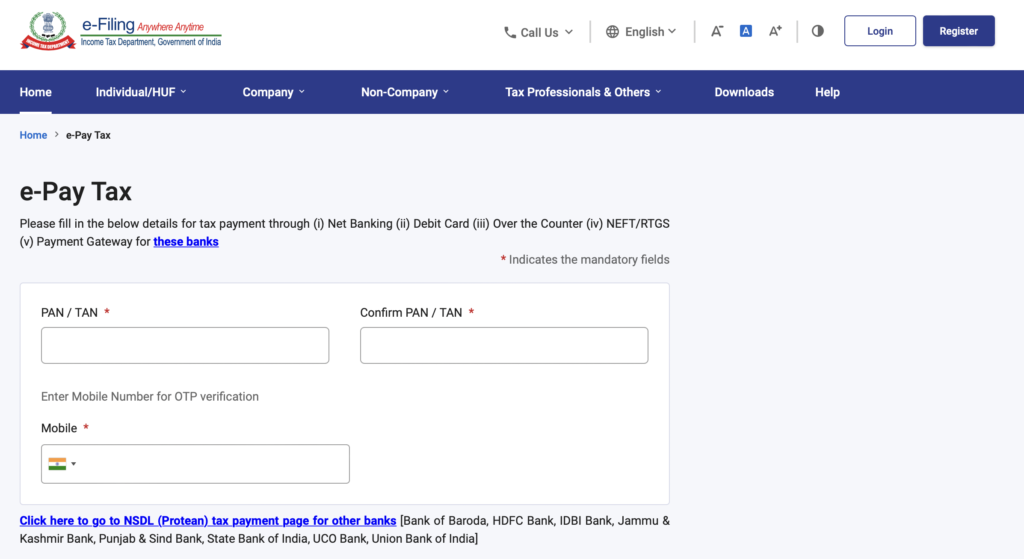

2022 has been the year of change, and one of the things that have changed has been the Income Tax Department. Apart from speedily processing refunds, one of the new enablements on the new IncomeTax website for India has enabled the option to pay your taxes with a credit card. In the TIN-NSDL portal (which still is live), one could only pay their Direct Taxes with a debit card or a net banking account with a few specific banks. However, that meant that many people could not access the online utility of paying taxes for this reason. Hence, the option to pay Income Tax with a Credit Card/Debit Card was also launched.

Since we are on the edge of the payment for Advance Tax, I thought of trying out this option today, and here is how you can also pay your Income Tax dues with a credit card. I tried out payment with two credit cards, and I will make the rest of the payment tomorrow now that I’ve seen the process work.

What payments can you make with your Credit Cards?

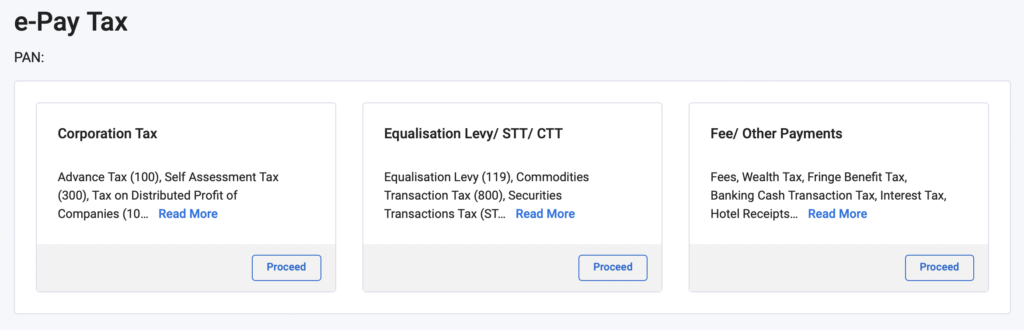

You can pay various dues to the Income Tax department with your credit cards. Here is the master list on logging in with a corporate account.

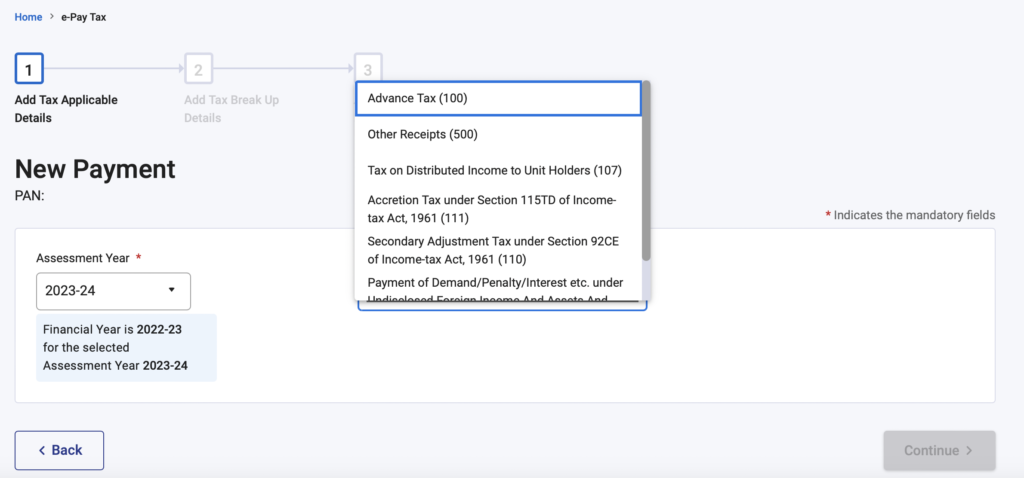

Here we go one step in, after picking the corporation tax option.

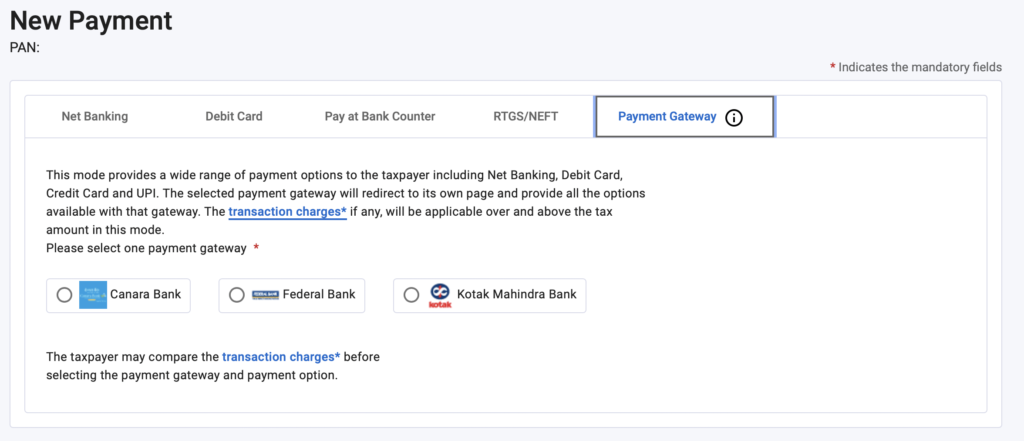

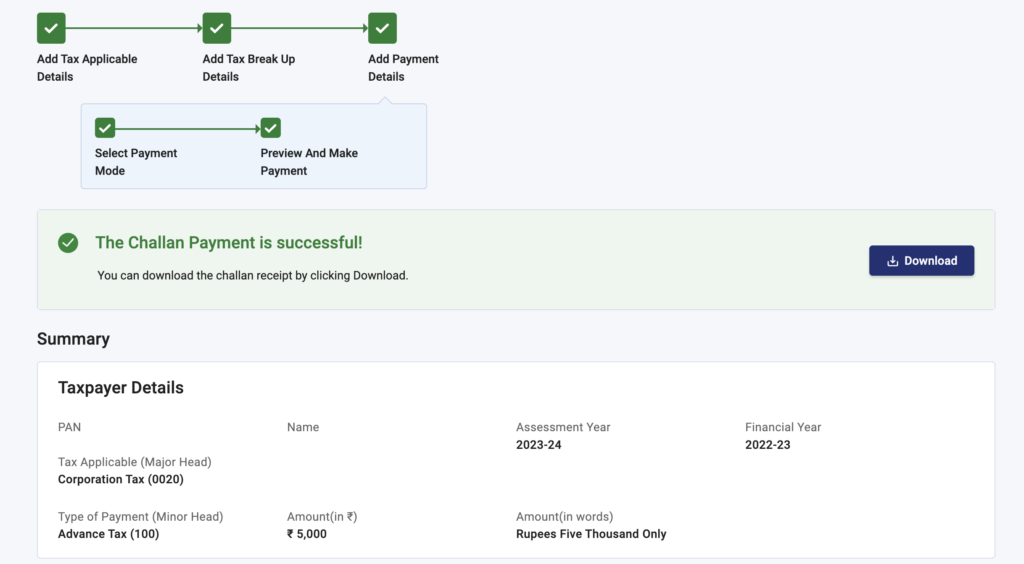

Once you have selected the Advance Tax option, you will be taken to a screen where you fill in how much tax you would like to pay. After that, you will be brought to the page where you pick the payment gateway option.

What cards are enabled?

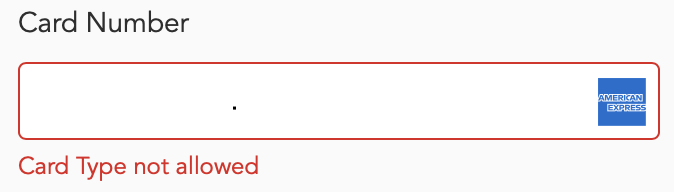

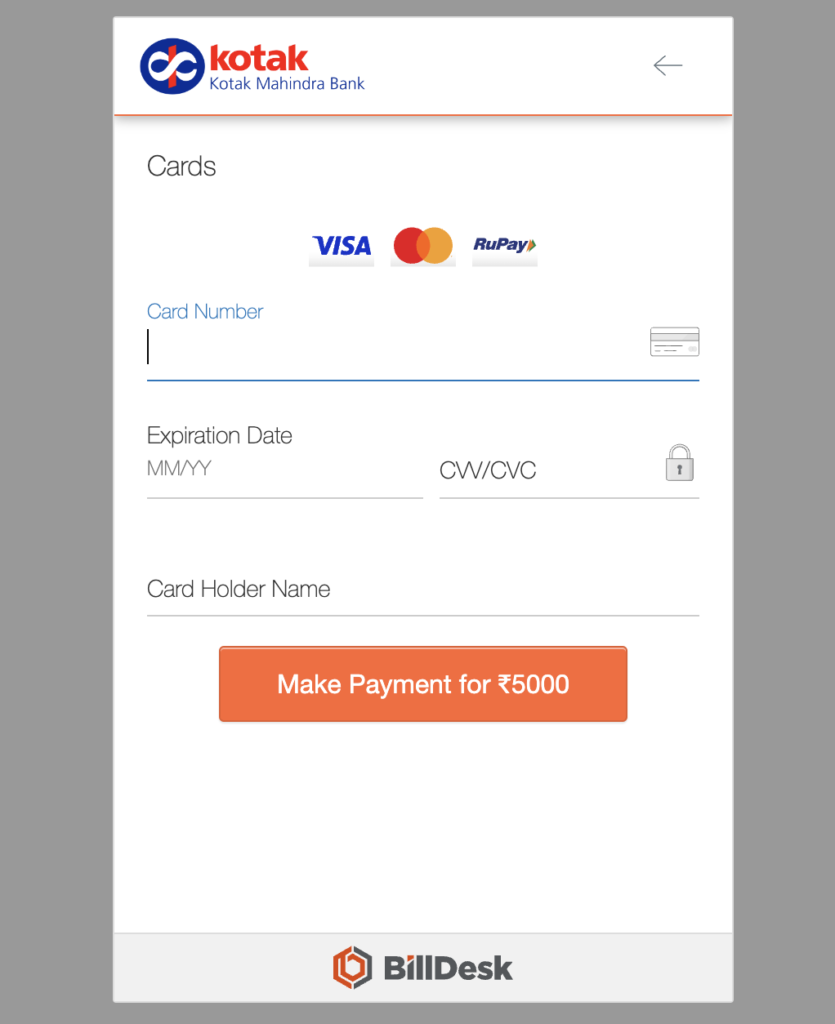

Visa and Mastercard network cards are enabled for use, as also the Rupay network (on the Kotak Mahindra Gateway). I tried using an American Express card, and here is what I got…

Which Payment Gateway to use?

The IT Department offers three payment gateways, although there are no screens at the moment with the success rate of each. You can use UPI/Debit, Credit Cards/Net Banking, and even international credit cards to pay your advance tax. Each Payment Gateway has a different assortment of pricing, as well as other options they offer.

I had quite a few unsuccessful attempts as I dug around, but here is what you need to know.

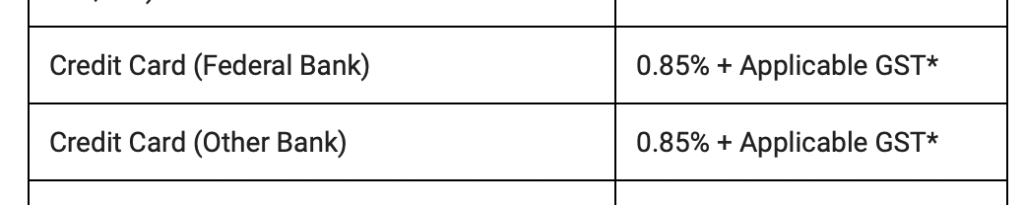

- Federal Bank charges you 0.85% over and above the amount of your transaction, and an applicable 18% GST (net 1.003%)

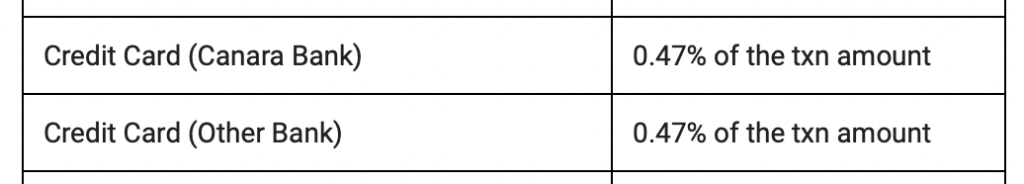

- Canara Bank charges you just 0.47% over and above the amount of your transaction and an applicable 18% GST (net 0.5546%). This is the lowest option.

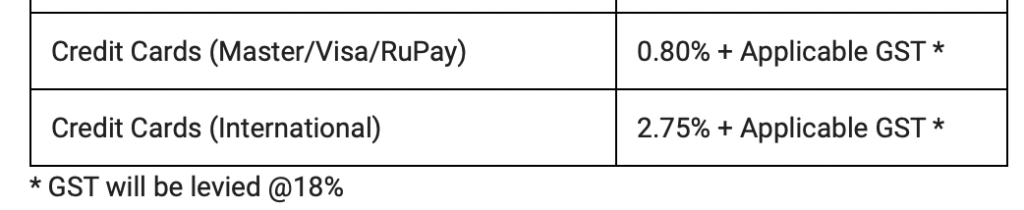

- Kotak Mahindra Bank charges you 0.80% over and above the amount of your transaction and an applicable 18% GST (net 0.944%). Also, the Kotak Mahindra payment gateway allows you to use an international credit card to pay your taxes, with a 2.75% transaction fee + 18% GST (3.245% net). This option is helpful for international entities who want to pay their taxes in India. For instance, fund managers who sit abroad but manage funds in India.

Ultimately, I went with the Kotak Mahindra Bank payment gateway because it looked like the most stable one to me (and also, it was a tie-up with Bill Desk). Additionally, you can get a tax invoice for the additional charges you pay out (including the GST charged). I’m still waiting on the invoice, but it was the only PG which gave me the option.

After putting through all the details, the PG shows the extra charges at the next step and takes you through the 2FA process to verify with an OTP. In the end, you get a quick update, an email from the IT department, and the payment challan.

The transactions are also reflected in the Income Tax portal pretty quickly.

What is the use case here?

The use cases could be many folds, but achieving milestone spending where needed is key. Certain cards will get you a fee waiver if you spend an x amount in a year, and other cards will get you bonus points if you meet a minimum spend in a month. Not just that, you can get the Axis Vistara Cards for the first year free if you can put in a certain minimum amount on them within 90 days (prepare for the fourth instalment in March 2023 already!). Remember, HDFC Bank CCs will have this go away on January 1, 2023.

Bottomline

You can now pay your income tax in India with a credit card for anywhere between 0.47% to 0.85% surcharge (ex GST). MasterCard, Visa and Rupay credit cards are enabled, and American Express does not work for these transactions. The transactions post immediately on the Income Tax portal as well.

Have you tried paying your Income Tax dues with a payment gateway? What has been your experience with this?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

I tried an international card and it didn’t work.

Does Axis Magnus card get points? If we advance pay the taxes.

SBI cashback card should be eligible for cashback on tax transaction. Can anyone confirm if tried already?

Anyone know if SBI cards give points on govt sites?

I used Citi Prestige on Canara Bank payment gateway. The charges were Rs.472 for every 1L paid and 18% GST. Will wait for the statement to see if i get points for the same.

Citi India does not award RPs for transaction on govt. sites.

Tried the feature for the first time last month. Used Canara Bank due to lower transaction fee. Does one get reward points on these transactions? Waiting for my statement to get generated.

Hdfc and axis bank credit cards have stopped crediting reward points for transactions made on government sites! Maybe many more too do not offer reward points.

@Deccan, most Axis cards have stopped, but their Super Premium ones are still up with it.

I enquired – the transaction is processed through PayU which is categorised as a utility mercjamjt and therefore no award points are awarded. I don’t think there’s anything to do with the government website!

@R, PayU is a payment gateway for tonnes of merchants. The merchant definition is qualified by what the merchant declares he/she is, not by which gateway they used. If they told you otherwise, either they did not understand the rules themselves, or they were trying to mislead you.