We are ten days away from our next Mileage Mentor MasterClass in Mumbai. Over a period, we have received a large number of requests from our readers requesting us to help them figure which are the best credit cards for travel and in turn, maximise their miles and points earning to travel better. Some people don’t know where to start, and a lot of people who’ve started are finding it challenging to wrap their heads around the business of credit card rewards, airline loyalty and hotel points.

The simple point is that we can all travel better by maximising our everyday spends and earn miles and points on our credit cards. Let me illustrate this to you through a simple example.

Picture this; two families are planning a weeklong summer vacation from Mumbai to London. They also have a similar travel budget of INR 2,00,000 each for two people.

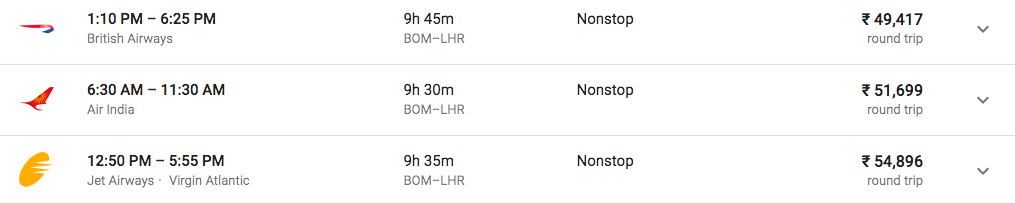

Family 1 compares fares across various OTAs and finally decides to book economy seats on Air India. Their round-trip air ticket costs them INR 1,03,400, leaving them INR 96,600 to find a lovely apartment in London, manage their commute and for sightseeing around the city.

Family 2 is a regular reader of Live from A Lounge and have been collecting points on their travel rewards credit card. They convert points from their SBI credit card to Air India Flying Returns and book business class seats on the same Air India flight using their Flying Return miles. All they pay is INR 3,000, i.e. taxes on that ticket.

Air India Boeing 787-8 Business Class Bed

That leaves them INR 1,97,000 to plan the rest of their London trip. They get a beautiful apartment in Central London, maybe use their AMEX credit card (Free now!) to collect Marriott Rewards points and stay at the plush London Marriott Park Lane which is opposite the Hyde Park. They explore excellent restaurants maybe even save up enough money to add a weekend trip to Bath.

London Marriott Park Lane: The Room

In the end, both families have a great vacation. The only difference being that the family 2 travels more comfortably and to more places with the same amount of money.

The Mileage Mentor MasterClass is intended for folks who wish to travel like family two where Shipra & I will put together all our combined expertise and experience to guide travel enthusiasts who want to travel the world in luxury.

We are doing it and so can you! Imagine flying Singapore Airlines’ First Class all the way from Mumbai to Los Angeles along with a meal in the Private Room, or Etihad Airways fabulous Etihad Apartments from New York to Sydney. We’ve travelled the length and the breadth of the world for next to free, including evergreen hotspots such as London and vacationed on secluded islands in the Maldives using imaginative redemptions.

For instance, we just finished up a 15-day vacation in December, where we spent time in Europe chasing Christmas Markets, and we flew Business Class on the way out & First Class on the way back to Mumbai. We paid only for two hotel nights, and everything else came with points.

Sign up now because we have a nice discount going on on the Mileage Mentor MasterClass Mumbai through February 4, 2019.

In these 3-hour workshops, targetted for the beginners and the intermediate level users, we will talk to you on the following lines:

- Miles & Points Concepts

- Airlines: How to Earn those Miles and How to Burn those Miles to get on the pointy edge of the plane

- Hotels: Why being loyal helps you, and how to maximise your hotel loyalty benefits

- Credit Cards: Learn how to generate miles and points on your everyday purchases, and what works best for your spends.

We are going to talk about the Indian perspective and how you can get the best seats in the house from India. Sign up today so that you don’t miss out on the discount and ask us which credit card you should use to pay for the Masterclass.

After the workshops, we will leave the floor open to help answer your questions. This workshop will be limited to 12-13 participants. Here are some pictures of people who’ve signed up before and are now elevating their travel.

Access to the Mileage Mentor MasterClass is at a fee of INR 7,000 + 18% GST (INR 8,260) per head. However, these are the last days to get a 15% discount. For those who sign up today, the Masterclass is available for INR 5,950 + 18% GST (INR 7021 per head). We’ll make sure you get everything you need to know in these discussions to have you started on a lifetime of champagne sitting up front.

Here is a fascinating story from one of our readers, who managed to go from Zero to 80,000 miles by using the knowledge from the forum.

The Event details are as follows:

- Mumbai: February 9, 2019 (10:00 AM) at WeWork Bandra Kurla Complex

- Ticket once bought is non-refundable. You can, however, transfer your ticket to someone else.

- Free flow of hot beverages and a working lunch is included in your ticket.

- A 15-minute optional 1-1 consultation with the organisers, on the day of the workshop or later on a First Come First Serve Basis.

- Internet Access will be provided.

- In case the event is cancelled, the organiser’s liability is limited to a full refund of the fee paid.

- If you require a Tax Invoice, please send us a mail at billing@lfal.net to receive the same.

So, what are you waiting for? Sign up now, and get set for your next glass of champagne on the plane at the earliest. See you at the MasterClass soon!

British Airways First Class Boeing 787-9

You can book your tickets on LiveFromALounge.Plus.

I am looking forward to seeing you all there!

Hi Ajay,

Any plans for Pune again this year, missed the last one.

