As I reached another 7-figure benchmark on the total number of miles and points I control (my own and my family), I thought it would be a good idea to do some slice and dice on the data for my own self to be able to understand where I stand, and for you to have an insight as well.

For the purpose of this exercise, I just downloaded all my balances from AwardWallet, and assigned the same value to all the miles there. So, an Air India mile = An AAdvantage mile = A Hyatt Gold Passport Point = an IHG point. In reality they are different, because for instance you need much lesser Hyatt points to stay at a Park Hyatt as compared to the number of IHG points to stay at a top end InterContinental. So, all the points have a value of 1 here.

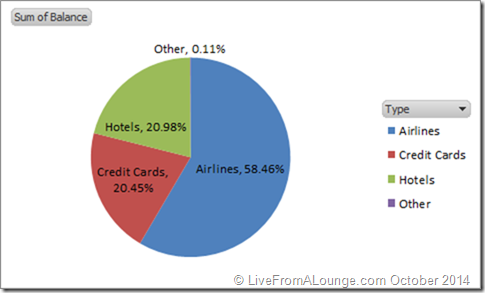

First, the total looks like this in percentages. 59% of the points and miles stash I have is Airlines, while another 20% is with credit cards (basically Citibank PremierMiles and Prestige points). 21% is with hotel partners. This shows the relative ease with which airline miles can be earned in India, because a lot of the miles here must have been earned from Credit Card spends with Air India and Jet Airways.

Related: India’s best mileage credit card finder 2014 Edition

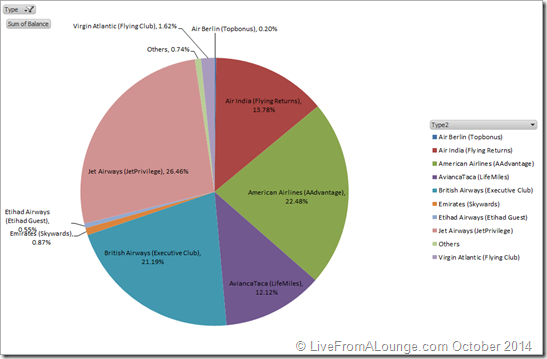

Next up, I sliced up my Airline balances, to see which airlines do I really really care for earning miles in. Here is how it looked. I don’t have exposure to every 3rd frequent flyer program in the world, and I have concentrated on earning miles in a few programs, and adding all my mileage to these programs to the extent possible. Why? Because some of them are carriers which I am geographically exposed to, such as Jet Airways and Air India, which are carriers I fly all the time. Then some other carriers where I try and build a book of mileage because I like them a lot, such as American Airlines AAdvantage. LifeMiles is the only balance which I’ve ever purchased, so every thing else is accrued to me via flying or credit card spends. Etihad, Emirates, Air Berlin and Virgin Atlantic are all promotions credited to those accounts. Everything marginal, such as Aegean where I have 6000 miles or stuff like that went into the Others bucket.

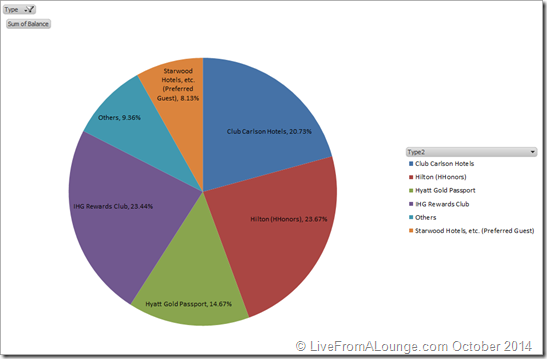

Thirdly, I decided to slice and dice my hotel accounts, to see where was I most concentrated. One of my pet peeves is that I stay at a hotel very often, where I don’t get any points for the stay, but just 500 miles every time I stay there. So, that is a lot of hotel spend down the trash can for earned mileage.

