A couple of weeks back, I reviewed the Citibank Premier Miles Credit Card for all of you. Too bad, as a fallout of the breakup between Citibank and Jet Airways, Citibank is forced to revise the product proposition, and the earlier product is no longer on the market. To help you choose if to go with the Citibank Premier Miles credit card or not, I review the new card product for you below.

Citibank is currently offering to switch all existing Citibank Jet Airways Credit Card holders to this card product by June 30.

Sign-up bonus: If you are signing on for the card afresh, you will be offered 2 complimentary ticket codes which allow you to book domestic flight segments at least 15 days in advance on any airline in India. These codes have to be used via the Premier Miles Portal and you get a base fare waiver of upto INR 1,500 on your per ticket.

Additionally, all card holders, whether new, or switching from the Jet Airways Citibank credit cards, will be offered 10,000 Premier Miles bonus in their card account after making the first purchase of at least INR 1,000.

Fee: For new signups, the fee is INR 3,000 per annum, plus taxes. You get 3,000 Premier Miles in your account for paying the fee. For those cardholders switching from the Citibank Jet Airways CC, the fee will be pegged at INR 1,000 plus taxes per annum.

Eligibility: Not publicly disclosed.

Features: Considering I hold the older version, I can say this is a stripped-down version of the earlier product offering in India.

The Premier Miles credit card comes with access to the Premier Miles portal like mentioned above, where only Premier Miles customers can book their hotels or tickets. You get 10 Premier Miles / INR 100 spent on your airline,hotel and travel bookings made via this website. You also get 10 Premier miles / INR 100 spent on your airline bookings made directly with the airlines (via websites, callcenters and ticketing offices), however, a limit of INR 5,00,000 per calendar year has now been imposed for earning 10 PM/INR 100 on airline reservations. After that, you get the regular earning rate of 4 PM/INR 100.

The new variant launched is a Visa Signature card, so it offers the benefits of access to the Visa Signature lounge program, which is valid till 30th September 2012. The lounge properties include all the Plaza Premium Lounges in India, Singapore, HK, Malaysia,Canada and Oman. It also counts in the Mumbai lounges offered by Celebrations and Carnations. For some reason, unlike the MaserCard program, the Visa program does not have unlimited visits but 5 Visits per Quarter imposed on the card. Here are the T&C (in PDF). The Priority Pass benefit has been withdrawn (after customer research, no less ![]() ).

).

Premier Miles: The reason I loved the PM card was quite simply, the PMs itself, and the unlimited ability to earn them. That, for one, has been curtailed. Also, this product is now a funny concoction. This is an Indian credit card, however, does not offer access to 2 of the Indian airlines loyalty programs any more! Overnight, Jet Airways’ Jet Privilege program and Kingfisher Airlines KingClub program was exited from the program, and now the only Indian airline program you can transfer into is Air India’s Flying Returns. You also have Singapore Airlines, Thai Airways and Cathay Pacific’s programs to transfer into. They all transfer into 1:1 points. Premier Miles never expire. (Sources have told me Avios and Delta Skymiles may be added as program partners soon, but till it is confirmed, this is a rumor).

Earning Premier Miles: Like I’ve mentioned earlier, for people who manage and book and their own travel plans, this card is for you. While Citibank has capped the ability to earn the 10 PM/100 Rs. to only INR 5,00,000, the ability remains unlimited via their own PremierMiles portal. However, be aware the card portal cannot handle complicated routings.

For any other spend, however, Citibank has increased the capability to earn to 4 PM/INR 100. This is a significant increase for the general spends category and I can see significant benefits coming your way with that change.

Redeem Premier Miles: The Premier Miles card offers the capability to transfer to the 4 programs listed above on a 1:1 ratio.

Citibank also claims to have revised their Premier Miles redemption charts for offering redemption via their own PM website. For Domestic Redemptions, the burn ratios have been brought down slightly, for instance, 10,450 miles for a BOM-DEL redemption instead of the 10,500 miles for a full-service Y redemption usually needed on Jet Airways. However, a new rider has been introduced, where for bookings inside 3 days of travel date, double Premier Miles will be needed. While my bookings are usually not last minute, this could be a disadvantage for some of you who may decide to redeem last minute.

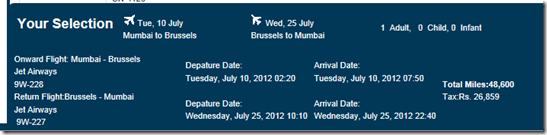

The real changes are on the international redemptions, or so I am told. Citibank is apparently trying to work out redemptions at a rate which is lower than the airline’s own redemption rate. How the algorithm works is something I am working to decode, but this is a nice discovery. I was not enthusiastic about making redemption bookings via the PM website earlier, but this looks good now. Have a look at the redemption chart, for some sectors, which I discovered earlier today.

