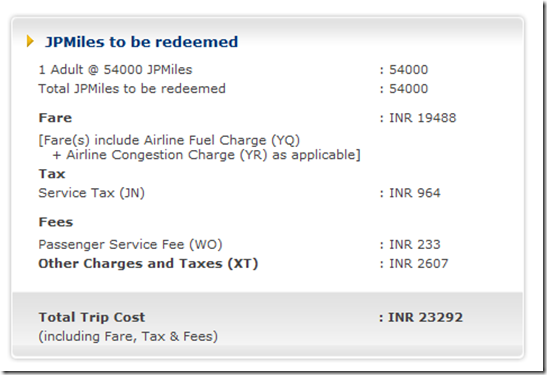

For the existing Citibank PremierMiles customers, they would have received an email communication a few weeks back, announcing a new redemption rate of Rs. 50 per 100 PremierMiles. I did not write about it at that point of time because I was not sure if this was an additional method of redeeming miles, or the only way for redemptions on the website premiermiles.co.in. Here is how it looked.

Now, the PremierMiles credit card has come a long way from its original promise. I discovered this card in December 2011, when it was an also ran product. When the card first launched into the limelight in May 2012 as a replacement to the Citibank Jet Airways credit card, there was a very solid and promising promise not just on earning but burning miles, except you could no longer transfer into the JetPrivilege program. They had India’s dominant full-service carrier Jet Airways still on board, and were offering redemptions on a 10% haircut to Jet’s own chart. Heck, that was beautiful! Here is a look at their chart at that point of time, and then the one from Jet Airways’ own website.

![]()

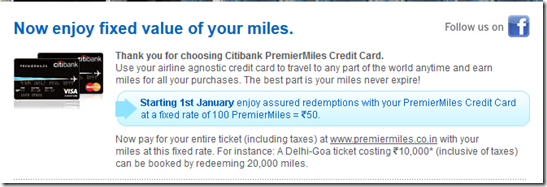

Then, Jet Airways pulled out of the entire PremierMiles program, and we were left with no redemptions on Jet Airways via their website. So, there was a steady redemption chart, which offered economy (full-service & low fare) and business class redemptions, at the same rate as an airline would. Which meant, for instance, 8400 PM for a BOM-DEL redemption in an LCC, 10450 for a BOM-DEL redemption in a full-service carrier such as Kingfisher Airlines or Air india, and about 21000 PremierMiles in Business. What PM was doing, was to extinguish your miles, and book a ticket for you in cash. So, it really worked in their favour to have you spend 8400 PM + some money instead of spending Rs. 4000 on the same ticket on SpiceJet/Indigo/GoAir.

The only way they left to redeem with Jet Airways was a workaround, stating that you buy a Jet Airways ticket and they will refund the value of the ticket with a 50 paise per PremierMile value on that. I did not like that value at all.

Further, a few months down the line, they decided, in the name of an enhancement, it was also a good value to have Indigo tickets available at 50 paise per PremierMile.

Then, they adjusted some of these fixed redemption rates to reflect the costly pricing they were getting on those tickets. For ticket prices that were going up up and away, redeeming Citibank PremierMiles for a fixed cost still looked like a good option for those who had them. Imagine spending Rs. 5,000 on a one-way ticket v/s spending 8400 miles + some money on it, which was going to maybe cost them a bit of money.

Finally, when Indigo started pricing like a mainline carrier than an LCC, they knocked off Indigo from the list of LCCs and moved it to the list of the full-service carriers, at their own will. They also started, on an experimental basis, I am assuming, a dynamic pricing where Citi 2x’d the Rupee cost of a ticket and presented it as a redemption option.

And now, with effect from January 1, 2013 a dynamic redemption is the only option to book on the PremierMiles website. As per the email I reproduced right at the beginning of this post, Citibank decided not to go out of pocket on these tickets anymore, and the fixed option is out of the window.

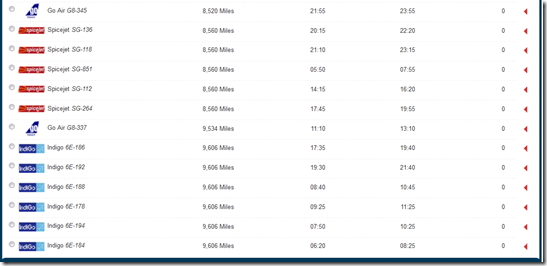

Now, you only get a pricing option on domestic tickets inline with market price of the ticket. Take an example, on BOM-DEL for instance, which was available for 8400 PremierMiles + taxes earlier. Now…you can get it for a better or worse price depending on when you book. Here is a screenshot of some options I picked for a random date, you see redemptions from 8500 PM (inclusive of taxes) to 9600 PM (inclusive of taxes), and there are more as well but not on that page. Below you see the real cost of the ticket at Rs. 4339 on the GoAir website.

I’ve always maintained that I like the transfer option better than the redeem option. It is the sweet spot of the Citibank PremierMiles card. Specially when you can transfer 1:1 to British Airways, Thai Airways, Air India, Delta, Singapore Airlines & Etihad Airways. Sometimes with a bonus thrown in. Cost of miles won’t go up in the days ahead so I hope Citi does not get too greedy and raise these redemption rates as well.

How do you like the new changes to the redemption options? I am indifferent for myself since I’ve never redeemed PremierMiles for a domestic ticket, but I do understand a lot of you do that all the time. But I find this a solid devaluation case.

Leave me a comment below to share your views on how you intend to use your PremierMiles this year, and how these changes affect you.

Related Posts:

- Sunday Plastic: The ‘new’ Citibank Premier Miles Credit Card

- Hang on, do not use your Citi PremierMiles for Jet Airways redemptions

- Citibank PremierMiles: New promotion and Indigo redemptions

- Citibank adjusts some PremierMiles redemptions

- Citibank PremierMiles: Etihad Guest is a partner, Indigo changes & dynamic redemptions go mainstream

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

This is sad. I use it only for Dom redemptions, I am moving out to JP cards.

@Ashwin, if you book in good time, I still see you will get a good redemption rate on metro flights

Yes it is a good idea to transfer to FFP’s esp with the last bonus miles offer. But then with airlines releasing limited inventory of redemption seats topped up with ever increasing taxes. It is becoming a little difficult to keep a finger on once choice.

@theflyingsikh, ultimately, if you transfer into one good FFP depending on your needs, you should be able to earn and burn well. For instance, on long-hauls like to the USA, the value deals on premiermiles.co.in go away!

Im not 100% sure as yet to cancel the card or keep it. But looking at some international redemptions the card now seems to be proving acceptable. Esp when you can choose to pay for miles+money on the payment page and knowing that the tickets issued will be on actual revenue booking class and not redemption class. One can get a certain amount of miles back into the airlines FFP.

For example. I looked at Bom-Sin-Bom on MH is about 44k miles inlcuding tax. If the same sector is redeemed via 9w using JP miles its 40k miles + full tax or 38k miles+tax with Air Indi miles.

As with MH it will be a revenue ticket and one can choose to get miles credited into MH FFP, their partners i.e one-world airlines (from feb) or even jet.

Similar offers for Bkk too on CX and other asian destinations with UL.

Some of the UL redemptions in J class are decent too.

But again all this is related to Airlines offering low fares to certain destinations currently.

@theflyingsikh the best redemptions are in the transfer partners, do you agree?

Hi Aj,

Here is my opinion

http://airlinersindia.s4.bizhat.com/airlinersindia-ftopic12912.html

@theflyingsikh why would you advocate leaving the card.. What would you start using then?