I’ve been on the trail of the SBI Aurum Credit Card, which has been teased by SBI Cards for a while as their new premium offering, going up and above the SBI Card Elite which they have had so far as their top-tier credit card.

SBI Cards is planning to enter the super-premium cards space with something called Aurum, a black card with a gold streak in the middle. Might just be invite-only, given some of the data points I've seen so far. (Don't @ me) pic.twitter.com/UaVF4SaGh5

— Ajay Awtaney (@LiveFromALounge) January 14, 2021

The new card is finally launched as an invitation-only credit card at the moment, and here is what we know about this new card from the SBI Cards stable. SBI Cards has created a special website for this card at aurumcreditcard.com and also ran full-page front-page ads without much information about the card in the newspapers.

The new SBI Aurum Credit Card is going to be a metal card, with a fee of INR 10,000 + GST per annum. With the metal card in tow, this makes SBI Card one more in India after American Express Platinum Card and One Card to be offered in a metal form factor.

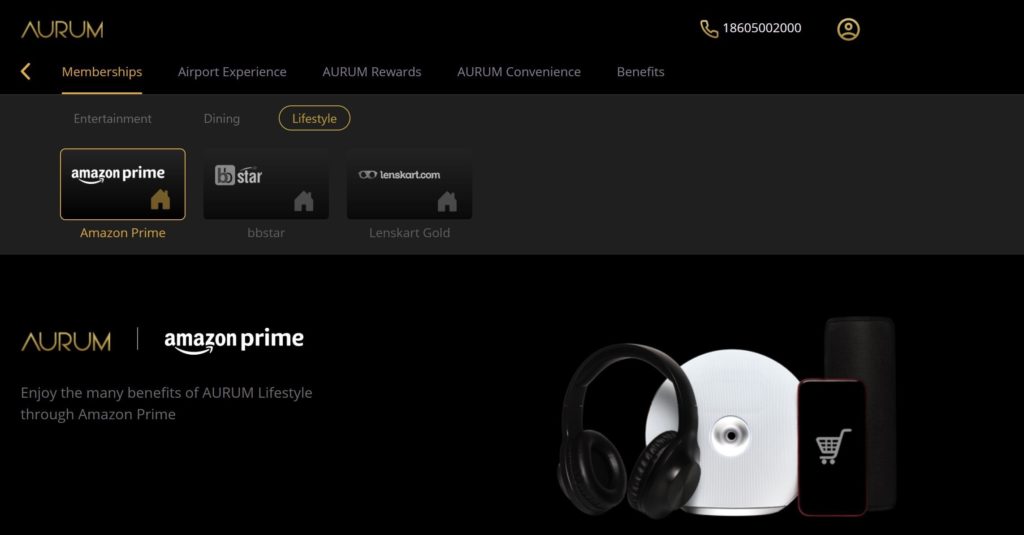

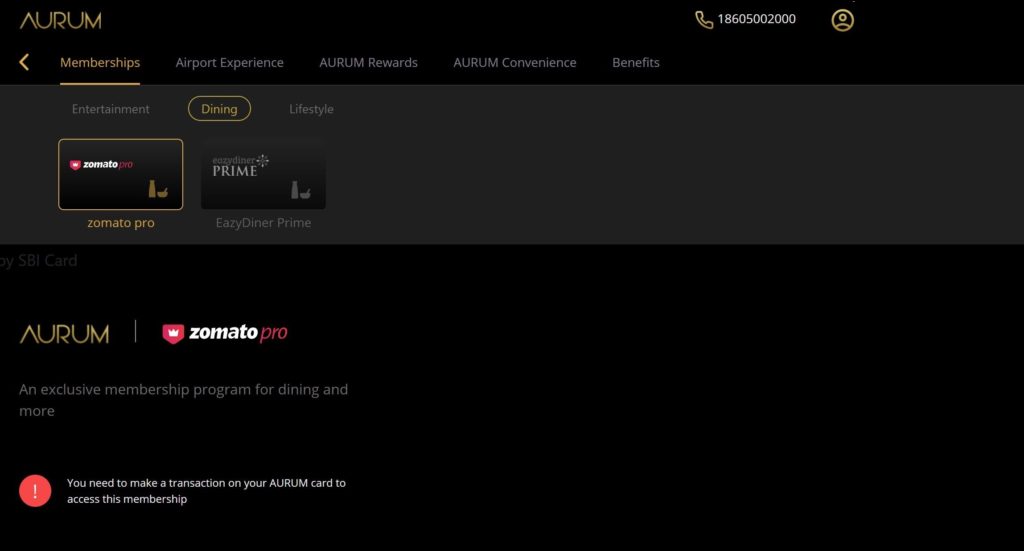

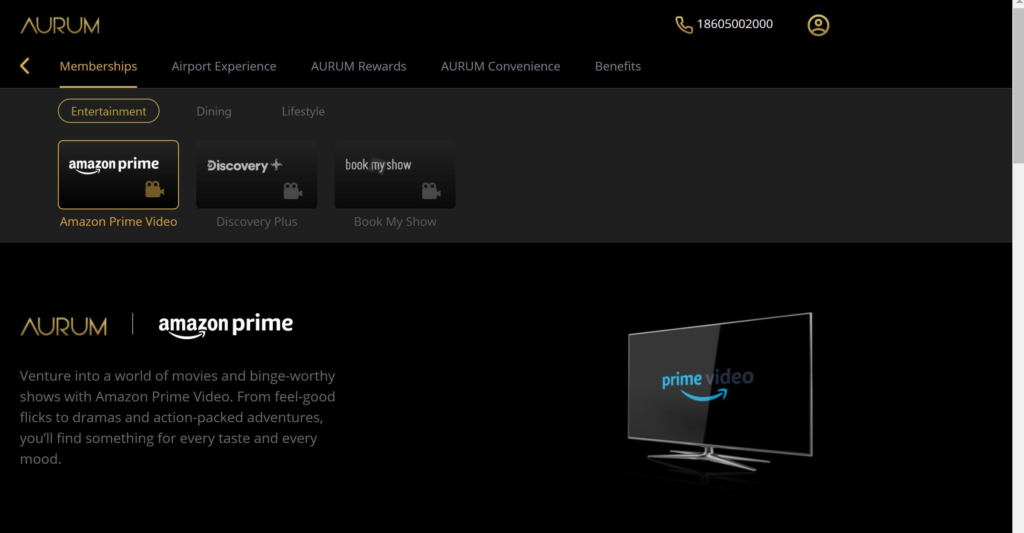

Membership Perks with SBI Aurum Credit Card

SBI Card will offer the following Entertainment, Dining and Lifestyle membership perks:

- Amazon Prime subscription

- Discovery Plus subscription

- Zomato Pro subscription

- EazyDiner Prime subscription

- bbstar membership

- Lenskart Gold membership

Err, the marketing tagline is “A Credit Card with curated privileges, exclusively for C-Suite executives”. To the best I know working with these people, they are not after free delivery of their grocery with bbstar.

Monthly Movie Tickets for INR 1000

SBI Cards will offer the Aurum Cardmembers monthly tickets worth INR 1,000 each (a total of INR 12,000). The Bookmyshow offer page for these tickets is now live. Each ticket discount can’t be more than INR 250 and you cannot claim more than two tickets in one transaction.

Joining and Milestone Benefits

SBI Cards’ Aurum Credit Card will offer 40,000 Reward Points, that will be redeemable at a value of INR 0.25 per point, for booking flights, hotels and so on via a portal. This comes in line with what almost all premium credit card issuers do for their paid cards, make up the entry fee to the club free by offering points or freebies for the first year.

The card also comes with milestone benefits, which do look pretty lucrative but are middle of the road.

- Tata Cliq vouchers worth INR 1,500 per month of crossing INR 1 Lakh spend

- Reliance Brands vouchers (Diesel, GAS, Hamleys, Ermenegildo Zegna, Giorgio Armani, Bottega Veneta, Jimmy Choo, Burberry and Salvatore Ferragamo amongst others) worth INR 5,000 when you cross INR 5 lakh spend per annum