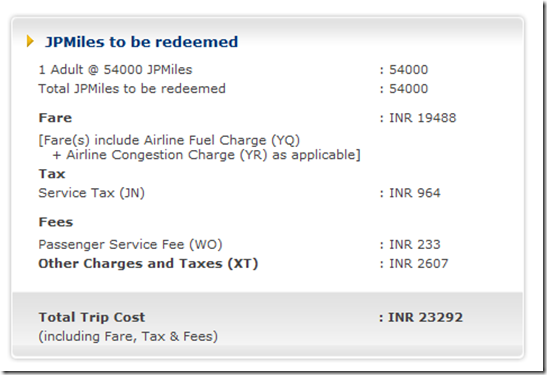

BOM-BRU on JetPrivilege costs 27,000 Miles on a one-way Y ticket and 54000 on a one-way J ticket. However, Premier Miles is undercutting it by a gorgeous 10%:

No, this does not come for free. The cost of this 10% off is usually an increased cash payout. Have a look below at booking via the Jet Airways website first on the BOM-BRU-BOM segment discussed above.

The cost is 54,000 JP Miles for Y (27,000 JP Miles o-w) Plus INR 23,292.

Now have a look at the booking via the Premier Miles portal.

This is 48,600 Premier Miles (10% less than the JP portal) + INR 26,859.

So, the way I see it, you are making up the difference via cash.

[Update July 2012: No redemptions possible using PremierMiles on Jet Airways]

The other interesting possibility this opens up, is that the booking made via the Premier Miles portal will be in a revenue earning fare class and you will get to earn about 8,000 JP miles on it as well (plus tier bonuses) and you stand the chance for an upgrade. However, I am still to make a redemption to see this happening and hence this is pure speculation till I can confirm this.

Overall assessment: Call me spoilt but Citi did it on their own by first giving me the ‘old’ Premier Miles product. And I love it. I won’t want to trade it for the new 4 PM per everything else product. However, it is a good product still, not a great one yeah, but a good one nevertheless.

However, I am told, the old product holders will also be gradually receiving communication from Citi to move to the new earning structure shortly.

Related Posts:

- Sunday Plastic: The American Express Gold Charge Card

- Sunday Plastic: Citibank Premier Miles Credit Card (Old)

- Burn Notice: Citibank and Jet Airways – friends turning foes!

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

Hi Ajay,

I had accumulated a large number of PM (> 100,000) on the card – now suddenly Citibank says that redemption will consume 2 miles to 1 rupee as against the earlier 1 mile to 1 rupee.

Is there a way to get them to address this? i mean, for people who saved up and accumulated miles for a trip to be told after a couple of years that they would now be worth only half of what was promised seems unfair.

Any suggestions?

@Vikram this change is not sudden but was made about 7-8 months back. They gave due notice and people had an opportunity to transfer/move over to prestige at that time

hello Ajay,

I was interested in getting the premier miles card. However it seems its available for residents of few limited cities of India. Is there any way around this?

Good review

just few points

on premeremiles portal they are charging twice miles for actual value of tkt

second they have 47706 series visa cards separately in the same category

@Rohit

I have closed my Citibank PM card account. I have moved to AMEX travel card and their customer service is more than EXCELLENT.

I am using Citibank’s IndianOil credit card (IOCC), the oldest one in my garage. It is the best card offering from Citibank’s stable, in terms of point to rupees ratio plus it is free for lifetime. However, just recently, I have noticed that the Indian Oil petrol bunks in B’lore are trying to dodge Citibank IOCC customers, they are not happy to accept this card anymore, presumably dissatisfaction brewing between Citibank and IOCL !!

i want to apply for citibank’s credit card but iam a lil bit confused b/w PM and citibank indian oil card.

because 1 pm= 05rs whereas 1 turbo point in indian oil card is equal to 1 re.

Also which platform will be better? Master card or visa?

@Rohit, 1 PM could be potentially equal to 2-3 Rs. if you transfer your premiermiles to a frequent flyer program and book a ticket with them. Visa is the better card at the moment

Hi All,

I would like to share my experiences with CITI-PM.

I applied for this card in mid of Dec’12 and received it by mid of Jan’13. On seeing that the membership has started from Dec’12 and I have been issued a VISA instead of MasterCard. I logged a complaint and they quickly responded with an apology and refunded one month’s membership fee in my account to compensate for the delayed delivery.

For card swap they took good three weeks. They mentioned that internal approvals are required to process the request and later they charged me one month’s extra membership fees. They say that you had two active cards (VISA and MasterCard) in that month you received your new MasterCard. Hell!! but I have got just one account!!

Customer Service – Okay types but if you call their help-desk a multiple times in a day for the same issue like I did for card swap issue then this freaks them out and they talk sarcastically.

Chip based card – In last couple of months, I have found that the CITI PM card is not supported by card readers which are either too old or do not have latest software updates installed.

