Scapia’s credit card users have one more reason to smile this festive season, as the fintech company is running a limited-time Festive Shopping Offer from September 22 to 26, 2025. Here is a reminder.

Scapia’s new Festive Shopping Offer

Scapia’s new offer is simple but rewarding: shop on partner platforms like Amazon, Flipkart, Myntra, or Nykaa during the five-day window, and you can walk away with up to 10,000 bonus Scapia coins. To unlock the reward, you’ll need to enrol via the Scapia app before you spend — so consider this your reminder to sign up first and then swipe.

The mechanics are tiered, making it appealing whether you’re doing modest festive shopping or making big-ticket purchases. Spending INR 30,000 to INR 49,999 during the period earns you 5,000 bonus coins worth INR 1,000, while spending INR 50,000 or more secures the full 10,000-coin bonus worth INR 2,000. These are, importantly, in addition to the usual Scapia earning rate of 10 coins per INR 100. With the bonus factored in, your effective return on these expenditures can climb from the regular 2% to as high as 6%, a solid festive multiplier at a time when discounts and cashback are already available.

There are exclusions to watch out for. Only shopping transactions on the specified merchants qualify, so everyday bill payments, insurance premiums, fuel, wallet reloads, and the like won’t move the needle for you here. In other words, this is one to plan around your Diwali shopping lists rather than your utility spending. Rewards will be credited by October 6, so you’ll need to wait a few days before you see the windfall reflected in your balance.

With the shopping season in full swing, this is the kind of campaign that can easily slip under the radar if you’re not paying attention. Scapia’s offer is short-lived, but the value on the table is real if you were already lining up big purchases for Amazon’s or Flipkart’s festive sales. All you need to do is enrol, channel your shopping through the right platforms, and watch the bonus pile up. Consider this your nudge to act now — the window closes September 26, and then it’s gone.

What’s the big deal about Scapia?

Instead of point systems and redemption processes, Scapia offers a different model: zero forex markup, unlimited domestic lounge access, and travel rewards through its “Scapia Coins” programme. Here is how the card works:

- Zero Forex Markup: Scapia eliminates forex markup, making it ideal for international travel and online purchases in foreign currencies. However, you don’t earn rewards on these purchases.

- Airport Privileges: When INR 10,000 is spent monthly, one can access unlimited domestic airport lounges across India. Scapia also offers the option to spend money at specific airport outlets (up to INR 1,000) and then reimburses you in the form of Scapia Coins (1 Coin is worth INR 0.2).

- Scapia Coins Rewards Programme: The card gives back 10% Scapia Coins on every transaction. Through the app, Scapia is currently offering 20% off Scapia Coins. With the current conversion rate of 5 Scapia coins = 1 Rupee, this translates to 2% on regular expenses and 4% on travel expenses. These coins can be redeemed for travel bookings, including flights and hotels, through the Scapia app.

- Lifetime Free Card: No joining fees, no annual fees.

The key draw for me is the Scapia Airport Privileges Programme.

Scapia Airport Privileges. How do they work?

Scapia Airport Privileges are activated when you spend at least INR 10,000 before the statement generation date for the current statement cycle. In the first month, it is activated the minute you have spent 10,000 INR. Once activated, you see that it is activated in your dashboard.

There are three parts to the Airport Privileges programme, and you can choose one when you are travelling domestically around the country:

- Dine at the Airport. You can dine at an airport outlet and pay with Scapia. They will return up to INR 1,000 worth of coins into your account if you dine at one of the six major metro airports in India (Mumbai, Delhi, Bangalore, Chennai, Kolkata, and Hyderabad) at an outlet listed in the app. At other airports, they reimburse up to INR 500. You need to select the outlet and activate it before swiping the card.

- Buy something at the Airport. You can also use this card to go shopping at the airport. Pay with Scapia. They will return up to INR 1,000 worth of coins into your account if you shop at one of the six major metros in India (Mumbai, Delhi, Bangalore, Chennai, Kolkata, and Hyderabad) at an airport outlet listed in the app. At other airports, they reimburse up to INR 500. Please select the outlet and activate it before swiping the card.

- Sign up for Lounge Access at the Airport. If you are not the shopping or eating at outlet kind, you can opt for old-school lounge access, which is available via a QR code generated in the app. At last count, 25 cities in India had lounges accessible through Scapia.

- Spa. At some airports, Scapia will also offer Spa privileges, allowing you to enjoy a quick treatment before boarding your flight. For instance, this is not available in Delhi but is available in Mumbai.

Remember, you can only claim one of the four perks in one airport departure, not all four.

I signed up for the card when it reopened for applications, and it was delivered with a fairly generous limit. I’ve heard that the card is also available to existing Federal Bank customers. I have no shortage of credit cards that offer lounge access, but I appreciate the feature that allows me to sit at a coffee shop and be reimbursed for it, rather than having to head to the lounge.

