One of the differentiated launches over the past few weeks in the credit card space has been from IndusInd Bank Credit Cards and EazyDiner, which has been one of the most reliable restaurant-booking platforms for years now around India. Coincidentally, its launch came around the time Zomato/RBL Bank wrapped up the 5% reward rate on the Edition co-branded card (effective September 22, 2022), and HDFC Bank had already removed the 2x points on standalone restaurant some time ago.

EazyDiner is the only independent table-booking platform in India; now that DineOut has changed hands from Times Internet to become a part of Swiggy and Zomato, well, it was always part of a more extensive ecosystem inside Zomato. EazyDiner’s partnerships are with higher-end restaurants, so you will find a lot of fine-dining establishments and casual dining restaurants on board their website/app for your reservations to be made.

The EazyDiner IndusInd Bank Credit Card

With restaurants running full nowadays and insisting on prior reservations, there was never a better time to be an EazyDiner Prime member. EazyDiner Prime is the dining programme that EazyDiner usually offers membership for INR 2,495 for a year, and the programme provides upwards of a 25% discount at various restaurants around India. The discounts could also go up to 50% in some cases. Fortunately, the EazyDiner IndusInd Bank Credit Card offers it as a part of the membership as long as you hold the card.

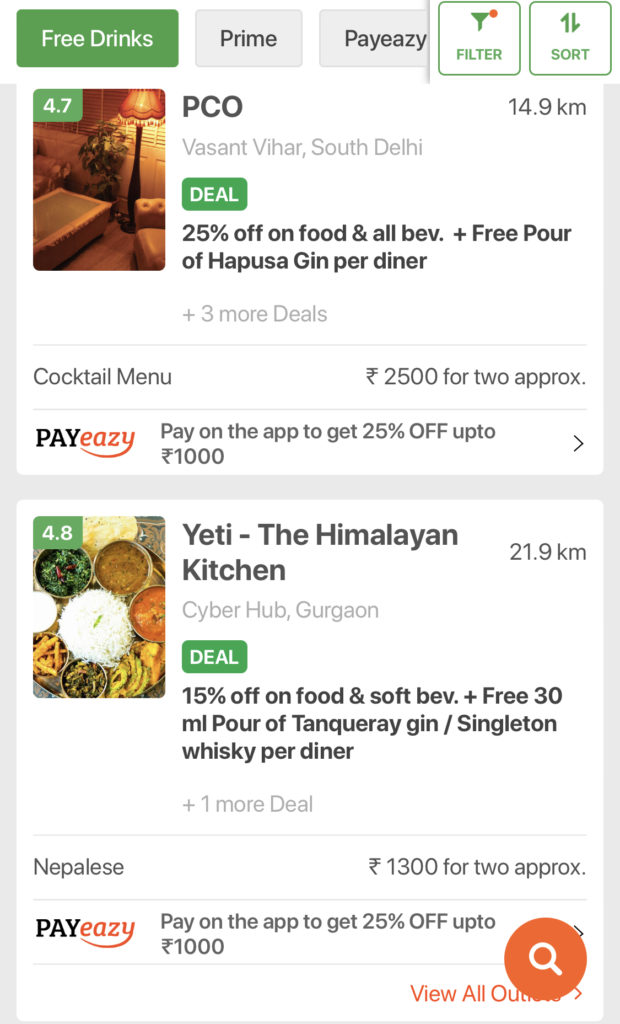

Beyond that, customers of the card will get another 25% discount when paying at any restaurant (with this card) using PayEazy, the inbuilt bill payment capability on the EazyDiner app, up to a maximum of INR 1000 per transaction. The beauty here is that the use of this 25% discount is unlimited for now, unlike the other bank offers that tie up with EazyDiner, and it is automatically applied. So, you could be, for instance, a business development person meeting three different sets of clients for breakfast, lunch and dinner, and you could get the discount thrice over in a day. The only catch is that if you do consecutive transactions at the same restaurant within 2 hours, the extra 25% discount won’t be applied, which is a Fair Use Clause.