Here, I see a lot of my points are with Hyatt and IHG, two hotel chains I genuinely give business to, apart from Starwood, which is also a chain I stay with when I get the opportunity. Hilton HHonors is a generous program in terms of the number of points they give away per dollar spend, however, they value much less as well. Starwood is a balance where less is more because each point is worth much more than compared to HHonors. Everything that was breakage, went to the others column, such as Marriott and Taj Inner Circle.

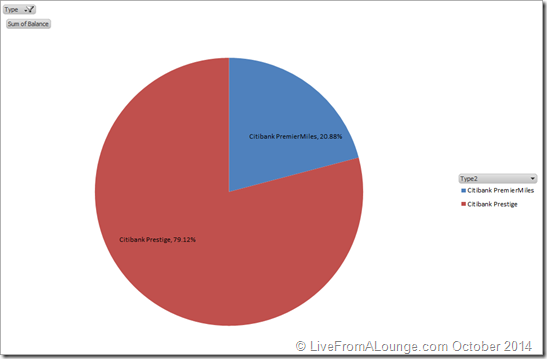

In terms of credit card spends, I really only earn Citibank points these days to the extent possible, because these can go into those points balances which I can transfer at will to programs I care for. A part of this was also helped by the double your mileage opportunity presented to those who have a PremierMiles card and want to upgrade it to Citibank Prestige. This is how that stash looks:

I gave up my American Express card as soon as I got it, so no Amex there.

What do I think of this?

I think I’m pretty well diversified in terms of the mileage I would require in the future, and not too much exposure to one program is always a good thing. I know of people who’ve had their balances with Kingfisher turn to ashes because one fine day the airline went bust.

Also, a great holiday is made not just with great airline miles but great hotel points as well, to compensate for the stays. So, I think I need to work harder to get some more hotel points in the bag, but I’ve been getting there. For starters, I’ve directed a lot of nights to Hyatt this year to get Hyatt Diamond just now, and I’ll work on SPG next.

What does your mileage stash look like?

Join over 3600 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Hi Ajay, I just started using AwardWallet a few days ago and it’s amazing! Just a quick question – how did you load the Citi PM and Prestige points on there? I just see Citi ThankYou points as an option but I think that is applicable for US-based Citi cardholders?

@Zain I’ve created custom accounts which I update manually for my Citi points.

@ Ajay – Understand your plan perfectly now. I am also on the same path, intend to hit the 10 L mark on Air India SBI card first, and then move all subsequent spend on Premier miles.

@ Ajay – you reckon it’s better to put your spend on Citi Prestige/premier miles because of the flexibility they offer in terms of transfer 1:1 THAN to put your spend on Air India SBI Signature card ? I think the additional miles offered on reaching spend based landmarks makes the Air India card far better, now more so with Air India being a part of Star Alliance. Citi promotions are twice a year at best, Air India SBI is an all year round spend card in my book.

@Amit I’ve already done the SBI Card 10L threshhold for this year, so there is no added incentive to get any thing beyond that this year for me. Hence, the evergreen PremierMiles, apart from when I need to book AI tickets which still goes on the AI-SBI card for me.

@ Ajay – Since you see to be more away than home, and that you have multiple loyalty memberships with Airlines. I would think of getting co-branded credit cards of BA, AI and Jet. They all have 2x miles when booked on their site with the respective cards. You current Premier Miles card give 10 miles/Rs100 for airline, and a Prestige Card gives 1 mile/Rs.100 or maximum 2 when it is in foreign currency. I am sure the co-branded cards will give more bang for the buck.

@Sahil I already have all the jet co branded cards and the air india one as well. After a point of time, I’ve started putting all the spend on premiermiles because while I may get marginally less no. of miles, this flexibility to transfer where i please is very very good in my book. If I would have had lesser balances on the programs I could have boosted that with using the co-branded cards, but I think I’ve passed that stage this year.