@Tanmay, we are still drawing up plans for the year, but I would strongly advise you to make a day trip to Mumbai and make it happen rather than wait for a while for me to come to Pune. It should be worth your while 🙂

Hi,would want to know more about signing up for the workshop & using a credit card to pay for the same

@Mohnish, which CCs do you have. Sign up here. https://www.livefromalounge.plus/mileage-mentor-masterclass-mumbai-january-19-2019

HDFC Regalia / AMEX Plat Travel

There is a Convenience Fee of Rs 170 extra to be paid.

Processing Fee Rs 143.42

Applicable Taxes Rs 25.82

I guess Amex is not accepted.

Amex is accepted Ashwin.

HDFC Regalia / AMEX Plat Travel

But to earn those points for first class and business class tickets, that person will have to first spend several lakh of rupees. For those who have a job like yours where you pay through your CC and employer reimburses in cash, its an extremely good proportion, basically free as your said but for average person it is next to impossible to accumulate so many points that they can travel as a couple like you without first spending lakhs otherwise on credit cards and their sign up bonuses.

To earn so much on just regular spends is really very hard and if spend a lot on your credit card without filling a similar Income tax return, you are in a bigger soup.

It is aspirational but those 2 families also had spent different amounts of money on credit cards.

Agreed but one can still optimize the spends on selective cards and earn more points. This can reduce the overall cost of the trip by some amount.

totally agree

@Manuj are you saying that spending money and paying your taxes is a bad thing? Then why are there new startups going after Credit Card holders? And yes, It is not very hard to earn on regular spends. I’ve done it for years. Perhaps you need to sign up for the workshop to find out for yourself.

@Ajay, i dont think that any where in my comment i suggested paying taxes is bad. Thats just intentional misreading, i would say.

Please enlighten us how much minimum money is required to be spent on the best of the card like diners black to get a free Delhi london business class ticket even at discount for people who carry no status and no extra privilege with any airline.

@Priyansh i make over 5,00,000 miles combining everything in a year, so i am very much into the game. all that you have told are credit card benefits, my point was very different that the two families can’t be compared, one is already spending way more money for daily expenses to earn so many miles and points. we should not compare apples and oranges. One has to first earn more to spend more and also pay taxes on that amount of money to spend on credit card. Its not a one way street. it is very difficult to earn even 1,00,000 points on daily spends, it will take years and not worth all the effort. for people with regular expenses like that, minting points is easier and worth it.

@manuj, sorry to break the news to you that it is indeed not that difficult. One year, we just ran Shipra’s card for household expenses only and she could still get enough miles for a BOM-LHR-BOM ticket.

Anyhow, if you earn 500K Miles then you would very well know that everyone starts small. Moving on.

Hey mate… One of the regular reader of the blog and also one of those whose spends on cards were limited to an extent.

But now, have managed to save/earn value worth lakhs due to this card craze and understanding a lil more about points game

First, my air tickets are directly booked by my company. Similarly my hotel expenses are average on lower side – probably 30k a year for work? May be in a good year, could be lil higher .

Anyway, to give you snapshot of how much I have saved:

50k worth flight tickets (actual rates) free via premieremiles.

Have 40k jet miles and other premieremiles/HDFC worth another 50k.

Got plenty of free movies and upgrades on flights.

It’s a long list.

But just few simple suggestions as per me- where even average person can get good value:

1. Use one card and for long if your expenses are low.

2. Now apps/sites which allow you to pay rent via cards. Use those. Good returns for paying 0.4% extra or such.

3. Don’t go for redemptions unless points getting devalued. I got my free Bali tickets round trip for couple after using same card for 4+ years.

4. Take advantage of points everytime, even if slightly extra effort. Like I play my uber expenses by HDFC premieremiles, giving me 13% return everytime. When I buy on Amazon/Flipkart, go via smartbuy to get again 13% extra value. Or can go via jet shopping to get extra jpmiles.

Side benefit, because I am crazy for cards and have lots of cards, often get discounts offers on cards and book/buy for extended family or friends- they pay me back in white so no issues to me.

Similarly, though rare occurance, till date would have earned 20k+ just for holding right card and getting that offer on gold coin. (Eg. Bought gold coin at 2950 and market rate 3300+)

This is very rare and small but just letting you know the benefit.

It’s not like you need super premium cards with high fees to get that value. Many cards I own are lifetime free like Axis Priority, Yes Preferred first, Diners premium, ICICI MMT signature.

Similarly some like Citi Premieremiles, SBI IRCTC give me enough value back to make it worthwhile to pay the small fees.

Anyway, just my 2 long cents 😉

While this class is definitely slightly premium for me especially with it being in Mumbai, my only point is, you can get good value from it if you can take advantage. Else the content on blog is also great for low spend users 🙂

“But to earn those points for first class and business class tickets, that person will have to first spend several lakh of rupees.”

There are other ways to spend points outside of first class travel. There are cards where you regular monthly household expenses can land you a sweet family vacation every year, or a non-trivial statement credit/vouchers.

You should sign up for the class.

Also, how on earth can your income tax situation be inconsistent with your spends? Unless you’re trying to steal tax, you’d never have a problem. Just never pay a card bill with cash.

@manoj, I don’t think it should be your business to teach others their business sitting in Dubai when you don’t really have any other insights to offer to this community.

I think the point he is trying to make is regarding mismatch between income filed in ITR vs payments made to credit card.

In cases where one’s company reimburses for official spends on personal cards, it is possible to have a higher sum of payments made to cards, than what is supported by income sources. Hence it can lead to one receiving a notice for explanation from Income Tax Dept.

It can also apply to very high manufactured spends, not supported by similar income.

@Anshul, you’ve been to the class and you know we don’t endorse Manufactured Spending at all 🙂

You mean to say if my father in law makes a payment directly for his tickets booked using my AMEX is called “Manufactured Spending”?

I call it being a good son-in-law.

@Mika ha ha ha

Yes Ajay, I agree. Just adding to what can get one a tax notice! 🙂