Vistara is the newest carrier that will take wings tomorrow, and as per the positioning they’ve wanted to make in the Indian aviation market, I’ve labelled them the Louis Vuitton of Indian aviation.

When Vistara opened for ticketing on 19 December 2014, they were out to make a statement. The tickets were positioned on the expensive brackets, and I booked a ticket at INR 11,428 including taxes and fees to be on the first flight. While I don’t have screenshots, I can promise you the pricing was rich and most flights on the DEL-BOM leg were pricing at least at INR 7500 in economy, and so on. If I can make a bold statement, they were outpricing themselves from the economy market.

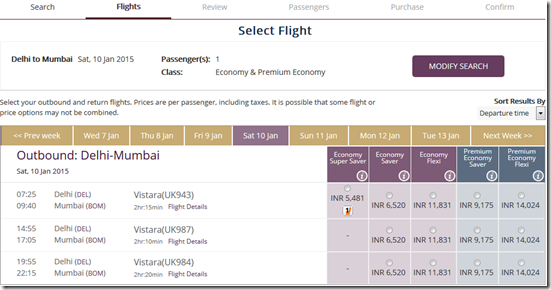

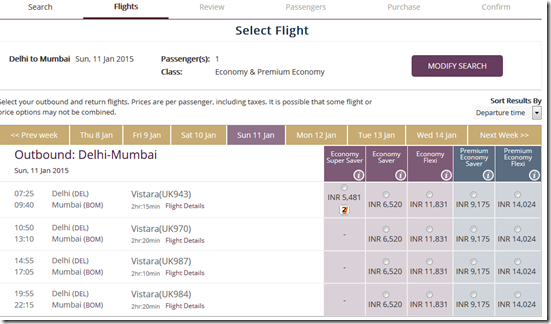

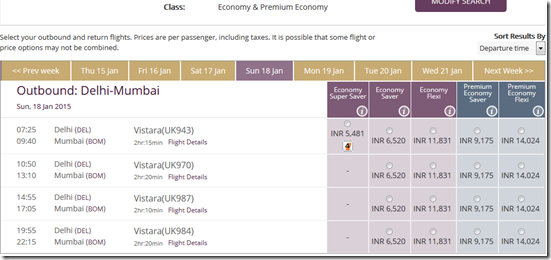

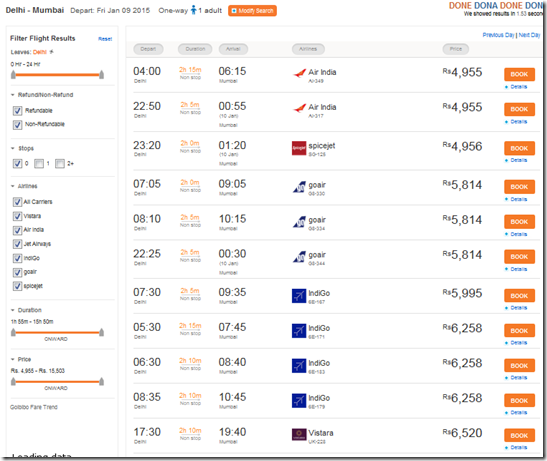

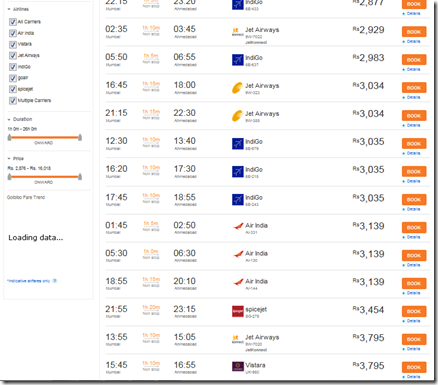

Yesterday, I posted how Vistara dropped prices all the way down, to be in line with Jet Airways and the other carriers on this route, all the way to INR 5400. Their schedule is currently published till Feb 15 2014 and will change after (they now have a third plane delivered this week!)

Other routes have a similar story to an extent as well. While I haven’t done a very deep analysis on all dates on all segments, but I see a trend basis random spot checks.

It beats me that the airline has already moved fares down even before launch. Did they adjust to the market reality, that India wants to fly the lowest priced carriers? Or did they not get enough traction and hence this forced their hand. Either ways, they are still the most expensive carrier around in my experience.

As for me, I cancelled my original INR 11428 ticket and rebooked for a cheaper fare. Even with the penalties, I saved about 3,000 on my ticket, which is a good amount of savings.

What do you guys think about Vistara’s pricing and yield management attempts?

Join over 4000 people who check-in daily to find out about the best in travel.

Free emails (once-a-day) | RSS Feeds | Facebook Updates | Twitter | Instagram

I agree with Prash – everyone around the world seeks value. Who wants to pay for expensive tickets if a reliable option is $100 less expensive?

Could be driven by reduction in Aviation fuel prices as well as less than expected load

Could be driven by reduction in Aviation fuel prices

There is a notion that Indian consumers a.k.a. third world consumers will be in absolute awe of a foreign product and that there will be a segment that is willing to pay a ludicrous premium to get the experience. Very quickly though, companies realize that the Indian a.k.a. third world consumers are really not in awe of those foreign products (in this case Singapore Airlines)and they price lower as well as customize to Indian needs. Third world consumers are no different from the first world consumers; looking out for “value for money”. I bet very few bought those obscenely expensive tickets and so risked flying near empty planes 🙂