. The Bank provides the primary cardholder with a quota of lounge access, which they can utilise throughout the year, and this limit goes up depending on the tier you are in.

- Silver: 8 Domestic and 4 International Lounge Visits

- Gold: 12 Domestic and 6 International Lounge Visits

- Platinum: 18 Domestic and 12 International Lounge Visits

The lounge trips are counted and maintained through the in-app functionality of the card, and unlike the rest of the cards where you swipe the card for authentication, here, you can generate a QR code to present the lounge reception. Also, once you have an active QR code, you can use it for yourself or anyone else travelling with you. So, you could guest three people into the lounge in one go, for instance, against using 4 of your lounge trips. Twenty-nine lounges across India are enabled for lounge access via this programme, and you can check the list here.

Since the lounge programme for Atlas is powered by Dreamfolks, you need to be very certain to use a specific lounge before generating the QR code. For instance, if you are at Mumbai Airport, you can pick up the Oasis Lounge and the TFS Travel Club at Terminal 1, but both are at different secure ends of the terminal. So, you need to be certain about using the right lounge to generate the code. Once generated, the code is valid for 48 hours. Or, for domestic trips, you could swipe your way in with the INR 2 authentication. For international trips, though, you must book your visit via the QR code generator in the app to access the lounge.

Axis Bank Atlas Credit Card Meet & Assist Benefits

Besides lounge access, Axis Bank’s Atlas offers two complimentary meet-and-greet services across Indian airports for Gold Tier members and 4 for Platinum Tier members. You can use this meet-and-greet service for Arrival or Departure at 29 Indian airports. The service needs to be booked at least 48 hours before departure online. You can also bring co-passengers, although you need to declare it upfront, and it gets deducted from your quota of services per annum. Again, you’ll need to request your Meet and greet through the app, usually about 48 hours prior.

Delhi Meet-and-Greet by Encalm Hospitality

Axis Bank Atlas Credit Card Airport Pickup Benefits

One of the Atlas benefits, where the card goes into Reserve territory, is Airport pickup service. Once you’ve spent INR 15 Lakh on the card and been qualified as a Platinum Tier member, you will be granted two airport pickup services, which can be used in select cities across India. In cities such as Delhi and Mumbai, you should expect luxury cars; in other cities, you might get an Innova. The chauffeur usually will turn up about 30 minutes before the time that has been made on the booking. Again, you’ll need to request your Airport pickup through the app, usually about 48 hours prior.

Here is a recap of all Axis Bank Atlas Credit Card Benefits. Be careful to read it with the alignment being off (on the Axis Bank website, and hence this screen grab).

Other lifestyle benefits offered by Atlas

Axis Bank tied up with EazyDiner, where you can get up to 25% discount (up to INR 800) on your meals twice a month.

Exclusions and drawbacks

Fuel pump spends are not granted reward points on the Atlas. However, they are instead given a 1% rebate on the fuel surcharge. They still count for the milestone spending monthly and annually as well. Rent transactions have been excluded from milestone coverage effective March 5, 2023, although, up to INR 50,000, they continue to earn rewards. Forex Charges are at 3.5%+GST.

Additionally, given that the Atlas rewards you in EDGE Miles and not EDGE Rewards, you don’t get accelerated rewards for spending on other Axis Bank properties such as GrabDeals or GiftEDGE. There is also no possibility (published at least) to get a fee waiver on this card.

Bottomline

Overall, the Axis Bank Atlas Credit Card, with its very lucrative rewards structure, is an excellent card for those who routinely spend on travel, or even if they don’t. Not only is it not marketed as an HNI credit card, but it has also been very stable compared to some of the other changes in the Axis Bank Credit Cards universe over 2023. The card comes without the pressure of spending INR 1 Lakh per month on it every month, and you can spend INR 20,000 in a month and INR 4 Lakh in the next month, with your spending counting towards the next milestone.

You get 2 EDGE Miles/INR 100 spent, apart from the potential of earning 17,500 Bonus points just by spending INR 15 Lakhs on the card in a year. Add that up with the handsome list of transfer partners, and you have a card grabbing all the right eyeballs these days. You also get lounge trips and meet-and-greet services.

Do you already hold the Axis Bank Atlas Credit Card? What has been your experience with the card?

Apply Here for the Axis Bank Atlas Credit Card

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

@AA, International spends get 2X miles after achieving Platinum tier, is that correct?

@Kushal, I’m waiting to find out myself. Back in the day, this language was included, but not anymore, I believe. And you know how Axis customer care is.

Thank you, do update if you happen to find out, I am also trying to get it in writing..but its AXIS 🙂

Remember, Axis Atlas does not grant EDGE Miles for transactions over INR 5,000, which means the maximum points you earn for insurance are 100 per transaction.

Does this mean the point capping is only on Insurance transactions or all transactions?

@Rohit only insurance

Does this card gives anniversary benefit..against the annual fee?? Or 5000miles is only welcome benefit and one time only

@Harsh, the renewal benefits have been explained in the article itself

My Magnus renewal is coming up next month. Thinking of downgrading it to Atlas. Is it a wise decision?

@Prashanth, I can’t speak on open-ended statements 🙂

Thanks Ajay for this informative post on Atlas. Just wanted to confirm that Govt spend and Utilities spend – would be eligible for both 2 Edge Miles per INR 100 as well as the milestone spend?

This is helpful. Maybe I will close my Axis VI as am getting a gold status either ways this year and go for this. However Axis VI still gives points for government spends. Is it true for Atlas?

Also, for the rent payment upto 50k, is there a surcharge on this card? VI has a surcharge and no points now 🙁

@AA, I think there will be a rent surcharge here as well (1%+GST up to INR 1500).

Ok. But still one gets the Edge Rewards. I checked with customer care, govt spending also count towards both milestone benefit and accrue the rewards too!