To add to it, the subscribers of the card unlock a “free alcoholic beverage” at about 200 restaurants across the country, where they get a premium beverage pours for all diners on the table, free of cost. Labels include Black Dog Whiskey, Hapusa Gin, Singleton Whiskey and so on, but the list of spirits is decided by the restaurant and displayed upfront on the app.

Signup Benefits

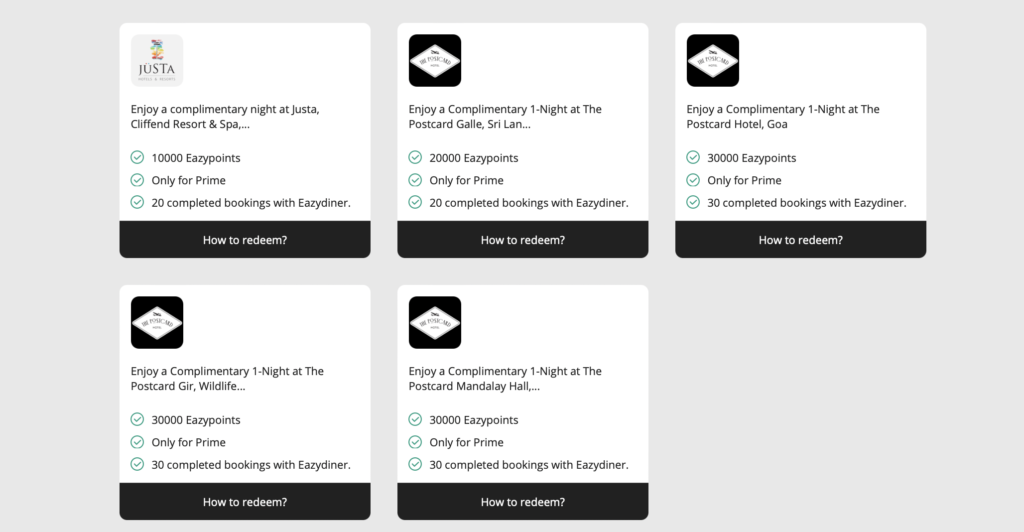

On signup for the EazyDiner IndusInd Credit Card, you get the delivery of a nice big box, which includes your card and some nifty coasters. Along with this comes an INR 5000 voucher for incidentals at the Postcard Hotels, the other project promoted by EazyDiner founder Kapil Chopra. Besides, once your EazyDiner account is joined with your EazyDiner co-branded card, you will automatically be upgraded to EazyDiner Prime and get 2000 EazyPoints, which is the loyalty currency of EazyDiner. The currency is added to your EazyDiner account on payment of the fee of INR 1995+taxes for the card.

