Club ITC, the loyalty programme of ITC Hotels, got into the limelight after it became a transfer partner with Axis Bank Credit Cards. However, that also meant that the customers of Axis Bank started to use ITC Hotels’ well-meaning arrangements for the benefit of their own hotel customers to use the loyalty programme as a method to optimise their conversions. Now, ITC Hotels has put a stop to some of these distractions.

Club ITC implements new requirements on transfers/pooling as of September 1, 2023

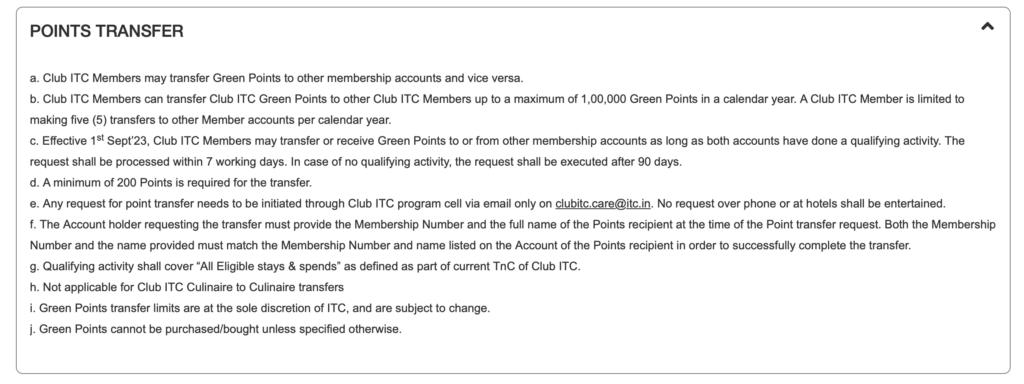

ITC Hotels Club ITC used to allow for the transfer of up to 100K Club ITC Green Points in a year to another programme member, free of cost. However, realising that a lot of members have never stayed with ITC Hotels and are just using the programme to consolidate their EDGE Rewards points, the hotel loyalty programme has now put in place new requirements for transfers.

As you would note in the new T&C now, effective September 1, 2023, Club ITC Members may transfer or receive Green Points if both accounts have done a qualifying activity. Here is the definition of Qualifying Activity per Club ITC:

- Eligible Room Night: An Eligible Room Night is a night during an Eligible Stay.

- Eligible Spends: Expenses (exclusive of taxes, discounts, paid-outs and gratuities) incurred by a Club ITC Member on identified brands of ITC, based on which Club ITC Green Points accrue to the credit of a Club ITC Member at Participating Hotels.

- Eligible Stay: A stay of one or more consecutive nights at the same Participating Hotel by a Club ITC Member on any eligible rate (including Reward Nights – stays booked using Green Points) by a Club ITC Member, which is billed to the account of the Club ITC Member. If a Club ITC Member checks out of a guest room and then checks back into a guest room at the same Participating Hotel within 24 hours, it shall count as a single stay for purposes of calculating stays and issuing Club ITC Member benefits.

Basically, Club ITC is stating that you can no longer utilise Club ITC as a go-between to transfer converted Axis Bank points between two accounts easily. If you don’t spend these points at ITC hotel properties, you should expect a 90-day delay in combining these points in two accounts. The best part is that this applies to both parties (those who want to transfer and those who received the transfer). The loyalty programme, however, has not changed the entitlement (of up to 100K points and 5 transfers allowed in a year)

Club ITC implements new rules to transfer points to Marriott Bonvoy.

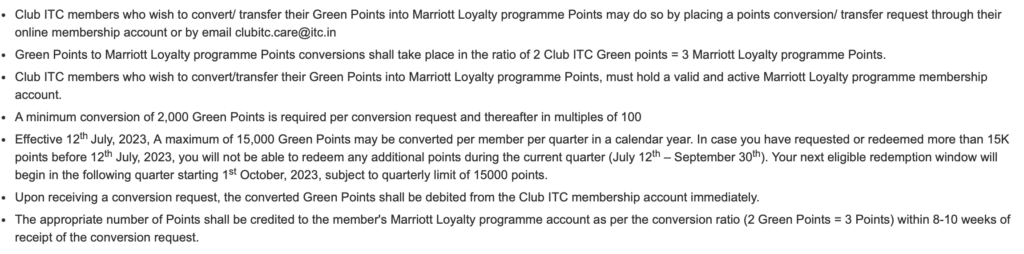

Although this came earlier, I also wanted to highlight the new transfer rules to Marriott Bonvoy. ITC Hotels, as a long-standing partner of Marriott Hotels in India (ITC Grand properties are a part of The Luxury Collection properties in India), also allows Club ITC members to transfer up to 60000 Green Points in a year to Marriott Bonvoy. Now, there are new rules around this, effective July 2023.

As you can note, again, in an intended move to stop getting used as a via media for people to move their Axis points to Marriott Bonvoy at a better valuation (Axis to Marriott was 5:4, while Axis to ITC was 5:4.4 including the recently expired bonus offer, which would convert into 6.6 Marriott Bonvoy Points). So, Club ITC implemented a fair use clause in July 2023, where you can transfer up to 15000 points in a calendar quarter to Marriott Bonvoy.

Bottomline

Club ITC has had to update their programme with some quick-fix measures to ensure that they don’t have a leaking bucket problem just because some people are trying to use their programme as a via measure to use their points (most probably transferred in from Axis Bank). No longer will you be able to transfer points around accounts if the account does not have a “qualifying activity” which means a stay logged or a redemption or something else.

What do you make of this move by Club ITC?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Right move