- Taj Vouchers worth INR 10,000 when you cross INR 10 Lakh spend per annum

- Waiver of annual fees for the next year when you cross INR 12 lakh spend per annum

Airport Benefits

In terms of airport benefits, this card offers you unlimited lounge access when you are travelling abroad, but only four lounge access domestically per quarter. I am not sure what the product managers at the SBI Cards and various other card companies in a similar boat go for here. They place limits on domestic lounge access which is much much cheaper and put out unlimited international lounge access (which, perhaps they know and hope for is not going to be used as much, hence keeping the costing low).

Foreign Exchange Rates on SBI Aurum Credit Card

For a card pitched in a high-end category, SBI Cards hasn’t moved the market. SBI Card will offer a forex interchange rate of 1.99% plus taxes on this Aurum Card, and that too, for transactions over INR 1,000 only. So your small tap and go transactions on the trains and so on, might not count, as long as you are spending anywhere less than USD 14.

I know there is more information awaited, such as the reward point earning ratio, but here is the simple deal, looking at the membership perks and the benefits on offer, it did not come across as something unique, and either most Indian card issuers don’t have the P&L to spend on unique partners, or they don’t have the reach to get it done.

Is it worth it?

Bottomline

SBI Cards has finally entered what is perceived as the top-end of the market where they will see competition from Axis Bank, HDFC Bank, IndusInd Bank and so on. SBI Aurum Credit Card is a metal form, and SBI Card tells everyone it is 6.6 oz in weight. And don’t go by the invite-only moniker, SBI Cards has kept it open for everyone (although temporarily the application link is down)

Have you signed up for the SBI Aurum Credit Card? Do share if there are things we need to know with this card?

P.S. Do keep your metal card safe because SBI Cards will charge you INR 1,500 if you need a replacement. Gulp!

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Irony is it is not based on your worth but on your age!

Persons older than 65 not eligible. Just when they can afford it.

@TJ Irony is you don’t realise most people who are their TG (salaried), retire at that age.

Nice

The new card was finally launched as an invitation only credit card at this time, and here we know about this new card which is SBI cards standard.

I believe there is ICICI CORAL card with invitation only with 5000 joining fees and more benefits

Wrong belief you have there

Sorry. It is called Carbon.

Pl check ICICI . It is invite only.

I had carbon, its discontinued now

if it has no travel tie up benefits such as taj or vistara or air india gold or equivalent membership in tow alongwith the card then it aint premium for me.

Not worth.

What is your opinion? is this card worth.