Earning and Burning Rewards

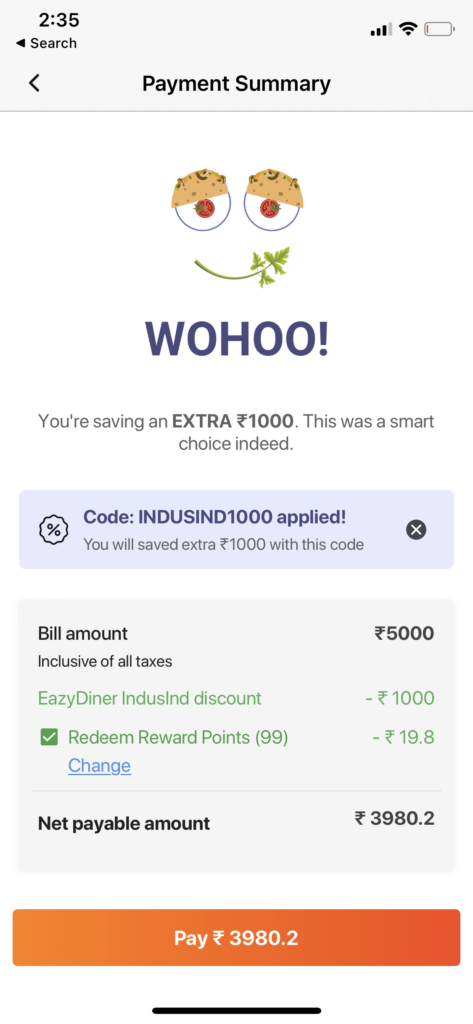

Using this card, you earn 10 Reward Points for every INR 100 spent on dining, shopping and entertainment. You earn 4 Reward Points per INR 100 spent for all other spends. Each Reward Point is worth INR 0.2, so you get a 2% return on spending for dining, shopping and entertainment. This is one of the highest returns on dining offered for lifestyle spending.

Reward Points earned on the EazyDiner IndusInd credit card can be redeemed at the time of payment via PayEazy against the restaurant bill. Reward points cannot be redeemed against cash credit. It would help if you used them on an ongoing basis because accumulated reward points will expire at the completion of every anniversary year.

It is essential to distinguish between EazyPoints, which are earned for dining, and the Reward Points you earn for spending. EazyPoints accumulate for using the EazyDiner app and when you go to an EazyDiner Prime restaurant. You get 3X EazyPoints on using EazyDiner for making a reservation, so 75 points per diner instead of 25 per diner for a non-Prime member and 50 points per diner for a Prime member. You can use them for various EazyDiner and PostCard Hotels redemptions, apart from renewing EazyDiner Prime and so on. Since I’ve been a long-time EazyDiner user, I have most of their offers unlocked, and these are the higher-end ones.

The reward points, on the other hand, are for the use of this specific credit card. You can use them at INR 0.2 value for redemption per point when paying your bills using the EazyDiner app.

Travel Benefits

EazyDiner IndusInd Bank Credit Card also comes with travel benefits, specifically, domestic lounge access twice a quarter. There is an extensive list of 35 lounges across India where this benefit is offered.

Entertainment Benefits

Every month, you can claim two free tickets on BookMyShow, capped at INR 200 value per ticket. The feature works just like any other bank offer at BookMyShow, except that you can utilise both the free tickets in the same transaction, so this is not a Buy One Get One promotion such as that with ICICI Bank.

Bottomline

The EazyDiner IndusInd Credit Card is made for those who like to dine out. In the major cities, there is excellent coverage of the kind of restaurants you would find listed on EazyDiner, enabling you to use the card towards earning a free meal or a date night with free pours of Gin! Additionally, you have unlimited access to a 25% discount unique to this card, which is over and above the 25% discount you might get at EazyDiner Prime participating restaurants. Overall, the card pays for itself and pays back many times over if you are using it for lifestyle and dining spending. You can apply for it via EazyDiner or the IndusInd Bank Credit Cards website.

Have you signed up for the EazyDiner IndusInd Bank Credit Card yet? What are your thoughts around the product proposition?

Liked our articles and our efforts? Please pay an amount you are comfortable with; an amount you believe is the fair price for the content you have consumed. Please enter an amount in the box below and click on the button to pay; you can use Netbanking, Debit/Credit Cards, UPI, QR codes, or any Wallet to pay. Every contribution helps cover the cost of the content generated for your benefit.

(Important: to receive confirmation and details of your transaction, please enter a valid email address in the pop-up form that will appear after you click the ‘Pay Now’ button. For international transactions, use Paypal to process the transaction.)

We are not putting our articles behind any paywall where you are asked to pay before you read an article. We are asking you to pay after you have read the article if you are satisfied with the quality and our efforts.

Aahaa! Great initiative for gathering some time with family and friends along with low budget

The best credit card for dining out with additional benefits apart from Dining like access to airport lounge, complimentary alcohol drinks, stay voucher, free movie tickets and more

nice