Like I wrote just a few days ago, SBI Card and Vistara were going to launch their new co-brand credit card, and I headed up to the launch to check out what the product was all about. Vistara and SBI Cards got together to work on this product about six months ago and came a long way into launching a new product as quickly as this one happened.

When it comes to reach, no one can beat the spread of the SBI Bank network around India in terms of physical presence. Here, Vistara did some excellent thinking to tie-up with “the Bank” as it is known in India, to get Club Vistara in the hands of more and more people. This is in line with the approach that the CEO of Vistara, Leslie Thng, speaks about, again and again, to make Club Vistara more of a lifestyle programme rather than just a travel benefits programme. Expect a lot more new announcements of partners from Club Vistara, and this is just a start on that front.

Leslie, at the launch, said, “Our endeavour is to enhance the value proposition of Club Vistara and elevate its position from a frequent flyer program to a more attractive, comprehensive lifestyle program that makes an essential part of everyday lives of our customers. As travel spends continue to significantly rise among today’s urban consumers, we wish to provide more options to the ever-increasing number of our loyal customers to join Club Vistara and enjoy the privileges of their Club Vistara membership.”

Even SBI Cards is keen on bringing on more products focussed on the travel and lifestyle segment, given they see their data and see a lot of spend and demand from their customers on this segment.

At the launch, Mr Hardayal Prasad, CEO of SBI Cards said, “SBI Card has always strived to bring products for its customers that are customised as per their diverse lifestyle and preferences, offering maximum value and enhanced experience. Travel is one of the key spend categories for our cardholders. Through our partnership with Vistara, India’s best airline, we aim to address unique requirements of our customers, especially urban millennials, whose spend on travel has increased over a period of time and are looking for related privileged benefits. This launch has increased our travel credit card portfolio that we have built over the years, targeted at fulfilling the varied needs of our customers.”

The two variants of the Club Vistara SBI Card come with various benefits, such as complimentary Club Vistara Silver/Base tier membership, welcome tickets on Vistara’s domestic network, One-Class Upgrade voucher, free cancellation on Vistara bookings, travel insurance protection, lounge access vouchers, complimentary membership to Priority Pass Program, and attractive rewards on reaching milestone spends.

The top-end variant is called Club Vistara SBI Card PRIME. This card offers a Silver tier membership to Club Vistara on enrolment and renewal. Hence, Cardmembers earn nine Club Vistara (CV) Points for every INR 100 spent on flight ticket bookings with Vistara (unless of course, you already have a higher tier, where you earn more). On day to day spends, Club Vistara SBI Card PRIME holders earn four CV Points for every INR 200 on eligible spends. These CV Points can be redeemed for domestic and international flights on Vistara and its partner airlines.

Here are the key features of the Club Vistara SBI Card PRIME, which has been coded blue to go along with the colours of the Vistara Premium Economy proposition

- 4 CV points/ INR 200 spent on the card.

- Complimentary Club Vistara Silver tier membership every year, which gets you lounge access as well as an upgrade once a year, apart from check-in at PEY counters and enhanced baggage allowance.

- A one-way Premium Economy class ticket on Vistara’s domestic network as welcome benefit and renewal each year

- Up to 4 additional one-way Premium Economy class tickets on Vistara’s domestic network upon reaching key milestones in spends

- INR 1.5 lakhs

- INR 3 lakhs

- INR 4.5 lakhs

- INR 8 lakhs

- Hotel gift voucher of worth INR 10,000 upon reaching key milestones in spends

- Up to 6 free cancellations of flight tickets booked directly with Vistara per annum.

- Two complimentary lounge visits domestically per quarter and four complimentary lounge visits per annum internationally.

- 3000 bonus CV points on spending INR 75,000 within 90 days of card issuance

- The card costs INR 2,999 + GST for the first year and onwards

Here are the key features of the Club Vistara SBI Card, which has been coded blue to go along with the colours of the Vistara Premium Economy proposition

- 3 CV points/ INR 200 spent on the card.

- A one-way Economy class ticket on Vistara’s domestic network as welcome benefit and renewal each year

- Up to 3 additional one-way Economy class tickets on Vistara’s domestic network upon reaching key milestones in spends

- INR 1.25 lakhs

- INR 2.5 lakhs

- INR 5 lakhs

- Hotel gift voucher of worth INR 5,000 upon reaching key milestones in spends

- Up to 4 free cancellations of flight tickets booked directly with Vistara per annum.

- One complimentary lounge visit domestically per quarter.

- 1000 bonus CV points on spending INR 50,000 within 90 days of card issuance

- The card costs INR 1,499 + GST for the first year and onwards

With these cards, Club Vistara and SBICards are focussing on the bigger pool of customers they can work with, rather than the small set of customers who would buy the most premium end of the card, hence no card which offers Business Class in their stable.

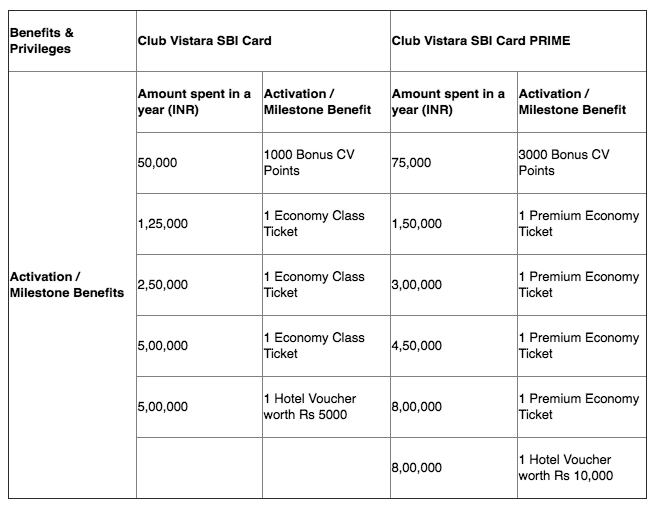

Here is the matrix of card benefits on various milestones.

