There’s a simple idea at the heart of the Scapia card: make everyday spending turn into travel, and remove the minor irritations that make travel expensive (read: forex markups and clunky redemptions). On paper, that’s an attractive proposition for someone who travels regularly but doesn’t want to carry a portfolio of cards. In practice, Scapia’s strengths are a genuinely easy app-first experience, a straightforward rewards currency (Scapia Coins), zero forex markup and a clever set of airport-centric benefits. I’ve been using the card since March 2025, and now, six months later, I’m reviewing it to see if it still checks out.

Scapia Credit Card Overview

The Scapia Credit Card serves as an entry pass to the Scapia Travel Booking Ecosystem, powered by an app. Scapia, a fintech company, has partnered with Federal Bank to issue credit cards. The credit cards are issued in accordance with Federal Bank’s policy. Approval is swift, and you’ll receive a digital card in the app within 24 hours. Limits are usually reasonable, too. From there, you get a physical card within a week, delivered to your address. The kit also includes some stickers. The card is free for life, so you’ll never have to worry about a fee.

Scapia has recently joined the RuPay bandwagon, offering two cards: an Orange card on the Visa network and a Green card on the RuPay network. If you are an older customer, you can get the RuPay Card separately issued via the app. A slight nuance, if you are a male cardmember, you get a card with a guy wearing a hat. If you are a female cardmember, you get a card with a girl wearing a hat.

Scapia’s Rewards Ecosystem: Scapia Coins

Scapia grants “Scapia Coins”, which are the unit you earn and spend. Each coin is worth INR 0.2 at the moment, so five coins are worth INR 1. You earn 10% coins on regular spends, i.e., everyday spends on the card (which is equivalent to 2% in INR Value). When you book travel through the Scapia app, the rate is 20% coins, which converts to an effective 4% return on those bookings in INR terms. The travel bookings on the app include flights, hotels, visas, buses and trains.

On the RuPay network, you can spend using UPI or your card. You earn 5 Scapia Coins for every INR 100 spent, which translates to 1% returns. The other nuance on the RuPay network is that you only get coins when spending at least INR 500 in one go.

Scapia Coins have a 36-month validity in normal circumstances and — importantly — if the card is unused for more than 365 days, accrued coins are nullified. The excluded categories for earning Coins include rent, education, gift cards, fuel, government spending, and wallet top-ups.

Unlimited Airport perks and lounge access

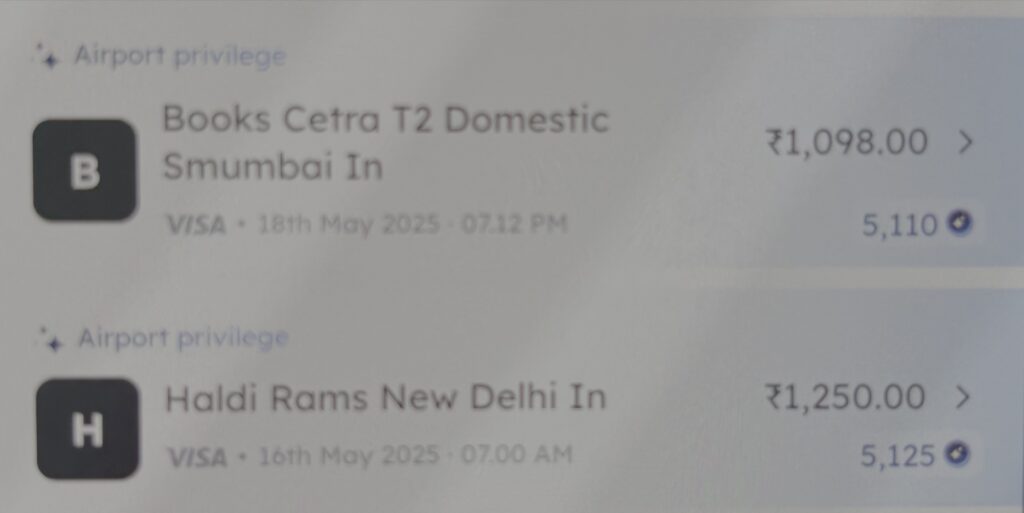

Scapia’s airport benefits are the differentiator. There are four selectable “airport privilege” options: lounge, dine, shop or spa, and the product gives you value back on airport spends for every domestic departure (caps vary by airport). In the top six cities of India (which are Delhi, Mumbai, Bengaluru, Hyderabad, Chennai and Kolkata), you can eat at an airport outlet or shop at an airport outlet for up to INR 1,000. Upload your boarding pass before swiping the card and receive up upto 1000 INR worth (5,000 Scapia Coins) immediately as the transaction is processed. At other Indian airports, it is up to INR 500. If you book a ticket through Scapia, they won’t need the ticket since they already have it.

You can only pick one of the four perks for one departure, and the name of the cardmember should match the name of the person travelling. Your other option is to go to the lounge or use an airport spa if available at the particular airport. Both cases are handled via QR code generation, which comes in once your ticket is uploaded. You can switch between the options until you have consumed the option at the airport. Also, one airport unlocks only once in 24 hours. For instance, if you are doing a DEL-IDR-BOM or a DEL-AMD-BOM ticket (Air India sells these connections), you can use the benefits at Delhi, Indore/Ahmedabad, but not at Mumbai. And the airport will unlock again after 24 hours, so that is a fair use built in.

Complimentary unlimited domestic lounge access is unlocked if you meet a modest monthly spend requirement ( INR 10,000 per billing cycle for Visa cardholders; or INR 15,000 for RuPay). It then stays valid till the next billing cycle, which you can check out in the dashboard.