CITI PM website and miles redemption – One of the annoying feature of their site is that the booking may fail if the price of the ticket has increased during the course of the transaction. In this case, the receipt will not be generated and you’ll get a call back from CITI to inform you that you need to pay the difference in amount so that they can get the tickets confirmed. Ok good, fair enough.

Now if you have booked this (failed) ticket using miles and you would like to book a ticket for a later date then get ready for a surprise – CITI will refund the miles in your account in next 15 to 20 working days!! This completely defies the purpose of booking the ticket thru their PM website.

In addition to this the PM website should allow the user to store the information like address and card details as profile-1, profile-2 and so on. At checkout provide check-box to select one of the profile and auto-fill all the details. This will enhance the process of ticket booking and increase the number of tickets successfully booked.

My PM account’s annual subscription ends this year, and I am looking for a way out.

Lastly if you fallen for that airplane zooming across the length of the card (as shown in the picture above in the article) then hold that thought. They don’t actually issue a card with a blue tailed airplane on it.

Hope CITI is not listening 😉

Hi AJ,

I got my card in June and was subsequently billed Rs 3000/- plus tax in the first statement. As per your blogpost, one should get 3000 Premier miles on paying membership fee whereas that has not happened in my case.

Also, can you please tell me as to how many free lounge visits is one entitled to in a quarter as per T&C of Visa Signature lounge program. Is the program likely to be extended beyond 30 September 2012?

@Rakesh, check here: https://www.online.citibank.co.in/portal/newgen/cards/tab/citi-premiermiles-card.htm?eOfferCode=CHLNAV, you should be getting 10,000 PremierMiles and 2 coupons as your welcome gift. However, this will come if you make at least one transaction of Rs. 1000 within the first 60 days. check the next statement for the credit, or you can SMS ‘REWARDS xxxx’ to 52484 from your registered mobile with Citi to check your balance.

Free lounge visits, is 20 per quarter. I cannot predict on the lounge program being extended or not yet since I have no information on that

Hi AJ…that’s what I initially thought, BUT THEN, why on earth would that be on the PM website? I wonder…

what is on PM website that you need clarification on?

Hey AJ…There’s a fair bit of buzz around the Citi-Jet break up, and only today did Citi get in touch with me after days of promises to call. Anyways… I was trying to figure out if there’s a method in the madness between the miles required under PM v/s under JP, and noted some very interesting bits of info on the PM.co.in website…

1. “Looking to book on Jet Airways or Jetkonnect?

Book on the Jet Airways website or Airline counter and

get 10 Miles per Rs. 100 spent.” – Obviously Citi is trying to $crew Jet even more, by offering this, I suppose (though under Jet’s current 3x bonus JP for spends upto July 15 might be better until then).

2. “Click here to redeem your miles on Jet…”

Use your Citibank PremierMiles Credit Card to book your preferred flight on Jet Airways through their website, ticketing counter or service center.

Call Citibank on below numbers and get your Jet Airways ticket refunded by redeeming miles.

Miles will be debited for these transactions at a value of 1 Mile = Rs. 0.50. (A ticket purchase of Rs 1000 would cost you 2000 Miles.)

This option is only valid for customers who have enough Miles to cover the entire ticket amount.

The refund can be processed for transactions that are settled and reflect in billed or unbilled status.

The refund will reflect in your card account within 7 days from the request received.

This refund will be valid for entire ticket amount including taxes.

Very very interesting ! Getting users to burn up their JP miles and giving cash back instead ! So Citi is essentially showing the .|. to Jet !!! LOLOL !!!

@Aniruddh,

you get 10 miles per 100 rs spent on airlines directly, be it Jet or Cathay or American or any other airline in the world. So this is not specific to 9w. on pt. no. 2, it is inface 9w who has taken away the happiness of citi. earlier, you could directly redeem on pm website, now you need to buy a ticket and citi will redeem, which is not such a good deal. take for example a ticket bom-bru, would have costed 27k miles on jp in economy, and 24.3k miles via premiermiles (plus taxes and yq on both). now, you stand to redeem many more miles for the same value. and plus, you are redeeming premier miles, not jet airways miles.

hope this clarifies!

Dear AJ,

I have applied for the new Premiermiles card today. The agent told me that although i had the option to go in for a Mastercard, i would be better off signing up for a Visa card. Which option is better in your opinion? I believe the difference is only in terms of lounge access. Considering that most of my travel is domestic, what would be better for me

Hi Rakesh, which airport is your home base? for me the significant difference between both is Mumbai where Visa offers a lounge but MC does not. I could offer you the lists here: http://www.hsbc.co.in/1/2/hsbcpremier/privileges-and-rewards/mastercard-lounge for MC and http://www.visa-asia.com/ap/sa/cardholders/offers/includes/uploads/airport_lounge_tnc.pdf for Visa. The MC list looks better for domestic, however, no Mumbai!

Thanx AJ. I am based at Mumbai, so i guess Visa it is for me.