Notice a few other things as well. The base variant gets you 1 CV point more / INR 200 than the parallel product from Axis Bank (Axis Vistara Card). Secondly, the SBI Card product has free cancellations built into the product, which is suitable for those who are prone to changing plans, as long as you are booking directly. Each cancellation is limited to INR 3,500 only, but nowhere does the card description say that is this only valid for the cardholder, or also other people booked by the cardholder. Third, this card even earns you points on fuel transactions. Fourth, the last milestone is lesser as compared to the parallel Axis Bank products.

- Club Vistara SBI Card PRIME offers up to 4 additional one-way Premium Economy class tickets on Vistara’s domestic network upon reaching key milestones in spends, compared to the Axis Vistara Signature Card

- INR 1.5 lakhs

- INR 3 lakhs

- INR 4.5 lakhs

- INR 8 lakhs (Axis Vistara Signature Card offers this at INR 9 Lakhs)

- Club Vistara SBI Card provides up to 3 additional one-way Economy class tickets on Vistara’s domestic network upon reaching key milestones in spends, compared to the Axis Vistara Signature Card

- INR 1.25 lakhs

- INR 2.5 lakhs

- INR 5 lakhs (Axis Vistara Card offers this at INR 6 Lakhs)

Besides all of this, notice the move from co-branding the card with Vistara to co-branding the card with Club Vistara, which will add to the top-of-mind recall of the programme with everyone pulling out the card ever so often, and thinking about CV points earned.

If you are planning to apply for this card, to avoid getting a new Club Vistara number auto-generated by the airline, make sure to use the same email address as enrolled with Club Vistara (apart from providing your CV number). In case of this card, points will get auto-credited to Club Vistara ten days after the statement is generated. Your challenge would be to wade through the broad swath of SBI Card propositions and pick the one you want since only one co-branded card is allowed per customer.

Bottomline

Club Vistara SBI Cards is a strong proposition when compared with the parallel products from Axis Bank. It adds more value as compared to the Axis Bank proposition (free flight cancellations and hotel vouchers). Not just that, SBI Card has a great franchise and it helps with the service on this card product as well. Club Vistara already has over 1.6 million members, and perhaps this card would help them get a significant number of new enrolments for Club Vistara in the days ahead.

What do you think of the newly launched SBI Vistara Credit Cards?

I’m thinking of surrendering the SBI-AI card and get this one, but there’s one big difference that I see is that AI gives miles while this card gives vouchers.

How’s the availability of seats on these vouchers. I’ve heard that only 1 seat is available per flight under this category. If that is the case then usability of these vouchers goes down drastically for me as I rarely travel alone. Even if I’m able to manage 6-7 vouchers in a year, I won’t be able to use them if I can’t book at least 2 tickets at a time.

hi,

I recently got this card (last week).

At the outset, disappointed by the low credit limit received, so low that existing cards have more than 3x the limit on this one.

The card got blocked automatically during online transactions, which resulted in 4 failed transactions, 3 of which were flight ticket bookings.

I am an existing Club Vistara member, which was specified at the time of applying. Despite that, I got a new membership number on the card. Customer service at both SBI Card & Vistara has been pathetic, with more than 10 mins of wait on call and still no response.

I also can’t find the link to pay the membership fee (1499) to get the benefits activated.

Has any of the users faced similar issues & can suggest how to get it resolved?

Hi Nachiket,

You will get the membership benefits activated once you have paid the annual fees of the card. This will come in your 1st monthly statement, asking to pay for the card. After paying the annual fees of the card, you will get your membership benefits activated post 15 days of the payment. Same was the case with me, when I paid for SBI Vistara Prime card, I got the membership status and the complimentary vouchers within 15 days post the payment.

Also, about the new CV membership, which you have got, speak to Customer Care of Vistara. The wait time is indeed bit more, sometimes for me, it has gone to more then 15 minutes, but was able to speak to their customer care and get the issue sorted out. Their CC is good and up to the mark. They will always get the issue sorted out, though it will require some patience from our end, as there are many people, who call them everyday.

For me, I had got a Lounge Access Voucher, One Premium Economy ticket voucher and One-class upgrade voucher. Well, I am hoping to use them for sure. Vistara upon teaming up with SBI is offering a lot of benifits. Also, not to mention, they even provide you the Priority Pass(used for accessing International lounge), which I have got for myself. As compared to other bank benfits, this is a lot, one can get for benefits.

Hope this has been helpful. Have a great journey with Vistara!

Regards,

Aviation Fan & Enthusiast,

Amrit

Hi would love to see at-least 5X / 3X for spends on vistara portal as a base feature. Overall a better package compared to Axis offerings.

Hi Ajay,

I wanted to ask if there’s any way to retain/get vistara silver after the end of the 1st year (won’t be able to collect enough points or flights)

Hi Ajay,

The application page says that complimentary ticket is given with Annual fees only. By going with their wording then it doesn’t mean that there will be a complimentary ticket with payment of Renewal fees.

As, is the case with Axis cards which I have tested.

hi,

will this card provide any benefit, if a person already hold axis vistara INFINITE..as it already gives GOLD status, and 6 points per 200 spends..but yes, i think Axis might be challenged to provide something like hotel vouchers in this card..