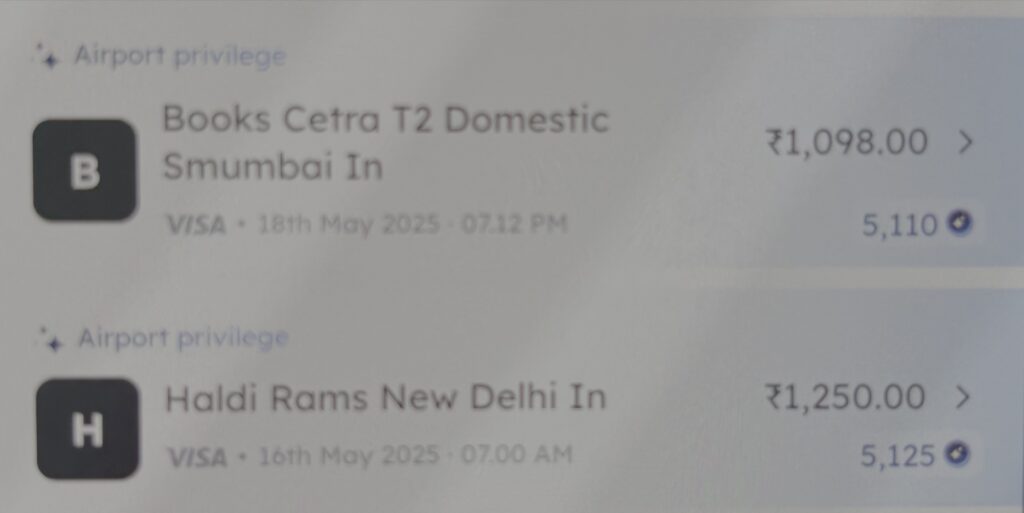

For instance, I was away for the Guns N’ Roses concert in Mumbai, and on the way out, I picked up some sweets, which were immediately reimbursed with 5,000 coins. For the return from Mumbai, I picked up some books and received 5,000 coins again. These coins are worth INR 0.2 each, so basically, I have coins worth INR 2,047 on a spend of INR 2,348, which is not bad at all.

Scapia International Spends: Zero Markup

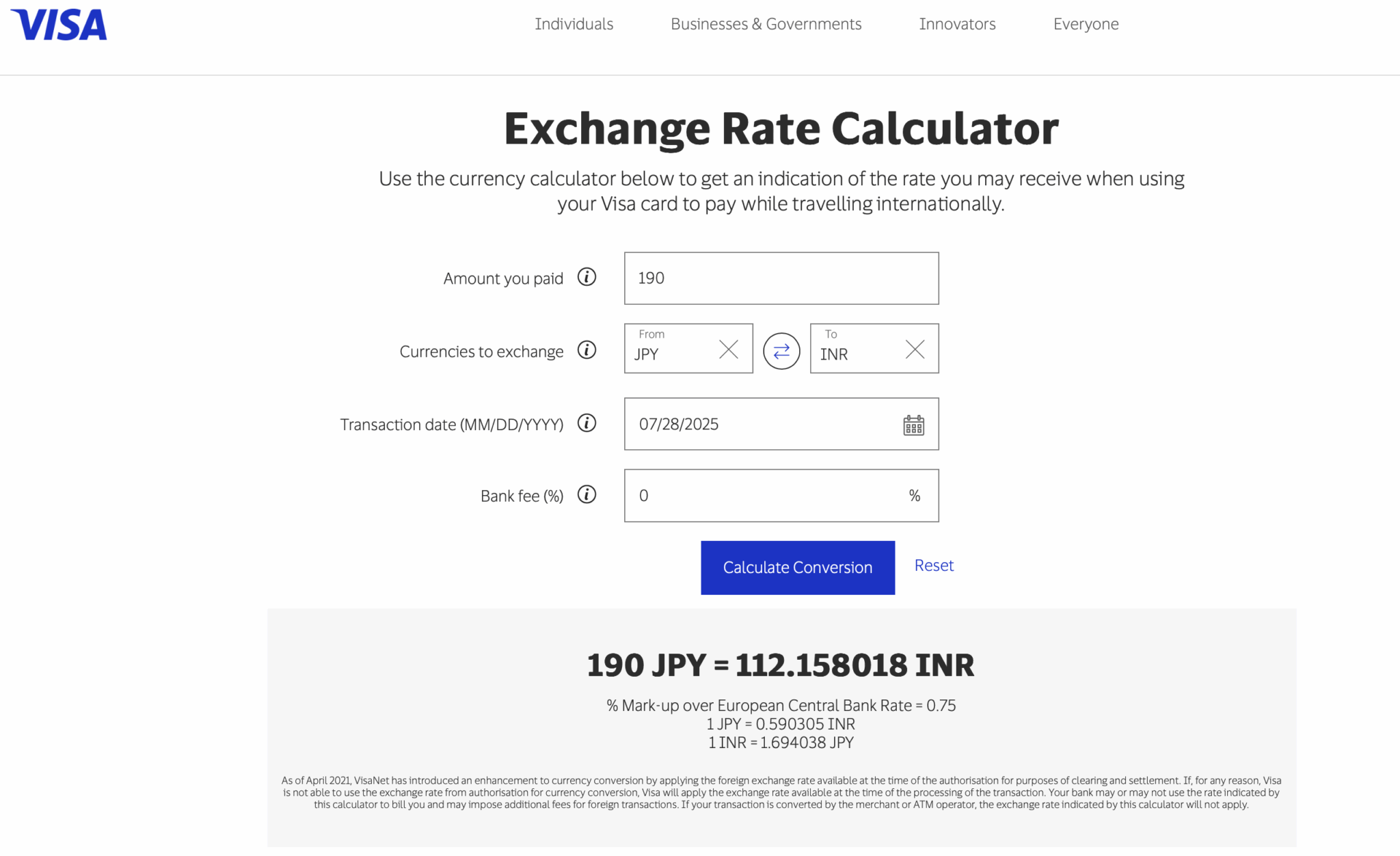

Internationally, this card is for all the pocket change expenses where I don’t care so much about the points, but to keep it away from my high-value spend card, the Olympus—a soda here, a small snack there. For instance, here is a swipe I made recently at the Tokyo Haneda Airport.

Which was posted exactly as Visa would have wanted it to post.

You can proceed with applying for the card here. Remember to collect your 1000 coins once the card is approved.

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Leave a Reply