Here is an instance of Scapia’s benefits, when I travelled to Mumbai and back in May 2025. I end up using these a couple of times a month, if not more.

Forex and international spends – Zero Markup

The card carries 0% foreign-currency markup. That alone changes the math for anyone who spends abroad or books international travel and hates seeing a 2–3.5% bank markup on top of the card network FX. With zero markup, you avoid that added per cent (and the GST on that per cent), so for regular international spenders, the savings compound quickly. The global spending contributes to your total monthly billing, which can help you clear the INR 10,000 barrier. However, you don’t receive any rewards for international spending.

How redemptions work — and what you can’t do

Coins can be used for travel redemption on the Scapia App to book flights, hotels and buses at the moment. More options might come in the future. The coins are not a statement credit option — they are an app redemption currency for travel and travel-adjacent offers. That makes the product strongly travel-oriented rather than a pure cashback card.

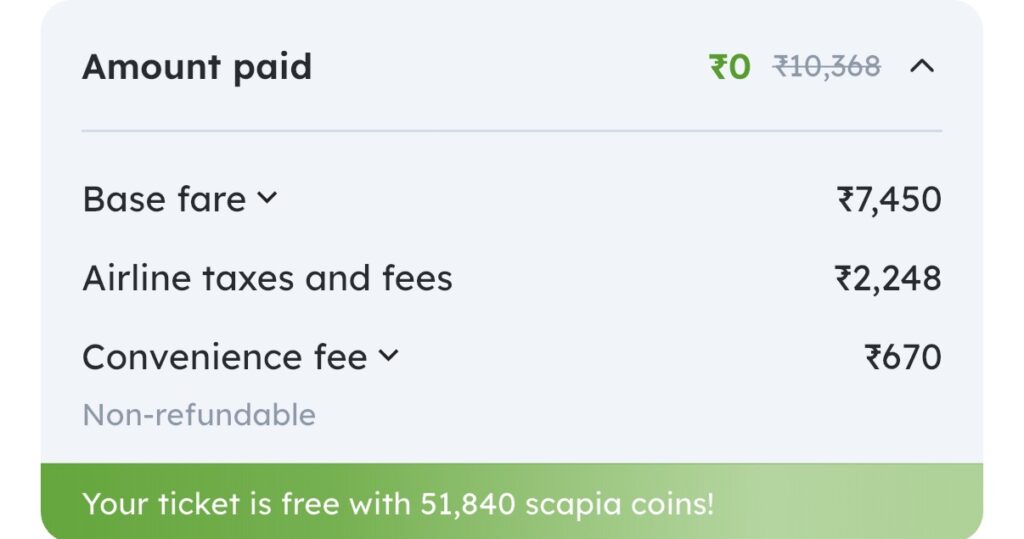

With flights, the beauty is that this is a double dip. If you book a flight on, let’s say, Air India, you can also claim Maharaja Points on the ticket. For instance, here is when I booked tickets between Pune and Delhi for two a few months ago. No out-of-pocket payments are required if you have enough coins. If you don’t have enough coins, you can adjust the payment with Scapia Coins and pay the rest with your card.

Onboarding and day-to-day experience

Scapia’s onboarding is intentionally app-first. There is a fast online application process, quick KYC scheduling, instant virtual card issuance and physical delivery within a few days — exactly the smooth digital flows you expect from fintech-led cards. The app’s UI and activation flow are central to unlocking benefits (activate airport privilege for a trip, generate a lounge QR, swipe the coin slider at checkout, etc.). If you like tidy mobile-first product flows, this one checks that box. You can apply here.

Where Scapia deserves credit — and where it’s intentionally narrow

Scapia’s strengths are clarity and focus. It provides a transparent travel currency (you can calculate rupee value from the 5:1 coin rule), eliminates forex markup for international spending, and pairs that with practical airport benefits that meaningfully improve trips. The app-led experience and fast virtual-card issuance are strong positives in a market where many digital signups still stall.

The trade-offs are also clear: this isn’t a card that gives statement credits or a flexible rupee cashback you can spend anywhere. The coins are travel-centric and must essentially be burned on the Scapia platform, so if you prefer pure cashback or statement credits, this will feel restrictive.

Who should add Scapia to their wallet?

If you travel domestically or internationally a few times a year and value airport lounges but don’t want to pay an annual fee for those conveniences, Scapia is an excellent addition. It’s especially compelling if you also book travel via apps (you’ll get the extra coin uplift there) and you like the idea of a single, simple travel coin economy rather than juggling multiple bank points.

Bottomline

Scapia is a lifetime-free, co-branded Federal Bank card aimed at travellers. It gives a base effective return of about 2% on regular spends and about 4% when you book travel through the Scapia app (because of the coin economics), charges 0% forex markup on international transactions, and unlocks unlimited domestic lounge access or airport consumption provided you meet the modest monthly spend hurdle. The card is digital-first, with fast virtual issuance and an app that makes redemptions simple.

If you prioritise travel convenience and app simplicity over flexible cash redemptions, go for it; otherwise, treat it as an excellent niche product rather than an all-purpose wallet replacement.

Apply for Scapia Credit Card here, and get 1000 Coins on approval

Do you already hold the Scapia Credit Card? What has been your experience with the card?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Cons: The party’s gonna be over someday.

Pros: But not today. The airport benefit is hard to say no to.

Applying via link.

Is there any eclusions on spend requirement for airport privileges, like wallet reloads, fuel, etc ?

@Swastik, not to my knowledge