Jupiter Money’s original EDGE Credit Card, a co-branded RuPay credit card issued with CSB Bank, marked its debut into the world of digital-first credit cards. The card was introduced in 2023. What stood out immediately was the lifetime-free model—no annual or joining fees. Users could choose one category (shopping, travel, or dining) and earn 2% cashback (in Jewels) on spends in that category, alongside a flat 0.4% cashback on all other transactions. Rewards—represented as Jewels—could then be redeemed for cash, vouchers, or digital gold (5 Jewels = INR 1).

Jupiter upgrades to EDGE+

Fast-forward to mid-2025: Jupiter Money has introduced Jupiter EDGE+ as an evolution, tailored to the current times. The upgraded structure promises more assurance, higher ceilings, and broader appeal. Tailor-made for the millennial and Gen Z spenders: frequent online shopping, travel bookings, UPI usage, and an appetite for transparent, tangible value.

Key motivations behind the shift:

- Simplify categories, which means there is no confusion over choosing just one.

- Higher cashback ceilings.

- Retain the frictionless, app-based experience.

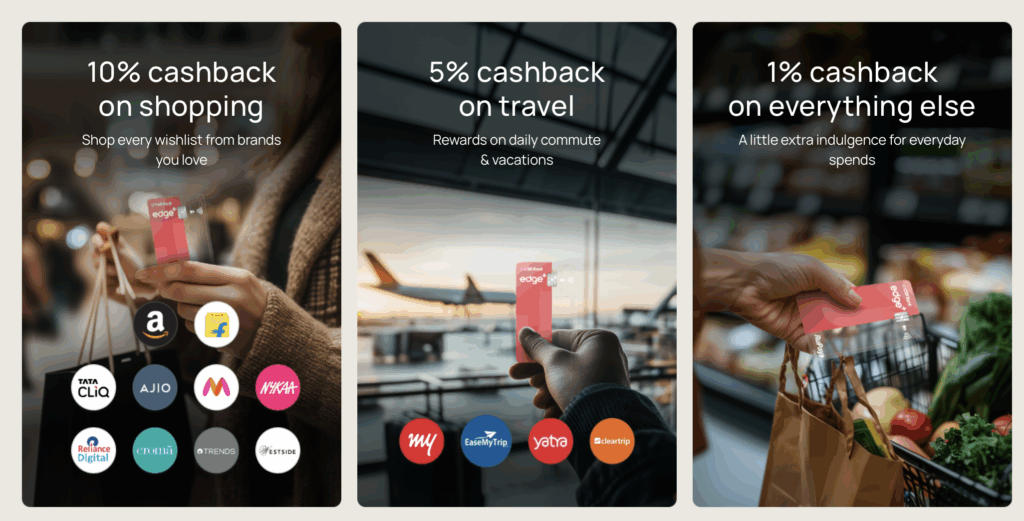

The Jupiter EDGE+ card reframes the rewards with a crisp tiered structure:

- 10% cashback, up to INR 1,500 per month on shopping at Amazon, Flipkart, Myntra, Ajio, Zara, Nykaa, Croma, Reliance Trends, Tata Cliq, and Reliance Digital.

- 5% cashback, up to INR 1,000 per month on travel bookings via MakeMyTrip, EaseMyTrip, Yatra, and Cleartrip.

- 1% cashback on all other eligible spends—online or offline—uncapped.

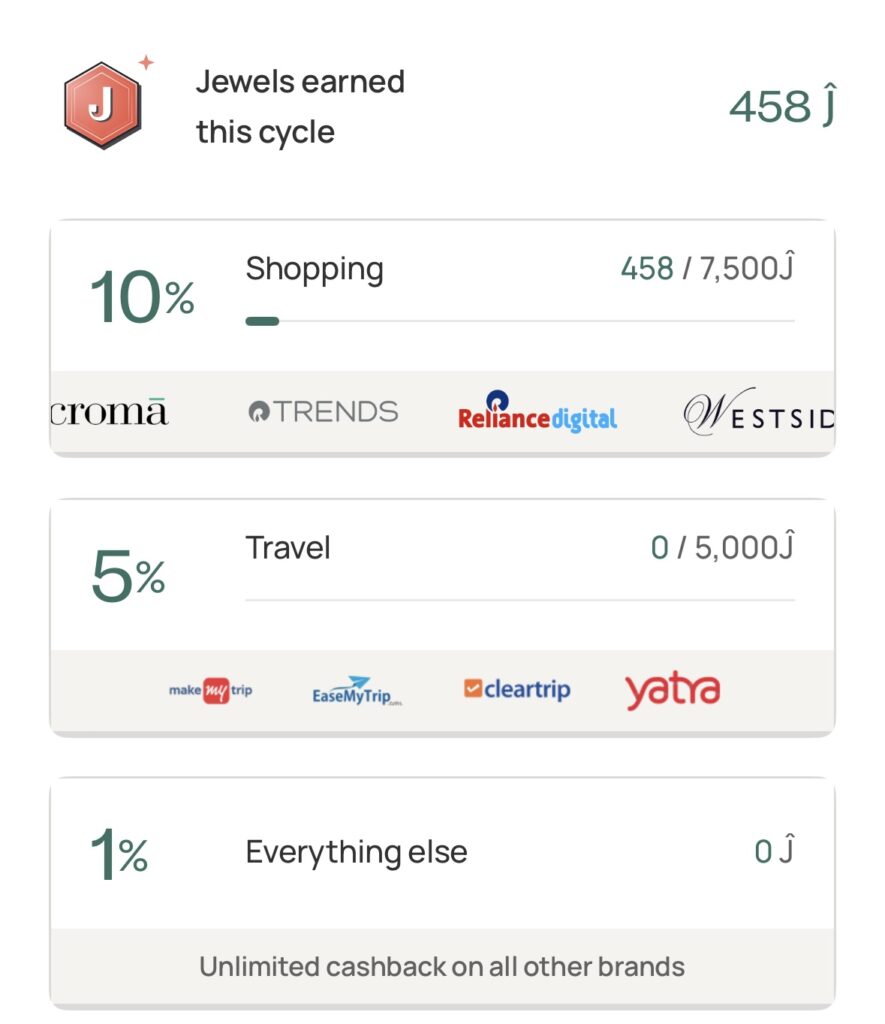

The bonuses are credited quickly, although you must wait for the return period of the product to expire before you can use them. There is a handy tracker for overall rewards earned per month, as well as the per-merchant limit. Since 5 Jewels are equal to 1 INR, the cap per billing cycle, for instance, on the shopping category is 7,500 Jewels. For instance, here is my dashboard for the current billing cycle.

The Jupiter EDGE+ Card is easy to get and only costs a one-time fee of INR 499+GST, in exchange for which, you get INR 500 worth of Jupiter Jewels over and above the rest of the spending-based Jewels. You can redeem Jewels as cash, gift cards, Digital Gold, or for bill payments. You can apply with this link on your mobile phone.

Bottomline

Jupiter EDGE+ is a cleaner way to use the Jupiter Card. There is no longer a choice between “shopping” and “travel” as you get both. And for a lifetime free card, the monthly caps are generous. INR 1,500 on shopping, INR 1,000 on travel and 1% on everything else. And of course, you can use this RuPay card for UPI as well.

What do you think of the Jupiter EDGE+ RuPay Credit Card?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply