I’ve been waiting to write this post for a while, partly as a reminder for all of us, that we can earn miles and points for every other thing in India, and also for taking stock as to how many miles and points I raked in last year, and how. I was waiting for some statements to close down on my credit cards to be able to complete the picture, and here it is, sliced and diced in various ways for your reading. For reference sake, all miles and points are counted in units and not in terms of any weights I assign to them. I want to point out these are purely my own balances, and my family’s balances are not included here. Also, you should note that last year, I took flying really slow because of stuff going on in my life.

Miles, Points and Everything in Between

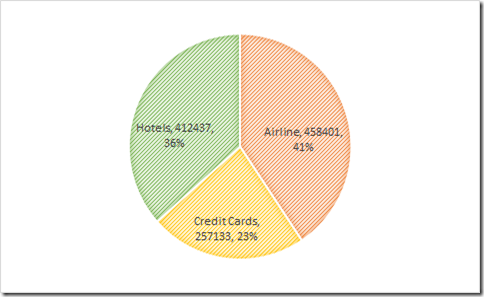

First, up there, you see the amounts earned last year via various methods as hotels and airline miles and points, and also credit card points which can be transferred across to any currency as we please. Airline miles lead the pack, but that is also because all the co-branded credit cards I have are airline credit cards, and the miles sweep in every month.

How did we earn?

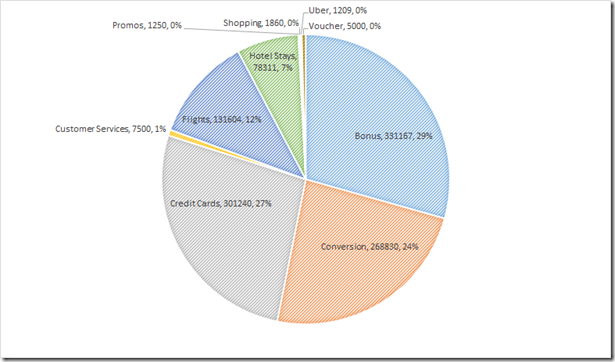

Like you notice, Flying only got me 12% of my overall miles and points this year. Credit Cards got me 27% of my miles, including those from co-branded cards such as the ICICI Jet Airways and stand alone cards such as Citi Prestige and SBI Cards. I count conversion as a separate category to avoid double counting some miles which existed as credit card miles, but were later converted to hotel or airline miles for my use. Bonuses include all sorts of bonuses from various activities, such as the conversion of IHG certificates to points, and the Hyatt 90,000 Gold Passport points bonus for my wedding. Uber also earned me some points.

Where did we earn?

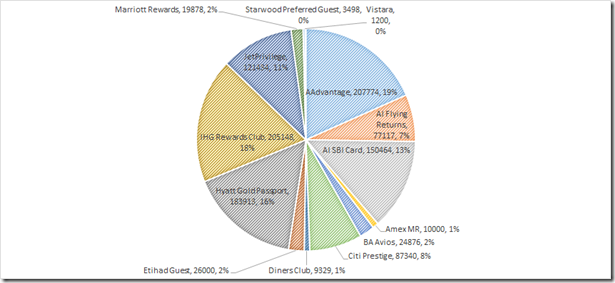

I’ve always been a believer in diversifying my mileage earning, and this is proof of walking the talk. You will see an assortment of programs and credit cards where miles have been banked. JetPrivilege continues to be my go to program for earning Indian flight miles, while in terms of hotels Hyatt Gold Passport is the leader. The numbers are distorted a bit by the conversion of my IHG certificates to points, which added a lot of balances to the account. AAdvantage was my best program in terms of earning miles for travel outside India. Diners Club, those balances moved into conversions to other programs, but I had a killing with them last year.

Those were some insights into my travel habits. I’m happy to answer any other details which you guys might want to have and I might want to share.

I’m sure you guys are doing a lot on your miles and points earning also last year, and it would be good to hear how did your mileage earning go over the past year.

Join over 5000 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

Hello Sir,

I really love your blog and it really helps me a lot. I own a Citibank Premier Miles Card but I am not too happy with it as the conversion ratio is 2:1 and earning miles is also less (4 miles on every ₹100) compared to many other Cards

I’m looking for a Travel Card which gives me maximum miles at lowest spending for any airlines or even Jet Airways is fine

I don’t spend way too much nor I travel by Air very frequently but targeting to earn 50,000JP Miles a year which is totally acceptable for me. I know it’s too much to ask that’s why I’m asking you if there is a way or loophole to get near to 50,000 JP Miles a year

I got a question to ask you. Sorry it’s off topic from what you have posted about your year end report

If I am a Platinum Jet Airways member and if I have lot of miles to transfer the miles to my wife, by that can I make her Platinum Jet Airways Member just be transferring Miles or say Gifting Miles? Because there is someone I know who made her wife Platinum but isn’t telling me how lol and I really want to know how so I can take that advantage for my wife as she’s not even a Silver Member and can’t access lounges

Thank you so much for these post on your blog. As I said it really helps us. Thank you once again

There two things I would like to ask you

Hi Anand,

Get diners club premium / black for making maximum miles by utilizing 10X promo.

For places that don’t take diners club use premier miles or any jp cobranded card (visa/mastercard).

You cannot gift status by transferring miles, status is earned only by flying although you can get silver for one year through with Jet Airways Diners club card(15 tier points joining bonus).

Ashutosh

Hi AJ,

I have been reading ur posts quite consistently lately and thanks for all the great stuff. Would you know if the credit cards available in India are also available with the same bonus and features even for NRI’s?

I have been collecting equivalents here in US and used my SPG points in Jaipur and Agra, which was awesome redemption, but couldnt do much regarding flights considering most Indian airlines are not part of major alliance… we used JetAirways for BOM-JAI, but ended up purchasing the ticket as i couldnt figure out alliance and availability at the time.. Hopefully for the next trip home I can take the family out completely on points as opposed to just stays.. :)…If I can hit the sign up bonus from Indian CC’s that will grow my pointbase for domestic travel there..

Hi Vaibhav,

The US credit cards are much better than whatever is offered in India (except for diners club cards due to the 10X promo ofcourse). The signup bonuses on Indian credit cards are very weak, you can make more points using Amex or Chase cc in US.

You can use Star Alliance miles on Air India, and Aadvantage, United miles on Jet Airways as it is a partner (booking might be a pain).

Ashutosh

Hi Ashutosh,

Thanks for the pointers. Around here the bonuses are getting very difficult to come thru. Chase is getting stricter in their approval process and Amex recently made it once in lifetime rule… Hence the quest for churning elsewhere 🙂

And yes, for jetairways, I couldnt even figure out how to search their award availability on their website.. I was in a time crunch but will give that a try again someday..

Hi Ajay,

I use Uber pretty frequently, how do i earn miles with uber rides?

Thanks!

@Mathew there is a link in the post which details how. On the road right now so can’t paste it for you here

Hi Ajay,

The co-branded JetPrivelege debit card from HDFC Bank rewards JPMiles on swiping the card wherever. What’s the MO here and are there any cavetas to this since I don’t see any flurry of an activity to my existing JPMiles Balance.

Read you soon,

Venus

Hi Venus, those miles usually post in fits and starts. So keep an eye on them. Also, you only get 2 miles per INR 150 spent.

What a douche

A lot to learn from you AJ….!! I have done half million this year but 80% through CC and Conversion Bonuses. I have yet to master earnings through Hotel stays. By the way I am Hyatt Gold Passport Platinum member. I plan to take membership of their Spa which costs me Rs 70K. Is there any opportunity to earn Hyatt points here?

@Krishnakumar the hotel would be in the best position to tell you if this is a qualified spend or not