Last week I reviewed the American Express Gold Charge Card for you all. This week, it is the turn of looking at the other card which has a place of pride in my wallet and gets a lot of my spend: Citibank Premier Miles Credit Card.

I picked up this card in December 2011, when the benefits on the Citibank Jet Airways Platinum Credit Card were downgraded, and I must say I am very happy with it so far.

Sign-up bonus: You get 2 ‘complimentary’ ticket codes which allow you to book domestic flight segments at least 15 days ahead of travel on any airline in India. These codes have to be used via the PremierMiles portal and you get a base fare waiver of upto INR 1500 per ticket on your bookings.

Fee: Free for the first year, INR 5,000 plus taxes on renewal (you get 5,000 Premier Miles bonus in your account on renewal). The other option is to allow them to deduct 5,000 Premier Miles from your account for the annual fee.

Eligibility: Not publicly disclosed

Features: This is one of the best ‘secular’ earning and burning travel credit cards I’ve seen in India. Since the world is moving to a chip-card, this one is a chip card as well. However, that could lead you to an embarrassing situation sometimes when you use it in India, since quite a few points of acceptance I know don’t know how to handle a ‘chip’ card! Sigh! They tell me it is declined and I wonder how could that happen, since my credit limit is usually only 30-40% utilised at any point of time.

The PM (Premier Miles) card comes with access to the PremierMiles portal like I mentioned above, which is a full-blown travel portal run exclusively for PM customers at Citibank. You can make your hotel and ticket bookings using this portal, and earn 10 PremierMiles/INR 100 spent. In a lot of cases, I’ve noticed the pricing is competitive but I always check the airlines own website and an established online travel agent to see what gives the best deal before booking. Sometimes the difference is minor enough to overlook since I’d get 10 PMs/INR 100 here v/s the 2.5 PM/INR 100 I’d earn with booking on an online travel agent.

Apart from the travel booking capability, you also get in hand a few specific tie-ups which could be of help. There are hotel-tieups which allow you buy-one get-one free offers currently valid at the Fortune hotels. The tie-up with Carzonrent offer a free upgrade on booking your car with them.

Since this card is issued as a MasterCard in India, you also get complimentary access to lounges across 6 cities in India where Clipper and Plaza Premium operate lounges. Also, you get a basic $99 PriorityPass complimentary, which allows access to airports around the globe @ $27 per person per visit.

The telephone helpline is very helpful, and you get directed to the CitiGold service when you call the appointed number. This means less waiting and more helpful agents. On the one and only occasion I have had to call, the agent was very helpful in doing some housekeeping on the card which I had forgotten about altogether.

Premier Miles: The reason I love this card, is quite simply the mileage earning capability it brings. Like I had mentioned in an earlier post, you can transfer your Premier Miles into 6 frequent flyer programs, which include Jet Airways, Air India, Kingfisher Airlines, Thai Airways, Singapore Airlines and Cathay Pacific. The awesome part is, the 1:1 conversion ratio. Of you can burn them on the PremierMiles portal with flight bookings or hotels. The Premier Miles never expire.

Earning Premier Miles: If you are a self-directed traveller, this one is for you. On your travel bookings with any airline across the world, if made directly with the airline (website/reservation office), you get 10 PM/INR 100 spent, and the same is the case if you book the ticket with the PM portal. If you book via another travel agent or online service such as Cleartrip, MakeMyTrip etc. you get 2.5PM/INR 100 spent. This is the same as using the card for other non-travel spends. I wish they added hotels to the 10PM/INR 100 list and I’d happily swipe it away on my hotel payments as well. But even otherwise, this is a card which allows me to earn miles for almost every little purchase I can make.

Burning Premier Miles: Like I mentioned earlier, Citibank offers the potential to transfer PMs as mileage currency to 6 frequent flyer programs at a 1:1 ratio. This is way better than most other cards in the market today. The Amex I reviewed last week, offers 1 JP Mile for 1.6 MR points, for instance. Also, I can transfer these miles to whichever program at short notice. For instance, I will transfer a huge stash shortly to JetPrivilege to benefit from the on-going 25% bonus offer.

Besides airline transfers, the Premier Miles portal also has the ability to book you tickets on any domestic/international route. For domestic redemptions, the burn rates are published and are in line with most airline burn ratios. So, DEL-BOM is offered at 10,500 PM via the portal on any full-service airline. Also, you get a reward redemption with the potential to earn miles on the ticket. Premier Miles bookings are essentially burning your points to buy revenue tickets with the airline. But the proposition becomes more attractive because you don’t have 1-2 seats per flight allocated for awards, but as many as your points can buy.

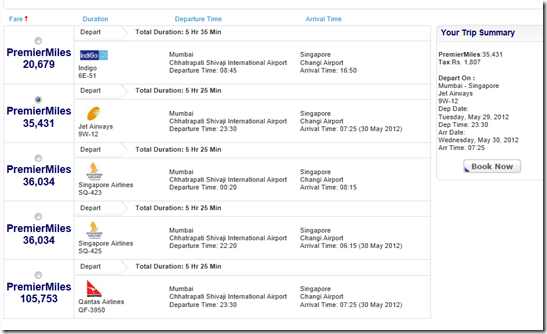

On the international side, however, the burn ratios are very unattractive and hence something I would avoid. Since they are ‘buying’ tickets, they don’t book into award classes, and the miles fluctuate all the time. There is no published award chart. So, for instance, if you wanted to book BOM-SIN, which Jet Airways prices at 20,000 JP Miles plus surcharge/taxes in Y, here, you get a different rate altogether.

However, I have to give it to them that you have the ability to pay for fuel surcharge in terms of miles rather than actual cash. However, I will choose to avoid this till the time things get better in terms of international redemptions.

Free Flight Coupons: Like I mentioned earlier, you get 2 free flight vouchers to start with when you accept the card. Citibank PM will also send you upto 3 more vouchers in a year every time you spend INR 1,00,000 on the card. For a frequent traveller, that means INR 7,500 worth of ticket value in year one, and INR 4,500 worth of ticket value on an ongoing basis. And Citibank PM proactively looks at these base fares. When they offered me the card, ticket prices were not so high, so these vouchers were good for INR 1,200 per flight and they revised it upwards on their own initiative.

Overall assessment:

If you travel frequently, you definitely should be getting this card purely for the value of the miles you get to earn via your travel bookings. With the first year free, you could always try it out and cancel if it does not work to your satisfaction. This one is one of my personal favourites.

Related Posts:

- Sunday Plastic: The American Express Gold Charge Card

- The Citibank Premier Miles Credit Card: It Works!

- Finally, a credit card which earns me lots of miles in India!

Disclosure: This post is not at the initiative of Citibank or their associates and I am not earning any fees to write this piece. It is purely my own opinion about the card and its utility.

Live From A Lounge is also present on Facebook, Twitter and available via RSS.

But this card’s conversion rate is still less good than the Jet Citibank card–that gave 4 miles per 100 rs spend. Do you know of any cards offering a similar conversion rate–especially now that Jet and Citibank have announced they will be discontinuing the card?

How about the PM earning from non travel related purchases?

@Phatmile, Like I said above 2.5 PM for 100 INR of non-travel spend

Wow that’s a good card.

The Citi PremierMiles card in Singapore is nowhere near this good! There is no travel portal, no category bonuses, let alone flight coupons.

I hope the number and other info in the image is not for real. 🙂

Excellent analysis AJ! Your blog is very useful, specially for “desi” mile addicts like me. Please keep guiding us!